IAN LEWIS, Contributing Editor, EAME

|

| Stage cementing operations performed with inflatable packers and port collars provide a reliable means of enhancing well integrity. |

|

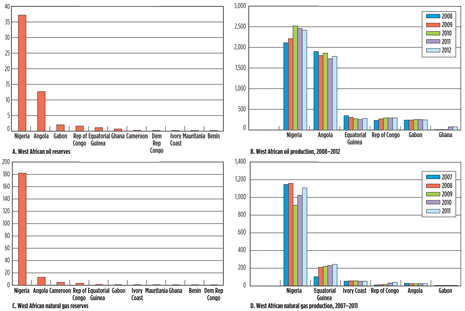

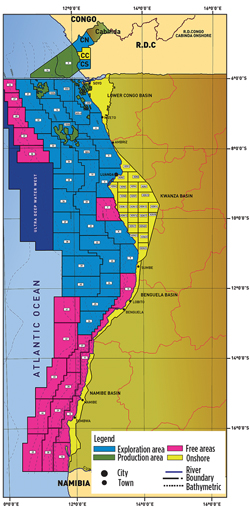

West Africa has one of the world’s leading oil and gas sectors, in terms of both oil and gas reserves, as well as production, Fig. 1. Nigeria remains Africa’s largest oil producer, but Angola may overtake it in coming years, due to the size of fresh discoveries in Angola’s offshore pre-salt, and an E&P slowdown in Nigeria, caused by uncertainties over future oil and gas sector legislation, political unrest, criminal activity, and technical problems.

|

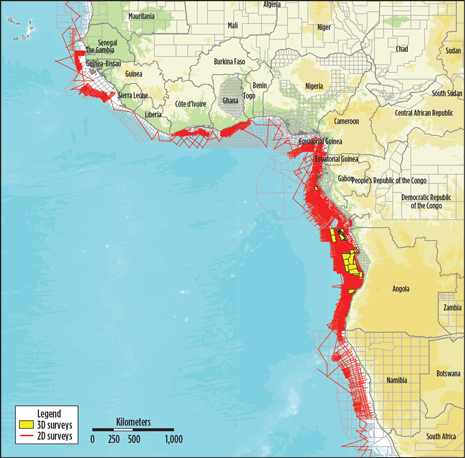

| Fig. 1. West African oil and gas reserves, and recent production. |

|

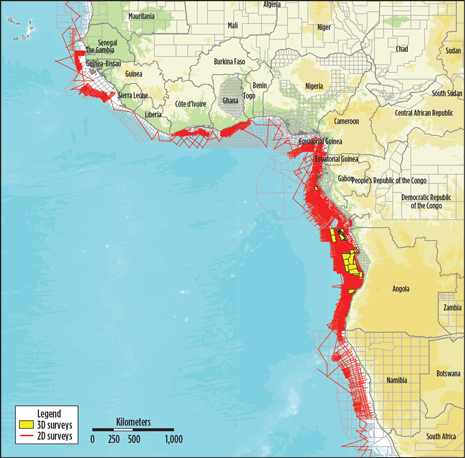

Recent oil and gas discoveries in Angola, Ghana, Ivory Coast and elsewhere in the region, have ensured that interest in West African oil and gas exploration will keep bubbling. Frontier exploration on differing scales is taking place across the Gulf of Guinea and further south, offshore Cameroon, as well as up north, offshore Mauritania. Operators can take advantage of extensive databases of both 2D and 3D seismic data throughout West Africa, Fig. 2. More than 25 deepwater rigs are drilling offshore West Africa, Table 1.

|

| Fig. 2. WesternGeco has acquired nearly 400,000 km of 2D and more than 100,000 km2 of 3D multiclient seismic data offshore West Africa. More new data acquisition is planned, as well as an ongoing program of reprocessing, using the latest depth imaging techniques. |

|

| Table 1. West africa deepwater drilling activity |

|

|

Ghana has one of the region’s most dynamic exploration sectors, as independent oil companies build on the discovery of the giant Jubilee oil and gas field in 2007.

Equatorial Guinea remains West Africa’s third-largest oil producer, though output has been erratic in recent years. Gabon and Cameroon are established smaller-scale producers with dwindling reserves.

