Bill Coates, CEO of MicroSeismic, explains how passive seismic technology is poised to be the next enabler for unconventional reservoir development, and how one operator’s early adoption is setting it apart from the pack.

The geoscience community has always been at the forefront of E&P technology innovation. You only have to think of how 3D seismic has transformed oil and gas exploration, virtually obsoleting the term “rank wildcat,” as exploration success rates have passed 50% in many basins. We have seen the evolution of time-lapse 3D or 4D seismic; ocean-bottom seismic, using seabed cables or nodes to produce high-resolution multi-component data; permanent life-of-field seismic reservoir monitoring; and marine, controlled-source electromagnetic surveys for direct detection of hydrocarbons, not to mention high channel count and cable-free land seismic acquisition. All these developments have made a huge impact on oil companies’ E&P success, efficiency and bottom lines.

SEISMIC RECEIVERS OPTIMIZE RESERVOIR DEPLETION

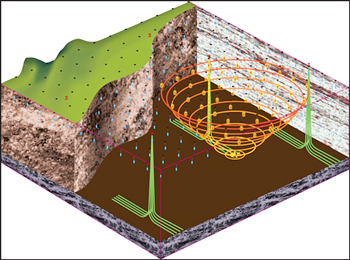

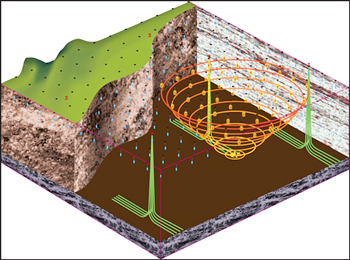

It’s not a stretch to suggest that we are now witnessing the latest technology worthy of joining the geoscience canon of innovation. Who, after all, would have thought of laying out hundreds or even thousands of passive seismic receivers over many square miles to set up what is, in effect, a giant microphone, thousands of feet above a shale oil or gas reservoir. This microphone allows geoscientists to record and map the exact location of the cracks created by hydraulic fracture operations—in real time, Fig. 1. It turns out that this technique offers an exceptionally economic method for monitoring hydraulic fracturing operations across a whole shale oil or gas field. Reservoir engineers can optimize reservoir depletion in a way previously not possible, thereby significantly increasing the return on a company’s asset. Just as important, the microseismic monitoring system is able to provide the factual evidence necessary to deflect environmental objections to hydraulic fracturing; for example, the perceived threat of contamination to public water supplies.

|

| Fig. 1. New real-time room where analysts watch microseismic data as it streams in from the field. |

|

When MicroSeismic founder and current Executive Chairman Dr. Peter Duncan first proposed his idea less than 10 years ago, it received mixed reactions. In 2005, the company barely managed to raise the $7 million of start-up money that it believed would be necessary to bring the concept to market. Today, participants in the mushrooming shale plays of the U.S. are paying close attention, as are companies contemplating similar operations abroad, such as in Poland, which appears close to committing to some shale-related production. Last year, the firm was able to attract an investment of over $100 million to take its services to the next level.

The company’s technology is at the critical intersection of the unconventional: between a horizontal wellbore, a hydraulic fracture and a shale reservoir. This technology provides, for the first time, an accurate picture of how the reservoir responds to hydraulic stimulation and hydrocarbon production over the life of the field. The dramatic production results achieved by Whiting Petroleum are a good example of how the technology works.

APPLICATION AT SANISH FIELD

Three years ago, Denver-based independent Whiting Petroleum was one of the early adopters of MicroSeismic’s hydraulic fracture monitoring system. Among Whiting’s largest projects are its North Dakota operations in the Bakken and Three Forks shale plays, making it the second largest oil producer in the state, according to the North Dakota Industrial Commission.

The company recently invested in the vendor’s continuing services, with the award of a third annual contract last November. The $5.7-million order was for monitoring of Whiting’s hydraulic fracturing operations, including all its Bakken and Three Forks wells over a 152-sq-mi area in Sanish field, North Dakota.

