|

| An exploration well is drilled for Genel Energy at Taq Taq field in Iraq. The firm continues to develop Taq Taq with horizontal wells and a second Central Processing facility (photo courtesy of Genel Energy). Central production facilities at Anadarko Petroleum’s El Merk field in Algeria, which produced 165,000 bpd of liquids during first-quarter 2014 (photo courtesy of Anadarko). Dana Petroleum continues to develop East Zeit field offshore Egypt, where the firm drilled 19 wells during 2013 (photo courtesy of Dana Petroleum). |

|

The impact of unrest in the Middle East and North Africa (MENA) continues to cloud the region with uncertainty. Overall, during 2013, the Middle East produced 32.2% of oil and 16.8% of gas globally, equal to a 7.0% decrease and 4.5% increase, respectively. North Africa produced 3.7% of oil and 4.4% of gas globally, an annual decrease of 13.2% and 5.1%, respectively (BP Statistical Review 2014).

Despite this, upstream exploration, development and production activity has continued in the MENA region. This article outlines the key activity over the last 12 months.

MOROCCO

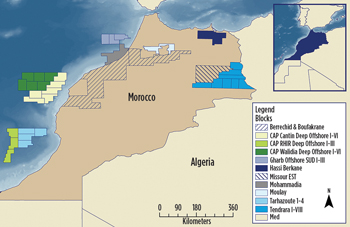

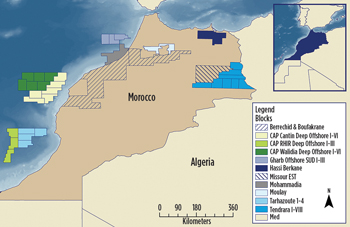

Moroccan agency, Office National des Hydrocarbures et des Mines (ONHYM), reported that 31 exploration blocks and five reconnaissance permits were awarded during 2013-2014, Fig. 1. Morocco saw Chevron and BP enter exploration licenses. Chevron was awarded the Cap Walidia Deep, Cap Rhir Deep and Cap Cantin Deep licenses in January 2013, and BP farmed into three licenses in a deal with Kosmos Energy in October 2013. Maxim Resources, Oil & Gas Investment Fund (OGIF) and Petra Energia were also awarded reconnaissance licenses over Hassi Berkane, Missour Est, Berrechid and Boufakrane, respectively; Petra Energia was awarded the latter two licenses.

|

| Fig. 1. Moroccan officials awarded 31 exploration blocks and five reconnaissance permits during 2013-2014. |

|

A number of current players have expanded acreage. Chariot Oil & Gas entered the Mohammadia reconnaissance block in March 2014, and Gulfsands entered the newly delineated Moulay Bouchta Block in April 2014.

Farm-in activity has also continued, with SK Innovation obtaining 9.375% working interest (WI) in the Foum Assaka Block from Fastnet in April 2014. In May 2014, Galp Energia acquired a 50% WI and operatorship of the Tarfaya Offshore Block from Tangiers Petroleum. Woodside Petroleum entered the Rabat Deep Offshore licence with Chariot Oil & Gas, gaining a 25% WI. San Leon also received interest in its Sidi Moussa acreage, with Genel Energy farming in with a 60% WI and operatorship. Cairn Energy entered Foum Draa, obtaining a 50% WI and operatorship.

ONHYM reported that 27 exploration wells were planned for 2014. At the time of writing, eight of these wells had been spudded, compared with a total of five wildcats drilled during 2013.

Offshore activity has seen Cairn Energy spud the Foum Draa-1 (FD-1) well, in October 2013, in the offshore Foum Draa permit. Although commercial hydrocarbons were not found, gas shows were reported to have been encountered. Cairn also drilled Juby Maritime-1 in the Juby Maritime permit in January 2014, encountering heavy oil.

In June 2014, Galp Energia spudded the Tarfaya Offshore-1 well. It did not encounter any hydrocarbon shows at either the Trident or Assaka prospects, and was subsequently plugged and abandoned. The latest exploration well to be drilled offshore is Genel Energy’s Sidi Moussa-1, which was spudded in late July 2014. The well has been drilling ahead and was expected to take two to three months to complete.

Onshore, PetroMaroc, formerly Longreach Oil & Gas, found significant hydrocarbon indicators while drilling Koba-1 in December 2013. The well, awaiting test results, was drilled in the Mokhtar Sud permit. PetroMaroc subsequently had success with its Kamar-1 well in May 2014, also in Mokhtar Sud. Kamar-1 intersected two distinct gas-bearing intervals.