The Republic of Congo is gearing up for fresh offshore production, while the Democratic Republic of Congo plans to introduce a new hydrocarbons law and has agreed to develop a border-straddling block with neighboring Angola. Exploration is being planned in the offshore frontier areas of Cameroon and Mauritania. But it is likely to take a major discovery to kick-start exploration in countries with little oil and gas infrastructure, limited experience of large investments and, in some cases, volatile political conditions.

Meanwhile, the North American domestic shale oil and gas boom means that West African oil and gas producers have lost a major Atlantic basin market and must look elsewhere for buyers. Much new oil production must find a home in Europe, the fast-growing and increasingly energy-hungry South American economies, or more distant Asian markets. The same challenges also face the developers of existing and proposed LNG capacities in Angola, Nigeria, Equatorial Guinea and Cameroon.

Asian investment is becoming increasingly important across a region traditionally dominated by European and North American firms. Chinese loans-for-oil deals could pave the way for greater involvement by Chinese firms in oil and gas exploration, if only as minority partners.

This regional report focuses on the region’s two largest producers, Nigeria and Angola, and one that promises to grow rapidly, Ghana.

NIGERIA

Nigeria is Africa’s largest oil producer (2.52 MMbopd in 2012), sub-Saharan Africa’s largest gas producer (1.1 Tcf in 2011), and a leading member of the Organization of Petroleum Exporting Countries (OPEC) since 1971. The oil and gas industry accounts for well over 90% of the country’s export earnings. Proven oil reserves stand at around 37.2 Bbbl, and proven gas reserves total around 182 Tcf, according to U.S. Energy Information Administration (EIA) data. Oil production has largely failed to move above the levels searched in 1980s, due mainly to political unrest, oil theft and technical problems in the onshore Niger Delta.

Exploration history. Most developments in Nigeria are concentrated in and around the Niger Delta region. Shell and Mobil began exploration in the mid-20th century. Oil was discovered in Loibiri field in the eastern Niger Delta, in 1956, by a Shell/BP venture. The companies began production in 1958. The industry expanded after the country’s independence from the UK in 1960. By the early 1970s, Nigeria was producing more than 2 MMbbl of oil. Shell remained the dominant producer. Elf, Agip, Phillips and Mobil were among other firms to make discoveries in the 1960s and early 1970s. Export terminals developed in this time included Bonny (Shell), Escravos (now Chevron), Forcados (Shell) and Brass (Agip). Exxon Mobil has the second-largest presence in upstream Nigeria after Shell, followed by Total.

A slump in oil production in the early 1980s was followed by a rebound, with output hitting 2.5 MMbopd in the mid-1980s. Currently, output is running well below a capacity of over 3 MMbopd, due mainly to the legacy of political unrest, oil theft and technical problems. Unrest and crime in the Delta have contributed to a shift in oil sector focus, away from onshore and inshore waters to deepwater projects.

Oil and gas export terminals in the Delta region have regularly declared force majeure on shipments in recent years, due to supply problems. The quest for new reserves, and greater profitability, were also major drivers in the move further offshore. Legal action has been taken by several Niger Delta communities seeking compensation from Shell, the government and others for damage from oil spills. In 2011, a UN report criticized Shell and the Nigerian government for not doing enough to maintain equipment and clean up oil spills in part of the Delta region over several decades. Shell has said that the majority of recent oil leaks in the Delta are due to oil theft, rather than operational failures.

Large offshore gas reserves are the basis for exports, though limited infrastructure is holding back their exploitation. The first Nigerian LNG was exported in 1999 from the Bonny Island terminal, now a six-train 22-MMtpa facility. Another train there and two new LNG plants are planned, but have yet to materialize, due to uncertainties over financing and erratic feedstock supply. Nigeria also sends gas to its neighbors in West Africa via the West African Gas Pipeline (WAGP), but supply has been unreliable.

Licensing activity and key players. Most oil and gas is now produced by joint venture companies controlled by the state. To increase government influence in—and revenues from—the industry, the state-owned Nigerian National Oil Corporation (NNOC) took 35% stakes in oil companies’ Nigerian operations in 1973, raising its share to more than 50% over the following years. The NNOC was superseded by the Nigerian National Petroleum Corporation (NNPC) in 1977.