Sanish field is MicroSeismic’s largest project to date and illustrates both the scale and surprising simplicity of the operation. Yet it is a technology that transforms the information available to reservoir engineers during fracturing and production operations. The conventional downhole monitoring method requires access to a monitor well or wells in which seismic imaging and other equipment can be installed. Downhole recording, due to the smaller size of its geophone array, offers a limited field-of-view, when compared to a larger surface antenna and cannot be used for long-term reservoir monitoring. There is also a temperature limitation on tools that can be placed in a well. Although the quality of downhole imaging can be excellent, the accuracy falls off about 1,500 ft from the geophone string. The process is essentially a check—and an expensive one at that—as monitoring wells can cost anywhere from $1 to $3 million—to confirm the execution of the fracturing operation.

EMPLOYING THE BURIEDARRAY SYSTEM

Since using the new technology, Whiting has dispensed with drilling monitor wells on its vast Sanish field acreage, at a considerable saving in cost and significant improvement in efficiency. It depends instead upon the BuriedArray system, which is MicroSeismic’s solution for life-of-field monitoring of hydraulic fracturing and reservoir production operations, Fig. 2. It is a concept inspired by passive seismic used for earthquake monitoring and has been successfully deployed in most of the major shale basins, including the Haynesville, Eagle Ford, Niobrara, Bakken, Horn River and Barnett. In practice, a grid of passive seismic geophones, with some customized modifications, has been buried in boreholes 3,000-4,000 ft apart, to a depth of between 50 and 300 ft across the entire 152-sq-mi extent of the Sanish reservoir. Each recording station is connected to a custom wireless network with wind and solar power to charge the batteries that provide the system electricity.

|

| Fig. 2. A BuriedArray of geophones, deployed across the field, enables the monitoring of multiple wells simultaneously over the life of the field. Continuous monitoring ensures that operators understand the variability in shale over space and time. This allows them to adjust completions as the reservoir changes, maintaining strong production. |

|

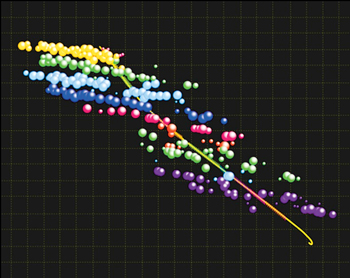

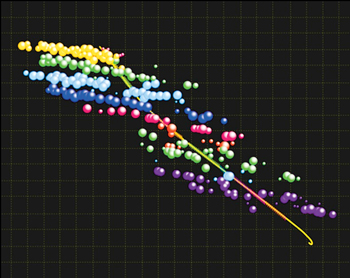

There is a small crew of geophysical technicians on the ground in North Dakota to keep an eye on day-to-day operations, but data collection from each station is transmitted continuously to a central recording and processing facility. The vendor’s patented Passive Seismic Emission Tomography (PSET) processing technology is then used to evaluate recorded data and provide the backbone for integrated answer products that describe and model the interaction of the formation and the fracture treatment, Fig. 3. In presentations of the technology, Dr. Duncan uses the analogy of the doctor’s stethoscope to describe how PSET can harness data from all the stations to focus back on the fracing point. In medical terms, the visual display of data could be compared to the instant image produced by a CT scan.

|

| Fig. 3. Frac monitoring results using MicroSeismic’s PSET imaging technology indicate good wellbore azimuth and frac spacing. The spheres represent seismic events sized by amplitude and are colored by stage. Operators use this information to optimize well and frac spacing. |

|

The service company has processed nearly 160 wells for Whiting in Sanish field at a rate of eight per month. Real-time results have not been deemed necessary, although the capability is available, and monitoring is always 24/7.

