CARON HOWARD, JON TARRIS and JAMES MCCORMACK, Deloitte Petroleum Services Group

|

| Dana Petroleum’s business in Egypt (left) consists of a balanced portfolio of operated and non-operated developments in the Gulf of Suez, the Nile Delta and the Western Desert. The firm’s portfolio of 17 development leases is producing about 12,000 bopd, including East Zeit field (pictured), where Dana is drilling a three-well program. In Yemen (center), Nexen’s PSA on Block 14 (Masila) expired on Dec. 17, 2011, and the firm turned over its production to another operator. Nexen still continues to produce oil at Block 51 (East Al-Hajr) at about 5,000 bopd. The PSA at Block 51 expires in 2023. Oman (right) has become Tethys Oil’s undisputed core area. After a farm-out, Tethys holds a 30% stake in Blocks 3 and 4, while also holding 40% of Block 15. |

|

The past 12 months have seen continuing instability in the Middle East and North Africa (MENA) region with the toppling of the regime in Libya, intensifying turmoil in Syria, and implementation of new sanctions against Iran. There have also been significant transitional changes, including the election of a new Egyptian president. Despite these events, oil-and-gas activity remains high, and investment in the region continues, even with new hydrocarbon provinces emerging. This review highlights key developments over the past year.

PRODUCTION AND RESERVES

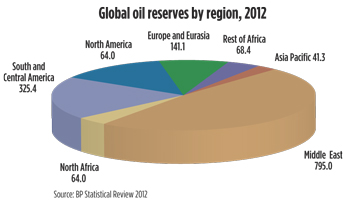

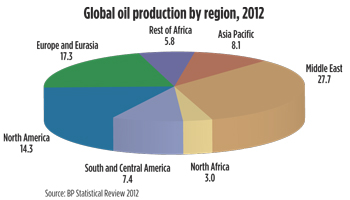

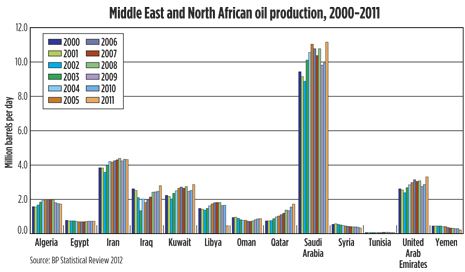

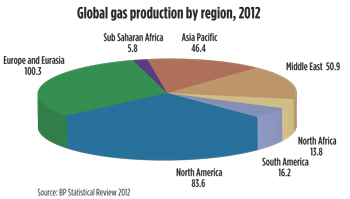

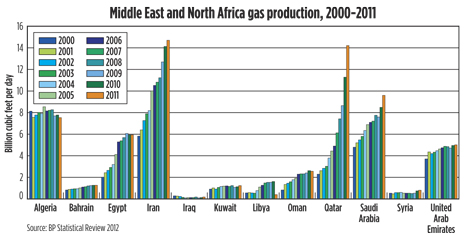

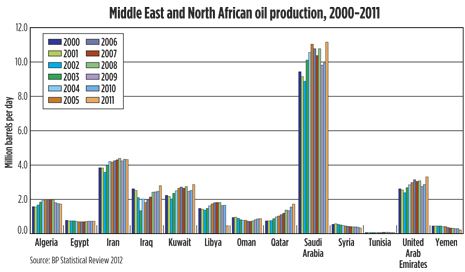

According to the BP Statistical Review 2012, oil reserves in the MENA region at the end of 2011 were 859 billion bbl, a 3.4% increase compared to the 2010 figure of 829.8 billion bbl, Fig. 1. This can be attributed mostly to Iraqi oil reserves increasing from 115 billion bbl to 143.1 billion bbl, related to results of initial surveys conducted by international oil companies (IOCs) as part of the First Iraqi Licensing Round. Oil production for 2011 was reported in the BP Statistical Review 2012 to be 30.7 MMbpd (Fig. 2.), rising from 29.5 MMbpd in 2010, a 4% increase. Large production increases occurred in Iraq, United Arab Emirates (UAE) and Kuwait. Significant decreases were observed in Libya, Syria and Yemen, Fig. 3.

