|

Feb. 2001 Vol. 222 No. 2

Outlook 2001: United States

|

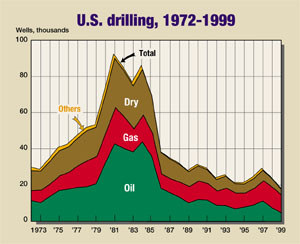

U.S. DRILLING

Strong E&P growth continues

The surge in drilling activity that finally got underway last year looks to

grow even more in 2001, quite possibly reaching levels not seen since the late ’80s, in terms of wells

drilled. Extraordinarily strong prices for crude oil and natural gas have repaired operators’ balance

sheets and sent them searching for ways to invest in new reserves. These same high prices probably will hinder

reserve growth through acquisition, thus placing increasing emphasis on drilling. Consequently, it appears

that the only limitations to even greater growth will be availability of personnel, equipment or viable

prospects.

Although some may wish that those remarkable oil and gas prices would last

indefinitely, reality doesn’t include $9 gas for long, and oil is still subject to OPEC’s whims and

missteps. But with the fundamentals of a tight market firmly in place, there is little doubt that the E&P

sector will continue to see healthy expansion. Highlights of

World Oil’s forecast for 2001 include:

- The drilling of 34,772 wells in the U.S., an increase of 20%

- U.S. Gulf of Mexico drilling will improve 14% to 1,162 wells

- A 22% increase in Texas drilling to 8,199 wells

- An average 1,120 rigs running in the U.S. during 2001, up 22%.

|

Oil and gas prices. Operators’

belief that improved market fundamentals were real, strengthened continuously throughout 2000. In addition,

OPEC’s frequent machinations to fine-tune the market also helped oil prices reach, then hold, at levels

not seen since 1990. On paper, there are still many questions surrounding OPEC quota discipline, and when and

if Iraq will resume, or even raise production. However, the fact remains that Saudi Arabia, Kuwait and the

United Arab Emirates are the only OPEC members whose quota changes actually affect the market. With their

current hawkish thinking, plus increasing world demand for oil this year, the Houston-based consulting firm of

Groppe, Long and Littell sees the spot price of WTI in the U.S. averaging around $30 per barrel during 2001.

Wellhead prices for natural gas skyrocketed late last year, peaking in the $10

per Mcf range as panicked buyers responded to record cold across North America and power shortages on the West

Coast. However, those natural gas prices, which on a Btu basis, correspond to fuel oil prices approaching $50

per bbl, simply aren’t sustainable. Thus, Groppe, et al., expects wellhead gas prices to average $4.60

per Mcf this year.

Operator surveys.

World Oil’s year-end survey of 17 U.S. major drillers (integrated companies and independents with

large drilling programs) and 148 independents indicates strong expectations for 2001. Majors plan 4,115 wells,

up 19% from last year. Independents responding will drill 1,784 wells, up a resounding 39%. The majors’

exploration plans are slightly stronger this year, with nearly 6% of their wells targeting wildcat prospects,

compared to 5% in 2000. Exploration by independents will remain very strong at about 33% of total drilling.

Both groups will still emphasize gas – majors expect that 37% of their

drilling will be for gas, while 50% of independents’ drilling will target gas. According to Baker Hughes,

about 80% of the rigs they count are targeting natural gas, which may cause one to question the gas-to-total

drilling ratios cited above. However, it should be noted that Baker Hughes does not count the hundreds of

shallow-depth capacity rigs, most of which are used to drill thousands of shallow oil wells throughout the

country every year.

Spending plans. Salomon Smith Barney’s

annual year-end survey of 234 U.S. and international operators indicates that worldwide E&P budgets will

rise 19.7% this year. Spending plans are based on an average oil price assumption by the respondents of $25.34

per bbl, which is up sharply from the $19.08 price assumed at this time last year.

For the U.S., the Salomon survey indicates total E&P spending of $29.7

billion this year, an increase of 19.3%. Independents are more bullish, with expenditures expected to grow by

20.4%, but the majors aren’t far behind with their 17.9% increase.

Area forecasts. The following summaries

represent important states or regions that greatly influenced the 2000 forecast.

