ShaleTech: China, Australia shales

When considered strictly from an available resource perspective, theirs is a trading relationship that should not be entirely necessary. Yet, as China remains stuck behind the technical and bureaucratic eight ball in efforts to exploit the world’s largest, estimated, shale gas reserves, it relies on quasi-neighbor Australia to feed much of its chronic, albeit cooling, thirst for liquefied natural gas (LNG).

Although China’s once super-charged economy has slowed appreciably, the world’s unofficial swing consumer is still second only to Japan as the world’s top LNG importer—a trend expected to continue over the next two decades, as an antidote to its still-stubborn coal addiction. Then again, much of that appetite could be fed in-house, if not for the myriad geological and governmental restrictions that continue to thwart domestic production of the world-leading 1,115 Tcf of technically recoverable shale gas reserves identified in the U.S. Energy Information Administration’s (EIA’s) 2013 global assessment, its latest. However, the EIA evaluation may swing far to the conservative side, according to IHS Energy, which, in its study, The Unconventional Frontier, puts the estimated shale gas reserves nearly three times higher at 3,295 Tcf.

Regardless of which assessment is correct, “technically recoverable,” as it pertains to China, is not altogether accurate. Complex and little understood geology, and a dearth of shale-specific technology and expertise have combined to keep a cork on most of its impermeable reservoirs. According to EIA data, the nascent shale sector contributed a meager 0.25 Bcfd to China’s cumulative gas production last year.

While Beijing continues to contend that China is a major shale player-in-waiting, officials last September slashed their once-overly-ambitious shale gas production targets by more than a third. Going forward, analysts say that until state-owned companies accept more assistance from their shale-savvy Western counterparts, unconventional production will remain on the starting blocks. “A ‘go it alone’ strategy will push back the likelihood of near-term commercial success on a wide scale,” Robert Clarke, Wood Mackenzie research director for global unconventional oil and gas, said in an email.

As for Australia, even amid an anti-fracing groundswell, unconventional production was given a prominent role in the federal government’s new Domestic Gas Strategy, which was released in April. Nevertheless, aside from a significant drilling program, targeting the organically rich Velkerri shale in the Northern Territories’ Beetaloo basin, major local players see less-than-rosy prospects for unconventionals anytime soon, if ever. Santos Ltd., for one, believes meaningful shale production is at least a decade away, while BHP Billiton Managing Director Andrew Mackenzie suggests that it is unlikely any semblance of the North American unconventional experience will be replicated elsewhere, including within his home country. “Shale will be more constrained to the U.S.,” Mackenzie told The Australian on May 12. “To create opportunities for growth going forward, we have to increase our appetite for investment in our conventional business.”

For now, the conventional onshore and offshore business that Mackenzie referred to is providing more than sufficient feedstock for an LNG sector that, by the end of the decade, is expected to overtake Qatar as the world’s largest exporter, according to both the International Energy Agency (IEA) and BP in its Energy Outlook 2035, released in February. With a significant chunk of that tonnage sailing to China, it has inadvertently placed Australia in the middle of an anti-trust squabble, with Beijing specifically targeting Shell’s proposed $70-billion acquisition of BG Group. Individually, both companies hold substantial shares of the Australian LNG export market, fueling China’s fears that the potential LNG juggernaut would bring with it excessive economic control.

According to the Australian Petroleum Production & Exploration Association (APPEA), Shell either operates outright, or has significant interest in, four operating or soon-to-be operational LNG export facilities, with an aggregate initial capacity of more than 43.7 MMtpa. Among its holdings, Shell is the sole owner of the 3.5-MMtpa Prelude project, which, with planned start-up in 2017, will be a floating LNG facility. BG, on the other hand, operates the 8.5-MMtpa Queensland Curtis LNG (QCLNG) plant, which began first deliveries in December 2014, in a 50-50 partnership with China National Offshore Oil Corp. (CNOOC).

After Shell CEO Ben Van Beurden’s goodwill mission to Beijing in early May, at least one analyst doubts it will be sufficient to placate leery officials. “The thing that could potentially tumble out of the closet is BG and Shell’s LNG projects in Australia, which export to China,” Gordon Kwan, the Hong Kong head of regional oil and gas research at Nomura International, told Bloomberg on May 6. “They might have to divest some stake.”

