JIM REDDEN, Contributing Editor

|

| A Continental Resources drilling location in North Dakota showing one of the 22 rigs the operator is running in the state and across the border into Montana. Courtesy of Continental Resources Inc. |

|

Apart from an implausible oil price collapse, the only potential sidetracks to the continuation of unbridled exploration and production in the Bakken/Three Forks shale plays are an overwhelmed infrastructure and ever-growing logjams in moving production from fields to refineries.

Industry and governmental officials, alike, warn that the besieged Bakken infrastructure may soon be completely overpowered. In an area where unemployment is a foreign statistic, once-bucolic ranch communities overnight have found themselves too heavily populated with incoming oilfield work to keep up with housing and other basic necessities. One service company executive described, as “dire,” the infrastructure issues in North Dakota, epicenter of the roughly 2,000-sq-mi inter-country play.

The pressure to wholly overhaul a transportation, facilities and services network caught off-guard by the meteoric onslaught of people, rigs and other equipment is magnified by publically-funded enhanced oil recovery (EOR) investigations underway, to coax even more sweet crude from the organically rich, but low-permeability Bakken shale, and the underlying, more-porous Three Forks formation. In addition, the rosy future, of what has been portrayed as among the globe’s fastest growing plays, is expected to be set in stone, once the U.S. Geological Survey (USGS) late next year releases results of a new assessment that promises to add considerably to an already world-class reserve base.

The North Dakota Pipeline Authority forecasts production to be upward of 730,000 bopd, by the end of next year, burying the now-record 546,000 bopd produced in January 2012. Until pipeline projects now on the books are in full operation, adding new production will further exaggerate a bottleneck that is forcing Bakken operators to discount prices.

Ron Ness, president of the North Dakota Petroleum Council, said the most recent state data show 153 million bbl of oil produced in 2011, from what is now the nation’s third-largest producer behind Texas and Alaska, respectively. He added that natural gas production in the oil-dominant play also reached an all-time high of nearly 156 Bcf last year.

Ironically, a relatively sultry winter by North Dakota standards, in tandem with rapid deceleration in dry gas drilling, is credited, in no small part, with helping reach the record production rate. The steady stream of rigs that began exiting the gas plays early this year freed up crews to hydraulically frac the newly-drilled Bakken wells. North Dakota’s fourth warmest winter since 1894 allowed operators to continue work without weather delays.

Ness said home-grown operators and a handful of international players drilled and completed a total of 1,200 new wells in North Dakota during 2011, many of which were drilled from increasingly popular multi-well pads. However, last year’s tally is expected to pale, compared to the 2012 forecast. Owing to the pace of permits being issued, the DMR predicts a minimum of 2,000 new wells could be drilled by the end of 2012, while RigData predicts as many as 2,500 new well starts this year.

As of mid-April, 223 rigs were making hole within the liquids-rich Bakken/Three Forks petroleum system. Of those, nearly all were drilling in North Dakota, which recorded 196 active rigs as of April 13, according to Baker Hughes, compared to 160 in the same period last year. The eastern Montana active rig tally jumped to 18 during the same period, an increase of eight over the previous year. Across the border, the Canadian Association of Oil Drilling Contractors said that as of April 17, nine rigs were drilling in the less-service-intensive Saskatchewan portion.

RE-ASSESSING RESERVES BASE

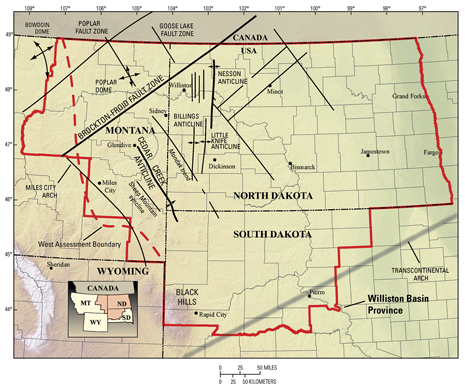

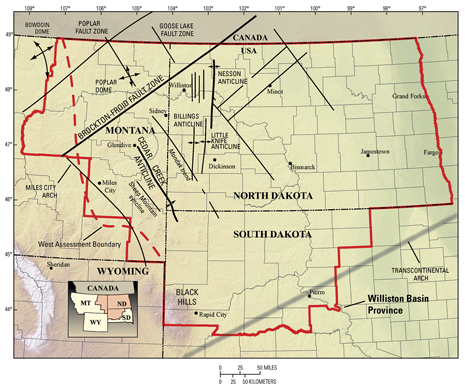

As presently delineated, the Bakken/Three Forks shale play occupies roughly two-thirds of the 3,000-sq-mi Williston basin and spreads beneath most of western North Dakota, and eastern Montana, and into Saskatchewan and Manitoba.

