Perceived ecological risk and the related political battles over access—not a lack of technology and operating know-how—will be the key challenges to accelerating the development of remote, high-cost Arctic oil and gas resources.

John L. Kennedy, 21st Century Energy Advisors Inc.

For several centuries, the Arctic attracted the most ambitious, daring and hardy explorers bent on finding riches and navigable shipping routes. For roughly the last half-century, explorers with the same fortitude and zeal have begun—but only begun—to search the Arctic for oil and gas.

Big discoveries began in Russia in 1962 with Tazovskoye Field and in the US in 1967 with Prudhoe Bay Field. Now, within the Arctic Circle, known and estimated undiscovered conventional petroleum reserves, along with unconventional resources, add up to an enormous energy stockpile.

Geographically, the Arctic continental shelves may be the world’s largest unexplored prospective area for petroleum, according to the US Geological Survey (USGS).

It all sounds very tempting. But the challenges are as daunting as the potential reward is large. And technological capability may be the least of those challenges. “We don’t see technology as an unsolvable puzzle in the Arctic,” said Hege Marie Norheim, Statoil senior vice president for Northern Areas. Rather than a lack of operating tools and skills, it is a mix of thorny political and environmental issues that is likely to be the biggest threat to accelerated Arctic development.

The April drilling accident and resulting ongoing oil spill in the US Gulf of Mexico have underscored the influence these issues will have on offshore exploration and development in every region. In the US, the impact on this year’s single offshore Arctic drilling plan was especially swift and severe: No exploration drilling by Shell in Alaska this summer on leases for which it had shelled out more than $2 billion and had already begun to mobilize equipment.

KNOWN AND UNDISCOVERED

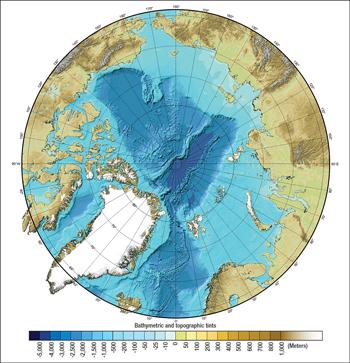

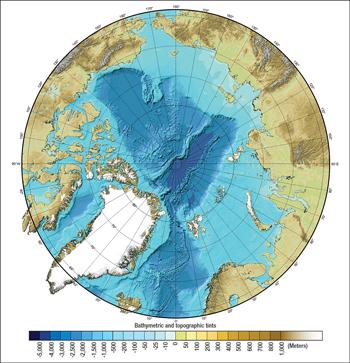

Starting at 66° north latitude, the Arctic Circle covers over 8.2 million sq mi. About 38% is onshore; one-third is under less than 500 m of water, Fig. 1.

|

|

Fig. 1. Bathymetric and topographic chart of the Arctic Ocean (composite based on sparse data). Courtesy of the University of New Hampshire and the US National Oceanic and Atmospheric Administration.

|

|

USGS estimates that the more than 400 oil and gas fields found north of the Arctic Circle contain about 40 billion bbl of oil, 1,100 Tcf of gas and 8.5 billion bbl of natural gas liquids (NGL).

Even though these known oil and gas resources total about 240 billion boe, the Arctic—especially offshore—is “essentially unexplored,” according to USGS.

In its 2008 report “Circum-Arctic resource appraisal: Estimates of undiscovered oil and gas north of the Arctic Circle,” USGS concluded that undiscovered reserves in the region may total 90 billion bbl of oil, almost 1,700 Tcf of natural gas, and 44 billion bbl of NGL, Table 1.

| TABLE 1. Technically recoverable Arctic resources |

|

In assessing 33 prospective geologic Arctic provinces, the study found that:

-

About 84% of this total resource will likely be found offshore

-

One-third of the yet-to-be-found oil—30 billion bbl, more than total US proved reserves—is in Alaska

-

Over a third of the undiscovered gas is in Russia’s West Siberian Basin.

The Arctic has 13% of the world’s undiscovered oil, according to USGS; about 70% is found in five provinces: Arctic Alaska, 30 billion bbl; Amerasian Basin, 9.7 billion bbl; East Greenland Rift Basins, 8.9 billion bbl; East Barents Basins, 7.4 billion bbl; and West Greenland/East Canada, 7.2 billion bbl.