Gulfsands has completed three of four planned wells on its onshore Rharb Centre permit. Al Krima-1 (AKR-1) was spudded in October 2013, followed immediately by Oulad Zid-1 (OZI-1) in November 2013 and, most recently, Lalla Yetou Updip-1 (LTU-1) was spudded in June 2014. AKR-1 and OZI-1 encountered gas; however, AKR-1 was heavily water-bearing. LTU-1 was the first well drilled following the acquisition of new 3D seismic on the permit. It was announced as a gas discovery in July 2014 after testing 6.6 MMcfgd.

Circle Oil also has had success onshore in the Sebou permit, with the SAH-W1 well drilled in June 2014. SAH-W1 encountered gas, and the discovery will come on-stream upon completion of a six well drilling program. The company estimates that 25 Bcfgd to be within the play. In August 2014, Circle spudded the Caid Guedari-1 (CGD-1) exploration well. This is the second exploration well that Circle has drilled in the Sebou permit.

ALGERIA

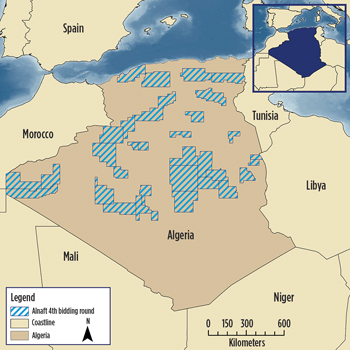

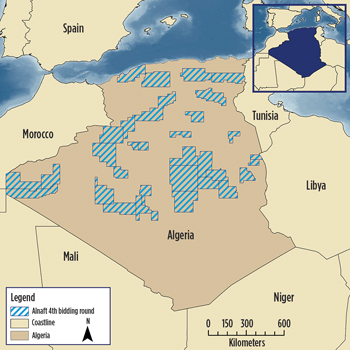

In 2013, Algerian natural gas production averaged 2.9 Bcfd, a 3.3% decrease from 2012’s levels. Oil production averaged 1.4 MMbpd, 2.7% higher than in 2012 but 14% lower than in 2003. Algeria has looked to reverse this decline through reforms of its fiscal policy. In January 2013, the hydrocarbon law was revised ahead of the Agency for Hydrocarbon Resources Valorisation (ALNAFT) bidding round in January 2014. The ALNAFT Fourth International Bid Round offers 31 onshore licenses (Fig. 2), covering 463,144 km2; of which 10 blocks are thought to contain unconventional resources. The blocks on offer cover the Tindouf, Illizi-Ghadames, Atlas and Reggane/Gourara basins.

|

| Fig. 2. Algeria’s fourth bidding round offers 31 licenses covering more than 463,000 km2. |

|

The Sonahess-operated Gassi El Agreb project, which includes El Gassi, El Agreb and Zotti fields, saw decreased production in 2013. According to Hess, the project produced an average of 35,000 bopd, compared to 50,000 bopd in 2005 when the redevelopment project was in its final year. (Sonahess is a JV between the Algerian state firm, Sonatrach and Hess Corporation.) However, according to the National Statistics Data office, since first-quarter 2014, an increase in production of 13.5% was seen compared to the same period last year. First-quarter 2014 also saw LNG exports increase by 20%. Sonatrach is also looking to use enhanced oil recovery (EOR) methods to improve production from ageing fields.

In early 2013, Anadarko’s El Merk field started production. This was the latest field to go onstream in Algeria. In first-quarter 2014, El Merk produced an average 165,000 bpd of crude oil, condensate and LPG, combined. Anadarko was ranked as Algeria’s largest foreign producer in 2013 (Fig. 3), producing from the El Merk and Hassi Birkine Grouped Field project, both in the Illizi-Ghadames basin.

|

| Fig. 3. Anadarko Petroleum remains Algeria’s largest foreign producer, with output concentrated in the Illizi-Ghadames basin (photo courtesy of Anadarko Petroleum). |

|

In the last 12 months, new acreage has been awarded, including the El Guefoul, Tinerkouk and Terfas permits to Eni in second-quarter 2014. Petroceltic also completed a farm-out of 18.4% equity in the Isarene permit to Sonatrach. Isarene contains Ain Tsila field, which should come on-stream in 2017.