|

| Fig. 1. Global oil reserves by region, billion bbl. The MENA region accounts for 52% of global oil reserves. |

|

|

| Fig. 2. Global oil production by region, million bpd. The MENA region accounts for 37% of world oil production. |

|

|

| Fig. 3. MENA oil production, 2000-2011. Saudi Arabia is, by far, the leading oil producer. |

|

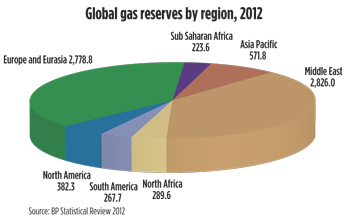

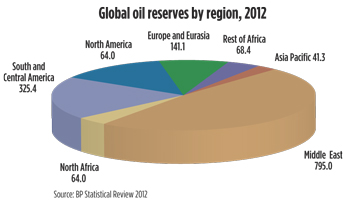

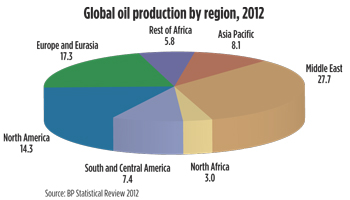

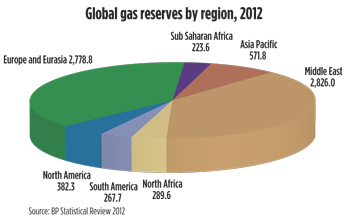

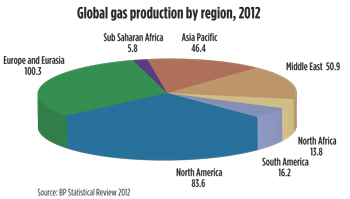

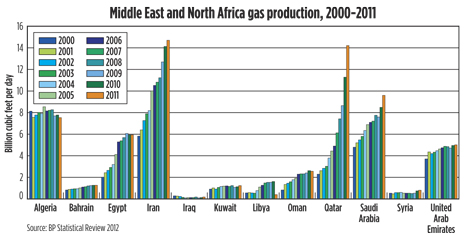

Gas reserves in the MENA region have remained relatively static, with only a small increase from 3,092.2 Tcf to 3,115.5 Tcf, Fig. 4. Gas production increased from 61 Bcfd in 2010 to 64.7 Bcfd in 2011 (Fig. 5), a 6% increase. Largest increases in production are in Qatar and Saudi Arabia. However, as with oil production, there was a large decrease in output from Libya, Fig. 6.

|

| Fig. 4. Global gas reserves by region, Tcf. The MENA region accounts for 42.4% of global gas reserves. |

|

|

| Fig. 5. Global gas production by region, Bcfd. The MENA region accounts for 20.4% of world gas production. |

|

|

| Fig. 6. MENA gas production, 2000-2011. |

|

While the MENA region has encountered significant political uncertainty over the past 12 months, activity levels remain relatively high. The region still faces many challenges, but continues to provide a major proportion of world oil and gas supplies, with this role increasing, if countries can export their vast reserves effectively. Following are overviews of major MENA countries, in terms of their oil and gas outlook.

SAUDI ARABIA

In Saudi Arabia, drilling last year remained close to the 2010 level. Saudi Aramco discovered Wedyan field in 2011. The Wedyan-1 well is 450 km southeast of Damman and flowed 2,300 bopd from the Mishrif formation. Saudi Aramco continued developing the Karan offshore gas field, the first non-associated gas field in the kingdom. The field is producing from 21 wells, distributed over five wellhead platforms. The raw gas is transported along a 110-km subsea pipeline to Khursaniyah. The field is expected to produce 1.8 Bcfgd by 2013.

A large increase in Saudi gas production was reported, approaching 10 Bcfd. Baker Hughes recently announced that Saudi Arabia sits on the fifth largest reserves of gas shale at 645 Tcf; however any development of shale gas reserves would need to overcome a lack of water for large-scale fracturing.

UAE

In the combined United Arab Emirates, oil production rose from about 2.4 million bpd in 2010 to just above 2.5 million bpd last year. Korea National Oil Corporation (KNOC) signed a contract with Abu Dhabi National Oil Company (ADNOC) to develop three blocks in March 2012. Under the contract, KNOC has a 34% interest, GS Holdings has 6%, and the remaining 60% are held by ADNOC. The three blocks contain 10 undeveloped fields with combined oil-in-place of 570 MMbbl.

Wintershall and OMV signed a Technical Evaluation Agreement in July 2012 to appraise the Shuwaihat sour gas and condensate field. Wintershall will act as operator, drilling three appraisal wells and conducting 3D seismic. If the appraisal phase succeeds, ADNOC will participate in the development.