Arctic undiscovered gas is 30% of the world’s total, about 70% of which is found in three provinces: West Siberia, 651 Tcf; East Barents Basins, 318 Tcf; and Arctic Alaska, 221 Tcf.

Two-thirds of the undiscovered Arctic resource is thought to be natural gas and NGL, commodities that are more difficult than oil to transport to market. New gas supply in milder climates closer to markets has, at least temporarily, reduced the urgency to develop high-cost remote Arctic prospects.

But in the longer term, that is likely to change. ExxonMobil’s most recent annual energy outlook report expects global gas demand to be 55% higher in 2030 than in 2005, compared with a total energy demand increase of only 35%.

Statoil’s Norheim echoed that forecast. “We believe the long-term gas market will be very attractive as the world continues to transform into a low carbon environment,” she told World Oil. “Technology will lower costs by making new solutions available, helping to make Arctic development competitive.”

In addition to conventional oil and gas, large volumes of methane hydrates are present. A 1995 USGS study suggested that “permafrost-associated” gas hydrates on Alaska’s North Slope may contain as much as 590 Tcf of gas in place. Known hydrates in the Prudhoe Bay-Kuparuk River area alone may contain 100 Tcf. How much of this gas can be recovered, however, remains to be seen.

There is heavy oil in the Arctic, too. Russian operator TNK-BP’s Russkoye Field in West Siberia contains an estimated 2.25 billion bbl of high-viscosity oil. After a pilot project, startup is set for 2014. Peak output of 7.5 million tonnes would occur in 2022. TNK-BP’s Van-Yoganskoe Field also has 18 accumulations of high-viscosity oil.

A QUESTION: WHO OWNS WHAT?

According to military and defense industry news site GlobalSecurity.org, the floor of the Arctic Ocean features “at least four large submarine elevations that could be considered to be submerged prolongations of the continental margins beyond 200 nautical miles: Chukchi Plateau, Mendeleyev Ridge, Lomonosov Ridge and Alpha Ridge.”

As more is learned about the Arctic’s promise and global energy demand accelerates, it is not surprising that governments have become increasingly interested in extending their maritime boundaries.

Claims for extending a nation’s boundary beyond 200 miles from its shoreline are handled within the framework of Article 76 of the UN Convention on the Law of the Sea (UNCLOS).

United States. Though it has neither signed nor ratified the Law of the Sea Convention, the US is working to define its Arctic continental shelf beyond 200 miles, and working with Canada to define US and Canadian rights. The two countries, as part of the US Extended Continental Shelf Project, conducted joint cruises to the Arctic Ocean in 2008 and 2009 to collect bathymetric and seismic data in support of “delimiting” their continental shelf, Fig. 2. A third joint cruise is scheduled for this summer, according to a US State Department official.

|

|

Fig. 2. The Canadian Coast Guard icebreaker Louis S. St. Laurent (foreground) and the US Coast Guard icebreaker Healy. Courtesy of Natural Resources Canada.

|

|

The 2009 survey emphasized the region north of Alaska onto the Alpha and Mendeleev Ridges and eastward toward the Canada Arctic Archipelago.

Canada. In April, Canada’s Foreign Affairs Minister Lawrence Cannon announced a visit to Resolute Bay and an ice camp on Borden Island to see work being done to prepare the country’s submission to the UN Commission on the Limits of the Continental Shelf. Canada plans to submit its claim in December 2013.

“At some point, there will be another line on the map of Canada showing the outer limits of the extended continental shelf,” Cannon said.

Norway. Also in April, the Norwegian Petroleum Directorate (NPD) announced that the UN commission had submitted its final recommendation for the limits of the Norwegian Continental Shelf (NCS) to the north. The new boundaries increase the area of the northern NCS by 235,000 sq km to a total of some 2 million sq km. According to NPD maps, the extended boundaries include an area in the Western Nansen Basin in the Arctic Ocean; an area in the Loop Hole in the Barents Sea; and an area in the Norwegian Sea covering parts of the Norway Basin and the Lofoten Basin.

Most of the area beyond 200 miles is under more than 2,500 m of water and on oceanic crust. NPD says the presence of oil or gas in these areas is unlikely.

