Despite an uncertain deepwater regulatory regime, shipyards are busy with 109 offshore drilling units under construction or on order.

Justin Smith, Offshore Rig Data Editor

To say that 2010 has been a tumultuous year for the offshore oil and gas industry would be something of an understatement. Following the sinking of Transocean semisubmersible Deepwater Horizon in April and the subsequent oil spill from the Macondo well in the US Gulf of Mexico, considerable scrutiny has been applied to offshore exploration and production activities around the globe.

Although it did not receive nearly as much media attention, the sinking of another rig in May, this time Aban Offshore’s semisubmersible Aban Pearl off the coast of Venezuela, did not help to assuage the fears of politicians and concerned citizens. Governments around the world began to reevaluate their offshore drilling regulations, particularly when it came to deepwater work, but only the United States imposed any sort of drilling ban.

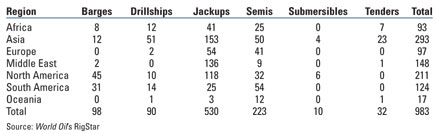

Despite the troubles in the US Gulf of Mexico and the international economic recession, many of the offshore oil and gas markets in the rest of the world are recovering, Table 1. Oil companies are beginning to generate higher profits, leading to greater investments. Recent rig orders that rig contractors have placed with shipyards are a clear indicator that strength and confidence are returning to the industry.

| TABLE 1. Rig count by region |

|

DEEPWATER GULF IN LIMBO

Even though the US Gulf of Mexico deepwater drilling moratorium was lifted in October, permitting has been another issue altogether. Operators and rig owners are in the process of recertifying their blowout preventers (BOPs), but not a single drilling permit has been awarded for deepwater drilling, not even for rigs with approved BOPs. Operators fear that it may still be months before any permits are issued, which many industry representatives argue is, in effect, keeping the drilling ban alive.

At the moment, according to World Oil’s RigStar global offshore rig database, there are nearly 25 deepwater-capable drillships and semis in the US Gulf that are on standby awaiting permits. A few of these rigs have picked up brief workover assignments, which is an activity that was never obstructed by the drilling moratorium, but most are simply waiting on location.

The owners of many of these rigs have come to agreements with operators for reduced standby rates, which will be in place until they can begin drilling again. BP is paying $360,000 per day to keep Pride International drillship Deep Ocean Ascension in the US Gulf, but will return to paying $540,000 when drilling commences. Noble Drilling semi Noble Clyde Boudreaux is earning $145,000 per day now from Noble Energy, but will return to $397,000. Semis Deepwater Nautilus and Ensco 8502 are also earning standby rates from Shell and Nexen, respectively. The contracts for these rigs will be extended by the amount of time that they are idle.

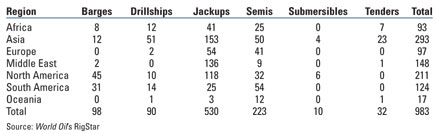

| TABLE 2. Mobile offshore drilling units under construction or on order |

|

|

Other operators have opted to move their contracted rigs out of the US Gulf in an attempt fulfill other drilling requirements elsewhere, while still paying a full day rate. Statoil chose to move Transocean drillship Discoverer Americas to the Mediterranean Sea to temporarily work offshore Egypt, while another Transocean rig, semisubmersible Transocean Marianas, was moved to Nigerian waters by Eni. Murphy Oil moved Diamond Offshore semi Ocean Confidence to the Congo, but will return the rig to the US Gulf in the first quarter of 2011.

Meanwhile, other operators are declaring force majeure with their rig contracts. Anadarko has declared force majeure in relation to semisubmersibles Ocean Monarch and Noble Amos Runner, and Statoil has done the same with semi Maersk Developer (Fig. 1) and Transocean drillship Discoverer Deep Seas.

|

|

Norway’s Statoil declared force majeure on its contract for the Maersk Developer semisubmersible in June, during the US Gulf of Mexico deepwater drilling moratorium. Before resuming its original contract with Statoil, the semi will first drill a well for ExxonMobil, which should be complete in the early spring.

|

|

Rig owners and the operators continue to attempt to settle these force majeure claims. One settlement option is for the operator to cancel the contract and pay a termination fee. The first rig to leave the Gulf of Mexico as a result of the drilling moratorium followed this course; Devon Energy terminated its contract of Diamond semi Ocean Endeavor with a $31 million fee. The rig is now working for Burullus Gas Co. off the coast of Egypt in the Mediterranean Sea.

NEW WAVE OF RIG CONSTRUCTION

Not surprisingly, the combination of a global economic recession, reduced oil and gas prices, and a weakening in the demand for energy led to few new rigs being ordered from shipyards throughout most of 2010. However, early in the fourth quarter, a number of new rigs, specifically jackups, have been ordered.

