Offshore Report

Harvesting the US Gulf of Mexico

Good to the last drop of BOE?

Ted Dodson and James Dodson, James K. Dodson Co.; Victor Schmidt, Drilling Engineering Editor

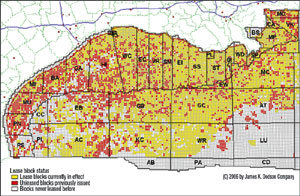

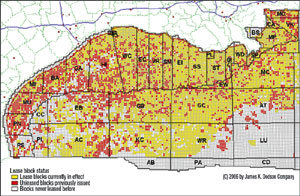

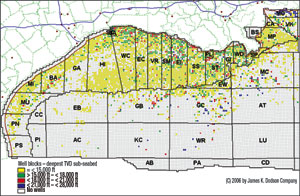

The Gulf of Mexico (GOM) is a very mature oil theater with the bulk of the acreage presently leased, Fig 1. Both the Western and Central Areas have seen leasing for decades, and many leases have been recycled repeatedly. Only a few, shown in white, have never been leased. The bulk of these lease blocks lie off the Texas coast and in the very deep waters of Walker Ridge (WR), Atwater Canyon (AT) and Lund (LU) areas. Surprisingly, there are a significant number of blocks (red) that have been previously leased at least once, but are not presently under lease.

|

Fig. 1. This GOM map shows the Western and Central Region blocks leased (yellow), blocks previously issued but unleased (red), and blocks never leased (white). Most of the GOM Shelf and most of the deepwater acreage is presently leased by the industry.

Click image for enlarged view

|

|

The total number of Federal OCS blocks under lease as of March 1, 2006 amounted to 8,016. Of this number 2,748 were in the Western Region and 5,268 in the Central Region. There were 3,471 unleased blocks previously leased at least once. All the open blocks in white have never been leased; most are in the Lund area.

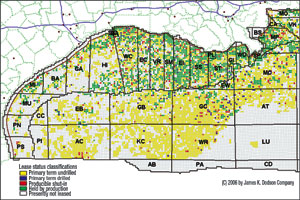

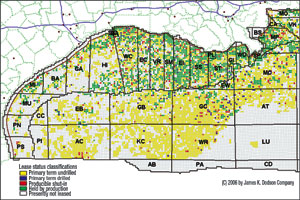

Another view of leasing, Fig. 2, shows that the bulk of the GOM Shelf blocks from High Island (HI) area off Texas to Mobile (MO) area off Alabama is held by production (green). Even more acreage is in its primary term (yellow) and the bulk of those blocks are in water depths deeper than 1,000 ft.

|

Fig. 2. Much of the GOM Shelf is held by production, but the industry holds significant deepwater acreage that has not yet been drilled.

Click image for enlarged view

|

|

Of the 8,016 blocks with current leases in effect, 5,815 leased blocks are held in their primary term. Of these, 5,648 leases are yet to be drilled, and 167 leases have had at least one well drilled on them.

There were 301 leases which are producible, yet have not started in production; and 1,900 leases are held by production. Leases held in their primary term that were not drilled are mostly in water depths deeper than 2,999 ft.

Who controls these blocks? Will they be tested?

Ever since the major oil companies’ sell-off of Shelf properties to the independent companies, the presence of the independents has been strong on the Shelf. The independents continued drilling with strong activity, drilling mostly development and step-out wells on the Shelf. But, that activity has not arrested the Shelf’s continuing production decline.

Of the 41,415 wells drilled on 4,828 blocks, 38,000 wells have TVDs above 15,000 ft; most of these wells are on the Shelf. Of the 125 GOM Shelf wells drilled between 2003 and 2005 with TVDs below 15,000 ft, about half have found new gas reserves, an excellent discovery rate. Wells drilled to depths above 15,000-ft TVD have discovery rates around 25%. Most of these wells produce around 3 MMcfd and deplete within three years.

