North American Outlook

North American drilling: Is the sky the limit?

United States by World Oil staff; Canada by Robert Curran, Calgary, Canada; Mexico by Sergio M. Galina Hidalgo, Mexico City

UNITED STATES

Well, it’s becoming obvious that the promise, "If we just get one more boom, we won’t $*#@ it up this time," just cannot be kept. Some combination of greed, ingenuity and market forces – and especially $75 oil – compels folks to scrape together whatever rigs they can, borrow money to build new ones, and drill, drill, drill. One thing is clear: The double-digit increases that we now see cannot be sustained. The best we can hope for is a soft creaming of the growth curve, back to single-digit growth, something that we can live with indefinitely. Overall though, the first half of this year shows the boom on a straight line to the sky. As we digested the numbers, state-by-state, district-by-district, there were some "disconnects" found, between what was, and what should be.

Operator surveys. This update of World Oil’s February survey includes 18 major US drillers (integrated companies and independents with large drilling programs) and 158 independents. The optimism expressed then continues, and has expanded the total number of wells planned for 2006.

|

What 158 US independents1 plan for 2006 – Midyear update

Click image for enlarged view |

|

|

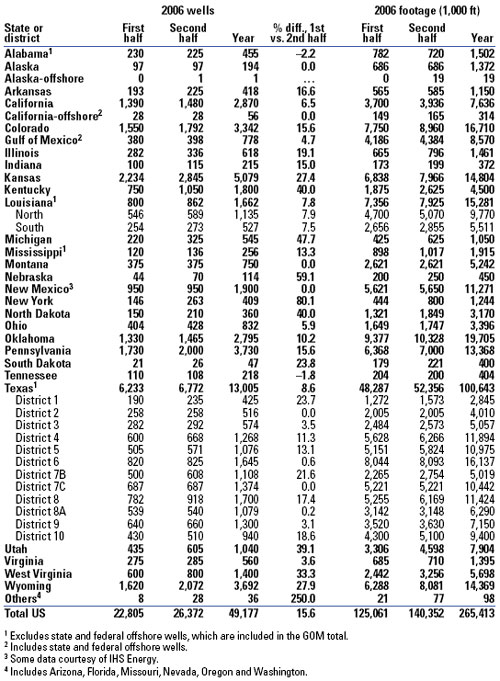

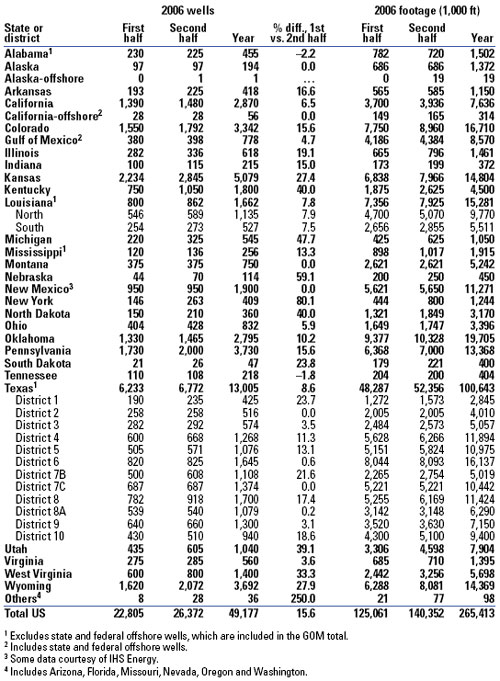

Overall, US drilling will jump to over 49,000 wells, up more than 3,500 wells from our February forecast. Major upward revisions occurred in Kansas (2,189 wells), Kentucky (240 wells), Oklahoma (495 wells), Texas (1,073 wells), and Utah (215 wells). It’s worth mentioning that surveys supporting this forecast are not collected scientifically, and it is not possible to sample all of the more than 1,000 independent drillers. However, the responses gathered represent a large majority of the major drillers’ plans and should reflect their 2006 activity.

| Midyear revision, 2006 US drilling forecast |

|

|

Rigs often show large differences among the rig-counting services (such as Baker Hughes, Smith International and RigData), which is something that we are used to seeing, given the different methodologies. Sometimes, even when all rig counts go in the same general direction and magnitude, the well count data show the opposite trend. This is usually due to small, below-the-radar rigs, especially with coalbed methane (CBM), or, when an area is experiencing a rapid change in drilling activity, the reporting agency is swamped and lags in its ability to gather the well data. This was particularly evident in Kansas, where only the local rig-counting service sees all of the shallow-well drilling rigs.