CHINESE ISSUES ABOUND

The anti-trust issue came to light nearly 15 months after Shell and China National Petroleum Corp. (CNPC) agreed to strengthen their long-term E&P JV, which includes joint shale gas exploration in western China’s heavily faulted Sichuan province block. “The current scope of the Shell-CNPC well manufacturing JV is to deliver services to joint, Shell/CNPC onshore, unconventional development projects, and Shell onshore conventional development projects,” said a Shell China spokesperson. “It can be expected to render services for future Shell projects and is also seeking to supply third-party customers in its existing markets.”

The partners are in the appraisal stage of a newly completed drilling program on the Sichuan Fushun-Yongchuan Block. “We have completed phase one drilling. Extended well testing is underway, and we are busy evaluating the results. We should know better about the next steps for the project in the coming months,” the spokesperson said.

Fushun-Yongchuan joins the Changning and Weiyuan Blocks in making the 301,000-mi2 Sichuan province the focal point of most unconventional activity to date, with an estimated 21% of the nation’s shale gas resources, says Tang Limin, director general of Sichuan Provincial Development. There, state-owned Sinopec says that by 2017, it intends to be producing some 10 Bcm/yr from Fuling field, near Chongqing, China’s first significant shale gas development. Sinopec says Fuling field will be producing 5 Bcm/yr at year-end 2015. Clarke, the Wood Mackenzie unconventional research director, said the Fuling development represents the most active and advanced of China’s shale plays.

“We estimate around 130 wells will be drilled in Fuling this year, taking the total to roughly 250,” Clarke said. “This is comparable to the level of development activity in Argentina’s Vaca Muerta play. Fuling is further advanced than other Chinese unconventional projects in the Ordos and Tarim basins, and will continue to lead the way for the foreseeable future.”

In his email response, Clarke emphasized that despite its comparatively advanced state, the Fuling play, over the long haul, is unlikely to generate the high-octane level of activity that characterizes established U.S. shales. “The Fuling development has turned into a very-focused play. We do not see decades and decades of drilling, like investors experience in many U.S. shale plays. As such, our models suggest that Fuling production could actually peak in the next few years. This would mark a short period between discovery and peak production, which is a commercial strength; however, the peak level is likely to be less than 1.0 Bcfd. For comparison, the Marcellus shale in the U.S. is producing close to 15 Bcfd today and has not yet reached its peak,” he wrote.

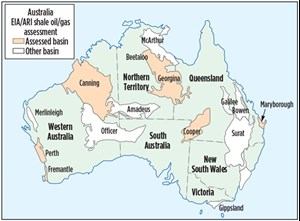

He is far from alone, as the general consensus holds that China’s still wet-behind-the-ears shale sector has a host of hurdles to overcome before it can be put in the same stratosphere as its North American opposite, Fig. 1. Along with its rebalancing economy, China’s national oil companies (NOCs) still struggle to crack the code of the complex geological composition of its typical shale formations. For another, unlike the more brittle marine shales that typify much of the U.S., many of China’s formations, particularly in the resource-rich Ordos basin, in the midwest, are laden with lacustrine shales, with an appreciably higher clay content that renders them more difficult to frac.

However, Clarke says that perhaps the most prevailing obstacle remains the solo approach of the state-owned operators, which, generally, have little experience and wherewithal in the intricacies of unconventional well construction and completion.

“Numerous Chinese plays are still very early in the exploration phase. They have not been fully delineated, well success rates are slow, and the optimal completion technology is far from understood,” he said. “Western investment has been muted, both from the service companies and E&P companies. Although shale gas subsidies are in place, and the government has hinted at enabling easier importation of equipment and technology, the plays are really in the hands of Chinese NOCs. These firms are, indeed, motivated to make tight gas, shale gas, and tight oil all succeed, but, in our view, they are still relatively inexperienced operators.”

Liang Quanshyeng, senior geologist and director of the Overseas Center, Research Institute of Shaanxi Yanchang Petroleum Group Co., Ltd., agreed that a glaring void exists nationwide, when it comes to shale know-how. “Facing the problems, such as high cost, low proven degree, imperfect technologies, shale gas exploration of China is still in the early stage. Thus, the exploration experience of America should be used for reference. We suggest that China and America could reinforce the technical exchange, in order to promote the development of shale gas industry in both countries,” Liang said in a September 2014 presentation at the most recent bilateral U.S.-China Oil and Gas Industry Forum (OGIF) in Denver, Colo. The annual public-private forum alternates between the U.S. and Beijing.

