ROBERT CURRAN, Contributing Editor, Canada

As Canadian producers turned the corner on 2013, the year ahead brought promise of little change from the issues that their industry faced last year. Natural gas prices remain low, and oil prices have been artificially reduced in Western Canada, as the lack of pipeline capacity has created a regional oil surplus. Canadian prices have been further dampened by growth in the American tight oil market, which has created a glut of its own in the U.S. Midwest.

The instability has created a wide variance in spending patterns, drilling plans, and both vulnerability and opportunity in the mergers and acquisitions markets. And yet, demand for skilled workers remains high, pressuring labor costs and limiting producers’ flexibility in planning for, and achieving, project and production goals.

Alberta oil prices were approximately $40/bbl less than West Texas Intermediate in early 2013. The limited access to markets has led to speculation about a variety of transportation sources, including rail, and proposals that include an intra-Canadian pipeline to ship crude to refineries in the east. Alberta Premier Alison Redford said in January that this “bitumen bubble” will cost the province about $6 billion in lost royalties during 2013.

It is not surprising then, that the fate of TransCanada Pipelines’ US$5.3-billion, 700,000-bopd Keystone XL pipeline proposal in the U.S., and the political football it has become, features so prominently in Alberta, where oil sands producers are feeling the pinch created by transportation constraints.

They are also watching, with interest, the hearings underway to consider an application by Enbridge to construct and operate its C$5.5-billion Northern Gateway pipeline, which would ship 525,000 bpd of crude from Alberta’s Athabasca oil sands area through British Columbia to the West Coast and on to burgeoning Asian oil markets.

|

| Depending on which firm’s analysis one wants to believe, Canadian drilling will be in a range anywhere from slightly down to as much as 7.5% higher in 2013. Photo courtesy of Nexen Inc. |

|

CAPITAL SPENDING

Oil sands spending and activity remain strong, although a recent scientific report published in the National Academy of Sciences says that oil sands development has caused elevated levels of hydrocarbon pollution in nearby lakes. The report, authored by scientists from Environment Canada and Ontario’s Queen’s University, is noteworthy in that it is the first time that credible scientific evidence has been brought forward that demonstrates a direct connection between oil sands production and contamination in nearby lakes. Despite the predictable rhetoric from environmental activists regarding the study, its findings clearly show that although hydrocarbons have increased substantially since the 1960s, the levels found are still well below levels that would prompt a warning under normal circumstances.

Nonetheless, many people are taking this as a warning that practices must change to mitigate the effects of oilsands development. And for its part, the industry seems to be taking the report seriously, as are provincial and federal politicians.

Regardless, oil sands activity will once again dominate Alberta’s landscape, both figuratively and literally. Investment in the massive deposits is projected to exceed $23 billion by the Canadian Association of Petroleum Producers (CAPP). And the Conference Board of Canada recently released a report that predicts investment in the oil sands will be about C$364 billion through 2035, not including the $100-billion spend over the past 10 years.

Individually, Suncor Energy has announced plans to spend C$4.2 billion on oil sands in 2013, of which just under $3 billion is for sustaining existing projects; Canadian Natural Resources has tagged $3.85 billion for oil sands (including $2.5 billion on the Horizon mine); Cenovus Energy has allocated just under C$2 billion to oil sands projects; MEG Energy has budgeted C$1.94 billion for in situ developments; Canadian Oil Sands will contribute C$1.3 billion to the Syncrude Canada mine, and Imperial plans to spend C$900 for its portion of Syncrude.

The protracted malaise in natural gas prices has done little to dampen enthusiasm for a possible uptick in natural gas prices and, in the long term, development of further gas transportation infrastructure. In particular, there is still the real possibility that an LNG facility may, someday, be constructed in Kitimat, British Columbia (or some other similar place on the West Coast), so that demand-heavy Asian markets might be accessible to Canadian producers.

Currently, 50/50 partners Chevron Corp. (operator) and Apache Corp. are proposing to build an LNG facility in Kitimat (about 400 mi north of Vancouver), with a target operational date of 2017. Previously, Apache, EnCana Corp. and EOG Resources had been the project proponents, but EnCana and EOG bowed out after the consortium failed to secure certain agreements with Asian customers.

Chevron and Apache recently received some good news, as the Canadian federal government introduced new regulations that will allow the project (sited on Haisla First Nation land) to proceed. The project already had approval from the National Energy Board.

Meanwhile, Golar LNG has announced that it plans to proceed with its Douglas Channel LNG project, also located in Kitimat, after finalizing contract awards for gas supply and LNG purchase, and securing approval from the NEB. The terminal is expected to begin operations in second-quarter 2015.