Perhaps the greatest disconnect this time was the anecdotal stories that we’ve all heard – and some individual experiences – that said we were running out of rigs and crews in North America. In some cases, newbuilds would be slow to be built, supposedly due to the difficulty in getting some rig component, such as an engine; in others, it was the lack of crews. These moderating factors helped justify our February forecast of 10.7% for this year. While we did see spotty evidence of rig-constrained conditions in some areas, overall, the industry has been doing a good job of showing just how resourceful people can be when there’s $75 oil.

As of July 21, the Baker Hughes and Smith International working rig counts have increased about 15%, adding roughly 200 rigs to around 1,665 units. As discussed in the Land Rig article (page 43), there are plans to add 500 rigs to the domestic onshore market within the next 18 months. Offshore, there are nearly 100 newbuilds planned or under construction (see page 47). Together, this means that, despite anecdotal stories and individual experiences to the contrary, there should be enough rigs for the boom to continue.

|

What 18 US major drillers1 plan for 2006 – Midyear update

Click image for enlarged view |

|

|

Expenditures were also revised upward from earlier forecasts by equity research firms. Lehman Brothers revised its 2006 spending forecast, initially made in December 2005 and predicting a 15% increase. Their revised forecast, made in June 2006, now calls for 28% spending growth. Bear in mind, much of this money goes into higher day rates and other costs, not just into well construction.

In North America, only Eni in its US spending and Mexico’s Pemex showed a slight drop. In Canada, the initial forecast was only bumped 1.3%, to 14.6% for the year. In the US, all of the majors were revised upward, often substantially, such as BP (13%), Chevron (19%), ConnocoPhillips (26%) and Shell (29%).

Prices are, of course, the driving force behind the boom. If we could reliably predict them, forecasting wells would be easy. All that we can say with certainty is that we cannot predict them, and that the disconnect between prices and underlying fundamentals is sometimes glaring.

For example, there’s a well-known price ratio of 6/1 for oil-to-gas on a Btu basis (MMBtu/bbl). Over the last 10 years, on a price basis, this ratio has been near 7.9. However, today’s oil price is about 11X that of gas, which should mean that either oil will come down, or gas will go up. However, gas storage is now 35% above the five-year average. Hurricanes or something else must disrupt supply, or demand must appreciably increase with a cold winter, to work off these very high storage levels. So, since it’s unlikely that gas prices will go up, all that’s left is for oil prices to go down, to get the ratio a little closer to historic norms.

Even at 8X, oil would need to be in the $40s to get to historic norms. But rhetorically, we’ve never seen a case (an equivalent) where extremely low gas storage levels were not cited as a cause for higher gas prices; so, why would the reverse not also be true (i.e., high storage levels imply lower prices)? There are, of course, at least 20 other factors that are beyond this discussion, and many of them are discussed in the first-page Editorial Comment. Also, it’s worth mentioning that markets can, and do, fool the best investors: Just when you put your money down, the historic norms cease to operate, and you lose it all.

Nevertheless, we are nervous about oil prices and, like many other folks, geopolitical excuses are all that we can cite for the present high-price premium.

Area highlights. Compared to 2005 totals, double-digit percentage drilling increases are anticipated by 15 states, a four-state increase from our February forecast. The largest total will be in Texas, with over 13,000 wells planned for the year. In 2005, independent oil companies were responsible for drilling 96% of Texas’ wells, according to Alex Mills, president of the Texas Alliance of Energy Producers. Independents also operated most of the state’s producing wells, including 90% of the oil and 86% of the natural gas wells. This pattern continues into 2006.

