Gulf of Mexico waits for a turnaround

REGIONAL FOCUSGulf of Mexico waits for a turnaroundLast year’s optimism has been replaced by cautious operators with pared-down programs, bred by lower oil and gas prices. Nevertheless, the 2002 outlook varies considerably, from dismal on the shelf to bright in deep water.Jerry Greenberg, Houston A year ago, nearly everyone working in the U.S. Gulf of Mexico (GOM) – from drilling contractors to supply vessel operators servicing the rigs and other service companies – was optimistic that 2001 would become the boom year they were waiting and hoping for. After all, natural gas prices were on their way to nearly $10/Mcf, and oil was approaching $30/bbl. Independent and major operators were drilling like there was no tomorrow. Offshore rig dayrates were high and getting higher. That is, until the beginning of summer. Development activity was strong in 2001, particularly as regards the number of subsea completions, which was nearly double the number of subsea completions in 2000. The number of subsea wells is forecast to be even higher this year, as well as in 2003. As many as four deepwater floating production systems are scheduled for installation during 2002. Additionally, up to 41 subsea completions could be installed in the U.S. Gulf, and possibly more.

Rig Market Picks Up Speed . . . The Gulf of Mexico rig market appeared very healthy at the beginning of 2001. Dayrates for 250 – 300-ft, independent-leg cantilevered jackups continued their strong market that began during the third quarter of 2000. The jackup market continued to experience higher utilization, and subsequently, higher dayrates through the first five months of 2001. Large jackup dayrates hit a peak of about $65,000 as jackup rig utilization was over 90%, Table 1. The reason was high commodity prices.

. . . Then Stumbles Prices began tumbling in late May, as oil and natural gas rates settled to more "normal" levels. Many operators had spent most of their entire year’s exploration budgets during first-half 2001 in response to the high commodity prices. As a result, jackup utilization experienced a near freefall, dropping 40 percentage points, to 52% at the end of the year from 92% in May. Day rates fell as a result, declining to an average of around $22,200 in December from an average $52,500 in May. December also saw the low day rate point for large jackups, at $17,500. All of the gains made during 2000 were lost during second-half 2001. On a percentage basis, floating rig activity was relatively high in 2001, averaging in the mid-80s from April through the end of the year, Table 2. However, dismal jackup utilization pulled down the U.S. Gulf, causing overall utilization to end the year at 60%, down from a peak of just over 90% in May.

Bleak Outlook The prognostication for 2002 is not particularly good. Operators plan to spend about 20% less this year in North America than last year, according to Salomon Smith Barney’s annual E&P spending survey. That company and many others predict an upturn in the Gulf of Mexico drilling market, beginning perhaps in late third-quarter 2002, when the economy is expected to become healthier. "The pessimistic view is that if there is a turnaround in the Gulf, it will be late in the year," said Tom March, associate publisher at OneOffhsore. "The optimistic view sees it happening a little sooner, maybe in the third quarter." But Marsh takes an even more bearish view: "In my opinion, there is no basis (for a turnaround this year) other than wishful thinking." There are, indeed, inquiries for rigs in the Gulf as evidenced by an announcement from Rowan Companies that it would have all of its jackups in the Gulf of Mexico working. But what the company did not highlight, according to Marsh, was that they are all one-well contracts with no associated options. "There is a lot of activity like that," said Marsh. "Nobody will commit to longer-term deals. Their thinking doesn’t include long-term rig and boat contracts." The U.S. Gulf jackup market is so tied to natural gas prices, that there is not much to say other than to watch storage and prices, added Marsh. However, the 12-month NYMEX futures strip is $2.37/Mcf, lower than the forecast price of $2.83 that operators said they were basing their 2002 budgets on in Salomon Smith Barney’s spending survey. The deepwater market is still holding its own, but even that is a surprise to the pessimistic Marsh. "The semisubmersible market is stronger than I expected it to be," he said. But there is still a gray cloud to this market segment, as well. Of the 31 semisubmersibles that were working in mid-January, according to Marsh, 17 of them were working under contracts that expired by the end of the first quarter. Drillships don’t begin to be an issue until the middle of 2003, when half of the eight drillships working in the U.S. Gulf will see their contracts expire. Deepwater Production Activity Is Strong Production activity in the U.S. Gulf, particularly in deep water utilizing various floating systems, is expected to be relatively active during 2002. Four floating production systems are scheduled for installation this year, Table 3. They include one mini-TLP and three spars, the latter of which has become the production system of choice among operators in recent years. Additionally, the industry plans around 40 subsea installations this year that will be tied back to those new floating production systems, as well as other existing platforms, floating and fixed.