During 2013, exploration activity continued with 93 exploration wells drilled, of which 85 were drilled solely by Sonatrach, with the remaining eight drilled by partnerships. Sonatrach reports that for 2014, 117 exploration wells are planned.

The continued exploration activity has resulted in a number of successes. PTT Exploration and Production Co. Ltd (PTTEP), CNOOC and Sonatrach have reported success on the Hassi Bir Rekaiz permit, hitting three discoveries. Sahane Bagas-1 found oil and associated gas in the Ordovician and TAG-I reservoirs and flowed, respectively, at approximately 2,658 bopd and 2.13 MMcfgd. The Rhourde Rhofat-1 and Rhourde Abaje-1 wells flowed at 478 bopd and 484 bopd, respectively. Additionally, PTTEP plans to complete at least four development wells in the Bir Seba license during 2014.

The Southwest Gas Project is a key development in southwestern Algeria, and is expected to start producing in 2017 at the earliest. The Touat project, to be led by GDF Suez in association with Sonatrach, is targeting peak production of 160 Bcf/year. The Reggane Nord project, led by Repsol, consists of developing six fields with expected peak production of 100 Bcf/year. Development of Timimoun field, led by Total in association with Sonatrach and Cepsa, has expected peak production of 60 Bcf/year. The project aims to to connect these fields to the central Hassi R’Mel gas hub.

According to the Algeria Press Service, Sonatrach hopes to rebuild oil and gas reserves by investing $102 billion in upstream activities by 2018, concentrating on developing shale and tight gas deposits, with a cumulative reserve estimate of 600 Tcf.

TUNISIA

In Tunisia, the country has continued to see new entrants while existing companies have increased acreage positions throughout second-half 2013 and first-half 2014.

New entrant Petroskandia acquired 50% WI and operatorship of the Teboursouk exploration permit in August 2013, with state owned Entreprise Tunisienne D’Activités Pétrolière (ETAP) holding the remaining 50% WI. February 2014 saw Mazarine Energy enter the Zaafrane permit, obtaining 90% WI and operatorship, with Medex holding the remaining 10% WI.

In 2014, Tunisia saw the return of Medco Energi, through its wholly owned subsidiary, Medco Tunisia Petroleum Limited, acquiring 100% of the shares of Storm Ventures International (Barbados) Limited for $114.03 million. Storm Ventures International (Barbados) Limited is a subsidiary of Chinook Energy Incorporation, a leading E&P company in Tunisia, that holds four exploration, two development and two production permits.

In second-quarter 2014 Rigo Oil Company Limited, a wholly owned subsidiary of Cygam Energy, entered into an agreement with YNG Exploration Limited for the Sud Tozeur permit. In this deal, YNG Exploration Limited will acquire 100% of Rigo Oil’s interest in the permit, subject to governmental approval.

A number of farm-in opportunities in Tunisia are also available. Circle Oil will farm-out 35% in the Mahdia permit. Cooper Energy continues plans to divest its assets, including the Hammamet Offshore, Bargou and Nabuel permits.

One exploration well was drilled in Tunisia during first-half 2014, in comparison to 14 during 2013. OMV drilled six exploration wells before the end of third-quarter 2013, including the Chadha-1, Lina-1, Maha-1 and Nada-1 in the Anaguid Block, all resulting in hydrocarbon shows.

In June 2014, Circle Oil spudded the El Mediouni-1 wildcat in the offshore Mahdia permit. The well was drilled to a TD of 1,200 m in the Upper Ketatna carbonates. Circle has estimated the recoverable prospective resources discovered by the well to be approximately 100 MMbbl.

With a focus on development activities, Winstar Tunisia, a wholly owned subsidiary of Serinus Energy, spudded the Winstar 12bis development well in Sabria field during July 2014, and plans Winstar 13 before year-end 2014. The wells are targeting Ordovician-aged Hamra and El Atchane sandstone formations. Sabria field was discovered in 1979, with 347 MMbbl of oil-in-place. Six wells have been drilled in the field with, 3.1 MMbbl of oil and 8.8 Bcf solution gas produced by the beginning of 2014, according to Winstar.

Major infrastructure projects underway include the Nawara gas field development project, operated by OMV with ETAP. OMV will invest $680 million, and construction is expected to take up to three years. This project is expected to open up south Tunisia to further opportunities and bring down development costs for future projects in the region.

