Offshore in depth

Decision models increase offshore bidding wins, reduce costs

|

Have you ever wondered about the process that oil companies follow to prepare and submit bids for offshore leasing auctions? Understandably, E&P companies keep details of this activity confidential, treating them as closely-held secrets to prevent competitors from snatching their target blocks. You would expect them to support their multi-million-dollar decisions with the best minds and analytical tools.

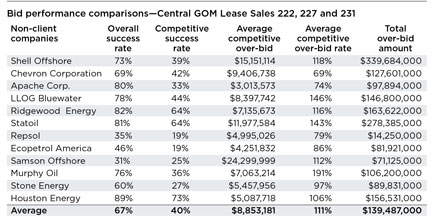

But if offshore lease bidding is so scientific, why do companies consistently overpay for blocks? In the March 2014 Bureau of Ocean Energy Management (BOEM) sale for blocks in the Central Gulf of Mexico, winning bidders overpaid nearly $600 million, clearly a windfall for the federal government, but, at least partly, an unnecessary expense that reduced the economic value of leases for the winning bidders. The March lease sale was not unique. An analysis of the last three Central Gulf of Mexico lease sales from 2012 to 2014 (see table) showed that 12 active bidders overbid an average $8.9 million per block, to win competitive bids, overpaying by an average 111%, compared to the next highest bid. Including blocks receiving only one bid, which are required to exceed BOEM’s minimum bid amount, these companies, combined, overbid $1.7 billion for these three rounds, for an average overbid of $139.5 million for the leases they acquired. “Of course, companies need to overbid to some extent to win blocks,” said Michael Walls, Ph.D., a geologist and professor in the Division of Economics & Business at the Colorado School of Mines. “But the objective should be to overbid as little as possible in the process. The challenge is to determine a fraction of the estimated value that should be bid to optimally balance risk and reward.” E&P companies typically choose blocks to bid on, based on an expected net present value (NPV) of the block, which is calculated on such factors as seismic data, offset production, geologic trends, reservoir characteristics, the cost of development, and the proximity of existing infrastructure. Companies also consider the importance of the block to their overall E&P strategies. Significant overbidding can occur when “must-have” blocks are auctioned, but such high payments can reduce the economic value of those blocks. In addition to performing the NPV calculation for each desired block, Walls recommends that bidders also determine which other companies are likely to bid on the block, and analyze their bidding behaviors. This competitive analysis can help bidders decide on an amount. Decisions become extremely complicated, when a large number of bidders is expected for a block. Risk is increased, because a bidder may have less information than competitors, may be uncertain about the project’s value, and has difficulty predicting the behavior of multiple bidders. Recent advances in bid decision models can improve the quality of bidding in the competitive environment, Walls suggests. He and his energy economist collaborators have developed a software model called SmartBid, which combines an econometric analysis of previous bidding behaviors, and their impact on current bidding outcomes, and a decision analysis model that recommends an optimal bid amount. To estimate the likelihood that a target block will receive multiple bids, which is of keen interest to decision makers, the model uses logistic regression. Among many factors, this analysis takes into account the target block’s water depth, offset production, and competitive bidding behavior on similar blocks in prior lease sales, including consortium bidding activity. To estimate the expected winning bid amount on a block, the approach uses a multiple regression model, which also uses the block attributes described above, as well as past competitive bidding behaviors on similar blocks. “The goal of the multiple linear regression models,” Walls said, “is to correctly predict the winning bid value, using the most parsimonious regression model.” The SmartBid model that Walls and his colleagues developed also provides a forward-looking decision analysis approach that estimates the optimal bid amount on a targeted block. The optimal bid amount is a function of the likelihood of winning the block at alternative bidding amounts, and the firm’s estimate of the block’s NPV. Walls believes that decision support models provide a more systematic, rational approach to bid-setting. In the three Central Gulf of Mexico lease sales discussed earlier, companies using the decision model had a competitive success rate of 53%, compared to 40% for the 12 operators listed in the table. Their average competitive overbid was just $4.1 million, instead of the $8.9 million for companies not using the tool. |

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)