"Recently, we have seen some majors enter the natural gas play in the Barnett Shale in the Fort Worth basin," Mills said. "Shell and ExxonMobil have jumped into the activity in the 20-county area around Fort Worth."

Certain regions had good reasons for the activity they saw. Wyoming was the only state experiencing a downturn, year-to-year, albeit all in coalbed methane, and not too severely. We were overly optimistic there in our February forecast by 500 wells. There is a host of reasons for this.

First, there’s an ongoing "discussion" with neighboring Montana over CBM de-watering discharges into the Powder River and other streams. The BLM has been remarkably slow in issuing permits to drill, but it has recently added staff to alleviate this.

Half of all permits issued are not drilled. Sometimes, it’s because operators run out of time (one year, with a one-year extension), while others are waiting on infrastructure. Pipes, pumps, electricity and other infrastructure are not keeping up with demand. One official said that suppliers do not want to get caught again like they did in 2002, with too high expectations. Some 6,000 wells are shut-in, and about half are new wells waiting on production infrastructure. And a new, deeper play, the Big George, is taking longer to drill and complete.

Finally, some Wyoming landowners were surprised when a rig showed up to drill. It turns out that some landowners did not own the subsurface mineral rights to their land under an old settler’s law. Recent legislation has changed this practice.

Kansas is soaring in its year-to-year drilling. Our January prediction was almost 2,200 wells short of the more than 5,000 wells we now forecast for this year. Permits there are only good for six months, and with the average well depth only about 3,000 ft, small rigs, often drilling with air, have been streaming in during the first half of the year. Also, two new CBM plays – the Forest City basin in the northeast, and the southeastern Cherokee basin – will see some 1,800 CBM wells drilled this year, compared to 700 for 2005.

We were overly optimistic in February for New Mexico by 500 wells, but better data showed that the state is steadily, but modestly up in 2006, but only by about 4%. Drilling in the Bakken formation in Williston basin is showing up in the well numbers, especially in North Dakota, where 2006 could wind up being 63% higher than 2005. We had forecast 270 at the beginning of the year, but we had to revised that upward, to 360.

Last, the activity in Texas District 7B – the Barnett Shale, seems to know no limits. That’s a prediction we got right in January, but recent activity and forward indicators surprised even us. The Barnett trend is near the juncture of three districts: 5, 7B and 9. All show significant drilling increases over our earlier forecast. Combined, the three districts expect to drill 3,484 wells, a 15% increase over our earlier estimate. Across Texas, the state will see an 8.9% increase in drilling from February’s forecast.

As of the end of June, Texas’ RRC counted 251,782 active wells statewide, with 142,437 oil producers and 72,799 gas producers.

About these statistics. Production of World Oil’s tables is aided by data from a variety of sources, including the American Petroleum Institute, ODS-Petrodata Group, the Texas Railroad Commission and most other state regulatory agencies. In addition, 176 operating companies with drilling programs responded to this year’s survey. Our survey is not scientifically randomized, and new environmental and political challenges may emerge at any time. Please note credits and explanations in table footnotes.

World Oil’s editors try to be as objective as possible in this estimating process to present what they believe are the most current data available. It is realized that sound forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting is a dynamic process, and most historical data will be continually updated over a period of several years before the "books are closed" on any given year.

CANADA

The new millennium has been good to Canadian oil and gas producers. For almost four years, they have enjoyed an unprecedented surge in energy demand and high commodity prices. Although high activity creates other issues, operators, nonetheless, are on track for another remarkable year.

Overview. Record oil prices through the first half have shone a spotlight on a fundamental shift that’s occurring in the Canadian market, as oil sands development begins to dominate Alberta’s economics and politics. On the gas side, unexpectedly low prices have slowed short-term activity, but North America’s growing demand should provide the incentive to go after higher-risk, higher-cost gas in the long term.

Despite the recent gas price downturn, drilling has continued briskly, as evidenced by producers’ ability to add to reserve totals for both oil and gas. Given the declining production of conventional oil and gas in Western Canada, achieving positive reserve revisions is a good sign, at least for now.