Russia. Russia claims the 1,220-mile-long Lomonosov Ridge as an extension of its territory that should give it ownership of 1.2 million sq mi of the Arctic. Though its effort five years ago to claim this Arctic territory was rejected, a May 2009 article in The Times reported that Russia plans to make another submission to UNCLOS.

In early May, after a late April visit by Russian President Dmitry Medvedev to Norway, it was announced that the two countries had resolved the decades-long disagreement over a disputed area of the Barents Sea. The new delimitation extends the two countries’ land border northward beyond all the islands of the Barents Sea, splitting the disputed area nearly in half along a line that is thought to run through several oil and gas fields identified by Russian seismic surveys in the 1980s.

“We think that is a very attractive area,” Norheim said of the Norwegian side of the demarcation. The agreement is subject to ratification by both countries’ legislatures.

SPILL RESPONSE AND MORE

Operating regulations and environmental policy vary among governments, but throughout the Arctic, the bar is high. Strict rules abound related to air, water, soil, wildlife and ocean life. The accident in the Gulf of Mexico is a grim reminder of the critical importance of oil spill prevention and response.

“Significant resources have been focused on oil spill prevention, but the event in the Gulf has put the emphasis back on response,” Shell’s Alaska spokesman Curtis Smith told World Oil. Shell just completed a four-year joint industry project in which large amounts of oil were spilled in a variety of Arctic conditions to test available cleanup tools and techniques.

“That was a very valuable four years of research for us, and we have incorporated those findings into our oil spill response fleet,” Smith said.

In Alaska, the general National Pollutant Discharge Elimination System (NPDES) permit required for offshore areas restricts the seasons of operation, discharge depths and areas of operation. It also has monitoring requirements and other conditions.

For Shell’s now-suspended 2010 Chukchi/Beaufort Seas drilling program, for example, emissions from the drillship Frontier Discoverer and support vessels would be regulated by an air quality permit issued by the US Environmental Protection Agency (EPA) under the Clean Air Act.

Among other elements, Shell’s environmental protection plan included:

-

Ultra-low-sulfur fuel for all emission sources on the rig and all support vessels

-

Water-based muds composed of chemically inert materials

-

Common table salt in mud to control bacteria without bactericide

-

Only chemicals on the OSPAR Commission’s PLONAR (potential of little or no harm to the environment) list, which comply with Norwegian standards for zero harmful discharge

-

An anti-fouling chemical in cooling water that rapidly breaks down.

In Canada, a call for bids on five areas in the Arctic notes special environmental precautions related to bowhead whales and polar and grizzly bears, all designated as a species of “special concern” under the Species at Risk Act; migratory bird habitat sites; and certain caribou herds.

ACTIVITY AND ISSUES

Field size is important in Arctic development. Prudhoe Bay’s large reserves, for example, made an oil pipeline commercially viable and allowed the development of smaller North Slope fields.

According to an October 2009 report by the US Energy Information Administration titled “Arctic oil and natural gas potential,” about 61 large oil and gas fields have been discovered within the Arctic Circle. Forty-three of these are in Russia. Of the remaining 18, six are in Alaska, 11 are in Canada’s Northwest Territories, and one is in Norway.

The report said 15 of these large fields—11 in Canada’s Northwest Territories, two in Russia and two in Alaska—are not yet productive.

Alaska: ANWR? A gas pipeline? The Arctic can lay claim to the largest oil field in North America, Prudhoe Bay, with an estimated 13 billion bbl of technically recoverable oil. Prudhoe Bay owners BP, ConocoPhillips and ExxonMobil have drilled more than 1,300 wells in the field.

In addition to Prudhoe Bay, BP Exploration Alaska Inc. (BPXA) operates 13 North Slope oil fields, including Northstar, Endicott and Milne Point, and owns an interest in five other producing fields operated by ConocoPhillips. Total production from BPXA’s operated fields is about 500,000 boepd.

Efforts continue to pass legislation to open the coastal plain of Alaska’s Arctic Natural Wildlife Refuge (ANWR) to tap an estimated 10 billion bbl and 4 Tcf.

