Pramod Kulkarni, Editor

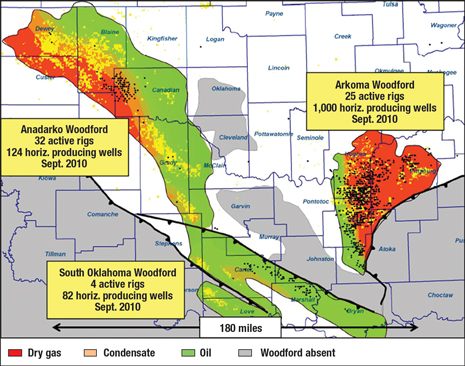

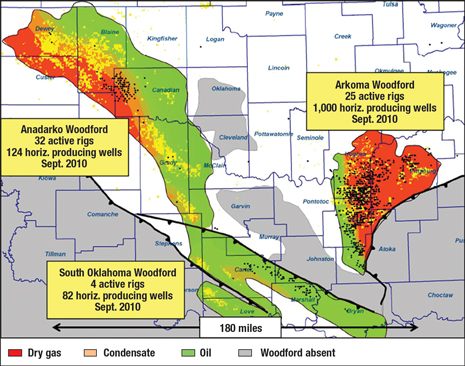

The Woodford is a 4-Tcf shale play located primarily in southeastern Oklahoma, with specific activity in the Anadarko, Arkoma and South Oklahoma Basins, Fig. 1. The first oil and gas production began in the 1930s from conventional vertical wells. In 2005, Devon Energy was the first to drill shale targets, applying horizontal drilling and multistage fracturing techniques introduced in the adjacent Barnett Shale, Fig. 2. The play includes both oil and condensate windows, but the geology has complex layers and faults that require the same type of prospect delineation, precision drilling and optimum completions that are needed for success in conventional plays.

|

|

Fig. 1. Activity in the Woodford Shale is concentrated in the Anadarko, Arkoma and South Oklahoma Basins, with dry gas, condensate and oil production. Courtesy of Continental Resources.

|

|

|

|

Fig 2. Devon Energy was the first to target Woodford Shale gas in 2005, through horizontal drilling and multistage fracturing.

|

|

The Woodford has not been making headlines as have the Marcellus, Haynesville or Eagle Ford Shales, but two of its leading operators—Devon and Newfield—have sold their Gulf of Mexico properties to concentrate their efforts on the Woodford and other shale plays. Due to high prices available for oil and condensates, the drilling effort in 2011 and beyond is likely to shift away from the dry gas window.

GEOLOGICAL SETTING

The Woodford Shale is situated at depths of 7,500–8,500 ft and varies in thickness from 50 to 300 ft. Table 1 provides a reservoir profile of the play. The shale is of Devonian-Mississippian age and has served as a source rock for both oil and gas production, depending upon the thermal maturity and kerogen type.

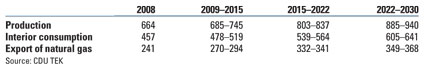

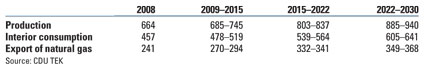

| TABLE 4. Forecast of gas industry dynamics to 2030, Bcm |

|

Unlike other shale plays, the Woodford has complex layering, faults and extensive sealed fractures. Three-dimensional seismic and geological analyses are required to characterize the faults, dip, and the direction and intensity of the natural fractures for optimum lateral orientation and completion strategies. Unfaulted dip panels are the preferred locations for horizontal wells. Prior to 2007, the Woodford had primarily 2D coverage; since then, CGG Veritas has acquired 284 sq mi of 3D seismic data in the core Atoka and southern Coal Counties.

OPERATOR ACTIVITY

Operators active in the Woodford Shale are primarily US independents that have extended their conventional operations in the Mid-Continent region into unconventional opportunities. The majors active in the play are BP, through its purchase of Chesapeake properties in 2008, and ExxonMobil through its acquisition of XTO in 2009.

Continental Resources is the largest leaseholder in the Woodford, with 258,816 net acres in the Anadarko Basin and 47,201 net acres in the Arkoma Basin. The company was running eight rigs in the Anadarko Woodford by the end of 2010. IP rates for the wells in this area ranged 2.0–4.5 MMcfd and 72–105 bopd. In the Arkoma Woodford, Continental achieved good results in 2010 from drilling in East Krebs County, with production ranging from 2.2 to 4.2 MMcfd.