Concurrently, the product blend continues to shift toward heavier crudes, and will continue to do so, with even more oil sands projects planned for the next 10 years. Estimates peg expenditures above C$100 billion (C$1.14 = US$1) to recover the gooey black gold. A shift has also started in gas production, as producers look for ways to offset declining conventional supplies. One that is garnering more interest in Canada, and in Alberta in particular, is coalbed methane (CBM).

Although only about 7,000 CBM wells have been drilled so far in Alberta (out of 206,000 unabandoned wells in the province), interest in CBM is growing. Given that the latest report from the Canadian Gas Potential Committee indicates that there is somewhere between 11 Tcf and 45 Tcf of CBM (compared to an estimate of zero in 2001), the growing interest in CBM is understandable.

Higher activity has caused some difficulties, the most notable being the problems that companies have had in attracting and retaining enough skilled labor to meet skyrocketing needs of not just their industry directly, but ancillary industries as well, such as housing and construction. In fact, the Petroleum Services Association of Canada (PSAC) has identified the labor shortage as its members’ number-one concern, with some companies recruiting workers from Asia and Europe.

Pipeline matters. Another issue of concern is long-term oil pipeline capacity, particularly from Alberta’s oil sands. The National Energy Board recently raised the possibility that pipeline capacity could be constrained as early as 2008. Pipeline firms have been busy proposing and applying for new lines to meet the demand. TransCanada PipeLines Ltd. (TCPL) is seeking regulatory approval for its 435,000-bpd Keystone proposal, to ship crude from Hardisty, Alberta, to Wood River, Illinois. TCPL competitor, Enbridge Inc., has suggested building a C$3.6-billion, 400,000-bpd pipeline that would ship crude directly from Hardisty to Houston, with a possible in-service date of 2011. However, a rival proposal from Altex Energy Ltd., a private Canadian firm, is for a similar 250,000-bpd line that would ship crude directly to the Gulf Coast. Altex is targeting a 2010 in-service date.

Enbridge also plans to construct a US$920-million, 180,000-bpd line to transport diluent from Chicago to Edmonton, Alberta. Demand for diluent has increased substantially, due to growing production of heavy oil and bitumen in Western Canada. The line should be in service by 2009.

Policy issues. Politically, Canada’s commitment to the Kyoto Accord is in question after the new, federal Conservative government stated that Canada will not meet Kyoto’s CO2-reduction targets and that Canada’s role as a major energy producer should be taken into consideration. In the past, critics have suggested that implementing Kyoto could cost industry C$40 billion, if a carbon tax or similar mechanism comes into effect. This is unlikely under Prime Minister Stephen Harper’s administration. In fact, reaction to the Harper government’s first budget has been largely positive among businesses. Highlights include cutting corporate tax from 21% to 19% and eliminating corporate surtaxes.

M&A activity. So, with less political uncertainty, an industry-wide bottom line solidly in the black, and no sign that prices will soften in the long term, many companies are looking to grow through mergers and acquisitions.

In July 2006, Shell Canada and BlackRock Ventures jointly announced that BlackRock shareholders had tendered over 99% of the company’s common shares to Shell’s friendly C$2.4-billion all-cash offer. Meanwhile, Anadarko Petroleum said it would dispose of western and northern Canadian assets to help fund its US$21.1-billion acquisition of Kerr-McGee Corp. and Western Gas Resources Inc. These assets could fetch just under C$4 billion.

Two other major mergers were also completed recently. Penn West Energy Trust and Petrofund Energy Trust have merged to create North America’s largest energy trust, valued at about C$11 billion. In the service sector, the merger between Savanna Energy Services and Western Lakota Energy Services makes the new entity the third-largest drilling contractor in Canada, with a combined value of about C$1.5 billion. Trusts were active in the first half, as Shiningbank Energy Income Fund acquired Find Energy Ltd. in a deal worth over C$440 million. Internationally, Talisman Energy Inc.’s UK subsidiary, Paladin Resources, has sold Talisman Expro Limited to Endeavour Energy UK Limited for US$414 million.