As usual, spending plans for 2013 are reflective of the mixed status of the industry. Suncor Energy Inc. has announced another increase in spending, to C$7.3 billion in 2013, about 12% higher than the $6.5 billion spent in 2012, although the total represents a decrease from previously announced spending plans. Of that amount, $4.2 billion is earmarked for projects at the company’s oil sands operations.

Canadian Natural Resources Limited has also announced an increase to its spending plans, targeting expenditures of C$6.95 billion, compared to $6.45 billion in 2012. Approximately 55%, or $3.8 billion, are ticketed for the company’s Horizon oil sands mine ($2.5 billion), and development of its Primrose and Kirby in situ oil sands projects ($1.3 billion).

Husky Energy Inc. plans to increase 2013 capital spending by $100 million, to C$4.8 billion, compared to $4.7 billion last year. More than half of its budget is devoted to western Canada, split between oil sands, heavy oil, conventional and unconventional developments.

EnCana Corp., with its traditionally gas-weighted production portfolio, has actually announced plans to increase spending to between $4 and $5 billion, with a heavy focus on gas liquids, and in particular, development of its holdings in the Duvernay shale gas deposits of western Alberta.

Cenovus Energy Inc., EnCana’s oil-weighted twin, has set its 2013 capital budget slightly higher than least year’s levels, at $3.2 billion to $3.6 billion. Its Foster Creek, Christina Lake, and Pelican Lake projects will utilize just over 50% of this year’s spending.

After posting a C$731-million loss in third-quarter 2012, Talisman Energy announced a reduced capital spending budget of about $3 billion, down 25% from last year. Amid rumors that it is a potential takeover target, the company also announced layoffs of more than 200 people, mostly in Calgary, late last year.

Takeover rumors continue to dog a number of Canadian companies, including EnCana (which has denied the rumor), on the heels of two takeovers of Canadian companies by foreign, state-owned companies in 2012. In December, the Canadian government approved the C$15.1-billion bid by China’s CNOOC Ltd. for Calgary-based Nexen Inc., and the $6-billion acquisition by Malaysia’s Petronas of Progress Energy Resources Corp. The government said the deals represented a net benefit to Canada, after securing a number of commitments from each, including a promise to maintain Canadian management and employment levels.

However, Canadian Prime Minister Harper also announced that takeovers of Canadian oil sands companies by foreign, state-owned entities will be permitted on “an exceptional basis only.” The announcement came as something of a surprise, as the Harper administration has actively courted the development of Asian markets for Canadian oil and gas in recent years.

Meanwhile, Exxon Mobil and Imperial Oil partnered to make a friendly, C$3.1-billion cash-and-stock offer for Calgary-based Celtic Exploration in October. The deal has an unconventional focus, featuring 545,000 net acres in British Columbia’s Montney shale and 104,000 acres in Alberta’s Duvernay play.

Overall, the value of mergers and acquisitions in 2012 was a record C$54 billion, according to Sayer Energy Advisors, which dwarfed the $16 billion recorded in deals in 2011. Sayer is projecting a lower total in 2013, noting that the historical pattern tends to be a significant drop-off after years with high activity.

But industry pundits are having a hard time projecting what sort of action Canadian oil and gas mergers and acquisitions might generate in 2013. Some are predicting that the second-half increase in deals is a trend that will continue into 2013, while others point out that there are few targets, due to a dearth of new companies entering the market recently.

|

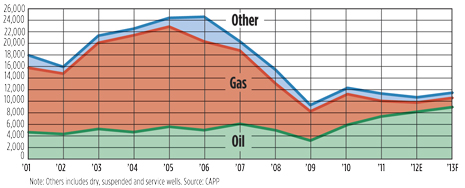

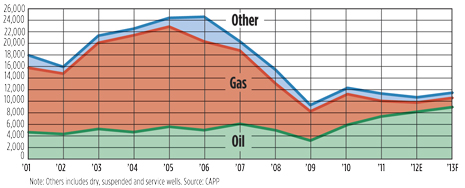

| Canadian wells drilled, 2000–2013 |

|

DRILLING

Given the continued low price for natural gas, it is no surprise that oil drilling once again dominated Canadian activity in 2012. According to Daily Oil Bulletin records, there were 11,070 wells drilled in Canada last year, of which 8,745 (79%) were oil wells. Overall, drilling fell about 14% from 2011 levels of 12,869 wells. Exploratory drilling continued to decrease, with just 1,245 wildcats and appraisals drilled last year, down 19% from 2012.