Prudhoe Bay also contains an estimated 26 Tcf of recoverable natural gas that still awaits a pipeline. In pursuit of that prize, Alaska Gas Pipeline LLC (Denali) filed a plan with the US Federal Energy Regulatory Commission (FERC) on April 7 to solicit commitments for gas treatment services and gas transportation. The plan called for a 90-day open season to begin July 6.

The project, a partnership of BP and ConocoPhillips, would consist of two pipelines on the North Slope, a gas treatment plant and a 48-in. pipeline to ship up to 4 Bcfd of gas to the Alberta Hub in Canada.

FERC has also approved a 90-day open season that began April 30 for a joint effort of TransCanada and ExxonMobil. That project is a 1,700-mile pipeline from the North Slope to TransCanada’s Alberta system, then to North American markets. The open season also will gauge shipper interest in transporting North Slope gas to a potential LNG export terminal at Valdez, Alaska.

Offshore Alaska, Shell US had planned a July–October program that would have been the first drilling on the Alaska Outer Continental Shelf (OCS) since the early 1990s. But in late May, as a response to the GOM accident, US President Barack Obama suspended any consideration of applications to drill in the Arctic until 2011.

US federal lease sale plans had already been revised in early April. The revised 2007–2012 OCS leasing program scheduled no sales in the North Aleutian Basin and Alaska’s Beaufort Sea, and no additional sales in the Chukchi Sea.

The US Minerals Management Service estimates that there could be 27 billion bbl of recoverable oil and 120 Tcf of recoverable gas in Alaska’s Arctic territory. The existence of these prospective basins “is potentially a game-changer,” said Shell’s Smith. “The Alaska offshore could be home to some of the most prolific undeveloped hydrocarbon basins remaining in the US.”

To respond to reenergized opposition to drilling driven by the GOM spill, Shell planned additional precautions, including a cofferdam, use of underwater dispersants, placement of a remotely activated BOP on the seafloor, and more frequent BOP testing. The company also planned to have another rig stand by to begin a relief well if needed.

Before its program was suspended, Shell had planned to drill in the Beaufort Sea until Aug. 25, when the subsistence whale hunts begin. The rig would then have moved to the Chukchi Sea. Water depths are about 150 ft; expected drilling depths are 7,000–8,000 ft in the Chukchi Sea and as deep as 10,200 ft in the Beaufort Sea.

Shell’s permit would have allowed it to drill up to two wells in the Beaufort Sea and up to three wells in the Chukchi Sea, but it could only drill a total of three wells in Alaska during the season.

Beaufort Sea discoveries would most likely be served by pipelines that connect to the Trans-Alaska pipeline, Smith said. In the Chukchi Sea, a 70-mile subsea pipeline, after coming ashore, could cross the National Petroleum Reserve-Alaska and continue to the Trans-Alaska pipeline.

Italy’s Eni owns 176 leases in Alaska, all located onshore and offshore on the North Slope. Nikaitchuq, the first development project operated by Eni in Alaska, has estimated recoverable reserves of 180 million bbl of oil. Total investment will amount to about US$1.45 billion. Eni also has a 30% working interest in the Oooguruk oil field, located 5 miles offshore in the Beaufort Sea, in about 5 ft of water. Oooguruk’s estimated recoverable reserves are 90 million bbl of oil; peak production of 20,000 bpd is expected in 2011.

Norway: Broad Arctic interests. Official estimates put the total resource on the Norwegian shelf in the Barents Sea at about 6 billion boe. South of the Barents, but still in the Arctic Circle, areas off Lofoten, Vesterålen and Senja may contain another 1.3 billion boe, according to NPD.

Statoil has operated in the Arctic since 1981, discovered Snohvit Field in 1982 (Fig. 3), and has drilled 80 exploration wells on the NCS in the Barents Sea. This year, Statoil will drill “a very exciting prospect in the southwest of the Barents,” Norheim said. “We are very interested in having licensing rounds in the Barents.”

|

|

Fig. 3. Norway’s Statoil discovered Snohvit Field in the Arctic in 1982, developed it subsea, and is shipping LNG from the port at Melkøya. Courtesy of Statoil ASA.

|

|

Statoil is a partner with Total and OAO Gazprom in developing Russia’s giant Shtokman gas and condensate field in the Barents Sea. Statoil also recently increased its exposure offshore Alaska, and is preparing for future licensing rounds in Greenland, Norheim said.