Shell Petroleum Development Company of Nigeria (SPDC), which still produces more than a third of the country’s oil from 31,000 sq km in and around the Niger Delta, is 55%-owned by NNPC. Shell, as operator, owns 30%, Total has 10% and Agip retains 5%. PSCs replaced joint operating agreements as the main contractual arrangement in the 1990s, a move intended to make deepwater E&P more attractive to companies. For example, Shell’s deepwater assets are 100%-owned by its Shell Nigeria Exploration and Production Company (SNEPCO) vehicle, and are operated under a PSC with NNPC.

The first round of deepwater acreage was awarded in 1993, while the most recent auction was held in 2007. Further licensing is on hold until after the introduction of a long-delayed Petroleum Industry Bill (PIB). The PIB is designed to overhaul a sector seen as inefficient, opaque and prone to corruption. Recent drafts of the bill appear to have made some elements of future PSCs more financially favorable to IOCs, but uncertainties remain, especially over royalty payments.

Recent E&P activity. Two deepwater projects could add around 350 Mbopd to Nigerian crude output after 2015, when both are due to start producing—Exxon Mobil’s Erha North project (50 Mbopd) and Total’s Egina (150-200 Mbopd). Deepwater drilling is largely on hold until after the PIB is introduced. Exploration is also being stymied by a lack of investment, often because NNPC, though a major shareholder, is unable to meet its share of project funding. In a bid to raise funding for further exploration, NNPC and Exxon Mobil are considering jointly tapping bond markets by 2016, to help boost funding for drilling.

Majors continue to divest acreage in the shallow waters of the Niger Delta. In June, Chevron said it would sell its stake in two exploration blocks. Shell, Eni and Total have recently sold several producing blocks that they jointly owned. Smaller players have replaced them, including UK-listed Heritage Oil and Eland Oil. In late 2012, ConocoPhillips said it had agreed to selling its Nigerian company to Nigeria-focused, Toronto-listed, Oando Energy.

Chinese firms are also filling the gap. Addax, owned by China’s Sinopec, has said it is seeking further growth in Nigeria, having bought Total’s 20% stake in offshore Block OML 138 for some $2.5 billion in November 2012. Onshore, northern Nigeria may hold commercial oil reserves, but little exploration has been carried out, so far, and political unrest in the region is likely to restrict it for the time being.

Future plans. Timing of future oil and gas developments in Nigeria is largely dependent on the timetable for the PIB, as few investors will commit to Nigeria until the basis for operations is clarified. The first draft was introduced in 2008, but it met opposition from both international oil companies and within government. Oil companies are concerned that the PIB may result in unacceptably high taxes and royalties on offshore production. Some Nigerian politicians are concerned about powers that would be granted to the oil ministry to grant leases on oil blocks unconditionally, and politicians from northern Nigeria are concerned that a proposed wealth fund will benefit the south more.

Following several revisions, the bill is now being assessed by a legislative committee charged with making it more widely acceptable before sending it to parliament. The stakes are high. Shell has said it could invest $30 billion in offshore projects, if the PIB produced clear contract terms. The company has also suggested that Nigerian output could reach 4 MMbopd, but only if sweeping organizational and funding changes take place.

Gas investments are being hampered by the same uncertainties, as well as the disappearance of the U.S. as a potential LNG export market, and a failure to develop the domestic gas market, which, in a nation of over 160 million people, potentially could be huge. Nigerian fields flare less gas than they used to, but they flare more than those of any country besides Russia.

While NNPC has suggested that three long-mooted LNG projects could all go ahead, there seems to be little chance of progress in the near term for a 7.8-MMtpa seventh train at the NLNG plant, the 10-MMtpa Brass LNG facility in Bayelsa state, or the 6.3-million-MMtpa Olokola (OK) LNG plant.

ANGOLA

Angola has 12.6 Bbbl of untapped reserves, according to Petroleum Minister Jos Maria Botelho de Vasconcelos. The minister further said the reserves would last 15–20 years at current production levels. Angola’s target is to achieve a production rate of 2 MMbopd during 2014–2015. The country’s oil production averaged 1.87 MMbopd in 2012, according to the EIA. The country’s ambition of pushing output above 2 MMbopd more rapidly has been dented by delays in production from BP’s Plutao, Saturno, Venus and Marte (PSVM) development in Block 31—the country’s first ultra-deepwater project—and in the expansion of the Chevron-operated Block 14. If the pre-salt proves as oil-rich as expected, Angola will be vying with Nigeria to be the continent’s top producer.