While gas has been its primary unconventional target, China also comes in at number three, worldwide, with an estimated 32 Bbbl of shale oil resources, according to the 2013 EIA assessment. In May, Reuters reported that PetroChina had recorded its largest tight oil discovery in its Changqing field, in western Shaanxi province. The discovery is reported to hold more than 730 MMbbl.

Despite the widely acknowledged lack of unconventional technology, in an update on the then-status of China’s tight oil activity, Cai Bo of the Research Institute of Petroleum Exploration and Development for PetroChina, told the OGIF that significant completion advancements have been made over the past several years. He particularly cited a new, low-friction, slickwater fracturing fluid, which, he says, can cut well stimulation costs in half, as well as the introduction in China of advanced tiltmeter and microseismic post-frac monitoring devices, among others.

“After nearly three years of steady development progress, the terrestrial tight oil accumulation theory has already initially formed, four supporting key technologies have been improved, and a number of favorable prospecting areas have been found in Ordos, Junggar and Songliao basins,” he said.

AUSTRALIA ON HOLD

Meanwhile in Australia, with oil becoming ever-harder to come by, gas drives exploration, though to what degree shale will contribute depends on whether you are talking to the folks in Canberra or operators. The latest EIA assessment places Australia seventh in the world, with 437 Tcf of technically recoverable shale gas reserves, concentrated in six key basins (Fig. 2), which officials have placed front and center in the country’s new domestic gas strategy.

APPEA, in April, applauded the government’s newly released Domestic Gas Strategy, giving shale, coal seams and other unconventional gas sources high priority. “Unconventional gas accounts for 40% of production in the eastern Australian gas market. It also contributes significantly to our export market, as Australia remains on track to be the world’s biggest exporter of LNG by the end of the decade,” said Paul Fennelly, then-acting CEO of the trade association.

However, months earlier, many of those directly responsible for meeting that strategy had cautioned “not so fast.” “We need to make sure we have the right technology, and understand the nature of the shale-gas resource,” James Baulderstone, head of unconventional gas at Santos, told The Australian on Sept. 26, 2014. “We’re in the learning phase now for the next five to 10 years.”

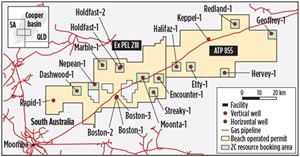

Since then, of course, commodity prices went on a free fall, taking many of the high-cost pure shale prospects with them. The outlook for Australian shales took a significant hit on March 27, when Chevron walked away from its holdings in Beach Energy’s Nappamerri Trough acreage in the Cooper basin, Fig. 3. Two years earlier, Chevron had earmarked capital spending of up to $349 million in the Queensland ATP 855 concession, which is operated jointly by Beach Energy and partner Icon Energy.

Chevron was still onboard in January, when Beach completed the first stage of its vertical and horizontal drilling campaign in the ATP 855 holdings, which included a four-well frac stimulation program. In March, Beach said it was still analyzing data from the initial program, and intends to formulate key objectives for its Stage 2 program by mid-year 2016. “Minimal spend is anticipated over this period,” the operator said in a statement, while CEO Rob Cole told the Sydney Morning Herald on March 28 that further development, sans Chevron, would progress “at a pace consistent with prevailing market conditions.”

Elsewhere, in the Perth basin, operator Norwest Energy NL and majority partner AWE Ltd. planned to run a 3D seismic acquisition program in first-quarter 2015, as a prelude to drilling the horizontal Arrowsmith-3 shale gas well later this year, or in early 2016. The JV completed final testing of the Arrowsmith-2 discovery well in 2014 with “results high-grading two intervals for potential development: the Carynginia formation and the Irwin River Coal Measures,” according to Norwest.

The Arrowsmith-2 was actually drilled in mid-2011 to test the shale gas potential of the EP 413 concession. The well was hydraulically fraced the following year, in five stages, originally testing four potential horizons: the High Cliff Sandstone, the Irwin River Coal Measures, the Carynginia formation and the Kockatea shale. In initial testing, the well flowed at a maximum co-mingled flowrate of 3.5 MMcfgd.

