Retention efforts remain critical

Priorities shift quickly in today’s dynamic business environment. This year’s headlines about oil and gas workforce reductions, and company restructurings, have replaced story lines that previously highlighted critical skill shortages and lucrative compensation packages.

A 2015 Mercer survey of 154 oil and gas organizations, within the U.S., Canada and Mexico, found that 16% of respondents may reduce staff, and 32% plan to decrease the “buying” of external talent. These results are in contrast to Mercer’s early 2014 survey, in which 66% of survey respondents cited the “buying” of external talent as their top talent management strategy.1

While companies strive to reduce costs during a slowdown, they also must recognize that they cannot sacrifice an organization’s long-term success for short-term gains, particularly as relates to human capital. Times of uncertainty require companies to remain vigilant about human resource issues, including the retention of high-performing and sought-after employees. Companies cannot afford to lose valuable talent, whether the price of oil is $30/bbl or $130/bbl.

IMPORTANCE OF RETENTION

During the recent global recession, employers across all industries focused on reducing costs. This caused many companies to overlook retention, compensation and talent development initiatives amid the struggling economy and high unemployment rate. However, many of these organizations are now experiencing the negative impacts of inattention to these critical human resource issues.

Reports indicate that workers across all industries are actively seeking prospects elsewhere, causing a renewed focus on employee retention and compensation issues. According to a recent survey of business managers, executives and human resource professionals, worries about employee retention are at an all-time high. Nearly 60% of PayScale’s survey respondents, across a large cross-section of industries, cited retention as their top concern, with those in the professional, scientific and technology services industries topping the list. Furthermore, 50% of company respondents believe there is a lack of qualified applicants for their open job positions.2

There is no sign of relief coming anytime soon. PayScale’s survey found that retention worries grew significantly over the course of the year, with 82% of respondents more concerned about retention at the end of 2014 than they were at the beginning of that year.3

An important lesson many of these companies learned is that ignoring employee retention efforts during a downturn can be detrimental when the market rebounds. The oil and gas industry must keep this in mind, as it operates under the current market conditions. Personnel cuts that go too deep can affect existing workers, causing undesired departures, due to additional stress and workload. Industry workers with sought-after skills may be hard to replace in the future, especially as baby boomers continue to retire.

Retention efforts may shift, based on the circumstances, but companies should not disregard them altogether. Whereas in recent years, there was a broad poaching of oil and gas workers, companies can now focus more selectively on the retention of specific personnel. Companies must acknowledge, and reward, top performers and those with in-demand skill sets. By addressing the needs of these key personnel, organizations can remain competitive during an economic slowdown, as well as prevent an employee exodus when the cycle inevitably turns.

A typical estimate for the cost of employee turnover is 150% of the worker’s annual salary when recruitment, interview, lost productivity and training expenses are considered. This does not include the intangible costs associated with the loss of institutional knowledge, critical business relationships and unique expertise.

Retention efforts cannot be isolated or one-size-fits-all events. Companies must address turnover continuously under all market conditions, and be flexible enough to meet individual employee needs. Money, alone, will not guarantee that employees remain at their organizations. A combination of factors affects employee engagement and motivation, and, ultimately, their loyalty.

EMPLOYEE CONSIDERATIONS

A recent Robert Half survey revealed that among U.S. employees—across a range of industries—the top causes cited for leaving their jobs were inadequate salary and benefits (38%), followed by limited opportunities for advancement (20%), unhappiness with management (16%), boredom with the job (10%), overwork (9%) and lack of recognition (6%).4

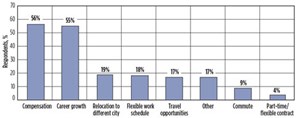

Oil and gas workers have expressed similar, although not identical, reasons for dissatisfaction with their previous employer. A worldwide Gulf Research survey revealed that the top reasons upstream oil and gas workers were dissatisfied with their previous employers included poor leadership/senior management (33%), compensation (28%), an organization’s culture (24%), lack of career path (23%), lack of management support (21%) and lack of advancement (20%). In contrast, among the reasons that upstream survey respondents chose to work for their current oil and gas employer were compensation (56%), career growth (55%), relocation to a different city (19%), and flexible work schedule (18%), Fig. 1.

The reasons that employees left one company, and the reasons that they joined another, are not always aligned. In fact, the Gulf Research survey found that the main reason employees moved to their current employer was better prospects at the new employer (55%), rather than dissatisfaction at their previous employer (19%). Therefore, companies must be aware of what they offer their employees, as well as what incentives are being used by competitors to lure them away. Nearly 52% of the upstream oil and gas respondents agreed, or strongly agreed, that their employers used programs and incentives to retain productive workers.5 The effectiveness of these programs depends on the individual company.