Activity in the Gulf of Mexico should rise about 14% to 1,162 wells in

2001, an activity level limited only by equipment availability. Although some producers claim that high costs

for rigs and other services, brought about by their limited supply, could dampen spending plans for 2001,

Robert E. Rose, president and CEO of Houston-based drilling contractor Global Marine, disagrees. Rose says, "Higher

rig rates might hurt the marginal prospects, but not the good prospects. There’s no question that rigs

and capital migrate to the prospects that are the best. Companies with the best prospects put the most money

into them and attract the rigs." Rose also noted that it is the drilling contractors that push down rig

rates while trying to underbid each other when jobs are few. But in the up cycles, producers bid up rig rates

to assure themselves access to a unit for drilling their prospects.

Texas, likely the state hardest hit by the 1999 oil price bust, is

making an amazing recovery. This year should see drilling increase a healthy 22.1%, to 8,199 wells. If

achieved, the 2001 well total will represent a 70.6% improvement from 1999, but it will still be almost 8%

below 1998’s level.

The three Texas Railroad Commission districts that encompass the oil-prone

West Texas region are all indicated to enjoy above normal activity improvements. District 8, which once was

the largest in terms of wells drilled, will remain number two for another year, but will see drilling climb

32% to above a thousand wells again in 2001. A little further north, District 8A should record a 15.5% gain in

drilling. District 7C also will be a big growth area, as 973 wells are expected, for an increase of 31.5%.

District 4 in extreme South Texas should hang onto its title of number one in

drilling, mostly because of its natural gas targets. A 14.8% rise in activity there should produce 1,127 wells

this year.

Continuing gas development, particularly in the southern half, will send Louisiana’s

well count rising 14.2% to 1,523 wells. High oil prices are also having an effect in the northern half of the

state, where activity is expected to jump 16.5% to 905 wells. Exploration work will get a boost over last

year, as operators tell World Oil that 37% of planned drilling will be exploratory, compared to only

21% last year.

California’s mostly shallow-depth, heavy oil fields are highly

susceptible to oil price fluctuations and thus, took a beating during 1999. However, as demonstrated by the

dramatic turnaround during 2000, these same attributes allow the state’s operators to react very quickly.

This year, the state’s energy problems are expected to impact drilling. Consequently, only a 3.5% rise in

drilling is expected.

Coalbed methane development programs will again be a major portion of Rocky

Mountain drilling this year. Collectively, Rocky Mountain wells should climb from 6,659 in 2000 to 7,334

in 2001. Wyoming is home to most of it, and thus, will see drilling rise 7.2% to 5900 wells in 2001.

If coalbed wells are excluded, then Wyoming drilling will rise from 1,000 wells in 2000 to 1,400 wells this

year. More than half of Colorado’s wells target coalbeds, and with natural gas selling at record

prices, coalbed development will cause drilling in the state to soar 38.5% to 900 wells this year.

In the Mid-Continent area, Oklahoma will experience a 38.1% rise in

activity to 3,050 wells. Gas development is still high priority, especially among the majors, and with high,

relatively stable oil prices; Oklahoma should exceed 3,000 wells this year. Kansas is predicted to

have a good year too, as drilling jumps 11.8% to 1,300 wells. The state is heavily gas-oriented with its giant

Hugoton field and operators are taking advantage of higher gas prices.

About These Statistics

World Oil’s tables are produced using the aid of data from a

variety of sources, including the American Petroleum Institute, ODS-Petrodata Group, the Texas Railroad

Commission and most other state regulatory agencies. In addition, 165 operating companies with drilling

programs responded to this year’s survey. Please note credits and explanations in table footnotes.

World Oil editors try to be as objective as possible in this

estimating process to present what they believe is the most current data available. It is realized that sound

forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting

is a dynamic process and most historical data will be continually updated over a period of several years

before the "books are closed" on any given year.

|

U.S. drilling 1859 – 1999 |

|

What 148 U.S. independent drillers plan for 2001 |

|

What 148 U.S. independent drillers plan for 2001 |

|

Forecast of U.S. wells and footage to be drilled in 2001 |

|

Operators active in the Gulf of Mexico, and wells drilled, during 2000 |

|