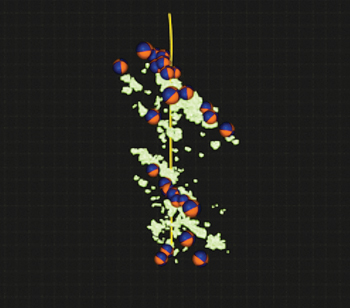

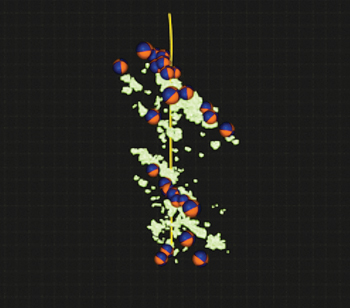

PSET analysis employs some widely-used geophysical techniques, but the differentiator for Whiting came from its patented depth-migration algorithms. These provide a complete, and more precise view of the reservoir than classic downhole microseismic processing, Fig. 4. There are a number of reasons why this is important. Shale varies from basin to basin, well to well and even frac stage to frac stage. As new wells are drilled and produced, they affect other wells in the field. Reservoirs also undergo change over time in response to development activity, and this means the optimum fracturing strategy has to be constantly re-evaluated. Continuous monitoring makes it possible to understand well-reservoir interaction over time. Analysis meetings with Whiting often focused on the effect of fracturing on neighboring wells. Such discussions on the data opened the door of opportunity to re-think completion and field development strategies; for example, identification of re-fracturing or infill well opportunities to maintain optimum production over the life of the field.

|

| Fig. 4. PSET processing and imaging technology identifies source mechanisms that help geologists understand how the rock is breaking during fracing. Operators use this information to optimize their completions and field development strategies. |

|

RESULTS

In its 2010 Annual Report, Whiting reported that based on results of its microseismic studies and reservoir pressure monitoring in both the Bakken and Three Forks formations, additional infill drilling was necessary to maximize recovery in Sanish field. As a result, the company increased the total number of gross operated wells that it expected to drill in Sanish field by 153, to 535. Whiting also noted that the installation of 298 permanent geophones across Sanish field had allowed the company to gather microseismic data on every fracture stimulation that it had pumped into the field, concluding that the information had been “useful in determining the effectiveness of our hydraulic stimulations along with assisting in developing the proper spacing of wellbores in the field.”

Whiting’s experience offers evidence that when it comes to hydraulic fracturing in unconventional plays, microseismic monitoring is extremely helpful. The ability to continuously monitor has many advantages, including increased production. For example, a completion or production engineer can identify the location of a mechanical failure and rapidly intervene, lowering the cost of the intervention and minimizing lost production. The same applies to cementing or casing failures that are difficult to determine and costly to a production program if not detected.

ADVANTAGES OF MICROSEISMIC

In summary, the near-term benefit of the technology is being able to monitor and describe the interaction of the reservoir and fracture treatment by accurately placing microseismic events in 3D space. Integrating wellbore and field-scale geologic, geomechanical and petrophysical information can provide the best possible answer on how the rocks are breaking, and how the reservoir will respond post-treatment. Since MicroSeismic doesn’t operate a pressure pumping or completions business, clients receive an unbiased evaluation of the stimulation’s effectiveness. The long-term benefit is being able to track changes in the reservoir over time. Shale is highly variable, and understanding that variability is key to maintaining strong production over the life of the field. Wells in these plays may show strong initial production, but they often decline rapidly. Without a continuous stream of microseismic data to evaluate the reservoir, operators are often left to guess on potential solutions. Economics in the shales are finely balanced, and anything that reduces risk and increases certainty has value.

It remains a fact that the industry has not yet fully realized what may emerge as microseismic technology’s biggest potential contribution to unconventional resource development. It could well be that the assurance provided by long-term microseismic monitoring will counter the many objections being expressed about hydraulic fracturing, including aquifer contamination and hydraulic fracturing-induced seismicity (i.e., small earth tremors).

FUTURE OF FRACTURE MONITORING

Currently, countries such as France, Britain and Australia have put hydraulic fracturing operations on hold, pending further investigation into the environmental impacts of the process. Delays always add cost and may limit the pace and breadth of the “shale revolution” outside of North America. However, it is clear that being able to accurately track and report on the progress of fracturing operations is in the interests of oil companies, regulators and communities at large. Microseismic monitoring should result in the optimal number of wells being drilled to achieve maximum production. This is environmentally friendly in itself—less surface disruption and potentially fewer frac jobs. There is no doubt that hydraulic fracturing is at a critical juncture in terms of public perception and acceptance. The new technology has the ability to bring transparency to this process, providing answers to all sides of the debate—operators, communities, landowners and government regulators. This allows all parties to benefit from the significant value that shale plays provide.

|