On Oct. 1, Atwood Oceanics executed construction agreements with PPL Shipyard in Singapore to construct two Pacific Class 400 jackups. These new rigs, which are scheduled for delivery on Sept. 30 and Dec. 31, 2012, will each have a rated water depth of 400 ft. The total cost of each rig is about $190 million. Atwood and PPL have also arranged option agreements for up to three additional Pacific Class 400 jackups.

Mermaid Maritime has entered into a letter of intent with Keppel FELS to build two jackup rigs with options for another two jackups for a new Mermaid-led joint venture named Asia Offshore Drilling (AOD). The letter of intent has a combined value of about $360 million, with each of the first two rigs valued at $180 million. If exercised, the options for the additional two rigs are expected to bring the total contract value to more than $700 million.

The two Mermaid jackups are scheduled for delivery on Dec. 1, 2012, and March 1, 2013. All four of the rigs will be based on Keppel FELS’s KFELS B Class proprietary design, each with the capability of operating in up to 350 ft of water.

Also in Singapore, Seadrill has entered into an agreement for the construction of two jackup rigs with Jurong Shipyard. The new units, which will be built to Friede & Goldman’s JU2000E design, are scheduled for delivery in the fourth quarter of 2012 and first quarter of 2013, with a total price of $400 million. The rigs will be able to drill to 30,000 ft while working in up to 400 ft of water. In addition, Seadrill has options for the construction of up to four more jackups at Jurong.

Not all of the rig orders were placed with Singaporean shipyards. Seadrill placed an order in mid-November for two more F&G JU2000E jackups to be built at Dalian Shipbuilding Industry Offshore Co. (DSIC). These units are scheduled for delivery from the Chinese yard in the fourth quarter of 2012 and the first quarter of 2013, respectively. Seadrill has options with DSIC for the construction of two additional jackups.

In the Middle East, Eurasia Drilling entered into a letter of intent with Lamprell to build a new jackup rig destined for Caspian Sea operations. The new jackup will be built to the Letourneau Super 116 E design, with the hull and related components to be pre-fabricated by Lamprell at its Sharjah, UAE, facility. The remaining component fabrication, final assembly and commissioning will be performed at a shipyard in the Caspian Sea. The rig will be designed to operate in water depths to 350 ft and drill to a total depth of 30,000 ft. Construction is expected to be complete at the end of 2012.

South Korean shipbuilder Samsung Heavy Industries on Nov. 11 received an order for two dynamically positioned, dual-derrick drillships from Seadrill. Capable of operating in up to 12,000 ft of water, the rigs are scheduled for delivery in the first and second quarters of 2013. In addition, the Norwegian contractor can order two more drillships from Samsung through an option that can be exercised in the first quarter of 2011.

At the moment, 109 mobile offshore drilling units are under construction or on order around the world, according to World Oil’s RigStar, Table 2. Of those 109 rigs, 45 are jackups, 34 are drillships, 27 are semisubmersibles and the final three are tenders.

Seventeen rigs that were originally scheduled for delivery in 2010 have yet to be delivered, and the vast majority of those will be pushed back to 2011 or beyond. Currently, 54 rigs are scheduled for delivery in 2011, with 31 more planned for 2012. Only seven rigs are scheduled for delivery in 2013, but that number is certain to climb as rig deliveries slip back and new rig orders are placed.

Recent rig deliveries include two jackups, COSL 921 and COSL 922, which were delivered to China Oilfield Services Ltd. from the Huangdao Shipyard of Offshore Oil Engineering Co. Ltd. in Qingdao, China, on Oct. 31. The rigs are cantilever jackups built to the Friede and Goldman L-780 Mod II design. They are designed to operate in water depths up to 200 ft with a maximum drilling depth capability of 20,000 ft. Both rigs are now working in China’s Bohai Bay.

Meanwhile, Keppel FELS delivered the first of three KFELS N-Class jackup rigs being built for Rowan Companies. The rig, Rowan Viking, can operate in up to 430 ft of water and drill to a total depth of 35,000 ft. Construction of the remaining two KFELS N-Class rigs, the Rowan Stavanger and the Rowan Norway, are on schedule with expected deliveries in the first and second quarters of 2011, respectively.

Not only jackups were delivered in the fourth quarter of 2010. In addition to the two jackups COSL received, the company also took delivery of DP-3 semisubmersible COSL Pioneer on Oct. 26 from Yantai Raffles. The rig is capable of drilling to a total depth of 25,000 ft while operating in up to 2,500 ft of water. Another semi, Lone Star, was delivered Oct. 13 to Queiroz Galvão Perfuraçoes from International Metal & Construction Company Inc. (IMAC) in Abu Dhabi. While COSL Pioneer does not yet have a contract, Lone Star, which can drill to a total depth of 25,000 ft in up to 7,800 ft of water, is working off Brazil for Petrobras.

|