LIBYA

In Libya, production fluctuated during 2013. Between January and May, output remained stable at 1.35 MMbopd. However, by August, production had fallen to 590,000 bopd and then further declined to 220,000 bopd in November 2013 (BP Statistical Review 2014). Disruption to production and exports has been caused by continuous protests and strikes.

The Libyan government is striving to increase oil production by means of EOR methods. Meanwhile, in June 2014, it reached an agreement with protestors to re-open El Feel and El Sharara fields in the Murzuq basin and Wafa oil field in the Illizi-Ghadames basin. The Ministry’s inspection and measurement department stated that El Feel field was set to produce 80,000 bopd within days of re-opening. El Sharara restarted production in July 2014, with state firm NOC reporting 327,000 bopd.

Security in Libya remains unstable. Shell withdrew from two exploration blocks in 2012. In June 2013, BP abandoned plans to explore the Ghadames basin. BP has yet to surpass the exploration stage in its Area A and B onshore permits, and it does not currently produce oil in the country. BP’s first offshore well has been pushed back until 2015. In September 2013, Exxon Mobil cut staff and operations in the country, and Marathon Oil attempted to farm-out its acreage. Despite companies leaving Libya, the NOC lifted its force majeure on the Zuetina oil harbor on April 28, 2014, in a continued attempt to resume exports to pre-2011 levels.

During 2013, exploration levels rose and have continued to improve during 2014. Drilling highlights include Total’s A-001-16/003 offshore well. This well follows Total’s three-year break in exploring Libya. The well is the first of two planned for 2014, costing around $120 million.

NOC-owned Arabian Gulf Oil Company (AGOCO) also struck two discoveries in the Sirte and Ghadames basins with the FF-002-047 and G-001-NC004 exploration wells, respectively. Algeria’s Sonatrach, along with Oil India and Indian Oil, discovered gas and condensate in the Ghadames basin with the C-001-096-01 well. They also struck a discovery in AREA 95-96 of the Murzuk basin.

Poland’s PGNiG hit its second find in Area 113 with the B-001-113/01 exploration well. Two production tests confirm gas flowrates of 4 MMcfgd.

EGYPT

In Egypt, oil production remained steady at an average rate of 695,004 bpd during 2013. However, gas production decreased from 5.9 Bcf in the 2010-2012 period, to 5.43 Bcf in 2013 according to BP Statistical Review 2014. Oil reserves calculated at the end of 2013 totaled 3.9 Bbbl, a 10% increase over the last decade, while natural gas reserves reached 65 Tcf, a 6% increase.

During December 2013 Egyptian General Petroleum Corporation (EGPC) and Egyptian Natural Gas Holding Company (EGAS) launched simultaneous international bidding rounds. The EGPC round offered 15 exploration blocks, five offshore and 10 onshore, covering an area of 31,107 km2. In addition, EGAS offered eight exploration blocks, five offshore and three onshore, covering an area of 26,012 km2. EGAS initially offered seven exploration blocks, adding a third onshore block in February 2014.

Last year, Apache was awarded 20 development leases, representing one of the firm’s most successful years in Egypt, Fig. 4. The Oil Ministry in Egypt also has reported that 20 exploration and production sharing agreements were signed during 2013, with companies due to spend $698 million and drilling 107 wells.

|

| Fig. 4. The Karama gathering center supports Apache’s production operations in Karama field, where the company’s first discovery was struck in the Abu Gharadig basin in 2001 (photo courtesy of Apache Corp.). |

|

Petroceltic has confirmed the ratification of the exploration agreements covering the North Thekah, South Idku and El Qa’a concessions. It has budgeted $32 million for developments in 2014, following $60 million spent on construction and field development in 2013. TransGlobe Energy also finalized four production sharing contracts from the 2011/2012 EGPC bidding round, and now has 100% interest in the Northwest Gharib, Southwest Gharib, Southeast Gharib and South Ghazalat concessions.

Major deals saw Apache complete the sale of 33.3% of its Egyptian oil and gas business to Sinopec in November 2013, receiving $2.95 billion in cash. Vegas Oil and Gas divested the Alam El Shawish West, Northwest Gemsa and East Ghazalat concessions in April 2014 to focus on its East Lagia and West Obayed licenses.

During 2013, 103 exploration wells were drilled, followed by approximately 26 further exploration wells in first-half 2014. According to the Egyptian Oil Minister, 48 discoveries were made in the 2013-2014 fiscal year (37 oil and 11 gas), adding reserves of 53.2 MMbbl of oil and condensate, and 392 Bcfg.