Frontier projects. Higher revenues have renewed interest in developing frontier projects, where costs are extremely high, and operating conditions can be very challenging. In Canada’s Beaufort Sea, the prospect of recovering vast reserves of McKenzie Delta gas has tantalized producers for decades, with limited results. But now, with negotiations ongoing to construct the McKenzie Valley Gas project, which would ship gas south to Alberta, then on to North American markets, interest has been rekindled. A recent land sale for Beaufort Sea licenses resulted in work commitment bids in excess of C$50 million. Encana has applied for significant discovery licenses for two wells drilled in the area with partners Anadarko and ConocoPhillips.

In the Northwest Territories, Husky Energy Inc. and its partners have been touting two recent gas discoveries in the central McKenzie Valley. They have announced plans to acquire more seismic in the area to better evaluate other prospects. The risk of pursuing these opportunities is illustrated by Devon Canada’s recent announcement that its C$60-million exploratory well in the Beaufort Sea did not result in the substantial gas find that the company had expected.

Land sales. Interest in oil sands has sparked a big surge in Alberta land sales, resulting in a record six-month high. Across Canada, operators spent almost C$2.7 billion through June, more than doubling the previous $1.1-billion record, set in 2005. Alberta’s land sales brought in almost $2.2 billion, including $1.1 billion for oil sands, up 184% over 2005. British Columbia took in $404 million (up 60%), Saskatchewan raised $102 million (up 48%), and the Northwest Territories received $122 million (up 110%).

Drilling activity. High land sale bonuses generally indicate an upcoming surge in drilling. However, low gas prices are creating some uncertainty as the summer wears on. Through the first half of 2006, operators drilled 10,556 wells, compared to 10,132 in 2005, according to Daily Oil Bulletin records. However, the increase is largely due to a frenetic winter drilling season, and recent numbers indicate that levels are not likely to surpass 2005 totals. Producers have also begun to target more oil, which also reflects the gas pricing downturn. Nonetheless, gas drilling still represented over 70% of wells drilled. Most likely, between 24,000 and 25,000 wells will be drilled.

World Oil’s survey of Canadian drillers confirms that their focus remains steady, with 73% of all wells drilled targeting gas (see first table). Last year, producers targeted gas in about 80% of wells. It now appears that second-half drilling will be flat, with 70% targeted on gas. Total second-half drilling may be up by just a handful of wells, with the largest decrease in British Columbia (down 60%). Activity in Alberta will be down 4% in the second half, while drilling in Saskatchewan is expected to surge by 116%. Much of Manitoba’s drilling will be in the second half.

|

What 30 Canadian drillers plan for 2006 – Midyear update1

Click image for enlarged view |

|

|

Rig activity saw an average 519 units working through first-half 2006, out of 798 rigs available through June, according to Canadian Association of Oilwell Drilling Contractors. CAODC has adjusted its 2006 forecast downward by 8.6% to 23,827 wells drilled, versus the 26,070 it predicted last fall. Again, lower gas prices are the main reason. Meanwhile, PSAC predicts 26,725 wells will be drilled in 2006. Results from World Oil’s survey of provincial regulators in all provinces indicates closer to 25,000 wells (see second table).

| Canadian drilling, 2006 provincial forecasts – midyear update1 |

|

|

Production. Updated figures for conventional output of crude oil and condensate show an average last year of 1.523 million bpd, including 160,000 bcpd. This production level was achieved by 59,078 active producing wells. Of that number, 55,942 wells, equal to 94.7%, were on artificial lift. This compares to 1.567 million bpd of conventional production in 2004, including 162,000 bcpd.

|

Workovers of Canadian wells in June 2006 were up 50% from a year earlier. Photo by Kurt Abraham, Managing/ International Editor.

|

|

East Coast. On Canada’s East Coast, 2006 has been a busy year. Newfoundland’s oil production now represents about one-third of Canada’s total light oil output, according to the provincial petroleum board. Of this, Hibernia field contributes the lion’s share, averaging just under 200,000 bopd, with Terra Nova field contributing almost 100,000 bopd. However, a mechanical failure shut down Terra Nova production in May. Field operator Petro-Canada now believes that it will not resume production until the fall of 2006.

