Systematic candidate selection improves Haynesville refracturing economics

In the Haynesville shale, costs associated with drilling, casing, cementing, perforating and hydraulic fracture stimulating a new horizontal lateral typically range from $6-8 million. By contrast, refracturing an existing wellbore—reopening established fractures or accessing previously unstimulated zones of good quality reservoir along the lateral—now costs from $750,000 to $1.5 million.

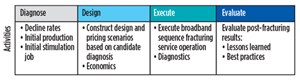

Given today’s low commodity prices, refracturing represents an intriguing alternative for operators to minimize capital expenditures, while maximizing production, estimated ultimate recovery (EUR), and return on investment. However, not every declining or underperforming shale well is a viable candidate for refracturing. To identify laterals with the highest economic potential, Schlumberger developed a systematic candidate selection and design workflow as part of its Broadband Sequence fracturing service for unconventional plays, Fig. 1.

Using this approach, Encana refractured one of its low-producing Haynesville wells in 2014. As a result, gas production increased from 100 Mscfd to an approximately 2.7-MMscfd average rate during the first 30 days after refracturing, and the well’s five-year cumulative production rose an estimated 1.0 Bscf.

WHERE REFRACTURING MAKES SENSE

The initial hydraulic stimulation of a horizontal wellbore is normally done by pumping down perforating guns and fracturing plugs to isolate each proppant fracture stage, typically a few hundred feet in length. Refracturing, on the other hand, is usually performed, without mechanical isolation, in a lateral entirely open to flow thousands of feet long by substituting degradable chemical diversion pills for fracturing plugs between each stage. Refracturing of vertical wells has been going on for several decades. But applications to horizontal wells in unconventional plays are quite new, and still evolving. Few operators have much relevant experience, which is why it is important to understand the types of laterals and specific conditions in which refracturing makes sense.

In general, refracturing represents a viable alternative to drilling new wells only in areas of good reservoir quality, where producing wells are underperforming for certain operational reasons, and net payback from incremental production meets the operator’s hurdle rate within a specified time frame.

What this means is that any refracturing candidate selection and design process must accomplish several things. It must identify underperforming wells; determine the causes of poor performance; assign potential candidates to different refracture treatment strategies, based on sound criteria; and accurately forecast both post-refracturing production gains and economic outcomes of various completion scenarios. Shortchanging any of these steps could undermine project feasibility, regardless of how well the job is delivered in the field.

What, then, are the usual causes of poor performance? For one thing, early completions in unconventional plays employed geometrically, or evenly, spaced perforation clusters, without regard for reservoir heterogeneity or stress variations. Many clusters were spaced too far apart to effectively drain the resource. Also, fracturing fluid and proppant volumes were too small, leaving the reservoir under-stimulated. Often, fluid viscosities and pumping pressure limits on equipment were too low to fracture zones of higher formation stress. Thus, portions of the lateral were abandoned. In certain cases, over-flushing pushed proppant too far into the reservoir, allowing the point of contact between the fracture and the lateral to close. Production logs indicate that, due to sub-optimized completions, 30%–40% of perforation clusters contributed no production whatsoever, leaving considerable reserves in place.

Furthermore, many initial completions suffered damage of some kind, causing production to decline much more rapidly than newer offset wells. A common damage mechanism during drilling was mud loss into the formation, which created barriers to flow that proved difficult to break up and remove. Damage also occurred during production. Frequently, operators opened the choke too wide, too soon, causing an overly aggressive drawdown. Migrating clays broke off from the matrix, mixed with the proppant pack, and moved into fractures, effectively plugging them up. Proppant also became embedded or compacted in fractures that crossed zones with swellable clays, causing the formation to sag or creep, creating pinch points that cut off flow altogether. In shale oil plays, heavy components, such as paraffin and asphaltenes, also plugged fractures. Finally, chemical interactions between surface and formation fluids and minerals caused scale to precipitate in fractures and around perforations, inhibiting or severing connectivity to the lateral. Images taken with downhole cameras have shown that up to 75% of perforations may be covered with scale.

