Operators take shelter from the oil price storm

It’s been quite the wild ride that U.S. oil and gas firms, and their service company partners, have been on during the last eight-plus months. Indeed, one has to go all the way back to 1986 to find an industry downturn as severe as the current one. During that year, U.S. drilling fell 45.4%, from 1985’s figure of 71,108 wells to just 38,809. This year’s decline is not quite that severe at –39.6%, but the effects across the industry are very much the same.

In response, operators have cut costs in every way imaginable. The list of staff reductions, office closings, project postponements and curtailed capital expenditures is long and varied, and we will not belabor the details. Yet, producers are doing some very novel, productive things in the field, in the name of reducing costs. Exemplifying the theme of “doing more with less,” operators are employing new equipment, new devices and new techniques to reduce drilling time from spud to rig-release, frac wells more efficiently and drop overall well costs substantially, all of this while improving average new-well IPs.

Meanwhile, much like a speeding train coming into a city from wide-open trackage, the great U.S. shale revolution has been slowed to a crawl by low oil prices. Generally speaking, activity this year in the major shale plays is about half of what it was in 2014. Yet, according to the U.S. Energy Information Administration (EIA), average new-well production, per rig, continues to rise in the seven major shale plays—the Bakken, Eagle Ford, Haynesville, Marcellus (Fig. 1), Niobrara, Permian and Utica—ranging from 3% to 5%. It also should be noted that these seven regions accounted for 95% of domestic oil production growth and all domestic natural gas output increases during 2011-2013.

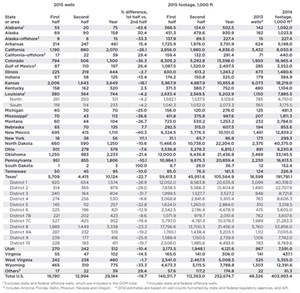

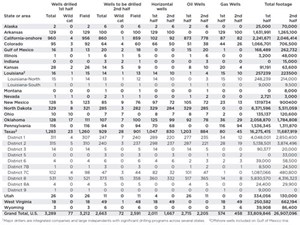

Thus, for the remainder of 2015, World Oil’s forecast (Table 1) includes these highlights:

- U.S. drilling will decline 19.7%, from 16,190 wells in first-half 2015 to 12,994 in the second half

- On a year-to-year basis, U.S. drilling will fall 39.6% to 29,184 wells in 2015, from 48,326 wells in 2014; our revised total for 2014 drilling is just 96 wells higher than our mid-year forecast 12 months ago, a difference of just 0.3%

- The amount of U.S. footage drilled will decrease 19.9%, to 112.4 MMft of hole in second-half 2014, from 140.3 MMft in the first half. Furthermore, year-on-year, footage drilled will lose 37.5%, to 252.7 MMft. Ironically U.S. footage hit a near-record total of 404.0 MMft in 2014.

- Despite the overall downward trend, there are some signs that a few bright spots will develop in several states later this year.

- Based on a theme of “more from less,” operators are coping with low prices by wringing out more value from their assets. They are accomplishing this by utilizing new technology, focusing on sweet spots in core plays, and benefiting from lower equipment and service costs.

In addition, World Oil’s own proprietary survey of major drillers, and small- and medium-sized independents, supports these findings. Among 13 major drillers and 85 independents (Table 2), activity will decrease 19.0% from first-half 2015 to the second half. These operators will also devote 82.7% of their drilling to oil projects. In all, World Oil’s two survey groups, combined, represent 5,952 wells, or 20% of all U.S. drilling.

Capital spending. The well-respected senior managing director and analyst for Oil Services, Equipment and Drilling at Evercore, James West, released in mid-June the summer version of his twice-yearly survey of oil and gas companies’ capital spending. Not surprisingly, he found that in North America, capital budgets are expected to fall 34.2%, to $154.2 billion from $234.4 billion last year, as low commodity prices curtail investments significantly. In the U.S., spending will be down by the same percentage, totaling $119.3 billion vs. $181.3 billion during 2014.

And while capital spending by most firms will remain tied to the swings in commodity prices, the risk/reward of those swings is skewed to the upside. The average WTI price that would prompt higher spending in 2015 is $72/bbl, approximately 20% higher than current levels. One third of respondents noted that they would increase budgets, if oil prices reached levels between $60-$69/bbl, with the majority of respondents noting $65/bbl as the price level that would spur additional investment.

