|

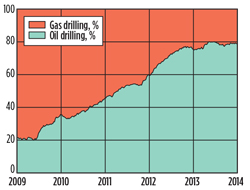

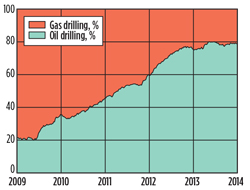

The average U.S. rotary rig count dropped in 2013 by more than 8%, compared to the previous year. This development is counterintuitive when compared to the surge in hydrocarbon production. The contrast is greatest when only natural gas is considered—the number of rigs targeting gas fell even more significantly to just around 21% of total hydrocarbon drilling, down from 80% in mid-2009. Clearly, the move toward more efficient drilling and completions has continued, though we would expect that trend to level off as new technologies and expertise penetrate deeper into the market.

|

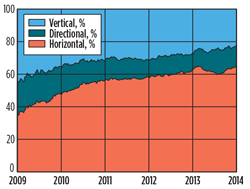

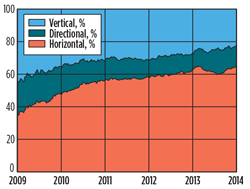

| U.S. drilling split by trajectory. |

|

|

| U.S. drilling split by target. |

|

The history of the U.S. drilling industry in the past five years has been a story of horizontal drilling. This trend should continue, with laterals becoming longer, more numerous, and more closely spaced. Horizontal and directional drilling and completions now comprise 65%, almost doubling since 2009, while traditional vertical wells account for just a fifth of wells drilled.

In some ways, this trend has been mirrored in the shift from natural gas to crude oil. There is no mystery here—although gas production remains high, and demand is strong and growing, oil prices in the $100/bbl range make liquids the more far attractive target across the board. As natural gas prices rise, along with consumption and exports, gas may once again get its share of attention.

| Average number of U.S. rotary rigs in operation1 |

|

|

For the most part, the rig count has dropped uniformly across the board, from the historically large producing regions of Texas, Louisiana and Oklahoma, to growing areas, such as North Dakota. Minor exceptions are found in a few regions, notably Texas’ Eagle Ford shale (District 3 in particular), and offshore in the Gulf of Mexico, which climbed by 10 rigs last year to an average 56 units running.

|