In the Western Desert, Apache dominated activity, drilling 181 development and injection wells, and 54 exploration wells, during 2013. Apache experienced a success rate of approximately 60% from its 2013 exploration wells and has planned to invest $1.4 billion in 2014.

In August 2013 Apache announced seven new discoveries, including the Riviera SW-1X and Narmer-1X; of these discoveries, six are already producing. During first-half 2014, Khalda Petroleum, a JV between Apache and EGPC, made gas and condensate discoveries at its Herunefer-1X and BAT-1X exploration wells. Herunefer-1X was the first of a series of exploration wells to be planned for the Matruh basin during 2014. Khalda believes that BAT-1X is a potentially large discovery, and plans to drill several trend exploration wells in 2014 to evaluate and appraise the find.

During first-quarter 2014, BP drilled the deepest offshore well in Egypt, in the El Burg Offshore Block of the eastern Nile Delta. Notus-1 reached a TD of 7,200 m and encountered gas in all of its target zones. The discovery has prospective resources of more than 6 Tcf. BP’s spudded the Opera Offshore-1 well in the Gamasa North 1A Block in second-quarter 2014.

In August 2014, Eni and BP started producing from the Denis-Karawan (DEKA) project in the Temsah offshore concession, via the new subsea well, Denise South-6, at initial rates of 63.5 MMcfgd and 800 bcpd. The project includes the development of five subsea wells, installing production systems, sealines and gas processing facilities at the El Gamil gas plant. Peak production is anticipated by first-quarter 2015, at an estimated rate of 229.45 MMcfgd.

During 2014, Apache is continuing its 265-well drilling program. The company drilled 67 wells during the second quarter, and this rate is expected to continue throughout second-half 2014. Khalda Petroleum will drill 37 exploration wells during 2014, having drilled 14 to TD. Of these, eight have been announced as discoveries. TransGlobe Energy had planned 51 wells for 2014, 16 for exploration and 35 for development.

ISRAEL

In Israel, Noble Energy’s Tamar field in the Levant basin, was discovered in January 2009. At the time, Tamar was Noble’s largest discovery in Israel, with estimated reserves of 10 Tcf of natural gas. Following a four-year, $3-billion development project, the field began producing in March 2013. During November 2013, Noble successfully made an eighth consecutive discovery at Tamar Southwest, which is thought to contain an estimated 700 Bcf of gross natural gas. Noble plans to tie-in the discovery during 2014, with first production targeted in mid-2015.

In Leviathan field, also discovered by Noble in 2010, an independent report by Netherland, Sewell & Associates cites that the natural gas and condensate reserve estimates for the field rose from 18.9 Tcf to 21.93 Tcf and 34.2 MMbbl to 39.4 MMbbl, respectively. It represents one of the largest offshore gas finds globally in the last decade and is expected to provide Israel with energy independence. Since appraisal of Leviathan began in 2011-2012, it has been widely anticipated that the field would be produced using LNG as the primary means of export, with an initial, two-train, onshore LNG plant planned. Export via pipeline has been considered a viable alternative. First production from Leviathan is anticipated in 2017. The field consortium has signed an agreement with BG Group to export 247.2 Bcfgd for 15 years via an underwater pipeline to its LNG plant in Idku, Egypt.

Meanwhile, Zion Oil & Gas was awarded the Megido-Gezreel Block in December 2013 for an initial three-year exploration period. Noble Energy and its partner Delek Drilling, have divested and relinquished several blocks in the country. In July 2014, Afek Oil & Gas was granted approval for a drilling program consisting of 10 wells in the Golan Heights region, where it operates Block 397/Ness.

PALESTINE

Historically there has been no E&P activity onshore in the State of Palestine. Nevertheless, in June 2014, the Palestine National Authority (PNA) launched an international bidding round for the Rantis-1 Block onshore. The PNA also announced plans to drill in the West Bank, in a bid to establish a local economy.

Offshore Palestine, one block, Gaza Marine, is licensed to BG and Consolidated Contractors. The block is in the eastern Mediterranean and contains the Gaza Marine gas discovery, which has reserve estimates of 1 Tcfg. Gaza Marine’s development has been on hold, due to ongoing disputes with Israel.