OMAN

Petroleum Development Oman (PDO) spudded 23 exploration wells during 2011, a significant decrease from the 37 spudded during 2010. This number is likely to decrease further during 2012, with only 10 exploration wells spudded in first-half 2012. Licensing for future exploration is slow to materialize into firm agreements. For example, the Ministry of Oil and Gas launched a licensing round for four onshore blocks in January 2012, with bids to be submitted by March 2012. A second licensing round was launched in April 2012 for Block 65. The second round closed on Aug. 27, 2012. No awards have been announced in either round. In a previous license award, Oman Oil Company Exploration and Production (OOCEP) signed a PSA for Block 42 in October 2011. OOCEP plans to acquire new seismic data and drill one exploration well.

In field projects, the Block 3 and 4 consortium of Consolidated Contractors, Tethys Oil and Mitsui is continuing development of Farha South and Saiwan East fields. A pipeline between these fields was completed earlier this year.

IRAQ

Drilling activity increased in the Kurdistan region during 2011, with 19 exploration wells spudded, up from 15 in 2010. In first-half 2012, six exploration wells were spudded, with another 19 wells anticipated before the end of the year. The Petroleum Contracts and Licensing Directorate launched the Fourth Licensing Round in April 2011, offering 12 blocks under exploration service contracts. Only four were awarded. A fifth licensing round with more than 60 blocks is planned for the next few months.

In other licensing, ExxonMobil signed six concessions with the Kurdistan Regional Government (KRG) in October 2011. In August 2012, Gazprom Neft signed a deal with KRG to acquire an 80% interest in the Shakal Block in the Kurdistan region. The block was previously relinquished by a consortium of Oil Search, Petoil and Prime Natural Resources in October 2011.

Also in Kurdistan, DNO announced a discovery in June 2012 with the Peshkabir-1 well. Additionally, Western Zagros announced an oil discovery at the Mil Qasim-1 well. Also, the operator announced an oil find at the Kurdamir-2 well in March 2012. Afren announced success at its Simrit-2 exploration well, spudded in October 2011. In another discovery, the Iraqi Oil Company, in conjunction with the South Oil Company, announced a find in the Missan area. Al Dima is the first oil field to be discovered in Iraq, outside of Kurdistan, in over 20 years.

In development activity, in July 2012, PetroChina, Total and Petronas started full-scale oil production from Halfaya field, which was awarded as part of the Second Petroleum Licensing Round in December 2009. Halfaya is expected to produce 100,000 bopd and reach a plateau of 535,000 bopd in 2016.

ISRAEL

Noble Energy made its fourth discovery in Israel in December 2011 with Dolphin field. The field is smaller than its earlier finds, with reported reserves of around 80 Bcf of gas. Noble then drilled the Tanin-1 well, making a more sizeable discovery, with reserves thought to be 590 Bcf of gas. The operator also made a smaller discovery at Pinnacles field in June 2012. The field should produce only 1 Bcf of gas, but due to proximity to Mari-B and a simple tie-back to existing facilities, it is considered economic. Smaller fields are becoming more economic in Israel, due to termination of gas supply from Egypt, as well as the Mari-B field coming toward the end of its life. Success has not been restricted to Noble. ATP Oil & Gas drilled its first well, Shimshon-1, in April 2012. The well was drilled in 1,104 m of water and found more than 19 m of gas pay.

Noble began development of Tamar field, aiming to bring it onstream in April 2013 at around 1 Bcfgd. The development involves five subsea completions. Noble also decided to develop the Noa North field in July 2011, drilling two development wells and commencing production in June 2012. The field is estimated to produce 1.2 Bcf of gas.

SYRIA

The situation for IOCs has been difficult since the uprising, and in July 2012, the EU announced its 17th round of sanctions. Prior to sanctions, Syria exported most of its oil to Europe and earned $7–$8 million per day from oil and gas. Due to the restrictions, the country is thought to have lost around $4 billion. According to the International Energy Agency (IEA), Syria produced around 370,000 bopd and exported 150,000 bopd before the sanctions. Syria’s oil minister recently announced that production is less than 140,000 bopd.

Many companies have declared force majeure on their contracts. Gulfsands Petroleum declared force majeure in December 2011, and it can no longer participate in the operation of its producing assets and has also ceased exploration activities. Total, which produced around 39,000 boed in 2010, also stopped activity to comply with the sanctions. Other companies, including Shell, Suncor, Kulczyk Oil and INA, also halted operations.