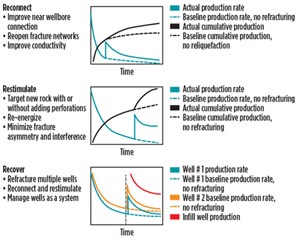

For wells that are underperforming due either to damage or sub-optimal initial completions, refracturing can do one of two things to revitalize productivity. In the case of damage, it can reopen existing perforations and fracture networks, effectively restoring fracture connectivity to the wellbore. This is known as a “reconnect” treatment strategy, Fig. 2. In the case of sub-optimized completions, it can increase total stimulated reservoir volume (SRV) by adding new perforations and fracturing previously untreated zones of high-quality rock. This is a “restimulate” treatment strategy.

There is, however, a third cause of poor performance in some shale plays. When infill wells are completed near a previously producing well on a pad (a “parent” well), interference—due either to pressure communication or asymmetric fracture growth—can have a negative impact on production. In these situations, it is essential to manage multiple wells as a system. Refracturing the parent lateral before initial treatment of offset wells can effectively recharge formation pressure in depleted zones. This increases the resistance of previously depleted rock, protecting the well from the stresses of offset fracturing, minimizing potential interference. This is a “recover” treatment strategy, Fig. 2. Refracturing all producing wells on a pad is known as “pad well refracturing,” an emerging strategy some operators have begun to explore.

In the Haynesville, unlike the Eagle Ford and other plays, some infill wells actually boost the productivity of parent wells, so well interference is not as widespread as under-stimulated zones and poor flowback, due to choke management. Sub-optimized completions are most often due to excessive cluster spacing, low-viscosity fracture fluids, small proppant volumes, low stage count, and inadequate pumping pressures. Common damage mechanisms include high drawdown due to choke mismanagement, and relatively high smectite clay content, which causes clay migration, creep, proppant embedment and pinch-outs. Historically, operators in the Haynesville and other unconventional plays achieved only 8%–20% recovery of in-place reserves. Clearly, there is room for improvement.

REFRACTURING IN THE HAYNESVILLE

In terms of refracturing, the Haynesville appears to be the most active shale play in North America. According to public records, nearly 50 horizontal wells have been refractured there. After a flurry of Haynesville activity beginning in 2008, the drilling of new horizontal wells peaked in 2011 and gas production plateaued in 2012. Both have declined drastically since then. Rig count remained flat from late 2012 through 2015. Most of the four-dozen refractured wells have been completed since the second-half of 2013. Today, less than 30 rigs are active in the basin.

One reason that Haynesville refracturing activity has been greater than in other unconventional resource plays is that a number of operators have been sharing data and best practices, enabling them to accelerate the learning curve. Another reason is that the Haynesville produces mostly dry gas under high formation pressure. Pressure gradients range from 0.9 psi/ft in the highest areas to 0.75 psi/ft elsewhere, which is still relatively high compared with the Barnett, for example, where the pressure gradient is approximately 0.46 psi/ft. Higher pressures not only store greater amounts of gas per cubic volume of pore space, they also enhance refracturing efficiency in previously untapped intervals and help clean up water-based fracture fluids more quickly, with high-pressured gas acting as a natural lift mechanism. Meanwhile, gas prices have not been hit as hard as oil over the past year, and many operators remain under contract to supply specified volumes to gas pipelines in the region. Therefore, refracturing represents a cost-effective means of meeting both operator and market needs.

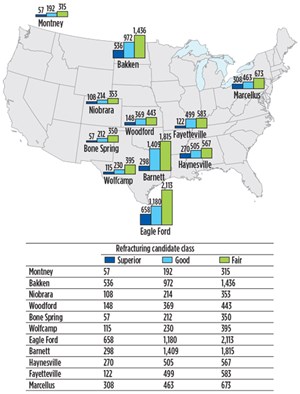

As part of a high-level screening of refracture candidate potential across North America, Schlumberger has conducted almost 200 technical and economic evaluations of 20 unconventional basins for over 50 operators. Some plays have literally thousands of refracturing candidates, Fig. 3. According to the initial analysis, the Haynesville had 567 fair, 505 good and 270 superior candidates for refracturing. Those ballpark numbers were further refined by running 2,649 horizontal Haynesville wells through an increasingly rigorous candidate selection workflow.