At White Rose, production averaged just over 49,000 bopd during the last two months of 2005, but it recently topped 110,000 bopd. The project is only authorized to produce 100,000 bopd, but operator Husky Energy plans to apply for an increase. By the end of the year, productive capacity could be 125,000 bopd. The company also said that bringing the field’s gas production onstream, from estimated reserves of 2.3 Tcf, will take at least 10 years.

Meanwhile, amid news that Hibernia’s productive life could increase by up to eight years, the field is center stage in a dispute between the provincial government and project partners. Officials contend that the amendment to the original application is a new discovery, but project partners maintain that the expanded reserves are covered under the original development plan and royalty agreement. The original deal contains a more favorable royalty regime than the current system that applies to any new project. Hibernia is operated by Exxon Mobil. Partners include Petro-Canada, Chevron Canada Resources, the government of Canada, Murphy Oil and Norsk Hydro.

Provincial officials were also embroiled in another dispute earlier this year, over a lack of progress in developing the Hebron/ Ben Nevis offshore heavy oil project. The province and project partners Chevron, Exxon Mobil, Petro-Canada and Norsk Hydro were unable to resolve a provincial demand for an equity stake, plus investment breaks sought by the partners. The field was discovered in 1981 and holds an estimated 600 million bbl of oil.

On the West Coast, British Columbia once again seeks to have the moratorium on offshore drilling lifted by the new federal government. Officials have said that lifting the moratorium would most likely allow seismic activity during an information gathering phase before any drilling occurs.

Oil sands development. In Alberta, oil sands development continues to dominate the provincial agenda, as three massive proposals from Suncor Energy, Albian Sands Energy and Imperial Oil have been set down for hearings before regulators. Underscoring challenges faced by producers, Suncor’s July hearing, which considered plans to build the Voyageur upgrader and North Steepbank mine, drew interest from the local municipality and health authorities. They contend that the project should be delayed until local infrastructure – roads, schools, medical facilities, etc. – is in place to accommodate the influx of workers required for the project. A decision on Suncor’s application is expected in the fall.

Issues associated with Canada’s labor crunch and high activity are also affecting the cost structure of oil sands development. Recently, both the Athabasca Oil Sands Project and the Long Lake Project announced that spiraling costs had increased their original budgets. For Athabasca, operated by Shell Canada, costs may have increased by as much as 50%. This would bump the phase-one costs to C$11 billion from $7 billion, and total project costs to C$20 billion from $13.5 billion.

Long Lake’s cost problems are less severe, but project partners OPTI Canada and Nexen now estimate the project may end up at C$4.2 billion, 10% higher than the original budget. To combat higher costs, operators look for more creative ways to structure their projects. The most effective measure is to reduce dependence on natural gas as a feedstock. At Long Lake, Alberta’s first gasification unit has been incorporated into the upgrader design. Suncor is following suit, with plans to build a coke gasifier for its third upgrader. Synenco has also incorporated a gasifier into its Northern Lights plans.

Husky Energy contemplates another option: building its own drilling and completion rigs for the proposed Sunrise in-situ operation. Sunrise got the green light from regulators in late 2005, and should begin production at some time between 2010 and 2012, with peak output of 200,000 bpd.

Mr. Curran is a Calgary-based freelance writer.

MEXICO

The recent presidential election on July 2 was the climactic end to a very tight race that essentially came down to voters choosing between two economic roads for the country to follow. On the one hand, the right-wing candidate, Felipe Calderon, supported the continuity of his fellow party member, President Vicente Fox’s neo-liberal model of integration with the American and world economies. This was seen as the means to achieve economic stability and growth. The other alternative was presented by left-leaning Andrés Manuel López-Obrador, who argued that government policies should focus on the country’s immediate needs for housing, food, health and education of two-thirds of the Mexican population, who live in poverty.