JORDAN

There has been limited activity in Jordan following the licensing rounds of November 2012 and April 2013. The Natural Resource Authority (NRA) launched a round for the West Safawi Block in 2012 and in 2013, the block offered again. To date, these blocks remain open.

SAUDI ARABIA

Oil production in Saudi Arabia decreased 1.1% in 2013 (BP Statistical Review, 2014) to 9.4 MMbpd (Saudi Aramco 2013 Facts & Figures). Saudi Arabia remains the world’s largest hydrocarbon producer with 13.1% of global production, and remains OPEC’s main swing producer, having capacity to increase production, when needed, to meet global demand, Fig. 5.

|

| Fig. 5. Saudi Aramco continues to maintain an intensive drilling program, to keep its productive capacity at approximately 12 MMbopd (photo courtesy of Arabian Drilling Company). |

|

Export dynamics from Saudi Arabia saw changes in 2013 as U.S. import requirements fell from 7.4 MMbopd at the end of 2013 to 6.5 MMbopd in 2014, the lowest seen since the early 1990s. Historically, about 25% to 30% of the U.S. imports came from Saudi Arabia. Due to this change, 53.8% of Saudi Arabian crude exports are now directed toward Asia. Saudi Arabia also expects domestic demand for natural gas to double by 2030, to 3.5 Tcf per year.

For the last decade, the South Rub Al-Khali Company (SRAK), a JV between Saudi Aramco and Shell, has been focused on gas exploration to meet growing domestic demand. SRAK has focused exploration efforts in the Rub Al-Khali Desert. Yet, following little success, the company announced in June 2014 that it had no plans to pursue further leads in the basin.

YEMEN

In Yemen, political instability has had an impact on oil exports. According to the BP Statistical Review 2014, exports decreased for a tenth consecutive year, falling from 451,000 bopd in 2003 to 161,000 bopd in 2013.

Since the licensing rounds of 2012 and 2013, drilling and licensing activity has been limited. The 2012 round offered five blocks, and companies such as DNO (Fig. 6)and KUFPEC were successful, winning Block 84 and Block 102, respectively. The second round closed in May 2013, having received applications from 45 companies, of which 18 qualified. Awards from this round are yet to be announced. In May 2013, Petsec Energy announced that it had increased its interest in Block 7 from 21.25% to 29.75%, purchasing 8.5% from Mitsui E&P Middle East.

|

| Fig. 6. A rig hand climbs up the side of a drilling unit operating on behalf of DNO in Yemen’s Nabrajah field (photo courtesy of DNO). |

|

Civil unrest in Yemen has seen a number of operators declare force majeure over licenses in the last year. However, exploration success has continued. DNO discovered Salsala field in Block 32 with the Salsala-1 well in October 2013. The well tested 3,400 bopd and 2 MMcfgd from the Shuqra formation. Reserve estimates are yet to be classified. However, DNO hopes to appraise the discovery during 2014.

OMAN

In Oman oil production rose 2.7%, to an average rate of 942,000 bpd, according to the BP Statistical Review 2014. This trend continued in first-half 2014 with an increase of 1.3% in oil production by the end of May. The Ministry of Oil and Gas announced plans to maintain production levels between 940,000 and 960,000 bopd over the next five years.

Licensing has remained steady in Oman, with companies such as Total and Petrogas LLC signing Exploration and Production Sharing Agreements (EPSAs). Total was awarded Block 41, and Petrogas acquired Block 55 onshore southeastern Oman. DNO, having expanded its presence in 2012 by farming into Block 36, is now in the final stages of relinquishing Block 31 with confirmation expected imminently. Most recently, on Aug. 3, the Ministry of Oil and Gas launched Oman Bid Round 2014. The bidding round includes two offshore blocks, 18 and 59, and three onshore blocks, 43A, 54 and 58, covering a total of 76,416 km2. The deadline for the submission of sealed bids is Oct. 31, 2014.

During 2013, there were 33 exploration wells drilled, including a number of successful discoveries, both on and offshore Oman. In December 2013, Masirah Oil drilled the GA South 1 exploration well, one of Oman’s first major offshore discoveries. Drilled in Block 50, the well flowed at 3,000 bopd during a 48-hr test. Masirah Oil also spudded the Masirah North North 1 exploration well in November 2013, in offshore Block 50. Last January, Tethys Oil announced the B4EW-6 as an oil discovery in the Saiwan East area, Block 4. The well tested at a rate of 2,200 bopd from the Lower Buah formation. Tethys is continuing efforts to appraise its discoveries, with latest activity represented by the drilling of the B4EW4-7 appraisal. DNO is also evaluating drilling targets in Block 8 with a three-well exploration program planned to begin in second-quarter 2015.