Newfield Exploration has 166,500 net acres in the Woodford Shale, its largest investment in any shale play. Since 2003, Newfield has drilled more than 100 vertical wells and 325 horizontal wells in the play. As of May 2010, the company’s total Woodford production was 200 MMcfed. Even though, at that rate, Newfield’s 2010 gas production in the Woodford would have been 20% more than in 2009, the company decided at midyear to undertake a voluntary curtailment of about 3 Bcfe of gas production due to low prices. When the price improves, Newfield expects to drill about a 1,000 wells at 40-acre spacing.

Newfield was able to increase the average length of its laterals from about 2,500 ft in 2006 to as much as 6,000 ft in 2010. This improvement was driven by what the company calls super-extended lateral (SXL) completions of lengths greater than 5,000 ft. One recent SXL well was the Madison 1H-15W well, with a lateral length of 9,983 ft and 20 fracture stimulation stages. The well had initial production of 13.5 MMcfd with about 25% of the frac load recovered. Another SXL well, Martin 1H-15E, had a lateral length of 9,405 ft and 19 frac stages. The well had initial production of 13.5 MMcfd with about 15% of the frac load recovered.

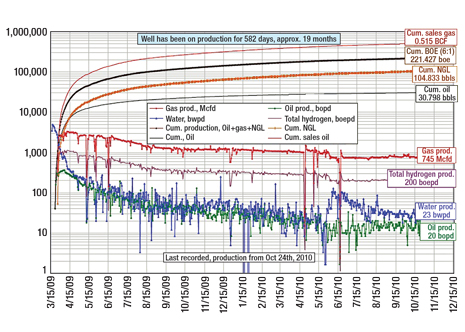

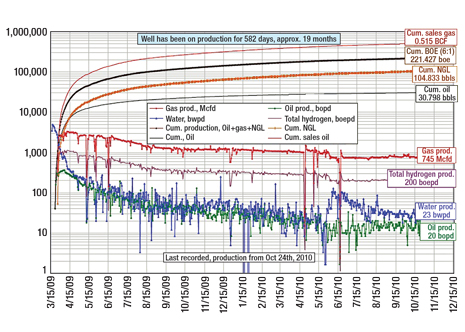

ExxonMobil entered the Woodford Shale through its acquisition of XTO Energy in December 2009. XTO was operating five rigs in the Woodford during 2010 on its 120,000 acres, to drill about 45 wells by the end of the year. Recent wells had IP rates of about 4 MMcfd and EUR of 4–5 Bcf. Figure 3 describes the production history of XTO’s Berwyn 1-15H well.

|

|

Fig. 3. Production history for XTO’s Berwyn 1-15H well reveals prolific extraction of gas and condensate, with about equal amounts of oil and water produced.

|

|

BP has 90,000 acres in the Woodford Shale. Since acquiring the properties from Chesapeake, BP has been working on a two-year program to improve its production efficiency and has reported a 60% increase in production through the application of intelligent targeting and advanced sand control.

Marathon has been actively involved in exploration and production in Oklahoma for more than 70 years, with well-established production from Cement, Huntley, Rocky, Knox, Elk City and Ammunition Fields. The company holds 75,000 net acres in the liquids-rich portion of the Anadarko Woodford and operates 320 net wells. In 2009, it performed a 13-well appraisal in the Brickyard prospect, located in the northeast area of the Anadarko Basin. Year-end 2009 production from the company’s completed wells in the Woodford totaled 6 MMcfed, with individual IP rates ranging 2.5–5.5 MMcfd.

During 2010, Marathon planned to drill 10–15 gross wells to yield an additional 200–300 net locations, with net resource potential of 170–270 million boe. Its 2011 drilling program will see three to five company-operated rigs drill 18–22 wells, and between 50 and 90 non-operated wells on acreage where Marathon holds interest. The company reports per-well costs averaging $7.5 million and 30-day IPs of 1,000 boepd.

Antero Resources has 76,000 net acres in the Arkoma Woodford region. In late 2010, Antero was running one drilling rig and was in the process of completing three horizontal wells. The company was producing 47 MMcfd gross from 115 horizontal wells and an additional 54 MMcfd of net non-operated production.