Russia: Development projects. Shtokman, discovered in 1988, will become a source of Russian pipeline gas, as well as LNG exports to Atlantic Basin markets, according to Gazprom.

The field is in about 320 m of water in the central part of the Russian sector of the Barents Sea shelf, 600 km northeast of the seaport of Murmansk. Reserves are estimated at 130 Tcf of gas and 53.3 million tonnes of condensate.

According to Gazprom, construction of the Startup Complex for Pipeline Gas Supplies is now a separate stage within Phase 1 of the development plan. A final investment decision on pipeline gas production is set for March 2011; a decision on LNG is expected by the end of 2011. Pipeline deliveries could begin in 2016 and LNG production in 2017.

Russian operator TNK-BP began an active development of licenses in the Yamal Peninsula and the northern Krasnoyarsk territory in Russia’s extreme north in 2009. Its licenses are over 500 km from the nearest pipeline.

In addition to Russkoye, the heavy oil field in the region, TNK-BP’s Suzunskoye Field has estimated reserves of 435 million boe. It has well-understood geology and high-quality light oil, according to TNK-BP. Production is expected to begin in 2012 and reach a peak of 4.5 million tonnes in 2014. Development will cost about US$2.5 billion.

Tagulskoye, also in the northern Krasnoyarsk territory, has a complicated structure with “numerous reservoirs” holding heavy crude. In 2009, the first pilot development project was begun and the first of five planned wells was drilled. The remaining four will be drilled this year.

Tagulskoye’s estimated reserves are 1.169 billion boe. First oil is planned for 2013–2014, with peak output of 4.9 million tonnes in 2017. Development cost is estimated at US$3.1 billion.

Canada: A new bid offering. In Canada’s Arctic Islands, 19 significant discoveries resulted from fewer than 200 exploration wells, according to a 2008 estimate by the Northern Oil and Gas Directorate of Indian and Northern Affairs Canada (INAC). The agency estimated known resources in the Mackenzie Delta/Beaufort Sea at more than 1 billion bbl of oil and 9 Tcf of gas in 53 significant discoveries.

At the end of 2008, Canada’s National Energy Board (NEB) estimated the Arctic portion of the country’s oil reserves at over 4.7 billion bbl. NEB considers the Beaufort Sea and High Arctic “key sources for Canada’s future conventional oil supply.”

Currently, there is no offshore drilling in Canada’s Arctic and no applications are before NEB. But that may change as a result of a bid offering launched March 6 and scheduled to close July 6. As of late May, there had been no change in this schedule, but NEB had begun a review of Arctic safety and environmental requirements in light of the GOM spill.

According to INAC, the four Mackenzie Delta blocks offered total about 291,000 hectares; a fifth block, located between 70° and 71° north latitude in the Beaufort Sea, covers 206,000 hectares.

A proposed Mackenzie Delta pipeline is also progressing. The project is a joint proposal by Shell, ConocoPhillips, ExxonMobil, Imperial Oil Resources Ventures and the Aboriginal Pipeline Group. It would deliver gas and NGL from three Mackenzie Delta fields to Canadian and US markets.

From a processing facility near Inuvik, an NGL pipeline would connect to the existing oil pipeline at Norman Wells. The Mackenzie Valley Pipeline, a 30-in. pipeline with three compressor stations and a heater station, would take up to 1.2 Bcfd of processed gas 1,196 km to a proposed interconnection in Northern Alberta.

NEB held final arguments on the Mackenzie gas project in early April and plans to release its “reasons for decision” on whether to provide authorizations in September.

Greenland: The search begins. USGS estimates that eastern Greenland contains 31 billion boe; northern Greenland, 3.3 billion boe; and the West Greenland/East Canada area, 17 billion boe.

Offshore western Greenland has extensive oil seeps and thick organic shale beds. But only six wildcat wells have been drilled offshore Greenland, five during 1997 and one in 2000. Oil and gas shows resulted, but no commercial discoveries.

That could change this year. In mid-May, Cairn Energy’s plan to drill four wells this summer in its Disko West blocks was “in the final approval process,” Cairn spokesman David Nisbet told World Oil. The four wells are part of a three-year offshore western Greenland program that will target a gross risked resource of 385 million bbl of oil.