Exploration history. Onshore drilling begun a century ago, when a Portuguese firm started exploring in the Dande River valley in the onshore Kwanza basin. However, the first commercial discovery, in Benfica field to the south of Luanda, was not made until 1955, with first production a year later. Angola’s first offshore discovery was made in Malongo field by Cabinda Gulf Oil Company in 1968. That company was bought by Chevron, which still has a strong Angolan presence.

The country’s protracted civil war, which stretched from independence from Portugal in 1975 to 2002, all but stopped onshore exploration. However, offshore exploration continued, unexpectedly producing a major discovery by France’s Elf (now part of Total) at Girassol field, located in a newly drilled formation in deepwater Block 17, 140 km from the coast.

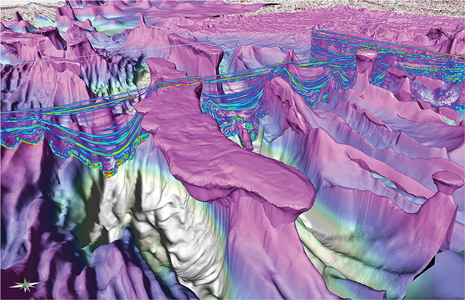

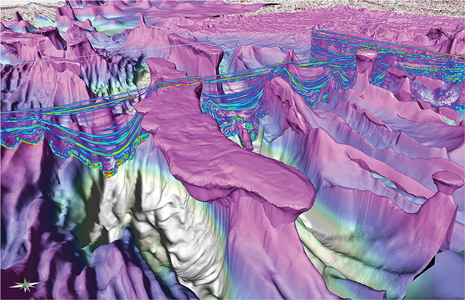

Since then, firms, including Chevron, ExxonMobil, Maersk, Total and BP, in partnership with state oil firm Sociedade Nacional de Combustiveis de Angola (Sonangol), have made a string of large deepwater discoveries in similar Oligocene and Miocene geology, Fig. 3. Angolan deepwater blocks have now produced more than 100 major oil discoveries, of which over 30 have been brought into production in 13 development complexes.

|

Fig. 3. Interpretation of seismic data from offshore Angola reveals the presence of

mini-basins for sediment deposition and overhangs that may serve as traps. The Aptian salt (purple and white) is a regional seal for pre-salt reservoirs. Image courtesy of Sonangol EP and WesternGeco. |

|

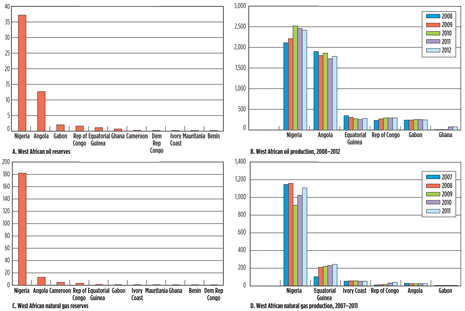

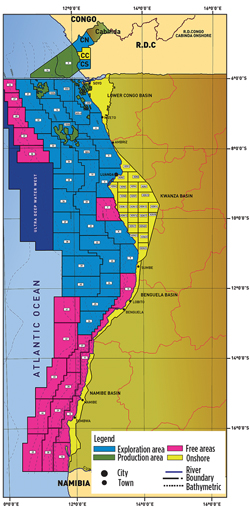

Licensing activity and key players. Sonangol has handled onshore and offshore licensing since 1978, and has held a majority stake in all E&P projects. The most recent licensing round took place in January 2011, when 11 offshore pre-salt blocks were offered, Fig. 4. These were concentrated in Angola’s pre-salt acreage, which has attracted attention because of its geological similarities with the oil-rich Brazilian pre-salt. Winning operators included BP, Statoil, ConocoPhillips, Cobalt, Total, Eni and Repsol. The round was carried out via a restricted bidding process, followed by negotiations on production-sharing contracts (PSCs) and license partners.

|

| Fig. 4. Offshore concessions awarded by Angola. |

|

Recent E&P activity. Total is the country’s leading operator, producing more than 700 Mbopd from three development complexes on Block 17: Girassol, Dália and Pazflor. Exxon Mobil’s three developments on Block 15 also have a capacity of over 700 Mbopd, but have been producing less than that recently.