CANDIDATE SELECTION PROCESS

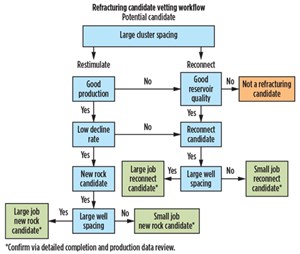

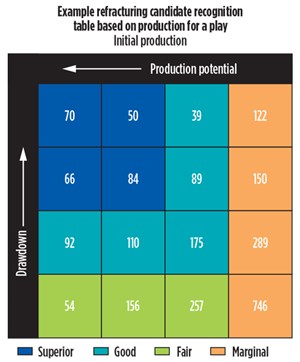

Even before attempting to design the stimulation treatment, successful refracturing operations require a systematic approach to candidate selection, Fig. 4. Based on public data for the Haynesville play, seven criteria helped determine (a) whether or not a particular well was a viable candidate, and (b) if it was, which of the refracture treatment strategies described above—reconnect, restimulate or recover—would be appropriate. Criteria included age of the well, cluster spacing, reservoir quality, initial production rate, drawdown rate, well spacing and initial proppant volume.

The first criterion for high-level screening of a potential refracturing candidate was the age of the well. Only horizontal wells producing for 12 months or more were chosen for the Haynesville study. At least one year of production data was necessary to properly evaluate production and decline rates.

The second criterion was cluster spacing. A well with original perforation clusters spaced less than 90 ft apart might qualify as a reconnect candidate, but only if it met at least one of two additional criteria: good reservoir quality and a relatively high drawdown rate. These criteria typically indicate that the initial fracture completions were damaged or simply under-stimulated. The goal, then, would be to reopen and reconnect existing near-wellbore fracture networks to the lateral wellbore. Wells with poor reservoir quality were not considered viable refracture candidates.

To qualify as a restimulate candidate, a well had to have clusters spaced more than 90 ft apart, a relatively high initial production rate, and a moderate rate of decline. These criteria typically indicate that the initial completions were sub-optimized. The goal, in this case, would be to target new, previously unstimulated rock by adding new perforations.

Another criterion was well spacing. If the nearest offset well was 800 ft or more away from the candidate under consideration, the refracture job could use a larger volume of proppant. If an offset well was closer than 800 ft, the job would be smaller and far-field diversion would need to be considered. In the Haynesville, a large restimulation job, for example, might use 4-5 million lb of proppant overall, while a small reconnect job might use as little as 1.5 million lb.

Finally, if the initial volume of proppant per lateral foot was known, it was used to further refine the selection of economically viable candidates. In particular, wells with proppant volumes less than 1,000 lb/ft were considered under-stimulated, hence better candidates because they probably left more accessible reserves in place.

By plotting initial production rates against drawdown rates for all Haynesville wells, the study found 775 good refracturing candidates, Fig. 5 (dark blue and light blue), of which 270 are superior candidates (dark blue).

Even at $1.5 million per lateral, refracturing the top 270 candidates would cost Haynesville operators $405 million. Drilling and completing 270 new wells at $6–8 million per lateral would cost between $1.62 billion and $2.16 billion. While a new well may still achieve higher cumulative production than a refractured well, the overall cost per Mcf recovered remains greater and the investment is paid back in a shorter period of time.

FULL REFRACTURING WORKFLOW

Of course, candidate selection is just the beginning of a much broader refracturing workflow consisting, ideally, of four integrated processes: Diagnose, Design, Execute, and Evaluate, Fig. 6. After diagnosing potential candidates, as described above, it is essential to carefully design the refracture job, and run economics on multiple “what-if” scenarios.