Meanwhile, as if low prices were not enough to stymie the shale sector, Victoria state, which takes in the Gippsland coal seams, enacted a fracing moratorium, which is set to expire in July, but pressure to extend the ban has intensified. On the bright side, the February release of a long-awaited study by esteemed former government official Dr. Allan Hawke found “no justification for imposing a moratorium on hydraulic fracturing in the Northern Territory.”

THE BEETALOO BOUNCE

The green light to fracing is welcome news for Ireland’s Falcon Oil & Gas Ltd., and partners Origin Energy Ltd. and Sasol Petroleum Australia Ltd., which have initiated a nine-well, four-year drilling program to prove up the commercial viability of the 4.6 million gross acres under control in the Beetaloo sub-basin of the remote Northern Territory.

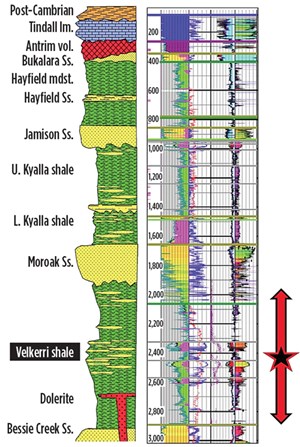

The combination vertical and horizontal drilling program targets the gas-prone Middle Velkerri marine shale, generally described as one of the organically richest in Australia, with a total organic carbon (TOC) content of 1.5-6%, according to Falcon Oil & Gas Australia, Fig. 4. The Beetaloo, a subset of the greater McArthur basin, has been linked with the aforementioned Vaca Muerta shale, as among the largest unconventional resources outside North America.

The Falcon-led trio spudded the first of three vertical wells to be drilled this year (Fig. 5) as part of the A$165-million program, which will be followed in successive years with five horizontals and another vertical well, all of which will be hydraulically fraced. Former partner Hess abandoned the play in June 2013, after declining to farm-in with a 62.5% stake.

“The geology of the Beetaloo is pretty well understood, and we are dealing with some of the oldest rocks in the world (1.4 billion years old),” Falcon CEO Philip O’Quigley said from the firm’s Dublin headquarters. “The exploration program is designed to get an even better understanding of the geology. The focus has turned to proving up a commercially viable prospect through a combination of vertical and horizontal exploration and appraisal wells.”

Over the past 10 years, scattered drilling programs have been initiated in the Beetallo, where one of the earliest targets was the overlying and wetter Kyalla shale. Together, the two zones are estimated to hold an equivalent 44 Tcf of recoverable reserves. “There is definitely a stacked play potential, but our approach over the next three to four years will be the Middle Volker,” O’Quigley said. “We are not going to ignore the Kayla, but it will not be the main focus of this drilling campaign.”

Between mining operations and previous drilling attempts in the area, a reasonably established infrastructure exists in the logistically challenged Beetaloo. However, reinforcement would be required, once production gets underway, which, O’Quigley concedes, will not be anytime soon. When it does, a ready LNG market is waiting.

“Production dates are a long way off, and it is too early to give any estimate yet. Any gas discovered in the Beetaloo will most likely play into the Pacific Rim LNG market, via Darwin or perhaps via a new pipeline to the East Coast. We now have three LNG trains in Darwin, with Inpex talking about expanding their two trains to six. So, from an LNG infrastructure viewpoint, we are more than adequately served,” he said.

Surprisingly, the untapped prospects of the Northern Territory recently drew unlikely interest from former Chesapeake Energy chief Aubrey McClendon, whose American Energy Partners LP reportedly is trying to line up funding for up to 16 million shale acres in the McArthur basin, the Wall Street Journal reported May 12. If successful, it would mark McClendon’s first attempt to acquire unconventional holdings outside the U.S. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- EOR/IOR technology: Advanced shale oil EOR methods for the DJ basin (May 2023)

- Regional report: South Australia: New life in a mature basin: S.A.’s Cooper basin CCS and exploration opportunities (May 2023)

- The last barrel (April 2023)

- What's new in production (April 2023)

- ShaleTech- Permian shales: Production hits new high amidst talk of looming plateau (April 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)