The two blocks, Sigguk and Eqqua, are in Arctic waters that pose ice management issues and cover a total of 23,000 sq km. Cairn has identified 30 leads and prospects in the area, where the water depth is about 500 m. The Tertiary is found at depths to 3,300 m, the Cretaceous below 3,300 m.

“We think the area has a lot of potential,” Nisbet said. “We hope these wells will provide some encouragement for further exploration.”

It is the first effort in Greenland that fits into what Nisbet calls Cairn’s “program point of view.” None of the previous wells drilled on Greenland’s shelf were part of a coordinated, extended program.

Cairn’s two-rig strategy for this summer’s drilling will use the Stena Don, a harsh-environment DP Class 3 semisubmersible, and the Stena Forth, an ultra-deepwater dual-mast DP Class 3 drillship. The strategy provides “relief well capability” from the start of drilling, Nisbet said—a capability that has received new attention in the wake of the spill in the Gulf of Mexico. Cairn estimates that the wells will take 30–90 days to drill.

Iceland shelf: Second round set. Though Iceland lies just outside the Arctic Circle, part of its continental shelf to the north is within the circle. Iceland’s National Energy Authority (NEA) expects hydrocarbons to exist in the Dreki area of the Jan Mayen Ridge there, in 1,000–2,000-ft water depths, about 300 km from the northeastern coast.

Only limited 2D seismic has been conducted in the area, and no exploration wells have been drilled. But NEA says there are indications that the Jan Mayen Ridge is a micro-continent similar to eastern Greenland and mid-Norway.

Iceland held its first licensing round last year. But the two applications—one from Aker Exploration and a joint application from Sagex Exploration and Lindir Exploration—were both later withdrawn.

Another round is set to open Aug. 1, 2011, and close Dec. 1, 2011, NEA oceanographer and exploration manager Thorarinn Sveinn Arnarson said.

TECHNOLOGY DIRECTIONS

Alaska’s Prudhoe Bay shows that new tools not available when a field starts up can increase its life and output. According to BP, Prudhoe Bay’s original recovery factor, for example, was expected to be about 40%; now it is estimated at 60%, boosted by later technical advances.

But much technology is already proven in Arctic service.

“We feel very comfortable operating in the Alaska offshore,” Smith said. Shell drilled most of the wells in the Beaufort Sea, four of the five wells drilled in the Chukchi Sea and has experience in Arctic areas of Canada, Russia and Norway.

“Year-round export is an important problem to be solved,” said Alex Bound, offshore and Arctic manager for engineering contractor Ausenco Sandwell. Ships must be outfitted for ice breaking. Pipelines are preferred for gas; some lease provisions even require pipeline shipment, Bound told World Oil. But studies have also explored the viability of LNG transport from the Arctic. The only year-round export facility within the Arctic Circle is OAO Lukoil’s Varandey oil terminal on the Barents Sea, Bound said.

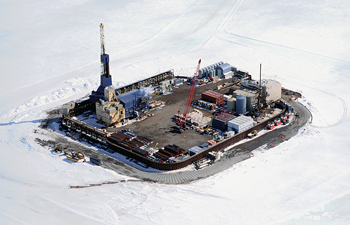

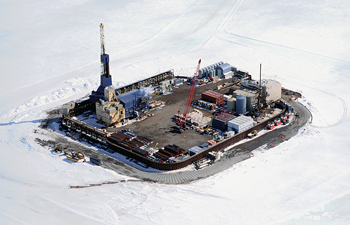

Above the water. Offshore structures in the Arctic are still few and far between, Bound said, but the Alaska Beaufort Sea has several artificial islands in shallow water where fishing and ice scouring occur. BPXA’s newest North Slope field, Northstar, began production in 2001 from a 5-acre island in 39 ft of water (Fig. 4) that has a footprint of only 0.05% of the reservoir’s area, according to the company.

|

|

Fig. 4. BP Exploration Alaska operates Northstar Field from a 5-acre manmade offshore island in the Beaufort Sea in about 39 ft of water. Courtesy of BP.

|

|

Oil is processed on the island and transported by an undersea pipeline to the Trans-Alaska pipeline. Transportation to and from Northstar is by ice road in winter and by helicopter or hovercraft the rest of the year.