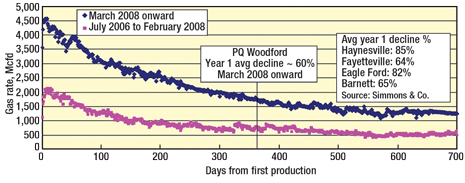

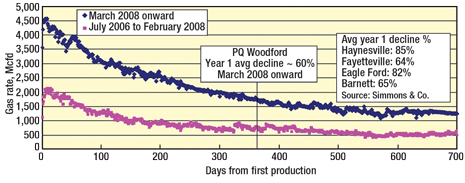

PetroQuest Energy holds 48,000 net acres in the Arkoma Woodford. The company formed a 50/50 joint venture with power company Next Era in May 2010 for a total transaction value of $234.6 million. As a result of the joint venture, Petroquest increased its drilling activity from one to three rigs in the fourth quarter of 2010. From its drilling program in 2008 to the 2010 program, Petroquest improved its lateral length from 2,600 ft to 4,500 ft, increased the IP rate from about 2.0 MMcfd to 4.5 MMcfd and reduced the one-year decline rate to 60%, lower than in any other shale play, Fig. 4.

|

|

Fig. 4. Petroquest achieved a significant production improvement for its second drilling program, initiated in March 2008.

|

|

Range Resources has only 7,800 net acres in the Woodford. During 2010, the company completed two wells in a condensate window. The wells averaged 1,176 boepd with about 68% liquids and 1,514 boepd with about 70% liquids, respectively. The company’s reserves in this area are estimated at 1.3 million boe.

LNG Energy has about 2,350 net acres in the Woodford Shale adjacent to XTO’s highly productive Berwyn 1-15H well. An initial horizontal well drilled by the company has produced 220,000 boe cumulatively to date and continues to produce at a rate of 200 boepd. For additional drilling, LNG has interpreted 3D seismic data for horizontal well development and is waiting on the improvement of gas prices.

MERGERS AND ACQUISITIONS

In July 2008, BP acquired all of Chesapeake Energy’s 90,000 net acres of leasehold in the Woodford Shale for $1.75 billion in cash. The properties are located in Atoka, Coal, Hughes and Pittsburgh Counties and have total production of 50 MMcfd. Chesapeake redeployed the capital from the deal into its Haynesville, Barnett and Marcellus Shale holdings, while BP added the Woodford properties to its existing 200 MMcfd of conventional production from Oklahoma’s Arkoma Basin.

ExxonMobil’s acquisition of XTO in December 2009 gives the Irving, Texas-based major access to unconventional E&P technologies that it may, in time, apply at its international shale holdings in Canada, Poland and Argentina.

TECHNOLOGY CHALLENGES

More than in other shale plays, technology is a key enabler in the Woodford Shale due to complex geology. Formation evaluation is critical for identifying sweet spots and dead zones, and to determine the optimum location and orientation of horizontal laterals and perforation stages.

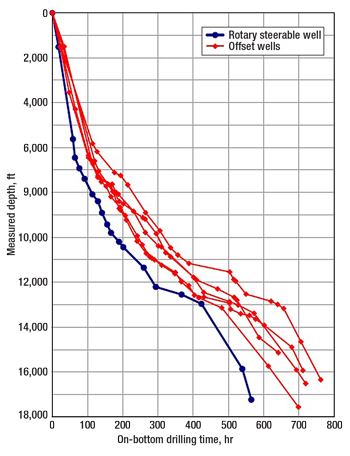

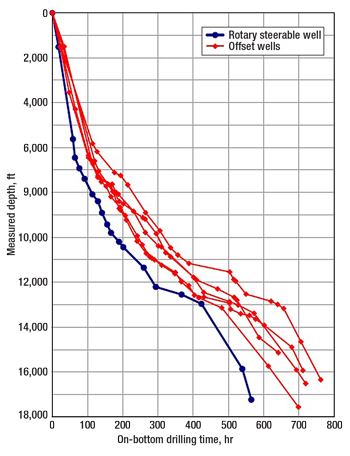

Rotary steerable at low spread cost. Baker Hughes introduced a rotary steerable drilling system in 2009 to drill J-shaped shale wells with a build or drop of 8°/100 ft at a lower cost than with the complex rotary steerable systems used for deepwater drilling. Several wells drilled with this system in the Woodford Shale reduced wellbore tortuosity and improved drilling efficiency, Fig. 5.