The Design phase begins with construction of a static geological model of the reservoir. To determine how much of the reservoir the initial completions accessed and drained, that model is linked to sophisticated completion modeling technology to simulate the original hydraulic fracture network based on treatment pressures, microseismic data, production logs and other available data. Next, an integrated reservoir simulator is used to perform a production history match on the fracture model. Reservoir drainage and associated depletion is mapped over time, and resulting pressure changes caused by depletion are used to calibrate changes to the stress model. By calibrating the stress model with the existing fracture network up to the time of the planned refracture treatment, it is possible to simulate the potential impact of various completion designs. Observing how additional perforations, different pump rates, fluid viscosities, proppant volumes, number of stages and degradable diversion pills affect the direction, magnitude and efficiency of the refracture treatment, each parameter can be optimized accordingly.

Many operators assume that if a treatment design worked in the original lateral, all they need to do to refracture the well is apply essentially the same formula. However, since the entire lateral is open at once, treatment stages must be sized appropriately. Schlumberger recommends running smaller, more aggressive treatments up front, to make sure the existing fracture network is reconnected, then temporarily blocked off. Subsequent treatment sizes are systematically increased to target new reservoir rock with greater proppant volumes.

The Design phase concludes with rigorous economic analysis of optimal completion strategies and job designs, taking into account all equipment and service costs required to prep the well, perform the specified refracturing operation and put the well back online. Typical costs include pulling pump and/or tubing, ensuring casing integrity, cleaning out the well with coiled tubing before refracturing, adding perforations (as needed), performing diagnostics such as microseismic, pre- and post-treatment production logs, tracers and other monitoring technologies, pumping alternating proppant fracture stages and degradable diversion pills, and running coiled tubing to clean out the lateral afterward. A flowback crew may be needed to conservatively flow back the well, ensuring it is not drawn down too hard, which could damage new fractures, while preventing proppant from flowing back. If a pump or gas lift mechanism is required, it must be reinstalled with tubing. Economic modeling must properly account for all of these costs, and ensure that production gains are sufficient to achieve a reasonable return on investment within a specified timeframe, given various commodity price scenarios and the operator’s hurdle rate.

For the next phase, it may be necessary to reperforate portions of the lateral, where initial cluster spacing was too wide. In addition, two serious technical challenges that occur during many refracturing jobs must be overcome. One is ineffective diversion; the other is inadequate proppant transport along the lateral.

First, conventional diversion materials often fail to isolate existing fractures along the full length of the lateral. Either the particle sizes within diversion pills are not diverse enough to plug fracture openings close to the wellbore, or particles disperse during pumping, arriving downhole in insufficient concentrations to create truly impermeable barriers. To effectively plug any fracture opening, sequential refracturing uses degradable particles of four different sizes. To prevent fluid-particle separation and ensure diversion pills remain highly concentrated, synthetic degradable fibers are blended with the tetra-modal particles, Fig. 1.

Second, in traditional refracturing operations, as proppant-laden fracture fluids travel along the lateral from heel to toe, fluid velocity diminishes and proppant tends to settle out and build up inside the casing. This begins to create a sand plug that effectively blocks further stimulation. In some cases, half or more of the lateral may be unstimulated due to a sand plug forming near the heel. To prevent this problem, synthetic fibers can also be added to the fracture fluid, enhancing proppant transport by suspending proppant longer and transporting it further down the lateral during the refracturing treatment.

During the Execute phase, the effectiveness of fracture fluids and diversion pills is monitored using various sensors and tracers. Initial shut-in pressures (ISIPs) indicate which treatment stages are going into depleted zones and which are stimulating new reservoir rock. Microseismic monitoring is typically used to reveal where and how far fracture networks are propagating, stage by stage. Chemical and radioactive tracers in the subject and/or offset wells can indicate where fluids are traveling, which stages are flowing and whether connectivity is occurring between wells. To halt excessive fracture growth or redirect fractures into unstimulated rock, a proprietary far-field diverter can also be pumped during certain portions of the refracturing operation. This is particularly useful, where offset well spacing is tight.