Unlike the more-impermeable middle Bakken, where multi-stage horizontal completions are seen as requirements for maximum asset value, the lower and more recently delineated Three Forks/Sanish sands are higher in porosity and permeability values, and are said to deliver comparatively higher recovery rates.

Estimates of how much recoverable oil actually resides in the Bakken complex have been across a very wide board since the last USGS assessment in 2008 pegged recoverable reserves at up to 4.3 billion bbl. In the four years since, estimates have swung widely, with long-time Bakken pacesetter Continental Resources estimating the play holds potentially recoverable oil and gas reserves of no less than 20 billion bbl and 4 Bcf, respectively.

The USGS hopes to put the matter to rest with an updated reserve assessment it began last October. The results are expected to be released by the fall of 2013.

U.S. Sen. John Hoeven (Republican – North Dakota) called for the new assessment, arguing that investors needed to know how long the intense drilling and production would continue before funneling dollars into rebuilding a sorely outmatched infrastructure. “There is a strong feeling in the oil patch that the recoverable reserves are substantially greater than what has been shown by the USGS,” Hoeven said in an earlier release.

TAKEAWAY PROBLEMS MOUNT

The investments that Hoeven spoke of cannot come soon enough for companies, many of whom fear that until the infrastructure catches up, the industry is nearing the point where maintaining high activity levels will become unattainable. During last month’s Platts Rockies Oil and Gas Conference in Denver, company executives spoke of deteriorating roadways that make it difficult to move equipment, and a housing crunch that is a crisis.

Dan Eberhart, CEO of oilfield services company Frontier Energy Group, told the Associated Press during the conference that infrastructure issues, particularly housing, had become “dire.” “We’ve had to basically buy apartment complexes to put our people in. We’ve got campers around buildings. Housing is a giant, giant issue for us,” Eberhart was quoted as saying.

The AP also quoted Mark Williams, Whiting Petroleum Corp. senior vice president of exploration and development, as saying that with the current infrastructure, the rig count would soon cap out at around 300 units. In February, the state stepped in, saying it would spend $1 billion on western North Dakota roads and infrastructure projects.

By far, the most publicized headache for Bakken producers is getting oil to market without having to discount pricing. Overcapacity has created a severe bottleneck at the primary U.S. gathering hub in Cushing, OK, and forced Bakken crude to trade as much $18/bbl less than WTI.

Many complain that President Barrack Obama’s decision to forgo construction of the Keystone XL pipeline removed a potential artery for moving Bakken oil to southern refineries. A number of pipeline projects, including Oneok Partners’ recently-announced 1,300-mi Bakken Crude Express Pipeline, have since been forwarded to bring production farther south and bypass the Cushing hub.

In the meantime, approximately 25% of all Bakken production is being moved by rail, according to a spokeswoman for BNSF Railway, who added that an aggressive expansion plan is underway, which will have nine BNSF trains running daily, carrying up to 730,000 bpd of Bakken crude, Fig. 1. Today, each of the railway’s more than 100 weekly trains that traverse the Williston basin carries capacity of up to 81,000 bbl, she said.

|

| Fig. 1. A Burlington Northern Santa Fe train transports Bakken crude along a portion of the 1,000 mi of rail lines it operates in the Williston basin. Courtesy of BNSF Railway |

|

The Canadian Pacific Railway, meanwhile, claims its delivery of Bakken crude has jumped an astonishing 2,500% since 2009 and now amounts to a high of 8.5 million bbl/year.

INCREASING RECOVERY RATES

The current takeaway problems could be further aggravated, if the results of two publicly-funded investigations bear fruit. The federal and state-funded studies are looking at increasing the ultimate recovery rates of individual wells in the North Dakota portion of the Bakken/Three Forks shale play. North Dakota Bakken wells average ultimate recovery rates ranging from 500,000 to 900,000 bbl.

In late March, the University of North Dakota’s Energy & Environmental Research Center (EERC), with funding from the U.S. National Energy Technology Laboratory (NETL), completed a nearly four-year geomechanical study aimed at increasing per-well recovery of Bakken wells. According to EERC, the study’s objective was to optimize the success rate of horizontal drilling and hydraulic fracturing.