The 6-mile pipeline has a wall thickness triple that of typical onshore North Slope pipelines, according to BP, and has three separate leak detection systems.

Endicott Field also consists of two manmade gravel islands connected by a 1.5-mile, manmade gravel causeway. Processing facilities are on the 45-acre main production island; processed oil is sent 24 miles to the Trans-Alaska pipeline.

A recent Ausenco Sandwell project was the design of foundations and supports for various onshore and offshore facilities as part of Eni’s Nikaitchuq Field offshore the North Slope in 3 m of water. The field was developed using an artificial island connected to the shore by an ice road. For the pipeline, a trench was cut in the ice road and the pipe was installed with side boom tractors operating on the ice beside the trench.

Eni’s Oooguruk Field, 5 miles offshore, was also developed using a gravel island outfitted with facilities to accommodate drilling and field operations. About a third of the wells needed for Oooguruk will be drilled from onshore and the rest from the artificial island. Production will go to a 40,000-bpd onshore processing facility, then on to the Trans-Alaska pipeline system.

Subsea processing. In deeper Arctic waters, Statoil’s Snohvit development may signal the direction technology will take. “We are very proud of the subsea development at Snohvit,” Norheim said.

Statoil has said it expects “an increasing transition from topside installations to intelligent, remotely operated and autonomous seabed facilities, coupled to ultra-long subsea tiebacks and wellstream compression devices.”

A number of Statoil’s fields on the shelf are now being developed subsea, pushing subsea technology toward processing, including separation. Separating water and injecting it on the ocean floor reduces the amount of energy needed to bring it to surface and minimizes the risk of icing in the wellstream going to shore. Statoil also plans to be the first company to launch a subsea compression installation, adding it to one of its fields this year or next.

Currently, Snohvit, about 143 km offshore, takes the full wellstream to the onshore facility without any separation or compression.

“Subsea technologies are key technologies in the Arctic,” Norheim said. “Working subsea avoids many of the ice issues. And separation and compression on the seafloor allows a long-distance multiphase pipeline and remote control of the facility.”

Pesky permafrost. In permafrost areas, complex near-surface conditions can lead to seismic survey problems, including source-generated noise, static problems and imaging difficulties. The extent and continuity of permafrost vary with time and location, and flexural waves are sometimes so severe that they make the data unusable. But point-receiver acquisition can provide efficient signal sampling and record at sufficient spatial density to adequately sample noise for subsequent removal, according to Mark Ryder of Schlumberger Ltd.

In 2008, its WesternGeco unit launched the proprietary UniQ integrated land seismic acquisition and processing system, which supports point-receiver channel counts up to 150,000 live channels. In Arctic exploration, where low sensor densities are typically required, this additional capacity can be used to acquire large spreads.

In the Arctic, a key risk for structural interpretation and drilling positioning is long-wavelength travel time distortion introduced by heterogeneous permafrost. Permafrost with variable thickness, interspersed with thawed lenses and partially frozen zones, results in strong lateral velocity variations, disrupts the continuity of seismic events, and introduces false structures, Ryder said. A grid-based tomography method can correct these distortions by allowing the use of reflected events from deeper data to help find the correct update for the shallow section.

Well construction also requires special care in permafrost. Extended reach drilling, with the horizontal sections below permafrost and gas hydrate strata, will be especially useful in the Arctic. But within these zones, in certain applications, care must be taken to select mud systems that are compatible with permafrost and gas hydrate.

For depths of less than 1,000 m, Schlumberger has developed cements that set at low temperature to prevent melting of the permafrost around the wellbore during curing. This is particularly important where gas hydrates are present. Unexpected melting of hydrates will cause a dangerous release of gas outside the casing.

There is opportunity to further develop extended reach drilling and multilateral techniques, a Halliburton spokesman said, but most Arctic drilling complications are surface issues, rather than downhole conditions such as pressure and temperature.

|

THE AUTHORS

|

|

John Kennedy, president of 21st Century Energy Advisors Inc., analyzes oil and gas technology, markets and issues for a variety of clients. He has an engineering degree and has covered global petroleum activity for several decades.

|

|