The majors shifted their focus to the deepwater after selling-off their Shelf properties and invested in deep water. They were rewarded with discoveries that found large oil reserves. These new reserves, while significant, have not been enough to slow the Gulf’s production decline, which continues to drop at about 6% per year.

The GOM is now dominated by the independents that control over 80% of the primary term acreage in water depths out to 2,999 ft, Table 1. The majors have staked their claim to the deep waters beyond 3,000 ft, where they hold 55% of the acreage, a slim majority.

|

| Table 1 |

|

Major and independent oil companies undrilled primary term leases by water depth range and expiration year, 2006–2016

Click image for enlarged view |

|

|

Shallow water undrilled blocks in less than 1,000 ft. water depth amount to 1,754 blocks (31%), and 3,333 blocks (59%) are in deep water. Of the deepwater blocks beyond 3,000 ft, 1,617 expire (49%) in 2006, 2007 and 2008.

Over the next three years, 2,798 leases will expire, and the deepwater component beyond 3,000 ft makes up over 60% of that number. Most of these leases will not be drilled before they expire, which opens new territory for independents to explore and develop. The real question is whether the majors and independents still consider the GOM a viable oil and gas territory.

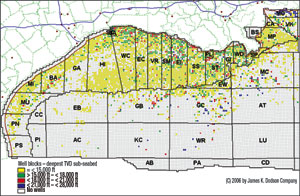

The new GOM frontiers lie deeper in the rock section. As can be seen on Fig. 3, the Shelf is well drilled to 15,000 ft (yellow). Between 15,000 and 18,000 ft (green) the drilled blocks are significantly fewer, and most of these drilled leases are within 50 mi of shore. These drilled blocks represent 2,154 wells.

|

Fig. 3. The GOM Shelf records significant drilling above 15,000 ft with less than half of the acreage tested to 18,000 ft and even less acreage is tested below 21,000 ft. Note the cluster of deep tests in the Mobile area (upper right). The deepwater regions of are lightly tested overall with only a few blocks tested below 21,000 ft.

Click image for enlarged view

|

|

Blocks drilled to between 18,000 and 21,000 ft (red) show a similar Shelf pattern, but are far fewer in number. These blocks represent 341 wells. A smattering of deep wells have been drilled in Garden Banks (GB) and Green Canyon (GC) areas with a cluster of deep shelf tests in Brazos (BA) area on the Texas side.

Most telling is the paucity of drilling below 21,000 ft (blue). These blocks represent only 163 wells. Aside from a cluster of deep tests in Mobile area, the Shelf has been barely tested below 21,000 ft. The deepest GOM well is in Green Canyon 320 and was drilled to 27,909 ft below the seabed.

Wells drilled below 15,000 ft on the GOM Shelf show a decline during the 2003 – 2005 period, Table 2. Drilling in 2005 was directly affected by the severe hurricane season. If drilling had continued at the 2004 rate, the total number of 2005 gas wells drilled below 15,000 ft would have been 48.

| TABLE 2. Gulf of Mexico wells drilled to >15,000-ft TVD in ðc 600-ft water depth |

|

|

The affect of increasing dayrates for offshore drilling rigs can be seen in the rise in average well cost over the same period. Average drilling costs jumped 50% to about $12.3 million during 2005 from about $8.2 million during 2004. The increase in drilling costs, as well as the need to drill for larger targets at deeper depths, is placing the GOM at an economic disadvantage compared to other oil provinces.

The GOM continues to decline, and the only way to turn it around is to drill – drill deeper and drill more. Those companies with producing properties on the Shelf have an opportunity to use their production to fund deeper tests. Those that are venturing into the deepwater frontier have a new climate of opening acreage in which to chase prospects.

|

THE AUTHORS

|

| |

Ted Dodson and James Dodson own and operate James K. Dodson Company, which has maintained a drilling and production database on oil and gas operations in the Gulf of Mexico, USA since 1970.

email@infogulf.com |

|

|