|

|

Fig. 5. A rotary steerable system designed for low-spread-cost environments improved drilling efficiency in the Woodford Shale compared to offset wells. Courtesy of Baker Hughes.

|

|

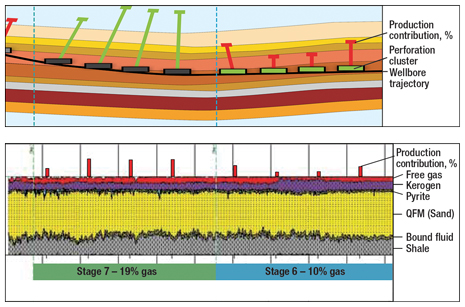

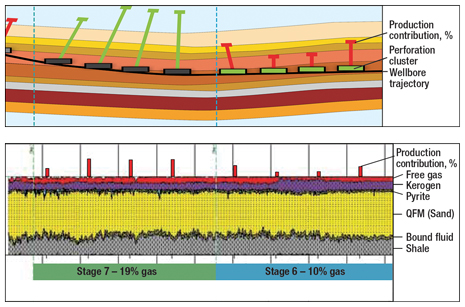

Advanced LWD and production logging. The integration of LWD and production logging measurements helped a Woodford Shale operator identify the most productive zones within a 4,000-ft lateral. The Schlumberger-operator team integrated offset vertical “triple combo” neutron, density and resistivity measurements with Schlumberger’s LWD service to map nine distinct shale layers with a cumulative thickness of 227 ft. After the well was placed on production, multispinner production logging data was integrated with the maps of reservoir zones to identify the most prolific zones, Fig. 6. The production logging measurements determined that more than 90% of the gas was produced from three of the nine mapped zones. Interpretations derived from LWD and production logging data showed that perforation clusters placed across higher free gas, lower clay content and lower calcite volume produced more gas.

|

|

Fig. 6. Geochemical analysis after the integration of LWD and production logging data enabled a Woodford Shale operator to identify drilling and production sweet spots. Two consecutive stages show 19% versus 10% gas production. Courtesy of Schlumberger.

|

|

High-volume fracing. Weatherford’s hydraulic fracturing services are being used heavily in the deeper portions of the play, including Caddo, Custer and Dewey Counties. The wells have measured depths over 20,000 ft and total vertical depths over 16,000 ft—possibly representing the deepest production from any shale formation in the world. Frac gradients in the horizontal sections of these wells reach or exceed 1.0 psi/ft.

A combination of slickwater and cross-linked fluids at 500-ft intervals is improving production at these high pressures. The goal is to increase the interval lengths to 600–700 ft to reduce stimulation costs while maintaining performance. Current pump rates average an extraordinarily high rate of 60–70 bbl/min.

Ultra-lightweight proppant. An operator seeking a long-term stimulation solution turned to the Pressure Pumping Services of Baker Hughes to fracture the shale zones with LiteProp ultra-lightweight proppant placed in a partial monolayer design, Fig. 7. Ultra-lightweight proppant has much lower specific gravity than conventional proppant, reducing its settling rate in water and providing improved proppant transport and longer effective frac length. This transportability allows the creation of proppant partial monolayers. Partial monolayers designed to 0.3–0.6 lb/sq ft have more space around each proppant particle, resulting in superior fracture conductivity with much less proppant.

|

|

Fig. 7. Ultra-lightweight proppant is poured into a hopper during hydraulic fracing of a Woodford Shale well. Its lower specific gravity, compared with conventional proppant, is associated with longer effective frac length. Courtesy of Baker Hughes.

|

|

For the Woodford Shale well, the fracture stimulation was pumped in six stages with a total of 76,000 bbl of fluid, 1.1 million lb of sand and 33,000 lb of LiteProp 108 proppant. Production in the first six months was the second-highest among five comparable offset wells fractured with 10,000–16,000 bbl of fluid and from 290,000 lb to more than 325,000 lb of proppant per stage. More significantly, after 14 months, cumulative production from the well that was treated using ultra-lightweight proppant exceeded that of every offset well.

NATURAL EXTENSION OF CONVENTIONAL PLAYS

The Woodford Shale play is ideally suited for operators—such as BP, Devon, Newfield, Anadarko and Marathon—who are already active in the Mid-Continent conventional plays. These companies will find it logistically easier to support their Woodford Shale projects than newcomers will, and their E&P staffs are well-versed in the technologies required to handle the complex geology of the region.

|