The study analyzed data from 360 cores of upper, middle and lower Bakken units that were cut from six USGS-defined Assessment Units, Fig. 2. Neither the EERC nor NETL has indicated when the results of the ongoing study will be released.

|

| Fig. 2. Assessment of undiscovered oil and gas resources of the Williston Basin province of North Dakota, Montana, and South Dakota. Source: USGS Williston Basin Province Assessment Team, 2011 |

|

On the state level, the North Dakota Industrial Commission voted unanimously in mid-February to study the feasibility of using carbon dioxide (CO2) to enhance oil recovery.

OPERATOR ACTIVITY UPBEAT

Infrastructure woes notwithstanding, most operators entered 2012 with plans for aggressive drilling and production programs. A sampling of select operators’ 2011 results, and plans for 2012, shows no E&P slowdown on the foreseeable horizon.

Continental Resources Inc., one of the widely acknowledged pioneers of the Bakken shale, acquired an additional 37,900 net acres from its majority-owned Wheatland Oil Inc. trust. The purchase also gave Continental interests in more than 1,000 gross wells with net proved reserves of 17 million boe.

As the largest leaseholder in the Bakken, Continental held 901,000 net acres prior to the Wheatland acquisition, 72% of which are in North Dakota. The operator closed out the fourth quarter of 2011 with the completion of 61 gross wells with 54 in North Dakota and the remaining seven in Montana. Continental also said it planned to add up to 40 ECO-Pad multi-well drilling locations in its Bakken/Three Forks holdings between 2011 and 2012, Fig. 3.

|

| Fig. 3. Producing wells on one of the 40 ECO-Pad drilling locations that Continental Resources intends to have in operation by the end of this year. Continental credits the technique with reducing costs as much as 10% per well. Courtesy of Continental Resources Inc. |

|

Hess Corp. Chief Executive John Hess told the Wall Street Journal last October that the operator intends to triple its Bakken shale production over the next three years. At the end of 2011, Hess was producing 39,000 boed and plans to produce 60,000 boed by the end of this year, leading up to a 120,000-boed plateau in 2015. Hess was operating 15 rigs as of April 11, according to the DMR.

Whiting Petroleum Corp., the third largest producer in North Dakota, holds 682,000 net acres in the Bakken/Three Forks petroleum system and is continuing to add to that position. During 2011, the company booked an estimated 45.1 MMboe of new Bakken and Three Forks proved reserves. During 2012, the operator plans to invest $851.1 million to drill and complete 218 gross (124 net) wells in the Williston basin, representing 53% of its total annual budget. A majority of Whiting’s 2012 activity will focus on pad drilling operations at its Sanish field and its Lewis & Clark/Pronghorn prospects.

Brigham Oil and Gas LP, which Statoil acquired in late 2011 in a $4.4-billion transaction, holds some 375,800 net acres, most of which are in North Dakota. As of mid-April, the operator had 19 rigs drilling in North Dakota, but has not released its 2012 drilling plans.

EOG Resources Inc. holds 600,000 net acres in North Dakota’s portion of the Bakken/Three Forks play and has a seven-rig development program underway, with plans to complete 60 net wells this year. According to its first-quarter 2012 investor presentation, at year-end 2011, EOG had booked 162 MMboe of proved reserves in the Bakken/Three Forks play.

Marathon Oil Co. holds 406,000 net acres in the North Dakota portion of the Bakken, and in December achieved record average production of approximately 24,000 net boed. The year-end 2011 production represented a more-than-70% increase over the 14,000 net boed the operator recorded a year earlier. As of Jan. 25, Marathon had 19 gross operated wells awaiting completion. The company is running seven rigs and plans to add an eighth in second-quarter 2012.

WPX Energy Inc., which cites Bakken shale development as having the highest incremental returns of any of its drilling programs, plans to spend upward of $370 million this year in its North Dakota holdings. By late February, the operator’s Bakken production had increased to 7,600 bopd after closing out 2011 with average production of some 6,400 bopd in the final quarter of 2011, a more than three-fold increase over the same period in 2010. The operator completed 25 gross wells in the Bakken last year.

ConocoPhillips holds 558,000 net acres in the Bakken, spread across North Dakota and Montana, where its 2011 average net production amounted to 17,000 boed. The major had six rigs working at the end of 2011 with plans to add four additional rigs this year. ConocoPhillips acquired Burlington Resources Oil & Gas Co. LP in 2006, which the North Dakota Industrial Commission listed as the operator for seven rigs drilling as of early April.