By the same token, West found that 62% of surveyed companies said they would decrease spending, if prices fell to between $45-$50/bbl. The average WTI price that would warrant a further retreat in spending was $47/bbl, or ~22% below current levels. Overall, given current prices, Evercore’s survey results suggest that higher WTI prices will incite greater incremental spending than lower WTI prices would curtail spending. Natural gas budgets appear relatively flexible, with 78% of respondents stating that prices of $2.50/Mcf or lower would be necessary to decrease spending. On the upside, 89% of respondents stated that prices greater than $3.50/Mcf would be needed to increase spending.

U.S. prices. After crawling out of the high $40s/bbl in January, both WTI and Brent continued a modest recovery toward higher levels throughout the remaining winter and spring, due partly to greater global consumption, as well as geopolitical instability in key regions. In late May and June, WTI averaged in the high $50s/bbl, while Brent stayed fairly constant in the low $60s/bbl.

However, on July 6, oil prices fell $4-$5/bbl in reaction to the “no” vote in Greece on its economic program with the European Union, as well as lingering concerns about China’s lower economic growth, higher oil exports from Iran, and continuing growth in global petroleum and other liquids inventories. Over the next two weeks ending July 24, oil prices declined roughly another $3/bbl, pushing WTI back into the upper $40s, with Brent in the low $50s.

Nevertheless, the EIA forecasts that WTI prices will average $55/bbl in 2015 and $62/bbl in 2016. Brent is projected to average $5/bbl more than WTI, at $60/bbl in 2015 and $67/bbl in 2016. The 2015 projections are roughly in line with World Oil’s most recent forecast of $56 for WTI and $61.25 for Brent.

As regards natural gas, EIA said that the Henry Hub spot price averaged $2.78/MMBtu in June, a decrease of 7 cents/MMBtu from the May price. EIA expects monthly average spot prices to remain lower than $3/MMBtu in July, and lower than $4/MMBtu through the remainder of the forecast. On an annual basis, EIA projects the Henry Hub price to average $2.97/MMBtu in 2015 and $3.31/MMBtu in 2016.

EIA’s forecast of U.S. natural gas consumption averages 76.5 Bcfd in 2015 and 76.4 Bcfd in 2016, compared with 73.5 Bcfd in 2014. Consumption growth in 2015 is driven largely by demand in the industrial and electric power sectors. EIA projects natural gas consumption in the power sector to grow 12.9% in 2015 and then fall 2.7% in 2016. Industrial sector consumption is expected to increase 3.3% in 2015 and 3.9% in 2016, as new industrial projects come online, particularly in the fertilizer and chemicals sectors.

U.S. production. The global industry consensus has been that world oil prices will not begin to recover, until evidence emerges that the U.S. crude production rate is showing definitive signs of declining. Some analysts had expected and/or hoped to see this begin to happen by the end of the first quarter. However, that was not the case, as several key U.S. operators noted in their first- and second-quarter reports that they were somewhat surprised at the slower-than-expected declines in their shale wells’ productivity.

Finally, in July, EIA said that its figures led the agency to believe that during May, compared to April, U.S. crude oil production declined 50,000 bpd. Output is expected to generally continue falling through early 2016 before growth resumes. Thus, EIA projects that U.S. crude oil production will average 9.5 MMbpd in 2015 and 9.3 MMbpd in 2016.

Meanwhile, EIA expects that marketed natural gas production will increase 4.3 Bcfd ( + 5.7%) during 2015 and 1.6 Bcfd ( + 2.0%) during 2016. Despite recent declines, natural gas output remains high, and EIA expects continued growth through 2016. Analysts say that increases in the Lower 48 states are expected to more than offset long-term production declines in the Gulf of Mexico.

Increases in drilling efficiency will continue to support growing natural gas production in the forecast despite relatively low gas prices. Most of the growth will come from the Marcellus shale, as the backlog of uncompleted wells is reduced and new pipelines come online to deliver Marcellus gas to markets in the Northeast. Accordingly, this will reduce demand for natural gas imports from Canada and also support growth in exports to Mexico.

