Subsea decommissioning growing in consequence

During the first quarter of 2015, Endeavor Management conducted a benchmarking study of subsea decommissioning practices across the industry, which was funded by Petrobras. Six respected operating companies participated in this study, including two majors, one large independent, one small independent, and two national oil companies. The geographic coverage spanned the world, but focused on four areas of major subsea development: North Sea, Gulf of Mexico, offshore Brazil and Australia. There was an excellent cross-section of responses to develop conclusions about industry practices, and to help define a path forward for future decommissioning practices.

LOCATIONS

Geographically, the Gulf of Mexico continues to dominate the decommissioning market because of the large number of discoveries and field developments over past decades. North Sea fields continue to be decommissioned, since there have been rapid declines, but it will likely take more time because the subsea infrastructures are larger, as are the facilities, and decommissioning of the large infrastructure is challenging.

Brazil has had little subsea decommissioning to date, but this effort is expected to begin in earnest in the next few years. Although the majority of subsea decommissioning projects continue to be in water depths less than 800 m, there is a definite deepwater trend.

More shallow-water reservoirs are reaching the uneconomic milestone, so those developments will soon require decommissioning. As with the initial development of subsea technology, the technology development for decommissioning will improve as operations move to deeper, more challenging fields.

As expected, the vast majority of decommissioning projects center around producing wells, as opposed to water and gas injection wells.

PLANNING & DATA

All participating operators emphasized the importance of planning in successful subsea decommissioning. Although not a standard practice yet, there was evidence that pre‐planning for decommissioning in the initial field development design could bring significant cost-savings during the end-of-life decommissioning program.

Gathering historical well information is a key success factor in analyzing decommissioning requirements, and in planning efficient operations. Critical information includes production history—cessation schedule, reservoir, geotechnical, drilling and completion records—“as built” infrastructure and modifications to that infrastructure. Data development can be done either by experienced contractors or employees. The key is relevant experience in the personnel doing the work. Those with knowledge of the operating history of the field are particularly valuable in planning subsea decommissioning activities.

REGULATIONS

The rules for deepwater decommissioning of oil and gas equipment seem to be less defined than for shallow-water wells. A clear understanding of existing regulations is essential to successful and economical execution of a decommissioning project.

Presentation of a compliant plan with clearly identified cost-saving options will aid the regulatory agency in assessing the viability of the decommissioning plan. Regulators in the U.S. Gulf of Mexico have defined rules for subsea decommissioning. While the Bureau of Safety and Environmental Enforcement (BSEE) provides for allowances not otherwise in the current regulations, BSEE is receptive to “adjustments” in the decommissioning regulations, when water depth exceeds 800 m. It has made other allowances in shallower water depths, when conditions warrant.

Alternate plans to the standard methodology for decommissioning must be supported with strong evidence, and submitted to BSEE for review on a case-by-case basis with the current environmental, health and safety risks.

TEAM FORMATION

A decommissioning team with extensive experience is a critical factor for successful project management and cost control. The main team activities include:

- Developing the plan

- Organizing the participants

- Ensuring that compliance and/or exceptions are fully understood by the regulatory agency

- Managing the offshore operation.

There is no single best approach to the makeup of a decommissioning team. Operators make teams of at least three configurations: all employees, some employees with some contractors, and mostly contractors with company supervisors. While the team profile is not related to the size of the company, the operator’s contract modeling is usually driven by corporate policy and legal considerations. The team, regardless of the size or makeup, may make recommendations for amendments, but the team profile has little to do with contracting models.

CONTRACTING & INTEGRATED SERVICES

Contracting models are one of the most important aspects to be evaluated. Operators and contractors, alike, are risk-averse. However, being able to quantify, and subsequently commercialize, risks is often the difference between a successful project and one with poor results.