Evaluate. For the final phase, after refracturing the well, all available microseismic, production log, tracer, and pressure data, as well as initial production rates are run through fracture network modeling and reservoir simulation again. Updating the geological model and history matching the new fracture network generates a revised economic forecast for the well based on resultant production.

REFRACTURING CASE STUDY

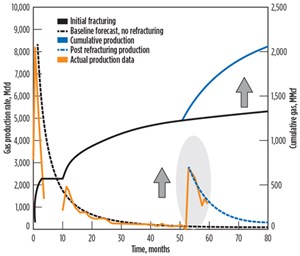

Encana Corporation is one of the operators that began refracturing older, understimulated horizontal wells in the Haynesville. One potential candidate, located in De Soto Parish in northern Louisiana, began producing in early 2010 at about 8 MMscfgd on a 12/64-in. choke. Following initial production (IP), however, the production trend underwent a very steep decline over the next few months. The well was shut-in for about six months, then came back online in early 2011 at about 2 MMscfgd. Over the next three years, gas production declined steadily, reaching about 100 Mscfd by mid-2014. In comparison with other wells in the area, it was among the poorest performers. Apparently, opening the choke rather aggressively in the early days may have damaged the fractures, most likely due to fines migration and proppant embedment in high-clay zones.

Based on the best initial cumulative performance of various offset wells, the lateral appeared to reside in an area of fairly good reservoir quality. With high IP and steep drawdown, it looked like a good candidate for sequenced refracturing using the new fiber-laden, tetra-modal diversion technology. Running the well through the candidate selection process, described above, confirmed its economic viability.

The lateral was about 3,900 ft long, of which 3,650 ft had been completed. Perforations clusters were approximately 95 ft apart, with five clusters per stage, and a total of some 600 perforations. Since cluster spacing was greater than 90 ft apart, 20 new perforation clusters were added. The nearest offset well was 5,000 ft away, so there was no possibility of well interference. Given the offset well distance, a larger restimulation treatment was appropriate. Since total proppant volume used in the original completion was about 3.5 million lb, or 962 lb/lateral ft, the candidate well was within the ideal range for refracturing (<1,000 lb/ft).

The sequenced refracturing operation was performed in August 2014, consisting of seven proppant fracture stages and six composite diversion pills. After each stage, the well was shut-in to measure instantaneous shut-in pressures (ISIPs), which indicated that the first three stages—in which the ISIPs varied from below 6,500 psi to almost 7,000 psi—were probably reactivating existing fractures before temporarily plugging them off with degradable particles and fiber. The final four stages—in which the ISIPs ranged from 7,000 psi to 8,500 psi—were effectively fracturing previously unstimulated rock. Because the operation apparently reconnected previous fractures to the wellbore and stimulated additional reservoir volume, the refracturing treatment operation was successful.

Encana’s initial post-refracture production came back at about an average of 2.7 MMscfgd for the first month, in effect regaining approximately 33% of the well’s initial 8 MMscfgd production from early 2010, while boosting its current productivity over 10-fold. Based on approximately four months of post-refracture production and drawdown data, the revised well forecast showed an approximate 1.0 Bscf increase in five-year cumulative gas (Fig. 7), assuming conservative choke management. Encana’s total cost for refracturing this underperforming lateral was one-quarter of the initial cost to drill and complete the well.

Other Haynesville wells successfully refractured using the same candidate selection workflow, completion design, and sequenced refracturing methodology—mostly reconnect treatments—have shown sustained initial production regains from 1.7 MMscfgd to more than 5 MMscfgd. Five-year forecasted EURs have shown increases of 20% to 65%. Economic success varies, of course, depending on the initial EUR of each well and the percent uplift regained by refracturing. But overall, the average IP regain has been approximately 33%.

PROMISING RESULTS

The application of refracturing horizontal shale wells is still in its infancy. Done properly, refracturing a viable candidate well can substantially boost productivity, increase EUR, and ensure a solid return on investment at a fraction of the cost required to drill and complete a whole new lateral in the same play. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Using data to create new completion efficiencies (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)