Oil and gas in the capitals

|

Oil is the source of Iraq’s problems. In 2003, after Iraq was invaded, I wrote an article entitled, “The future of Iraq: Democracy or Oilocracy.”1 I argued then, that the Bush administration had an historic opportunity to diversify Iraq’s economy and remove its oil dependency. Without economic diversification, “a new Saddam Hussein sneaks into power. Diversification is the kind of ‘preemptive strike’ that will prevent future dictators from taking over Iraq.” Without economic diversification, “In a few years, people will look at Operation Iraqi Freedom as one of the biggest blunders in U.S. history.” Now, we know how true these predictions were: Iraq became completely dependent on oil revenues, and another dictator snuck into power.

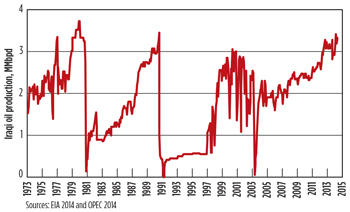

If dependence on oil revenues is the problem, then removing Prime Minster Nouri Al-Maliki, or forming a unity government, will not solve the current crisis, or any of Iraq’s long-term problems. From the above argument, one might conclude that the main reason for the U.S. invasion of Iraq was to gain control of the country’s oil resources. At the end of 2002, just about four months before Iraq was invaded, I wrote a piece in this column entitled, “Will the U.S. invasion of Iraq fit the objectives of Bush’s energy policy?”2 The article concluded, “No, the invasion is not about oil.” Now, we know that most oil contracts went to Europe and China. This topic was discussed again in June 2003, under the title, “The U.S. energy policy and Iraq’s Invasion: Does oil matter?”3 My conclusion was that U.S. control of Iraqi oil production did not fit the Bush administration’s energy policy objectives, which were championed by then-Vice President Dick Cheney. If oil was not the occupation’s objective, then what was oil’s role? The main conclusion was that “oil is not the objective of the invasion, but it is one of the main tools to achieve its objectives, which include regime change.” Ironically, the U.S. and the Sunni rebels in Iraq share the same strategic objectives, when it comes to controlling oil reserves—prevent the enemy from the source of his strength and finance a new regime of your liking from oil revenues. Now, we can see the vicious cycle that brings us back to the beginning of this column—if everyone wants to control Iraqi oil to fund a future government of its liking, Iraq will remain dependent on oil and remain in turmoil, as the country is ruled by dictator after dictator, with no end in sight. It is an oil curse. The above argument means either continuous turmoil, as dictators are deposed, one after the other, or a strong ruler, who will bring stability to Iraq but threaten neighboring countries. The impact of current events on global oil markets. Back in 2010, in this column, I wrote about an in-house study at NGP Energy Capital Management, that predicted an increase in Iraq’s production to only 4.9 MMbopd by 2018.4 While that prediction was considered “pessimistic,” as various groups talked about 6.0-plus MMbopd, recent events prove that even that prediction was too optimistic. What we have seen in Iraq, in recent weeks, is a Sunni revolution against Al-Maliki’s regime and Shi’a dominance. Since the Sunnis cannot push south, and Al-Maliki’s troops cannot retake lost territories, the possibility of a long civil war and a de facto division of Iraq into three regions is high. The expected growth in production is the first victim of this conflict. Iraq cannot deliver the 8 MMbopd that the government has been talking about, or even 6 MMbopd. Plans to increase production to 6 MMbopd and above are contingent upon building pipelines through western Iraq to Syria and Jordan. Now, these areas are under the control of Sunni rebels. Production growth is “gone with the revolution.” If all, or some, of the international companies leave Iraq, the country’s oil production will start declining immediately, even if oil fields and facilities are not attacked. However, the main winners are the Kurds. They achieved their dream of controlling Kirkuk and its oil fields. In the medium term, production and exports of 300,000-600,000 bopd from the region are feasible. But these exports do not change the fact that long-term forecasts of various agencies and groups still count on Iraq delivering at least 6 MMbopd, and now it cannot. Kurdistan’s production is already included in these forecasts. In conclusion, the short-run impact could be limited, unless Shi’a infighting, as the central government is weakened, limits production. But the long-term impact is significant, putting more pressure on North America to produce more oil. REFERENCES 1. http://www.steinbergrecherche.com/fralhajji.htm 2. http://www.worldoil.com/December-2002-International-Politics.html 3. http://www.worldoil.com/June-2003-International-Politics.html 4. http://www.worldoil.com/June-2010-Oil-and-gas-in-the-capitals.html |