U.S. rig count. As of July 31, the Baker Hughes U.S. rotary rig count was 874, down 1,015 units, or 53.7%, from the 1,889 figure of the same week in 2014. During the first seven months of 2015, the U.S. rig count averaged 1,108.5, down 39.3% from the 1,825.9-unit level of the same period in 2014. The decline was spread fairly evenly between the onshore and offshore sectors.

A year ago, the oil-gas split in the Baker Hughes U.S. rig count sat at 83% oil, 17% gas, after the gap had widened for several years in favor of oil. Since then, the split has narrowed slightly, with more rigs again targeting gas. Thus, the split now stands at 76% oil, 24% gas. This reflects that some operators feel gas prices are more stable than oil rates, and thus they can adjust and make a profit. It also reflects the continued strength of activity in the Marcellus and Utica shales of the Northeast.

State-by-state highlights. As the downturn has unfolded over the last eight months, a number of trends have emerged among U.S. operators. Companies that were heavily involved in shales have now reduced their activity and retreated to the so-called sweet spots of those plays. In addition, smaller independents have cut back their drilling severely, with many operators foregoing any drilling at all this year. Those smaller firms that are active are limiting themselves to shallow oil wells and/or gas wells in established fields. With the reduction in shale drilling, the number of laterals completed is less, and hence the total footage drilled across the country is proportionately less. While average footage per well was greater in first-half 2015 than during 2014, we project a slight decline in that number during the second half. Also, as alluded to earlier, operators are using all means available to be more efficient and productive in their projects, and thus cut costs as much as possible.

In Texas, the two centers of activity are still the Eagle Ford shale of South Texas and the Permian basin of West Texas. However, activity is noticeably quieter than it was just a year ago. Drilling in the Eagle Ford (mostly Railroad Districts 1 and 2) will be only slightly more than half its level during 2014. We project that District 1 will be down 49.2%, compared to 2014’s figure, and will decline 28.9% between the two halves of 2015. In District 2, the year-on-year decline will be slightly less onerous at 41.0%, with a drop of 29.0% between first-half and second-half 2015. And yet, even as activity lessens, the EIA reports that Eagle Ford operators continue to make efficiency gains in new wells, as the agency estimates that new-well oil production, per rig, has climbed 25 bpd, to 766 bpd in August 2015, up from 741 bpd in July.

In the Permian basin (Districts 8, 8A and 7C), oil-directed drilling comprises nearly all activity, with only 2% to 3% of wells targeting gas. Last year, operators came very close to breaking the record set in 2012 for most wells drilled annually in District 8. By our estimates, companies drilled 5,760 wells last year, and many of those targeted shale formations with long laterals. Consequently, operators may have actually broken the district record for most feet drilled, when they tallied 53.86 MMft of hole.

In contrast, we predict that companies will drill 42.0% fewer wells this year in District 8, and similar declines are forecast for Districts 8A (–53.3%) and 7C (–52.1%). Furthermore, activity is expected to shrink from the first half to the second half of 2015. This prediction is particularly well-supported for District 8 by World Oil’s own proprietary survey of operators, where a select group of firms in the area will drill at least 30% fewer wells this year.

The news is somewhat better for Texas districts where formations are more gas-prone. In Districts 4 (deep South Texas, along the Gulf Coast), 5 (Barnett shale, central Texas) and 6 (East Texas), we predict that drilling this year, compared to 2014, will only be down 30.7%, 17.1% and 11.4%. This reflects a growing sense among operators that gas prices are now more stable than oil, remaining in a relatively narrow range between $2.75/Mcf and $3.00/Mcf.

In neighboring Oklahoma, operators are hopeful that growing demand will, indeed, lead to stronger natural gas prices. Demand growth also would benefit the state’s economy, which remains more dependent on natural gas than oil, even though crude output has expanded over the last several years. With regard to the latter point, producers drilled a whopping 3,489 wells last year, with a majority of them targeting oil. This year, there will be a 33.1% reduction in drilling to 2,233 wells, although 70% to 75% will still target oil. World Oil’s survey group tracks closely with these trends. From the first-half level, Oklahoma’s second-half drilling will decline another 21.4%, to 983 wells.