BP’s PSVM project, Angola’s largest subsea oil and gas development, is ramping up production. The project is producing about 100 Mbopd, up from 70 Mbopd earlier in 2013, and will reach peak production of 150 Mbopd in December 2013, according to Martyn Morris, BP’s regional president. In June, China’s Sinopec agreed to buy Marathon Oil’s 10% stake in Block 31, where PSVM is located, for $1.52 billion.

Recent finds have highlighted the potential of Angola’s pre-salt blocks. Maersk’s Azul-1 well in Block 23, in the southern Kwanza basin, produced a find in January 2012 that the company said could flow at 3 Mbopd. Meanwhile, U.S.-based Cobalt International reported in February 2012 that its Cameia-1 find in Block 21 could flow at 20 Mbopd. Cobalt’s follow-up well, Cameia-2, drilled 3.55 km away, earlier in 2013, did not produce a hydrocarbon flow to the surface. However, the company said that it did detect the same high-quality hydrocarbon-bearing mound reservoir, and remained optimistic that flowrates across the basin would be significant.

Pressure to reduce gas flaring has prompted the development of gas-gathering infrastructure and an LNG plant to take advantage of proved gas reserves of around 12.93 Tcf. After more than a year of delays due to fires, pipeline problems and a lack of trained personnel, the $10-billion Angola LNG plant shipped its first cargo to Brazil in mid-June 2013.

Exports from Chevron’s 5.2-MMtpa facility at the mouth of the Congo River will allow the monetization of gas from a number of fields off Angola. The plant was originally conceived as a source of exports, supported by long-term contracts, to the U.S. market. But, with that path shut off, due to North America’s domestic shale gas glut, shareholders are focusing initially on spot sales to South American and European buyers, in particular, as well as to more distant Asian markets.

Upcoming plans. Various drilling campaigns are planned across Angola’s offshore blocks. Earlier this year, Total used its new 2.2-petaflop supercomputer, Pangea—currently the largest in the industry—to help analyze seismic data from the field in just nine days, more than four months faster than the firm’s previous computing capability allowed. Total also expects to start assembling an FPSO vessel for its CLOV project in Block 17 by the end of the year—the first time an FPSO has been assembled in Angola. CLOV comprises the Cravo, Lirio, Orquidea and Violeta fields and is the fourth development on the block after Girassol, Dália and Pazflor. It is expected to add 160 Mbopd on start-up in 2014, taking Total’s Angolan output to well over 850 Mbopd. Total plans to make a final investment decision on the Kaombo project in Block 32, later in 2013.

Chevron is pushing ahead with its Lianzi project, which involves installing a subsea production system in 3,000 ft of water, in a unitized offshore zone between Angola and the Republic of Congo. The development will be tied back using an electrically heated flowline to Chevron’s Benguela/Belize/Lobito/Tomboco (BBLT) platform in Angola’s Block 14. This technically challenging project is expected to start producing in 2015, with a peak flowrate of around 46 Mbopd.

GHANA

From being an oil importer in 1980, Ghana has improved its E&P enough to join the ranks of West Africa’s leading exporters with 79.6 MMbbl of oil exported in 2012. Much of the credit for this turnaround belongs to independents such as Kosmos Energy, Tullow Oil and Anadarko.

Exploration history. The first wells were drilled in western Ghana in 1896, in oil seeps within the onshore Tano basin. The first notable production followed Signal-Amoco consortium’s discovery of Saltpond field, some 100 km west of Accra in 1970. Between 1978 and 1985, around 3.5 MMbbl of oil were produced from the field, with 14 Bcf of gas flared.

Following creation of the Ghana National Petroleum Corporation (GNPC) in 1985, more widespread exploration began after the signing of agreements with several IOCs. The first major discoveries were not made until 2007, when Tullow Oil and Kosmos Energy discovered hydrocarbons offshore in the Jubilee field. Since the first well, Mahogany-1, was drilled, exploration has expanded, involving a number of operators. The first light, sweet crude was produced from Jubilee in December 2010. Upside estimates for the field’s reserves are around 2 Bbbl of oil, while those for natural gas are around 1.2 Tcf.