IRAN

Iran has been hit with a number of sanctions during the past year over international concern about its nuclear program. In January 2012, the EU announced an oil embargo against Iran, with a deadline of July 1, 2012, to wind down existing contracts. Collectively, in 2011, the EU bought 600,000 bopd from Iran, a quarter of Iran’s total oil exports. The resulting shortfall has been offset by Saudi Arabia, Iraq and Libya. Equally, other significant buyers of Iranian crude have agreed to cut their imports. The sanctions meant that many companies have left Iran, including Total, Eni, Edison and Statoil.

LEBANON

While Lebanon has never licensed areas for hydrocarbon activity, deepwater discoveries, such as Tamar and Leviathan offshore Israel, have increased interest in the country. The first deepwater licensing round remains anticipated, with 163 companies represented at the Lebanon International Petroleum Exploration Forum in July 2012.

YEMEN

Exploration activity decreased in Yemen in 2011 compared to 2010, to nine exploration wells last year, compared with 17 in 2010. This decline can be attributed to the continued uprisings in Yemen during 2011, resulting in many oil and gas companies suspending their operations. With the political situation improving, and more oil companies re-starting operations, the Petroleum Exploration and Production Authority of Yemen anticipates 23 exploration wells will be drilled during 2012.

EGYPT

Approximately 153 exploration wells were drilled in 2011 in Egypt, compared with 130 in 2010. However, the Ministry of Petroleum had previously announced that it expected to drill 350 exploration wells in 2011. In first-half 2012, more than 70 had been drilled, 16 by Apache.

Considerable investments have already been made in Egypt’s offshore industry, but with the launching of a new EGAS bidding round in June 2012, there are interesting opportunities for new ventures. The licensing round offered two onshore and 13 offshore blocks, and is scheduled to close in November 2012. Additionally, the awards from Egyptian General Petroleum Corporation’s (EGPC’s) recent bidding round, which closed in March 2012, are anticipated soon. The round reportedly received 25 proposals from 12 international companies.

About 40 new discoveries were made in Egypt during 2011, on par with 2010. Around 20 finds have been made so far in 2012. Apache continues its high activity level in the Western Desert with recent discoveries in Shadow field. The operator reported that it will invest $1 billion in Egypt during 2012. Also in the Western Desert, Eni, through its JV company, Agiba, made a potentially large Cretaceous oil and gas discovery.

Kuwait Energy, with its partners, Dover Investments and Beach Energy, drilled six exploration wells in the Abu Sennan concession, four of which recovered hydrocarbons. The company also made two finds in Area A in the Gulf of Suez basin. Also in the Gulf of Suez, Dana Petroleum made new discoveries near the Fin and Lorcan finds of 2010. The operator’s Matr field is now onstream, while Dana also made discoveries at East Matr-1X and North Matr-1X. BG Group struck gas in the Nile Delta with its Harmatan Deep-1 well.

BP and RWE’s $9-billion gas field development offshore Egypt may be delayed until 2015, due to the town of Idku taking issue with the building of an onshore processing plant. The project includes development of Giza, Taurus, Libra, Fayoum, Ruby and Raven fields, with combined reserves of 5 Tcf of gas.

ALGERIA

Sonatrach maintained its high level of exploration activity, reportedly drilling 160 exploration wells in 2011. The company announced that it plans to drill 110 exploration wells during 2012. The state company also recently announced that it had made 20 new discoveries in Algeria during 2011. According to Sonatrach, it has already made 15 discoveries of its own during first-half 2012. One of the 2011 discoveries was made by an IOC. The field was found by E.ON Ruhrgas in November 2011 with the Yacoub Nord-1 well and follows E.ON’s Zemlet Cherguia discovery made near the end of 2010. E.ON made an additional discovery with the NEY-1 well, announced in July 2012. All three discoveries are in the prolific Berkine basin, in the 406a Block awarded to E.ON in 2009. Also, PTTEP drilled the Rhourde Terfaia-1 well to 4,129 m and tested 1,000 bopd and 0.3 MMcfgd.

Field development activity is robust. Anadarko’s El Merk development is 90% complete, with first oil anticipated by the end of 2012. The development includes two 65,000-bbl trains and the capacity to process 600 MMcfgd. Repsol’s Reggane North development received approval in February 2012, and the operator and its partners plan to invest $3 billion, with production likely to span 25 years, with a plateau of 282 MMcfgd. The basic engineering on Total’s Timimoun project is complete. Total also submitted a development plan for the nearby Ahnet project, which has an expected plateau of 400 MMcfgd.