Looking forward, the industry anticipates installation of as many as 50 floating production systems during the next five years, through 2007, Table 4. They include six semisubmersible-based systems, eight mini-TLPs, one large TLP, 30 spars and five FPSOs, according to figures from Houston-based Quest Offshore Resources, Inc.

The greatest number of floating production systems is scheduled for installation during 2004 and 2005, with 13 units set for installation each of those years. The fields to be tied to these production systems range in water depths ranging from approximately 1,780 ft to nearly 9,700 ft. BP is the operator with the highest number of floating production systems planned, including six spars, one of which is scheduled for delivery this year at Horn Mountain field. Last year, the company set in motion its future plans regarding spars in the U.S. Gulf. In 2001, BP awarded a contract to CSO Aker Maritime for the engineering, procurement, fabrication and delivery of up to five spar hulls and mooring systems for the U.S. Gulf. The first spar is scheduled for delivery during 2003. Options exist for additional spars. The company will also provide conceptual and detailed engineering, along with procurement and installation support for all subsea equipment and risers for BP’s deepwater developments related to the spars. In a related contract, FMC Energy Systems was awarded a $250-million frame contract from BP. It calls for FMC to provide subsea systems and related services for the operator’s U.S. Gulf deepwater development projects. Hardware deliveries are expected to begin late this year. Other operators with spars in their future, according to Quest Offshore, include Anadarko Petroleum, ExxonMobil, Kerr-McGee, Murphy Oil and Unocal. Subsea completions saw a significant increase in their numbers in 2001, when 46 were installed, compared with only 24 the previous year. They are expected to experience another good year in 2002, Table 5. Quest Offshore Resources says that at least another 41 subsea tree installations are expected this year, but that figure could increase substantially.

"The 41 trees set for installation are booked, with contracts for supply of the trees already awarded," said Paul Hillegeist, president of Quest Offshore. "Adding the number of possible and probable tree installations by applying a weight to the possibility, we could see as many as 70 tree installations this year." Presently, 29 subsea trees that have already been awarded are scheduled for installation in 2003, with another 21 set for 2004. Those figures could increase significantly (due to the high number of plans), possibly totaling into several hundred trees installed by the end of 2007, according to figures from Quest Offshore.