In Louisiana, according to figures from the Department of Natural Resources’ Office of Conservation, activity remains much steadier than in most parts of the country. In both halves of the state, declines of less than 5% are forecast by state officials. Furthermore, the trend of the last several years toward more oil-directed drilling is expected to reverse somewhat this year, with a greater emphasis on gas activity in both sections of the state. In addition, the average footage drilled per well continues to rise. Last year saw the average climb to 6,000 ft in the north and 8,700 ft in the south. During the second half of this year, those figures are expected to rise to 6,100 ft and more than 9,000 ft, respectively.

North Dakota’s oil production peaked last December at 1.23 MMbpd, according to the state’s Department of Mineral Resources. It then remained in a narrow band between 1.18 MMbpd and 1.19 MMbpd until dropping below 1.17 MMbpd in April. Judging by operator activity, that output rate will continue to come down in the short term. Producers drilled just 660 wells in first-half 2015, and a 10.6% reduction to 590 wells is expected for the second half. All told, North Dakota drilling will total just 1,250 wells, down 47.4% from 2014’s level. The half-to-half decline is tracked closely by our survey group, which drilled 329 wells in the first half and will follow with 289 wells in the second half.

In the Northeast, activity is dominated by the ever-resilient Marcellus shale, which has provided the vast bulk of U.S. natural gas output growth in recent years. In fact, shale gas production from the Marcellus and Utica shales, collectively, has increased 12.6 Bcfd from January 2012 to June 2015. Even more telling is an EIA statistic, which shows that average, new-well gas production, per rig, in the Marcellus region was 3.2 MMcfgd in January 2012. By July 2015, that figure had increased to 8.3 MMcfgd. Accordingly, Pennsylvania will see its drilling drop only 19.0% from 2014’s level, to 1,806 wells, as operators exploit the wet gas and liquids windows of the Marcellus. To the west, in Ohio, where operators have concentrated more on exploiting the oil layers of the Utica, drilling will be off more noticeably, falling 35.0% to 579 wells, with a 7.6% drop expected between the two halves of 2015. The Marcellus, is also propping up activity in West Virginia, where drilling will total 480 wells this year, down just 8.6% from 2014’s level. Furthermore, this year’s activity will be split almost evenly between the first and second halves.

In the Rockies, where the brakes have been put on work in the Niobrara and other shales, there will be a very pronounced downturn in drilling for Colorado (–33.3%), New Mexico (–24.0%) and Utah (–47.1%), compared to a year ago. In addition, a majority of these states’ activity already has occurred in the first half of 2015. There are two bright spots in the region—the Piceance and the San Juan basins. Both of these plays feature gas activity, which is on the upswing. There is also fresh oil appraisal underway by WPX and other companies in northwestern New Mexico.

California’s shallow-oil market fared well last year, but activity is taking a hit in 2015. More than 3,400 wells were drilled in 2014, but there will be a 39.7% reduction to just 2,070 wells this year. In recent years, World Oil’s survey group, which accounts for roughly 85% of all wells in the state, devoted 92% to 95% of its efforts toward oil development. However, that share has shrunk slightly, down to a mere 90% this year, with a few more gas wells planned. We believe that nearly 60% of California’s drilling has already occurred in the first half of 2015.

Up in Alaska, the big story has been Shell’s return to the Arctic offshore this summer, as the firm tries to drill one or two wells during what remains of the season. But perhaps an equally significant story is that traditional activity on the North Slope and in the Cook Inlet remains healthier than drilling in most other parts of the country. Led by top operators BP and ConocoPhillips, as they tried to build back the state’s sagging oil production, Alaskan drilling hit its highest level since 2006, totaling 182 wells. This year, activity will be off only 12.6%, at 159 wells. Additionally, drilling will increase 30.4% from the first half of the year to the second half.

About these statistics. World Oil’s U.S. tables are produced with the aid of data from a variety of sources, including API, the Texas Railroad Commission, other state and federal regulatory agencies, and a variety of operators. We thank all contributors for their time and effort in providing data and analysis.

World Oil editors try to be as objective as possible in the estimating process, to present what they believe are the most current data available. Sound forecasting is only as reliable as the base data. Thus, well counting is a dynamic process, and most historical data will be updated continually over a period of several years before “the books are closed” on any given year. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)