Additionally, PetroVietnam and PTTEP have signed an engineering contract with Japanese Gas Corporation and Petroleum Authority of Thailand for the Bir Seba development. It is anticipated to produce 20,000 bopd by 2014, rising to 36,000–40,000 bopd by 2016. Further south in the Illizi-Ghadames basin, Petroceltic has submitted a declaration of commerciality for Ain Tsila field. Petroceltic aims to reach an average wet gas plateau of 355 MMcfd, with a further 106 wells required.

MOROCCO

Drilling activity in Morocco remains low, with four exploration wells drilled in 2011, a decrease on the seven wells drilled in 2010. No wells were reported during first-half 2012. Despite this, companies continue to invest in Morocco. Kosmos Energy expanded its position with the signing of the Essaouira offshore exploration license and the Tarhazoute offshore reconnaissance license. Pura Vida Energy, an Australian start-up, signed an agreement for the Mazagan offshore concession. Nautical Petroleum and Barrus Petroleum signed up for the Juby Maritime Block. Further agreements have been put in place onshore, including East West Petroleum’s Doukkala Block. Several reconnaissance licenses have been awarded.

TUNISIA

Eleven exploration wells were drilled in Tunisia in 2011, compared with 17 during 2010. There has been limited exploration drilling during first-half 2012. The consortium led by Chinook Energy drilled the unsuccessful Bir Jouacha-2 exploration well on the Sud Remada permit and plans to drill its next well in late 2012 or early 2013. Also, after 12 discoveries in 2010, only two were made in 2011, including Eni’s Bochra discovery on the Borj El Khadra permit in southern Tunisia.

Acreage continues to be awarded in Tunisia. DNO in October 2011 was awarded the onshore Fkirine prospecting permit, valid for an initial two-year period. DNO is looking to invest $2.5 million in its work program. Similarly, Topic SA, was awarded the Mateur permit in March 2012.

LIBYA

Drilling activity in Libya decreased in 2011 as a result of the revolution. While production is approaching pre-war volumes, exploration levels are still below the 50-plus wells drilled in 2010. However, companies are resuming exploration. Despite the drop in drilling levels, Arabian Gulf Oil Company announced in June 2012 that it had made a new field discovery with the D1-NC8 wildcat, drilled to 2,139 m, 400 km south of Tripoli.

The focus in 2012 has been the ramp-up of existing production. By August 2011, oil production had halted, but a return to pre-war oil output of 1.65 MMbopd by July 2012 was anticipated. In September 2011, production restoration efforts commenced with key fields, such as Al Jurf and Abu Attifel. Oil production levels had reached 400,000 bopd by October 2011, increasing to 750,000 bopd by November 2011.

By December 2011, production levels had increased to 840,000 bopd. In February 2012, total production reached 1.3 MMbopd, and by the end of April had risen to 1.5 MMbopd.

Prior to the revolution, Libya had seen some companies exit, including BG and Woodside. In May 2012, Shell announced that it would suspend drilling and abandon two licenses, due to disappointing results. Shell had signed deals involving exploration and upgrade of the LNG plant at Marsa Al-Brega. There have been delays. RWE is awaiting agreements with National Oil Corporation to form a J.V. and has postponed the start-up of its oil fields. RWE originally hoped to start production in 2014.

Foreign companies are gradually returning to Libya, despite some concerns over security and possible contract reviews. For example, Gazprom announced that it will decide by the end of 2012 whether to proceed with the Elephant project. Production rates are expected to reach pre-war levels of 1.6 MMbopd through a continued focus on field development and production. It was reported that Libya intends to invest $10 billion on raising production capacity from existing fields, and $20 billion on new exploration over the next decade.

|

The authors

Caron Howard is the Middle East and Africa manager in Deloitte’s Petroleum Services Group in London. She has been with the Petroleum Services Group since 2006, focusing on development of information services for the region. Before joining Deloitte, Ms. Howard worked in the Middle East business unit at BP as a geological technical assistant. She graduated from Royal Holloway, University of London, with an MSci degree in geoscience in 2003.

Jon Tarris is the North Africa & Mediterranean team Leader in Deloitte’s Petroleum Services Group in London. He joined the group in 2009 and currently leads the development of Deloitte’s information services in the region. Mr. Tarris graduated from the University of Southampton with an MSci degree in geology in 2009.

James McCormack is the Middle East team leader in Deloitte’s Petroleum Services Group in London. He has been with Petroleum Services since 2007, focusing on the development of information services in the region. He graduated from the University of Southampton in 2007 with an MSci degree in geology. |

|