|

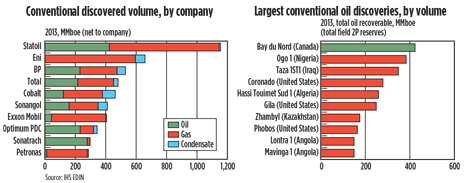

We live in a world where, increasingly, booking of reserves is accomplished by acquisition, rather than by the exploration and appraisal process. It’s true for onshore shale plays, for offshore mature areas, and for the burgeoning deepwater plays. It is refreshing, then, to come head-to-head with a company that still believes that the road forward lays in exploration. A series of meetings in Houston recently included insight into Statoil’s position as the leading global explorer last year (see left-hand chart), and a confirmed disciple of exploration as a “strategic focus.”

|

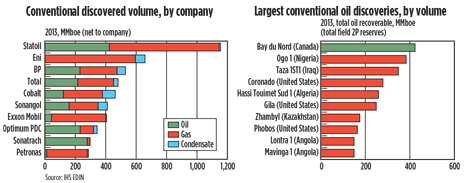

| Statoil is a leader in both discovered volumes and largest conventional oil discoveries. |

|

The company discovered 3.9 billion boe in 11 high-impact discoveries from 2011 through 2013, opening six new plays. Just as important, finding costs for the 3.9 billion boe averaged just $3/boe. And, CAPEX for the portfolio was significantly less than spending for the average sanctioned project, while IRR was higher. How did Statoil manage this? They managed it with a common sense approach, focused on high-grading, prioritization and capital discipline

High-grading. The first tenet of Statoil’s exploration focus is to high-grade opportunities and develop them in exploration core areas, such as the Gulf of Mexico. There, the high-grading process has focused on exploration of three prospects in differing geological zones: the Martin prospect in the Neogene, the Perseus prospect in the Jurrasic, and the Monument prospect in the Paleogene. According to Jez Averty, senior V.P., Exploration-North America, for Statoil, these prospects “rank highly in global prioritization” among the company’s global portfolio.

A second exploration focus for Statoil is the East Coast of Canada. According to Averty, Statoil has “identified multiple opportunities from 3D seismic shot over the Bay du Nord prospect” (see right-hand chart). A rig is due to move from Norway to this area in the fourth quarter, to begin exploration of the 1,100-ft deep prospect.

High-grading also involves selective exercising of timely options for the future. This has translated into net acreage increases in Norway, the Gulf of Mexico, Angola, Canada, Brazil, Russia, New Zealand and Australia, and an active exploration focus on six provinces (Norwegian Continental Shelf, Eastern Canada, Brazil, Tanzania, Angola and the Gulf of Mexico), up from a two-province focus in 2010. Judging the optimum time to proceed with exploration of high-graded prospects in these areas optimizes synergistic development of the portfolio, as a whole.

Prioritization. Statoil takes a global view of its exploration portfolio, allowing it to prioritize basins, prospects, wells, rigs and seismic. As a result, it is able to allocate resources to adapt to changing realities, both Statoil’s and its partners’. This ability to prioritize led the company to move a rig from the Gulf of Mexico to Tanzania last year, and another rig from the NCS to Eastern Canada this year. Prioritization is, thus, the ability to continually make those changes that optimize the entire global exploration program for maximum value creation. To put it another way: it accelerates best opportunities.

Capital discipline. Statoil has adopted capital discipline as a driver of its exploration focus to mitigate cost exposure, improve efficiency and increase the focus on value per boe. This creates an environment in which risk is continually balanced against value creation. That entails creating the correct balance between a high-cost, often risky exploration focus, such as pre-salt, and a safer, cheaper focus on near-field exploration.

Basing its exploration program on high-grading, prioritization and capital discipline will drive future operations. For 2014, that includes a global exploration program that provides $3.5 billion in exploration spending for 50 high-impact wells in six basins, resulting in a discovered P90 - P10 resource estimate of 400–1,500 MMboe.

Is any part of the Statoil global exploration program focus startling and/or ground-breaking? Not really. Is it a sound program that has paid dividends? Absolutely. That, in fact, is the beauty of the program. It’s not rocket science, but a sound exploration program designed to grow the company by the drill bit, at a time when too much emphasis around the industry is placed on the next business deal, and the one after, as the prime element of company growth.

|