Ensuring sustainable shale operations through water management

Hydraulic fracturing has spawned a renaissance in the U.S. oil and gas industry.

Shale oil and natural gas exploration has become a high priority in many regions of the world, to keep up with the ever-growing global demand for energy, which is expected to rise by 41% by 2035.1 As the price of oil continues to rise, oil-dependent nations are looking for ways to satisfy domestic demand. As the world’s second-largest consumer of natural gas, U.S. domestic consumption is expected to rise to 5.8 Tcf by 2040.2 To meet growing local demand, and reduce the heavy cost and burden of oil and gas importation, the U.S. has progressively developed its domestic production capabilities, which are growing at an unprecedented rate. Due to an increase in domestic output, the U.S. is positioned to surpass Saudi Arabia as the top global producer of oil and gas by 2015, reaching energy self-sufficiency in the next two decades.3 While shale oil and gas can be game-changing for the U.S., and beyond, concerns around the environmental impact of unconventional oil and gas extraction remain a hotly-debated topic. The majority of these concerns are tied to water issues, which indicates a significant opportunity for various stakeholders to gain a better understanding of the process. The hydraulic fracturing process can be an effective, safe operation through environmental and product stewardship, coupled with effective legislation and regulatory requirements that encourage and expedite the adoption of water treatment technologies to ensure sustainable industry practices. WATER AND HYDRAULIC FRACTURINGHydraulic fracturing can involve the use of more than 5 MMgal of water per well. A variety of organic and inorganic compounds are used in fracturing fluids—these compounds are designed to optimize formation fracturing and transportation. Consequently, it is of the utmost importance that the correct water quality and quantity is used during operations, to ensure that unwanted salts and compounds do not interfere with the performance of the fracturing fluid. Water management decisions, within shale oil and gas production, fall into three primary categories: water acquisition; water utilization within hydraulic fracturing operations; and the disposal of wastewater from drilling and production. Shale fracturing flowback refers to the portion of injected hydraulic fracturing fluid that returns to the surface, before and during initial production. The large quantities of flowback and formation water, generated during the fracturing process, must be treated before recycling, beneficial reuse or disposal. Typically, 10–20% returns within 7–14 days, with a rapid decline in quality and quantity. Shale produced water typically refers to water produced during the production phase of the shale wells, longer term; it has significantly lower flowrates and more consistent quality than flowback. RECYCLING AND REUSEWater consumption in the fracturing process, generally, ranges from less than 0.1%–0.8% of total water use, by basin. It can, however, seem like a large amount, especially when the fracturing takes place in areas that are facing drought, like Texas. Assuming 20,000 new shale gas wells are drilled each year, water demand for fracturing would require approximately 120 billion gal per year. While this is less than 0.03% of the total water consumption of the U.S., it is still a substantial amount, when you consider that the average U.S. residence uses approximately 100,000 gal of water, indoors and outdoors, each year.4 Despite the quantities of water needed, there is no reason that the water used for fracing needs to be either freshwater or of drinking quality. Water to support oil and gas production can come from a variety of sources, including saline and brackish water from surface or groundwater withdrawal; treated industrial or municipal wastewaters; and recycled water produced along with oil and gas. Water recycling is widely regarded as a potential method of reducing the impact of fracing on local water resources, particularly in areas where the process is new, or water is relatively scarce. Recycling also reduces the need for the long-range trucking of make-up water, to the well pad, and wastewaters, to remote disposal facilities. This provides both an economic and environmental win. Technological advancements allow for the reduction of water withdrawals and increased reuse of water recovered from producing oil and gas wells. The common practice, across the industry, has been to dispose of produced and flowback water by injecting it into disposal wells, after recovery. However, this practice has become limited by operational capacities, location, and environmental concerns, among other issues. Consequently, more and more producing companies are looking into water recycling technologies that allow wastewater to be effectively cleaned and reused in the next fracturing operation. This trend has grown, as larger volumes of wastewater are being collected, which allows for the adoption of advanced, and sustainable, treatment options. This long-term, centralized approach has directly advanced the growth of new technologies and solutions in the oil and gas sector. WATER MANAGEMENT TECHNOLOGIESA large range of technologies is now available to enable complete or tailored removal of ionic, organic and particulate contaminants from source waters, for injection; or produced waters, for discharge. Different drilling and hydraulic fracturing processes require different types of water treatment. Salinity and water composition must be compatible with the hydraulic fracturing fluid chemistry, and formation, to maximize shale gas recovery. Ultra-filtration can be used as a pre-treatment, and then reverse osmosis, nanofiltration and ion exchange technologies can be used to tailor the salinity of injection water to the formations into which they are injected, and provide particulate-free water to help maintain permeability. From fine particle filtration, to remove suspended solids; and selective ion exchange, for boron removal; to polymeric adsorbents, for organic compound and radium removal; numerous water management solutions are available to ensure that flowback and produced water is properly treated for recycling, reuse or disposal. These advanced treatment technologies have been used extensively in other industries, where water scarcity drives reuse. Measures are also taken to ensure that there are no circumstances in which flowback or produced water is discharged to the environment, or to municipal wastewater treatment plants, prior to significant treatment. Use of these processes, or any of these unit operations, will depend on the water composition of a given area. Filtration is one of the most common ways to remove contaminants from flowback and produced water. Dow Water & Process Solutions (DW&PS) developed the TEQUATIC PLUS fine particle filter to remove oily solids from frac water at disposal sites, which facilitates more continuous injection into the disposal wells, and provides a cleaner water supply around the shale formation and well, Figs. 1 and 2. The alternative is usually bag or cartridge filters, which are consumable products and require consistent change-outs. Putting a self-cleaning filter in place eliminates the need for entry into the vessels and, thereby, reduces exposure to contaminants. In fact, a producer in the western U.S. began using TEQUATIC PLUS for solids removal from produced and flowback water. For years, the operator had been using traditional bag filters at its centralized well injection sites. However, by switching to the fine particle filter, the company achieved a 99.5% water recovery rate, with improved solids removal, and, by eliminating the need for bag filter change-outs, the company was also able to reduce its staffing requirements.