The majority of the respondents enjoyed a shared-risk relationship that was forged with a combination of contracting strategies to mitigate (to the extent possible) the inherent risks associated with any decommissioning project. There was no clear “best practice for contracting models” identified by the participants. Each had tried, and was still using, various types of contracts based on risk and the specific scope of work. Key takeaways included:

- Limiting the number of vessels by using those that can support multifunctional services, e.g. survey, diving, ROV, and clearly defining the required capabilities of each vessel, such as crane capacity

- Contractual flexibility with the contractor is paramount for a win/win

- Turnkey contracts work, when both scope and risks can be identified

- Fixed day rate contracts work, when there are a lot of unknowns

- Both contract types can be sent out for competitive bidding

- For turnkey contracts, the scope of work must be clearly defined. Unknown risks will be difficult to quantify monetarily

- For fixed day-rate contracts, there is less risk, but the scope of work must be clearly defined to ensure that crew and equipment requirements are properly identified

- Both turnkey and fixed day-rate contracts can work with the same contractor by separating the scope of work appropriately.

The operators participating in the benchmarking study did not contract with Integrated Service Contractors (ISC). The operators either had rigs already on contract through their drilling departments, or rigs were contracted for specific wells. The production groups provided vessels for decommissioning support work, including ROVs, LWI, heavy lift vessels, and other vessels, as needed. Participants’ comments suggested that ISCs are not a suitable solution, except for specific turnkey activities, such as recovery of a manifold.

COST DRIVERS & TIME REQUIRED

The participants provided some excellent representative costs associated with the various operations. The actual costs cannot be predicted overall, nor by line item, due to the large number of variables associated with unknowns.

Budgetary projections can be developed on a “rule of thumb” basis, with contingency allowances added. Costs to plug and abandon (P&A) a single subsea well ranged from $1.1 million—on a well in a 133-m water depth using a dive vessel—to over $40 million on a well in a 1,600-m water depth, using a mobile offshore drilling unit (MODU).

Most offshore projects lasted four to six weeks, but the number of wells to be decommissioned will substantially impact the time to complete the work. When planning offshore projects, it is important to include contingencies, especially for weather and potential downhole delays during P&A operations. Complexities in the number and condition of wells, size of the development, and unforeseen weather issues can greatly alter the time needed to complete the work offshore. All tools should be ready when needed, and a backup plan approved in advance for any tools needed in an emergency.

VESSELS

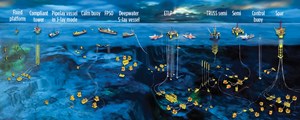

Larger operators tend to have vessels on contract for a variety of projects, decommissioning being one. Therefore, there is a tendency to use specialty vessels (ROV, diving, heavy lift, light well intervention [LWI], and MODU) as part of a campaign during multiple decommissioning projects, Fig. 1. Smaller operators tend to contract vessels with multiple capabilities, to reduce the number of mobilizations or demobilizations. They are also less risk-averse than larger operators and tend to use LWI vessels in preparation for a MODU, or to actually complete P&A work, when able.

The type of vessel to use for P&A varies substantially, based on operator preference and risk evaluation, the condition of the well and work to be performed, and vessels under contract to the operator in the geographic area, Fig. 2.

P&A OPERATIONS

Plugging and abandonment is far and away the most expensive single task during decommissioning, and is fraught with the most risks. The use of LWI vessels versus drilling rigs has many pros and cons. Large operators tend to use a full-service MODU, but they also have higher P&A costs. When employing a drilling rig for P&A work, as a part of the subsea decommissioning program, it is easiest to use one already on contract and to schedule the P&A tasks as a back-to-back operation. However, drilling crews are usually not efficient with decommissioning activities, because they are more focused on “making hole.” Methods used for P&A include:

- Tubing removal, though it is not universally part of the operation

- Cement plug installations, which are very precise as to depth and length

- Cutting casing; commonly at 5 m below mud line, when the subsea wellhead is removed

- Leaving wellheads in place; a practice that is becoming more popular with industry and regulators.

HYDROCARBON REMOVAL

A majority of flushing operations are done with seawater, due to economic reasons. Obviously there is also an environmental consideration by avoiding chemicals as part of the cleaning/flushing operation. Flushing of flexible components, such as flowlines, can be problematic, due to hydrocarbons in the composite layers.