Although compensation is a key reason for employee turnover, money, alone, cannot solve all retention issues. As surveys illustrate, keeping people motivated and engaged requires quality leadership and supervision, advancement opportunities, interesting job assignments, good working conditions, a culture of safety, positive co-worker interactions, a feeling of job security and recognition of individual contributions.

EMPLOYER ACTIONS

Company leaders must determine the likelihood that an employee will leave, and calculate the impact that this separation will have on the company. Only by quantifying these factors can the organization efficiently focus retention efforts on the right personnel. Employers are applying new technologies to maximize their efforts. Predictive analytics software helps identify drivers, track reasons and understand trends related to employee turnover, as well as suggest actions to prevent it. The software can mine and apply data from employee surveys, performance reviews, social media postings and other sources.

Preventative actions might include adjustments to compensation. Despite budget pressures, companies are aware of the critical connection between employee compensation and engagement. Companies that use real-time peer compensation data are better able to defend against turnover, based on financial reasons. The data should include base salaries, in addition to long- and short-term incentives.

PayScale’s recent survey found that 87% of respondents across all industries acknowledged that getting compensation right is very important to achieving optimal employee engagement.3 While the oil and gas industry is in a low-price environment, it is even more critical that employees are engaged, motivated and recognized for contributing to the organization’s overall success.

Industry benchmark salary comparisons reflect downward pressure on payroll budgets. Mercer’s recent salary study found that 18% of 154 surveyed oil and gas organizations in the U.S., Mexico and Canada plan to freeze or cut compensation for 2015.1 Similarly, Aon Hewitt’s compensation study found that 47.8% of surveyed UK oil and gas organizations intend to decrease their payroll budgets, and 25% plan to freeze compensation. Aon’s research suggests that companies will try to maximize retention by focusing on high performers and critical business roles when distributing their limited payroll and incentive budgets.6

As far as other forms of financial compensation, companies are adjusting targets for 2015 performance goals and associated bonuses. Employees with equity incentives and stock grants will feel the effect of lower stock prices. As always, employees will watch closely for any changes in retirement plans, health benefits, and other company-sponsored programs and initiatives. Although important, money is not the only tool to prevent turnover. Companies can use customized non-financial incentives, including leadership opportunities, flexible work schedules and training or mentorship programs to help retain workers.

Uncertainty is a destabilizing force that can impact employee retention. Honest and frequent communication regarding organizational changes, job security, performance evaluation processes and career advancement plans can alleviate some of these concerns. Companies can maximize retention, particularly as related to essential personnel and top performers, by addressing both the financial and non-financial needs of the individual employee. ![]()

REFERENCES

- Mercer, “Mercer changing energy industry dynamics survey,” news release, http://www.mercer.ca/content/mercer/north-america/ca/en/newsroom/changing-energy-industry-dynamics-survey.html, Feb. 2, 2015.

- Payscale, “PayScale report reveals companies struggle to keep pace with red hot talent market,” press release, http://www.payscale.com/about/press-releases/lists/press-releases/payscale-report-reveals-companies-struggle-to-keep-pace-with-red-hot-talent-market, Feb. 15, 2015.

- PayScale, “Companies increasingly concerned about retaining employees, PayScale data shows,” press release, http://www.payscale.com/about/press-releases/lists/press-releases/companies-increasingly-concerned-about-retaining-employees-payscale-data-shows, Oct. 8, 2014.

- Robert Half, “Why good employees quit,” news release, http://rh-us.mediaroom.com/2014-10-22-Why-Good-Employees-Quit, Oct. 22, 2014.

- Gulf Research, People Perspectives: An Oil & Gas Workforce Report and Outlook, Gulf Publishing Company, Houston, 2012.

- Aon, “Aon Hewitt survey says UK oil and gas industry is in uncharted territory on salaries,” news release, http://aon.mediaroom.com/index.php?s=25776&item=137168, Feb. 12, 2015.

- The C-Suite series: Chevron’s Hearne optimistic about firm’s growth in a future of low-carbon operations (July 2023)

- Drilling Advances: Plugging the brain drain (November 2022)

- Halliburton’s Miller sees optimistic path for upstream industry (September 2022)

- First Oil: End of an era for a Russian oil and gas icon (May 2022)

- First Oil: Looking for positivity among all the negativity (April 2022)

- The ESG perspective (October 2021)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)