Absorbent resin technology is utilized to remove organic compounds from aqueous streams for oil field water treatment. For example, DOWEX OPTIPORE polymeric adsorbent technology has helped enable the treatment of produced water at Encana Oil and Gas’ Neptune Water Treatment Facility in Moneta Divide, Wyo. By using DOWEX OPTIPORE as a pre-treatment, reverse osmosis membranes can desalinate water to “receiving body quality,” which is considered to be the same purity as mountain spring water. The water can then be effectively discharged. High water recovery allows Encana to minimize the use and cost of freshwater resources, while simultaneously reducing complexities surrounding local wastewater disposal and onsite wastewater trucking. Reverse osmosis, nanofiltration (NF), and membrane filtration are other widely recognized applications for the treatment of brines and high-salinity produced waters. DW&PS partnered with Omni Water Solutions to develop a mobile water treatment unit to effectively treat flowback and produced water in Texas’ Eagle Ford shale. The NF system reduces water hardness and boron levels, and includes both ultrafiltration and reverse osmosis membrane technologies, facilitating the reuse of cleaned water for drilling and hydraulic fracturing. The new, robust NF membranes enable the recycling and reuse of high-salinity produced waters by selectively removing ions—such as Calcium, Magnesium and Sulfate—that interfere with fluid and formation chemistries. For very high salinity waters, combinations of NF and reverse osmosis may be used to help clean and concentrate the brines—essentially splitting the waste streams into reusable heavy brines and fresh water. The recovered brine is reused for drilling fluids and hydraulic fracturing, while the low-salinity permeate may be beneficially reused as service water. THE FUTURE OF FRACINGFracturing operators are still facing challenges, when it comes to the recycling of water. Most challenges are coming from recycling back into the process itself, including understanding the chemistry and the needs of the formations better, and the water requirements. There are still many barriers in place before we see a lot of beneficial reuse of water from hydraulic fracturing, or produced water in general. More work must be done to remove those barriers for advanced treatment. That being said, shale energy producers and regulators are working to find ways to keep water flowing to the industry without impacting farmers, municipalities and growing populations, particularly in regions of the country where water scarcity is a challenge. For example, the state of Texas is in the midst of a historic drought—it has little surface water and many of its groundwater aquifers are drying up. However, hydraulic fracturing operations in the Permian basin and the Eagle Ford are booming—producing at 1,560,000 bopd—in large part, due to sustainable water management and the availability of innovative water treatment technologies.5 The industry is working toward making existing technologies better-suited for oil and gas usage. The use of reverse osmosis membranes, for treating condensed produced waters, is a relatively new adaptation of a well-established product. Dow is looking at providing new component technologies and developing current technologies further, to provide new applications in this market. At the end of the day, more advanced treatment systems are going to need to work together, to provide and share the work. There are efforts to solve the challenge of how to treat water with high variability, and how to put the pieces together to develop a treatment system that will work reliably. CURRENT POLICIES, FUTURE REGULATIONThe hydraulic fracturing process can be effective and safe through environmental stewardship and legislation of industry best practices. In Europe, several pieces of European Union (EU) legislation (Editor’s note: the EU is an economic and political union comprised of 28 member states) apply to shale gas operations, ensuring its safety and sustainability, and protecting the environment and human health. In the U.S., a complex array of initiatives, studies, regulations, jurisdictional disputes and legislation is pending in all 33 states that produce oil and gas, as well as in Vermont, which is not an oil and gas producer. At the request of Congress, there is a comprehensive study underway at the U.S. Environmental Protection Agency (EPA). The goal is to better understand the potential impacts of hydraulic fracturing on drinking water and ground water. The scope of the research includes the full lifespan of water in hydraulic fracturing—from water acquisition to wastewater treatment and waste disposal. The first progress report, released in December 2012, describes progress made, as of September 2012, on 18 research projects underway to answer questions associated with each stage of the hydraulic fracturing water cycle.6 Three of the fundamental research questions under investigation are:

Following a series of technical seminars, roundtables and webinars in 2013, a draft report is expected to be released for public comment and peer review in 2014. Given the long history of hydraulic fracturing—more than 60 years and over a million wells drilled in the U.S.—it seems unlikely that the EPA will recommend a ban or moratorium.7 However, a central issue is whether the EPA should have full jurisdiction to regulate the underground injection of fluids, for hydraulic fracturing of oil or gas wells, under the Safe Drinking Water Act (SDWA). Growing public concerns, and the large number of federal and state regulatory initiatives, suggest that new regulations will drive demand for improved water treatment and management, including reuse. In fact, the Bureau of Land Management has put out a proposal for hydraulic fracturing regulations, which was finalized in 2013.8 The proposal includes three main components:

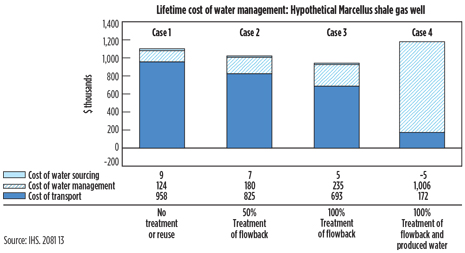

With the shale industry mobilizing at a rapid pace, legislators and regulators need to spend more time considering how they can accelerate the adoption of available water treatment technologies, especially those for frac water recycling and reuse. For example, Eagle Ford shale oil production has surpassed Alberta Oil Sands SAGD production in just three years, and Dow believes that it is conceivable that new plays—similar to the Eagle Ford—will produce 10% of U.S. oil in the next few years. Three years is also about how long it takes to pilot, permit, construct and commission a decent-sized potable water desalination plant—assuming everything goes perfectly. Regulators need to look beyond environmental politics and turn their attention to how they can accelerate the adoption of sustainable water technology, and provide guidance on reuse and secondary use for operators. Offering incentives that encourage industry to take advantage of existing solutions will help drive adoption of technologies that increase the reuse and recycle of flowback water. COSTS/BENEFITSIn unconventional plays across North America, the industry is facing the challenge of managing hydraulic fracturing water in environmentally and economically sustainable ways. According to a report by the Joseph M. Katz Graduate School of Business at University of Pittsburgh, the cost of procuring water for hydraulic fracturing operations is relatively small, averaging $3.00/1,000 gal in the Marcellus region.9 Wastewater management is the primary driver of water-related costs. In Pennsylvania, alone, approximately 4,700 unconventional oil and gas wells have been drilled.10 The active wells in this region will yield more than 10 billion gal of flowback and produced water during their operational lives. A recent IHS report suggests that decisions made about water management will have an impact, not only on the industry’s costs and profitability, but also on regional water supplies, infrastructure and local economies.11 IHS preliminary models show that freshwater withdrawal accounts for less than 1% of total water management costs. Water sourcing, treatment, transport and disposal combine to account for approximately 10% of a well’s operating expense, leaving the industry vulnerable to escalating and variable water management costs, at a time of low prices and slim profit margins. IHS has developed a cost optimization model to explore how decisions about water treatment, transportation and disposal impact total cost, Fig. 3. Using a hypothetical well, in the Marcellus, with an ultimate recovery of 4.4 Bcf of natural gas over a 20-year lifetime, and operating costs estimated at, approximately, $2.30/Mcf, the IHS model considers four cases for the treatment and disposal of flowback and produced waters. Overall, the study found that the most cost-effective approach was in the case where 100% of flowback was treated, but produced water was transported offsite for treatment. This strategy yields over $150,000 in savings, per well, compared with the no-onsite treatment case, due to a 38% reduction in transportation costs. It is important to note that these operating costs are highly variable from a regional glance, and optimization of well economics must be conducted on a well-by-well and play-by-play basis.

PROPER WATER MANAGEMENTProper water management is vital to sustainable hydraulic fracturing. Fracing can be an efficient, environmentally sound process to extract shale gas, provided that the correct procedure is followed, and the most appropriate technologies are used. A sustainable hydraulic fracturing process is one that is a closed loop from start to finish—where none of the materials are exposed to people or the environment. To achieve this, best practices—including the measuring and monitoring of shale operations—and sustainable technologies must be implemented in several key areas, including water sourcing; chemicals management; containment, treatment and recycling of flowback water; and gas/methane capture; as well as ensuring well casings provide a durable, impenetrable barrier between the well bore and the aquifer. Continuously improving and adopting advanced water treatment technologies, and best operating practices, is critical to ensuring the sustainability of hydraulic fracturing operations. As the global population continues to grow, balancing the need for clean water and energy will remain a focus for industry, regulators and communities, alike. With effective product stewardship, clean-burning natural gas and oil from shale reserves can be produced in a safe, responsible and effective manner. REFERENCES

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)