UNITED ARAB EMIRATES

The UAE produced 1.33 Bbbl of oil in 2013, an increase of 7.3% from 2012. Gas production also increased 3.3% in 2013 to 1,975.8 Bcf (BP Statistical Review, 2014). Development of existing fields continues to be a priority. Inpex Corporation and Abu Dhabi National Oil Company (ADNOC) were awarded a 15-year extension to Upper Zakum oil field and had all fiscal terms reviewed. The development project, called UZ750, consists of three stages and aims to increase and maintain production capacity at the target rate of 750,000 bopd over the next 25 years.

Zubara Energy, a subsidiary of Lime Petroleum, also received an extension for the Sharjah offshore block, to allow for drilling of an exploration well in third-quarter 2015. This will be the second drilling campaign for Lime Petroleum, following successful drilling offshore Oman.

In January 2014, ADNOC became the sole shareholder of Abu Dhabi Company for Onshore Operations (ADCO), after the 75-year-old ADCO contract involving international oil companies expired. Prior to this expiry, ADNOC held a 60% interest, partnered with BP, Exxon Mobil, Shell and Total, with each holding 9.5%, and Partex holding the remaining 2%. The EIA estimates that in 2012, ADCO’s production was as follows: Asab, Sahill and Shah fields produced a combined 430,000 bopd, Dabbiya, Rumaitha and Shanayel fields produced a combined 100,000 bopd and the Bab and Bu Hasa fields produced 360,000 bopd and 550,000 bopd, respectively. ADNOC has invited 10 companies to apply for new onshore contracts including the five former.

QATAR

Production in Qatar continued to rise during 2013 with oil and gas output reported at 1.7 MMbpd and 15.3 Bcfd, respectively (BP Statistical Review, 2014). Activity in Qatar is focused on field development, with Qatar Petroleum investing $11 billion in the redevelopment of Bul Hanine oil field to prolong production and increase output to 90,000 bpd by 2020. Bul Hanine currently produces at a rate of 40,000 bopd.

Exploration also continued in 2013, as Shell drilled a dry exploration well in North field within Block D.

KUWAIT

In Kuwait, 2013 oil production rose to 2.87 MMbpd, a 12% increase compared to 2012. This trend is expected to continue, with 2014’s production reaching 2.92 MMbopd by the end of the year. Kuwait is working on plans to increase oil production capacity, through EOR techniques, to 4.0 MMbpd by 2020. This is expected to cost approximately $100 billion.

IRAQ

Iraq’s production has rebounded to 3.1 MMbopd, the highest level since 1979. Production has been increasing at a rate of 26% every year since 2010. However, output increased only 0.8% in 2013. Gas production has been in steady decline since 2008, when a record high 67.1 Bcf was produced. In 2013, Iraq produced 21.2 Bcf, a 4.4% decrease from 2012 (BP Statistical Review, 2014).

In the Kurdistan region of Iraq, licensing activity includes the award of the Halabja Block to Gazprom Neft in February 2013, followed by newly demarcated blocks Gwer/Hamdan being awarded to the Komet Group in June 2013. Chevron was awarded Qara Dagh in June 2013, while Talisman Energy and Murphy Baranan Oil farmed out their interest in the Baranan concession to Total. Maersk Oil also farmed into the Piramagrun and Qala Dze Blocks with Repsol in January 2014. PetroChina entered West Qurna-1, buying a 25% WI from Exxon Mobil.

Iraq hopes to increase and maintain exports, and intends to build a 200-km pipeline to Turkey, with a capacity greater than 1.0 MMbopd.

Production from Badra oil field in federal Iraq commenced in May 2014, Fig. 7. Following extensive testing and an initial production target of 15,000 bopd, the field should peak at 170,000 bopd in 2017. Continued development of West Qurna-2 also has seen production figures rise to120,000 bopd in March 2014, and approximately 200,000 bopd in May 2014.

|

| Fig. 7. A Gazprom Neft rig drills at Badra field in Iraq during October 2013. The firm put Badra onstream in May, at an initial 15,000 bopd (photo courtesy of Gazprom Neft). |

|

In early 2014, Oryx Petroleum announced its third consecutive discovery, Zey Gawra, on the Hawler license in the Kurdistan region. The Zey Gawra-1 well flowed at an average 4,800 bpd of light crude oil from an 81-m column.

