The last barrel

Last month, this column stated that we are in a “new reality,” with regard to oil and gas prices. Furthermore, in the four weeks between that writing and this effort, additional events have taken place, suggesting that, at a minimum, there will be a downturn of at least a year, maybe more.

One of these events is the chopping-back of 2015 capital budgets by dozens of operators. Also, service firms and operators, most based in Houston, had announced personnel reductions of more than 30,000 people by early February, although some of that figure will be outside the U.S. Additionally, since the Jan. 23 passing of Saudi Arabian King Abdullah and the ascension of his half-brother, King Salman bin Abdulaziz, there has been no signal that the Kingdom will change its attitude on OPEC and global oil production levels anytime soon.

In the meantime, oil prices may have hit at least a temporary bottom, going as low as about $43.50/bbl before bouncing back to the high $40s and low $50s. Accordingly, our forecast in this issue calls for worldwide reductions in activity, although the worst declines will be in the U.S. and Canada, particularly in shales. Drilling will be down at least 20% to 25% in both countries, with total E&P spending suffering a 30% cut. As such, this reduction will at least be on a par with the downturns of 1997–1999 and 2009.

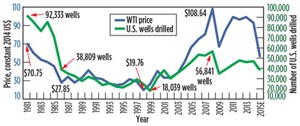

The larger question is whether this downturn will equal the activity depression of 1986-1989. As the chart on this page shows, since 1980, the number of U.S. wells drilled annually has paralleled WTI oil price movement (in constant 2014 dollars) in remarkably close fashion. Even the shape of the green line showing U.S. drilling mimics the shape of the blue-colored WTI price line.

What the numbers behind the two lines indicate is even more revealing. In inflation-adjusted 2014 dollars, the WTI spot price averaged $45.47/bbl in 1985. It then fell 38.8%, to a $27.85 average in 1986. At the same time, U.S. drilling fell 45.4%, from 71,108 wells in 1985, to 38,809 in 1986. Consider this—if WTI actually averages close to the $55.75 level that we forecast for 2015, then that price will have fallen 41% from the 2014 average of $93.26, a drop greater than in 1986. So, should we be looking for a drilling reduction of 40%-plus, rather than the 20%-to-25% reduction indicated in our forecast?

Additionally, once the WTI spot price fell below $45/bbl in constant 2014 dollars, it did not get back to that level, or above, until 2004, when it averaged $50.38. That is a 19-year gap, representing a number of tough years, including two additional downturns in 1993-1995 and 1997-1999. We’re not suggesting that this will repeat itself, because the market, structurally, is different now than it was then. However, there could be a very difficult period of much shorter duration.

A salute to three independent leaders. Between Jan. 1 and the end of May, the U.S. independent sector is losing three distinguished leaders, who have headed up prominent companies. The industry will be the worse for it, since each of these men has made a significant, positive impact.

The first is Steven Farris, whose retirement as chairman, president and CEO of Apache Corp. took effect on the same day that it was announced, Jan. 20, 2015. However, he continues as non-executive chairman until May 1, when he also retires from the board. Hand-picked by former Apache chairman and founder Raymond Plank in 1988 as V.P. of E&P, Mr. Farris rose to president and COO in 1994 and was responsible for Apache’s revenues growing from about $4.2 billion in 2003 to $16.42 billion in 2013.

The second is Bruce Vincent, whose retirement as president of Swift Energy Company was announced on Jan. 14, effective on Feb. 15. On the latter date, he also retired as a board member. Mr. Vincent had served as president since November 2004, after originally joining the company in 1990. During his long, distinguished tenure, Swift transitioned from being a niche operator in South Texas and southern Louisiana, into a premier player in the Eagle Ford shale. In addition, Mr. Vincent was quite active in industry affairs, principally as IPAA chairman from November 2009 to November 2011.

Last, but not least, Noble Energy Chairman Charles (Chuck) Davidson will retire from his post, and from the board, on May 1. Mr. Davidson’s retirement had been known publicly since last April. He was succeeded last October as CEO by Bruce Stover, but will stay on as chairman until May 1. Much like Messrs. Farris and Vincent, Mr. Davidson has enjoyed a long tenure at Noble, having joined the company in October 2000 as president and CEO. Over 15 years, he has transformed the firm into a major player, both in U.S. shale plays and internationally, particularly in the eastern Mediterranean.

It would be a great loss for these three gentlemen to disappear quietly from the U.S. upstream industry. Collectively, they possess immense knowledge, and have much to offer in terms of leadership and wisdom. Hopefully, each one will soon find a new endeavor in which to participate and provide fruitful guidance. ![]()

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)