NOVA SCOTIA CANADA: THE NEXT PLAY

Positioned to supply North America’s hungriest energy market

The Energy Information Agency (EIA) forecasts that natural gas consumption in New England will grow by roughly 25% over the next decade. The Eastern Canadian market for natural gas is forecast to more than double over the next 15 years.

Safe, reliable, established. Nova Scotia offers a mix of oil and gas prospects in tune with the needs of the US, and a location ideally suited to meet them.

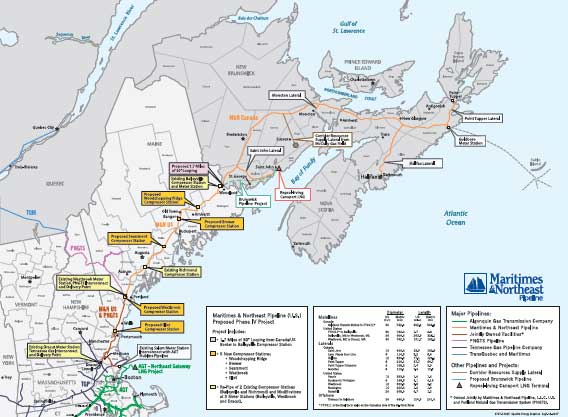

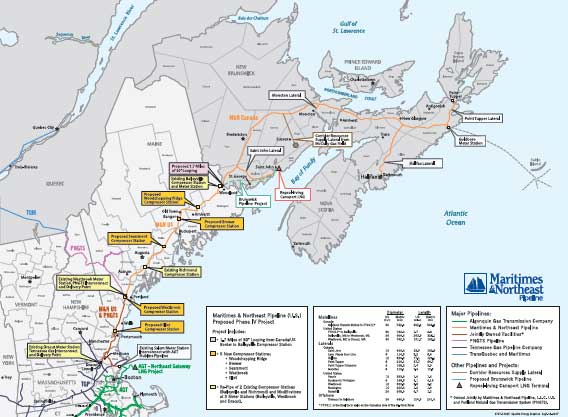

Canada is the US’s number one trading partner and trusted supplier of energy. This successful relationship dates back more than a century and tops more than $1.2 billion in goods and services each day. Nova Scotia has always been committed to providing a reliable and competitive supply of goods and commodities to the US. The largest natural gas pipeline in Atlantic Canada, the Maritimes and Northeast Pipeline (M&NP), moves more than 400 MMcfd from the Sable Offshore Energy Project (SOEP) to markets all along the pipeline, finally ending at Dracut, Massachusetts, north of Boston.

Maritimes and Northeast Pipeline spokesman Stephen Rankin says a $320 million expansion, which is scheduled to come on stream in 2008, will see pipeline capacity double to about 800 MMcfd on the US side of the line. “There is a great deal of expandability on the pipeline,” says Rankin. “About 80% of our deliveries are to the New England market.” Supply for the $1 billion pipeline, owned by Maritimes Northeast-Spectra Energy Transmission, will be supplemented by a new, New Brunswick LNG plant and an onshore gas supply in New Brunswick, Nova Scotia’s neighbouring province.

|

The route of Maritimes & Northeast Pipeline, from Sable Island to Boston.

|

|

The M&NP system opened in 1999 and consists of a 30-in./24-in. mainline that runs from the SOEP gas plant at landfall in Goldboro, to Point Tupper, through Nova Scotia, New Brunswick, Maine, New Hampshire, and Massachusetts. The mainline interconnects with Portland Natural Gas Transmission System, Tennessee Gas Transmission, and Algonquin Gas Transmission. Through lateral pipelines, M&NP serves Canadian markets in Nova Scotia and New Brunswick. Laterals included Point Tupper, 60 km; Halifax, 124 km; Moncton, New Brunswick, 12 km; and St. John, New Brunswick, 111 km. The project partners of Maritimes & Northeast Pipeline are Spectra Energy, Nova Scotia’s Emera Inc. and ExxonMobil.

As each year passes, the need for Canada to supply a regular and safe supply of energy increases. Current market size in New England is an estimated 0.8 Tcf/yr. Markets adjacent to New England in the states of New York and New Jersey are 1.1 Tcf/yr and 0.6 Tcf/yr, respectively. Atlantic Canada’s demand (Nova Scotia, New Brunswick, Prince Edward Island and Newfoundland) is an estimated 1.2 Bcf/yr. Nova Scotia’s position in the North American energy market now supplies up to 20% of New England’s gas demand.

Sources, including Natural Resources Canada and the EIA, forecast net exports of natural gas from Canada into the US to drop by around 50% (from 3.5 Tcf/yr to 1.5 Tcf/yr) over the next 15 years. This shortfall could be met by additional gas exports to the US. Nova Scotia could play a key role in supplying this market.

|