Newfield Exploration Co. of The Woodlands, TX, holds some 140,000 net acres in the Williston basin and 340,000 net acres in the Southern Alberta basin, many of which likewise target the Bakken, Sanish/Three Forks formations. To date, Newfield has drilled more than 40 successful Bakken and Sanish/Three Forks wells in the Williston, with production of approximately 7,000 boed.

GEO Resources Inc. holds 25,000 net-operated acres in northwestern Williams County, ND, and 8,200 net-operated acres in eastern Montana.

During fourth-quarter 2011, Geo Resources spudded six gross wells and completed four, including the Olson 1-21-16H that represented its first-ever well drilled in eastern Montana. The well averaged 300 boed in its first 30 days of production, prompting the operator to announce plans to drill additional Montana locations throughout this year.

PetroBakken Energy Ltd., the predominant operator in the southern Saskatchewan portion of the Bakken, plans to drill 96 net wells this year from its 750 net Bakken light oil locations. The Canadian operator has 954 producing wells.

TECHNOLOGY APPLICATIONS

Over the past year, Bakken operators employed a variety of new technologies that ran the gamut, from fostering better reservoir understanding to closed-loop solids processing.

Three Forks reservoir characterization technology. Schlumberger says its Rt Scanner triaxial induction service is helping operators in the more recently delineated and less-understood Three Forks formation more accurately compute hydrocarbon saturations and other reservoir properties.

Senior Petrophysicist Samer Alatrach said the technology allows Schlumberger analysts to deconvolve the true reservoir rock resistivity from the effects of the highly conductive shale laminae. The results of an Rt Scanner analysis give operators a way to effectively evaluate, on a well-by-well basis, the quality of the reservoir. “Tri-axial resistivities, when applied with gamma neutron spectral measurements through a suitable petrophysical model, more accurately describe the reservoir’s near-wellbore saturation and have helped operators make better drilling and completion decisions,” said Alatrach.

Hybrid intervention technology. In 2011, The Boots & Coots (a Halliburton Service), PowerReach hybrid intervention service continues to be used in the Bakken/Three Forks shale, where it debuted earlier in a multi-zone, hydrajet-assisted fracture (HJAF), live well stimulation. According to its developers, the uniquely engineered technology combines the intrinsic benefits of both large-diameter coiled tubing and jointed pipe in a single workstring for use in multi-frac and long-horizontal wellbores.

The intervention technology is used in tandem with Halliburton’s SurgiFrac service that combines hydra-jetting and fracturing technologies for live-well interventions. According to Boots & Coots, the PowerReach technology has now been used on 10 Bakken/Three Forks wells, with one well completed to 37 frac stages, and another that reached a maximum depth record of 20,332 ft.

Mobile closed-loop solids control system. During 2011, M-I SWACO said its dual-centrifuging, OptM-Izer mobile, closed-loop solids control system was employed on some 102 Bakken/Three Forks wells. Now in its third generation, the technology was engineered as a single-point dewatering and solids removal system for the wide range of flowrates encountered in the water and oil-base drilling fluid intervals, as well as the brine-based production zone.

Last year, the closed-loop system processed a cumulative 1.3 million bbl of surface water with a 20-well average of some 13,200 bbl/well. The company says the system’s versatility was reflected in a recent well, where it reduced low-gravity solids (LGS) concentrations in the active brine while simultaneously cleaning up and dewatering the 10,000 bbl of surface water delivered to accommodate an expected loss zone. The OptM-Izer technology is presently employed on 24 Bakken wells for eight different operators, said the company.

|

| Fig. 4. A winterized version of the Supreme Service & Specialty Co. Sand Dehydration Station (SDS), shown here at work in the Permian basin, will move to the Bakken/Three Forks play this year. Note the cloud, which illustrates the effectiveness of the built-in degasser to safely vent entrained gas. Courtesy of Supreme Service & Specialty Co. |

|

Sand dehydration technology. Later this year, Supreme Service & Specialty Co. of Houma, LA, said it intends to have a winterized version of its Sand Dehydration Station (SDS) operating in the Bakken, Fig. 4. As the name implies, the system dehydrates the sand and effectively separates the water, which is treated and subsequently reused, said Supreme Vice President of Business Development Tim LaBruyere. He added that the SDS, currently in use in the Eagle Ford, Haynesville, Permian basin and Barnett plays, includes an elevated, built-in gas buster configured to safely vent hazardous compounds.

|