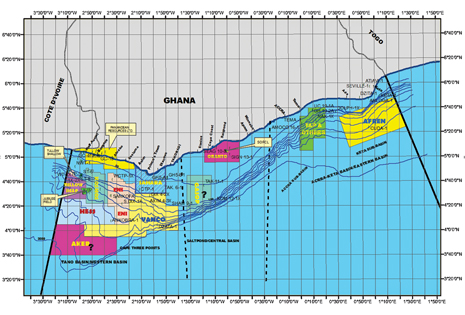

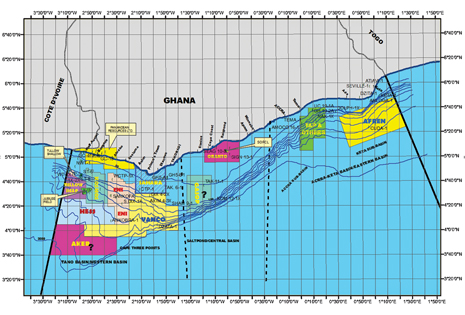

Licensing activity and key players. Under existing law, Ghana’s energy ministry issues licenses through a mix of competitive bidding and an open-door policy. No schedule is in place for further licensing at present. Between 2002 and 2008, 12 areas were licensed to 10 operators, including Kosmos Energy, Tullow Oil, Anadarko, Vitol, Hess, Vanco, Aker and Afren, Fig. 5. Interest in acquiring Ghanaian acreage has intensified, since the first major oil and gas finds were made.

|

|

Fig. 5. Licenses awarded offshore Ghana during 2002–2008.

|

|

Agreements under the present system attracted controversy in 2009, when a deal, under which Kosmos agreed to sell its 23.5% stake in Jubilee field to Exxon Mobil for around $4 billion, was blocked by the government. Officials said that Kosmos had shared data improperly in talks leading up to the sale. A joint $5-billion bid for the stake ensued from GNPC and China National Offshore Oil Corporation (CNOOC), a move that some observers suggested was politically motivated, reflecting the Ghanaian government’s wish to curry favor with China. A $3-billion oil-for-loans deal between the two countries commits Ghana to sending at least 13 Mbopd, to China. In fact, the Jubilee deal did not materialize, as Kosmos decided to retain its stake.

Recent E&P activity. The Tullow-led consortium had expected output from Jubilee field to reach 120 Mbopd by mid-2011, following production start-up in December 2010. However, technical problems initially stemmed production, limiting output to around 85 Mbopd in 2012. The situation has since improved, with production reaching 110 -115 Mbod in early 2013. Tullow has said that output could reach, or even surpass, the nameplate 120-Mbopd output of its FPSO by end-2013, as new wells come onstream. Tullow holds a 35.5% stake in Jubilee. It partners are Kosmos (24.1%), Anadarko Petroleum (24.1%), GNPC (13.6%) and Sabre/PetroSA (2.7%).

Tullow has been in talks with Kosmos over feeding potential production from the Teak, Mahogany East and Akasa discoveries in the adjacent West Cape Three Points (WCTP) Block through Jubilee’s pipelines. WCTP had been regarded as large enough to warrant its own FPSO development, but that looks less likely following disappointing results from the Teak-4 appraisal well.

U.S. operator Hess has made seven consecutive oil and condensate discoveries at its deepwater Tano/Cape Three Points Block, close to the Ivory Coast frontier. However, Statoil, which acquired a 35% stake in the acreage, in April 2012, disposed of it soon after, saying it had better opportunities elsewhere. Hess now holds 90% of the block, while GNPC has the other 10%. Hess said in March 2013 that it remained optimistic that there is enough oil for a commercial development, and was submitting appraisal plans for its discoveries to GNPC. The company is seeking a new partner to replace Statoil.

In January 2013, Eni reported that its first appraisal well at the Sankofa East oil discovery in its offshore Cape Three Points Block confirmed the project’s commercial prospects. The company said that it was planning production from the find, which it says could hold up to 150 MMbbl of recoverable reserves. The company’s first two wells on the block found gas, prompting the government to exhort Eni to develop it for domestic use to help Ghana reduce its dependence on the erratic West African Gas Pipeline (WAGP) from Nigeria. Eni holds a 47% stake in the block, in partnership with oil trader Vitol and GNPC.