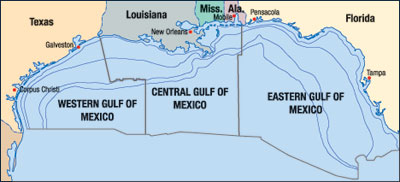

FPSO Potential While there is considerable activity on the horizon for floating production systems to be used with fields developed subsea, one of the production schemes garnering quite a bit of attention recently has been FPSO systems. Use of FPSO production schemes in the U.S. Gulf was not an option until recently, when the Minerals Management Service (MMS) decided it was going to accept applications for FPSO usage. This decision follows an extensive environmental and safety review of potential FPSO usage in the deepwater areas of the Central and Western Gulf. A recent ultra-deepwater discovery by Unocal in nearly 10,000 ft of water may be the first field to be produced with an FPSO. A comparative risk analysis (CRA) was also performed to compare the relative risks of an FPSO system with three other deepwater development systems, a fixed platform production hub, a spar and a tension-leg platform (TLP). MMS found the environmental and safety risks associated with FPSOs to be comparable to other types of production systems. Consequently, MMS has concluded that it will not categorically exclude FPSOs from use in the Gulf. The Environmental Impact Statement (EIS) evaluated a permanently moored, double-hulled, ship-shape FPSO with up to 1 million bbl of crude oil storage capacity. Although the EIS covered the Central and Western Gulf, each application will be considered on a case-by-case basis. The decision to accept applications does not necessarily mean approval for any specific FPSO site or project, but it provides a foundation for considering a specific company request to use an FPSO. When a specific project is applied for, the MMS will still conduct a site-specific environmental assessment, as well as a project-specific technical / operational review before a project is approved. However, a review for projects that fall within the base case can be completed in less time, because an EIS has already been prepared. Any proposed FPSO system that is not within the range of operations evaluated within the EIS will require a more extensive environmental review and National Energy Policy Act documentation. For specific projects, the MMS will require submission and approval of a deepwater operations plan, plus a development operations and coordination document before any FPSO can be installed. The decision to accept applications for FPSOs excludes the use of such systems in a 471-block area just off the continental shelf, ranging from Galveston, Texas, to New Orleans, Louisiana. This zone is part of the U.S. Coast Guard’s lightering-prohibited areas. The MMS will not approve the use of FPSO’s in the area for two years while it continues discussions with the Coast Guard concerning what measures might be necessary to protect the environment. DeepStar, an industry deepwater initiative group, funded the EIS, and MMS contacted an independent company to conduct the assessment. DeepStar member Texaco originally applied to use an FPSO for developing a field several years ago, to begin the process of permitting FPSOs in the Gulf. However, the lease for which the system was to be used was relinquished, because the field did not contain commercial quantities of hydrocarbons. Quest Offshore says that as many as six FPSOs are under evaluation for use in the Gulf. Operators considering an FPSO production system include Conoco, Kerr-McGee, Ocean Energy and Unocal. Water depths of the discoveries that might be tied back to an FPSO range from about 4,260 ft to nearly 10,000 ft. Generally, FPSOs are moored in shallower water with production tied back to the FPSO from subsea completions. In the Gulf, however, the FPSO could be much closer to the field. The Gulf’s First FPSO While Texaco was the first operator to apply for a permit to use an FPSO, Unocal may be the first to actually install such a system. The company is encouraged by the results of a discovery and appraisal well in Alaminos Canyon Block 903. The appraisal was drilled in 9,727 ft of water. A second appraisal may be drilled during the second half of this year. Unocal said it plans to put considerable effort into analyzing deepwater development options, including the likely use of an FPSO. Quest Offshore’s database indicates that Unocal could install an FPSO by 2005, with as many as six subsea wells tied back to it. Possible Obstacle There are a few double-hulled FPSOs that could be brought into the Gulf in fairly short order – should the economics be right – but another consideration is the present lack of shuttle tankers that satisfy Jones Act requirements. The shuttle tankers must be U.S.-built and manned, since they would be involved in coastal trade when they shuttle oil from FPSOs to a U.S. facility. The FPSO does not have to be U.S.-built or manned, because it will not be transporting goods to a U.S. port. Presently, there are no shuttle tankers that fall under Jones Act requirements. A likely scenario is that if a new double-hulled FPSO is built for the U.S. Gulf, then shuttle tankers will also be built at the same time. Construction time for the shuttles could reasonably be 24 months. To address the shuttle tanker issue last year, Conoco’s wholly-owned affiliate, Seahorse Shuttling and Technology LLC, formalized an alliance with Alabama Shipyard of Mobile Alabama, and Samsung Heavy Industries of Korea. The firms will develop a design / construction plan that could have U.S.-built shuttle tankers ready for service by 2004, well before the potential first FPSO is a possibility. Samsung previously built double-hulled tankers, as well as two double-hulled drillships for a Conoco / Transocean Sedco Forex joint venture. Now, Conoco and Samsung have completed a conceptual design for a new shuttle tanker classification, the Gulf of Mexico Maximum Cargo (GOMAX™) shuttle tanker. The double-hulled, dynamically positioned vessel will have a capacity of more than 550,000 bbl of crude oil and will still comply with the 40-ft draft restrictions of most Gulf of Mexico ports.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)