CUTTING CASING & CEMENTING

Mechanical cutters are by far the preferred method for cutting casing. In cases where the subsea wellhead is recovered, the depth of the main cut is fairly common at 5 m below the mudline, although some wells may see smaller casing cut at much deeper depths.

While “rock-to-rock cementing” is the best solution, it is generally impractical for most wells. Cementing the completion with all tubing and annulus barriers in place and verified is the most challenging aspect, and the appropriate steps should be taken to make this a more efficient process. There are resins available that are much better than cement for P&A, but to date resins have been used in very few P&A operations.

COMPONENTS DISPOSITION

Some subsea components are recovered because of potential recycling opportunities. This includes trees, pipeline end manifolds, pipeline end terminations, flying leads, and umbilical termination assemblies.

In the North Sea region, operators and regulators are following the original guidelines to recover everything possible, Fig. 3. In the Gulf of Mexico, operators and federal regulators work on a case-by-case basis to ensure environmental compliance and that decommissioning costs do not become unbalanced. BSEE is now supportive of leaving subsea wellheads in place (subject to fishing and naval issues), in case there is a future problem with the well that requires intervention. BSEE does not support leaving the tree on the wellhead, because it might be difficult to remove in the future. The “abandoned in place” option specifically follows regulatory requirements, amended or otherwise. The opportunity to abandon in place, deeper than 800 m in the Gulf of Mexico, is very evident.

The information collected from participants in this study, regarding the final status of “abandoned in place” subsea decommissioned equipment, indicates that there have been a significant number of risers, flowlines and umbilicals left on the seafloor.

ONSHORE DISPOSITION

Participants in this study have had little input or experience with onshore disposition. Facilities are chosen primarily by the contractors, but must meet all regulatory mandates for safe handling and disposition. Contractors for disposal can be difficult to find. This is a cost driver, since anything that is pulled from the seabed must be disposed of properly. Some questions, related to contaminants in the subsea components and downhole pipe, remain to be explored. These include normally occurring radioactive materials (NORM), mercury and arsenic.

HEALTH, SAFTY & ENVIRONMENT

It is common practice for operators to focus on HSE issues and to encourage safe operations for personnel, vessels and equipment. One of the participants in this study shared concerns regarding HSE requirements for their contractors. The participant sent a safety rep onto the platform and ROV vessel, to clearly convey to all contractors that they must follow the operator’s safety policies. In the future, this participant will have more kickoff meetings to review HS&E issues with all contractors.

Larger operators, e.g. the majors, tend to employ Subject Matter Experts (SMEs) that physically inspect each element of the operation prior to mobilization. This includes vessels, ROVs, diving spreads, and each of their operational elements including cranes, DP systems, ROV redundancy, pressure vessels, and gas diving components. MODUs have come under significant pre-inspection criteria as a result of the Deepwater Horizon incident, including actual operation of the BOP system and related support apparatus.

KEY LESSONS LEARNED

Planning cannot be overemphasized. This includes identifying possible problems that might be encountered, and having predetermined solutions for the most likely problems. The operator must ensure that both the equipment, including the vessel and personnel are well qualified to undertake the tasks identified in the scope of work.

In addition, the host facility should remain in place until all decommissioning work is planned. It may be needed for flushing and other tasks. An experienced decommissioning team, one with a thorough understanding of the field to be decommissioned, is essential to ensuring that the project meets everyone’s expectations.

Lastly, each P&A is unique. Do not underestimate the time required to compile and review documentation.

Subsea decommissioning is a growing segment of the industry in many ways. Older subsea fields and equipment are reaching the end of their expected service life. As a result, the decommissioning industry will follow a development path similar to the early development of subsea technology. It will move into ever deeper water, and require better tools and new technologies to properly recover, seal and abandon seabed equipment in a cost-effective manner.

Cost control will be a primary driver, balanced by the need to protect the ocean environment. Identifying, developing and applying best practice, from across the globe, will help prevent future problems and secure the industry’s continued access to the deep oceans for resource development. It is critical that the industry share best practices, in order to reduce costs and to minimize the risk of pollution incidents in the future. ![]()

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)