Oryx hopes to appraise the discovery in 2014 after an aggressive drilling program during 2013, consisting of three exploration wells and one appraisal. According to Oryx, the Demir Dagh-2 produced at rates of 4,000 bopd when put onstream during June 2014. Oryx anticipates increasing production to a target 40,000 bopd by 2015 and then to 100,000 bopd by 2016.

Genel Energy will continue development of Taq Taq field, with plans to drill the first horizontal well, Taq Taq-24, in the field during fourth-quarter 2014. Genel also has drilled vertical development well Taq Taq-27 during second-quarter 2014 and Taq Taq-28 was set to spud in the third quarter. Taq Taq oil field holds net 2P reserves of 453 MMbbl. Work is also underway to significantly increase production with a second Central Processing Facility (CPF II) to be complete in first-quarter 2015. The completion of CPF II will increase the production capacity of Taq Taq to 200,000 bopd, according to Genel.

Oil Search also continues to work in Kurdistan on its Taza Block, launching a comprehensive appraisal program on the Taza-1 oil discovery in December 2013. The program includes the Taza-2 appraisal well which was drilled to TD in July 2014. The well has since been suspended, due to regional tensions. Further plans include drilling of Taza-3 and Taza-4 appraisals.

Exploration continues in the Shakal Block operated by Gazprom Neft, also in Kurdistan. An initial exploration well was drilled in August 2014, to be followed by a second exploration well in late third-quarter 2014. Kuwait Energy Limited has continued to work towards fulfilling work commitments for Block 9, near Basra, by spudding an exploration well in March 2014. Testing of the well is to take place in second-half 2014. Future plans for the block include the acquisition of 3D seismic data in first-half 2015.

IRAN

In 2012, Iran was OPEC’s second-largest crude oil producer. By 2013, it had fallen to fourth place. Recent years have seen sanctions resulting in cancellations of new projects, as well as affecting existing ones. Sanctions were focused largely on imports and exports, thus affecting production. Last year, oil production averaged 2.7 MMbpd, 36% lower than the 4.2 MMbpd experienced in 2011 (U.S. Energy Information Administration). It is reported that first-half 2014 has seen increases in production of 200,000 bopd to 2.9 MMbopd. To help the production rate per well, National Iranian Drilling Co. has been employing a greater amount of horizontal drilling, Fig. 8. Iran also holds OPEC’s second-largest natural gas reserves with an estimated 1,193 Tcf, representing 17% of the world’s proved natural gas reserves (U.S. Energy Information Administration).

|

| Fig. 8. A growing share of Iran’s drilling activity involves horizontal wells (photo courtesy of Petroiran Development Co.). |

|

SYRIA

With sectarian unrest continuing in Syria during 2013, oil production averaged 56,000 bopd, representing a 91.4% decrease over the last decade, when output stood at 652,000 bpd (BP Statistical Review, 2014).

Despite this, Russian company Soyuzneftegaz was awarded Block 2 in December 2013 for 25 years under the Amrit permit. The block is offshore in the eastern Mediterranean. The contract entered into immediate effect, despite U.S. and European sanctions. Sanctions were introduced in May 2011, following which a number of companies have declared blocks as force majeure, and have stopped any involvement in E&P activity.

LEBANON

Following the formation and subsequent announcement of the Petroleum Council in November 2012, Lebanon launched its first international bidding round in May 2013. It initially offered 10 offshore blocks. Subsequently, the Petroleum Council reduced the official number of blocks on offer to five, with the remaining five to be offered potentially in the future. The blocks span the Sinai-Levant basin which has proved prospective for neighboring countries, such as Israel, where Tamar field was discovered and subsequently onstream in March 2013, and the Aphrodite discovery, which was made offshore Cyprus in 2012. Fiscal terms in Lebanon are considered to be attractive and competitive. However, the round has, most recently, been extended for the fifth time.

CONCLUSION

Despite the difficulties that face upstream operators in the MENA region, new entrants, licensing activity and drilling successes continue. New acreage continues to be awarded and available in a number of bidding rounds launched during the past year. Interest in well-known prospective plays and frontier regions, alike, remains high, showing that MENA still remains a key region for oil and gas globally.

|