Ophir Energy is drilling an exploratory well on its Starfish prospect in the Accra offshore block in mid-2013. Ophir, which has a 20% stake, recently acquired operatorship of the block from Tap Oil, which retains 17.5%. Other partners are Vitol Upstream (30%), Afex Oil (20%) and Rialto Energy (12.5%).

Discoveries on its Ivory Coast side of the Tano basin, adjacent to Jubilee field, have underlined the region’s prospectivity. Total said that it had hit light crude in the western part of Ivory Coast’s CI-100 Block, which it bought in 2010. In 2012, both a Tullow-led group and a Vanco Cote d’Ivoire/Lukoil consortium said that they had made discoveries on their offshore Ivory Coast blocks.

Upcoming plans. With most of the U.S. market’s needs now set to be met by increasing domestic supply, Ghana’s oil will need to find buyers elsewhere—mainly in Asia, where most African oil is already sold. China will be a major destination, given Ghana’s commitment to send oil to China under the $3-billion oil-for-loans deal and CNOOC’s interest in an oilfield stake.

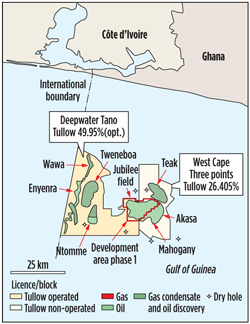

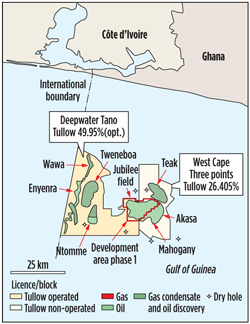

GNPC approved development of a second major offshore development in May 2013, with set targets for local content in the supply chain. Operator Tullow says it could start production from the $6-billion TEN (Tweneboa, Enyenra and Ntomme) development in 2016, and hopes to reach maximum production of 80 Mbopd, Fig. 6. The development is estimated to hold 300-500 MMbbl. Tullow is joined by Anadarko, Kosmos and GNPC in the consortium, which has spent $1 billion on appraisal work so far. The development lies in water depths ranging from around 3,500 to 6,500 ft, and lies some 25 km from the Jubilee project.

|

| Fig. 6. Tullow Oil is extending its E&P activity beyond the initial Jubilee field discovery. |

|

Tullow has reported that it plans to sell an unspecified part of its 49.95% stake in the project to raise capital for the development. Strong investor appetite can be expected, as the stake also includes a share in the already productive Jubilee field, which is owned by shareholders in both the WCTP and deepwater Tano blocks that it straddles, under a unitization deal.

Ghana’s offshore gas resources will be directed mainly toward the domestic market, where an expansion of gas-fired power, heating and gas-intensive industry is planned. Tullow is due to start supplying gas to the Ghana National Gas Company, once pipelines are in place. So far, associated gas from Jubilee has either been reinjected into wells or flared, neither of which are acceptable long-term options.

FRONTIER EXPLORATION

Following its success in Ghana, Kosmos Energy has turned its sights to frontier regions, both to the north in Mauritania and south in Cameroon. In Mauritania, Kosmos has signed PSCs over Blocks C8, C12 and C13, a contiguous area of 6.6 million acres. Geologically, this area is an extension of the Upper Cretaceous stratigraphic play in Ghana’s Tano basin. The company is acquiring 2D seismic data over the blocks and anticipates a more-focused 3D survey. First drilling is expected in 2014-15. In Cameroon, Kosmos has acquired onshore leases in the coastal region to test a northern extension of the late Cretaceous/lower Tertiary turbidite play. Acreage in the Ndian River and Fako Blocks is equivalent to more than 200 deepwater Gulf of Mexico blocks.

THE FUTURE IS AFRICAN

Despite the turmoil and uncertain legislative agendas in Nigeria, West Africa remains an assembly line of large oil and LNG projects for years and decades to come. The region shows, in remarkable fashion, how small independents are discovering new frontiers, and how the majors are applying their financial savvy and E&C expertise to bring large projects to fruition.

|