In Alberta, the well count dropped to 6,792, more than 16% at lower than the 8,117 wells drilled in 2011. Drilling activity in Saskatchewan decreased 9%, at 3,170 versus 3,491; in B.C., just 466 wells were drilled, a 26% drop from the 629 recorded the year before. And Manitoba set another annual record of in 2012, with 615 wells drilled, a 5% increase over the 583 wells drilled in 2011.

For the year ahead, the Canadian Association of Oilwell Drilling Contractors is calling for a further decline in activity, to 10,409 wells drilled, with an average rig fleet utilization of 40%. The Petroleum Services Association of Canada is considerably more bullish, calling for 11,475 wells to be drilled this year, a modest increase over 2012.

For its part, CAPP estimates total wells at 10,710 last year, including 11 offshore. CAPP forecasts a 7.5% pick-up during 2013, to 11,510 wells. The association estimates that 78% of wells will be oil-directed, and 12% will be exploratory.

PRODUCTION

According to CAPP, Canadian oil production, including conventional crude, condensate and oil sands output, averaged 3.189 MMbpd last year, up 1.6% from 2011’s figure. That figure may actually be a bit low, so an upward revision at mid-year is expected. Conventional crude and condensate accounted for 1.411 MMbpd, while oil sands output averaged 1.778 MMbpd, up 17.7%. The number of producing oil wells shot up 7.8%, 82,861, of which 66 were offshore.

Natural gas production was down 3.5%, averaging 13.8 Bcfd, or equivalent to just over 5.0 Tcf on an annual basis. The number of active gas-producing wells last year was 147,704, a gain of 4.9% from 2011’s figure. This is somewhat remarkable, given that gas-directed drilling was down considerably, but it is also indicative of the backlog of well completion work that operators were still finishing last year.

OIL SANDS

The enormous deposits in northeastern Alberta continue to generate attention, but despite all the negativity and dire predictions, activity remains strong, and the oil sands continue to drive economic strength in Canada.

Imperial recently announced that the start-up of its C$10.9-billion, 110,000-bpd Kearl oil sands mining project has been delayed by extreme cold, but the company expects to see first oil in short order. Also slated to begin production this year are Cenovus’ 40,000-bopd Christina Lake SAGD project, Canadian Natural Resource’s 40,000-bopd Kirby South SAGD development, and MEG’s 35,000-bopdSAGD project at Christina Lake.

Meanwhile, several projects saw first production in 2012, including Stage 4 of Suncor’s Firebag SAGD project, which should exceed 180,000 bopd in 2013. Stage 4 began operations under budget and ahead of schedule.

Shell Canada is awaiting a decision from a joint panel struck by Canada and Alberta to consider its C$12-billion proposal to expand the Jackpine mine by 100,000 bopd. That decision is expected this year. The Shell-operated Atahabasca Oil Sands Project has also been the source of some speculation, as Marathon Oil Corporation is reportedly in talks with India’s Oil and Natural Gas Corporation to sell its 20% stake.

The largest growth area in oil sands development continues to be on the in situ side. The smaller footprint, reduced impacts, and lower capital costs associated with this type of oil sands development, have spurred incredible growth over the past several years. In fact, Alberta’s energy regulator is projecting that production from in situ sites will surpass mining output by 2015.

|

| Suncor’s Firebag SAGD project saw first production last year. The Firebag project, overall, should exceed 180,000 bopd during 2013. Photo courtesy of Suncor Energy. |

|

LAND SALES

Land sales followed a cyclic pattern in 2012 as well, dropping to $1.38 billion, 67% lower than the $4.13 billion collected in 2011, which also happened to be the third-highest total in Canadian history. The record of $5 billion was set in 2008.

The vast majority of spending occurred in Alberta, which brought in $1.12 billion, down 69% from the record-setting $3.64 billion that the province garnered in 2011, sparked by interest in the Duvernay shale.

Revenues in British Columbia continued their free-fall, dropping 37.7% to $139 million, compared to $223 million one year ago. The 2012 bonus was the lowest total collected in natural gas-rich British Columbia since 1998. Meanwhile, Saskatchewan saw its revenue also fall significantly, down 57% to $106 million, compared to $248.77 million in 2011.

And on the East Coast, work commitment bids totaling $2.26 billion were put forward by the industry, sparked by bids in Nova Scotia worth just over $2 billion.

Land inventories are one of the most consistent indicators of future drilling activity, and any uptick in land sale volumes is a strong indicator that a recovery is underway in Canada.

|

The author

MR. CURRAN is a Calgary-based freelance writer with extensive industry experience. |

|