Political situation. The aftermath of the election is yet to be officially confirmed until September 7 by an electoral court, because López-Obrador lost by a 0.58% margin. He is challenging the outcome with a string of allegations over the vote count, a possible campaign overspend and alleged pro-Calderón bias among electoral authorities. The evidence and facts that support López-Obrador’s electoral fraud case are yet to be analyzed and pondered by seven magistrates, who, hopefully, will reach a convincing verdict for most of the citizens. If they do this, it will legitimize the election before the eyes of a nation that is so habituated to the vote-rigging of the former ruling party, PRI. That party ruled the country for seven decades until 2000.

Current odds indicate that Felipe Calderón will take over the country for the next six years and, as a candidate, he has promised to strengthen the fiscal and managerial autonomy of national oil company, Pemex; increase the investment to build up proven oil and gas reserves; and to seek more involvement of private capital in joint ventures for E&P in deep water.

Nevertheless, the implementation of these proposals may need the approval of Congress. Therefore, a major problem that the new government will face is the political reality of the country after the election. It has left the country divided between right and left, North and South or in "dos Méxicos," as some analysts have pointed out. In such a polarized country, the art of political compromise will be in high demand. Yet, as recent history has shown (unfortunately), political agreements in Mexico are rare merchandise.

Exploration/ drilling. Between 2001 and 2005, Pemex spent close to $60 billion in investments to support the company’s operations. This figure is impressive, considering that only half that amount was invested in the previous five years. Just in 2005, Pemex Exploration and Production’s (PEP’s) investment budget was more than $13.5 billion, setting a record high for the third straight year.

As a result of these relatively high investments, the company has steadily increased its most important operational indicators. For example, the 742 wells drilled in 2005 represent three times the 247 wells drilled in 2000. Furthermore, quantity has not replaced quality, because the drilling success ratios of 53% for exploration and 93% for development are, in both cases, only one percent lower than the last 10 years’ average.

A couple of interesting notes show the country’s focus on natural gas development. For instance, last year, only one-quarter of successful wells were oil producers. Furthermore, the non-associated natural gas-rich Northern Region, constituted mainly by the Gulf of Mexico coastal plain from the north-central portion of Veracuz to Tamaulipas and Coahuila states, south of the border with the US, took the lion’s share of drilling activities with 80% of the total wells drilled.

Another remarkable achievement is that Pemex was able to discover as many as 123 new fields in the last five years, compared to the 18 fields discovered in the 1996-2000 period.

Development/ production. Pemex has also been successful in developing its production potential, as shown by the fact that while there has been a boost in its reserves recovery rate from 14% in 2001 to 59% in 2005, there has also been an increase in both its oil and gas production by nearly 7% in the same period. Thus, last year, proven reserves were 11.81 billion bbl of crude oil and 19.96 Tcf of natural gas, while the country produced 3.33 million bopd, 426,000 bcpd and 4.82 Bcfgd.

As in recent years, the five main investment projects that concentrated nearly 80% of PEP’s budget in 2005 are as follows:

- The Cantarell heavy oil complex and the Ku-Maloob-Zaap basin in the Bay of Campeche received $2.3 billion and 1.6 billion in investment, respectively.

- The Antonio J. Bermudez light oil project, in southeasten Tabasco state, gained $680 million in investments.

- The Northern Burgos gas basin spent more than $1.1 billion.

- Investments directed to the set of 18 E&P gas projects known as the Strategic Gas Program totaled over $2 billion.

|

Although Mexico’s Pemex is investing more in natural gas development, the Cantarell offshore oil complex still benefits from a large share of the budget. Photo courtesy of Pemex.

|

|

If Pemex achieves its goals for 2006, the company will have drilled close to 800 new wells (790, up 6.4%) and, compared to 2005 (3.76 million bopd), it will have increased its oil production by 2%, including a favorable jump of 11% in light oil output. As for natural gas, the company also expects to increase that production by more than 10% over last year’s amount (4.82 Bcfgd), mainly supported by a 23% increase in non-associated gas output. In spite of the good operational performance shown by the company in recent years, its future financing ability could be jeopardized by the servicing of its too rapidly acquired debt. This debt has grown from $15 billion in 1995 to $99 billion in 2005.

|