International: Worldwide drilling

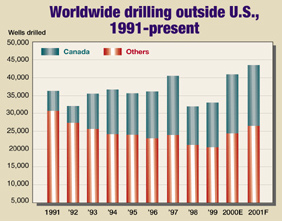

WORLDWIDE DRILLINGHigh prices breed surge in activityThere is nothing like unexpectedly large pocketfuls of cash to coax producers back to drilling, and that is exactly what happened last year. Oil companies will look back fondly on 2000 as the year in which OPEC kept its act together, allowing operators to replenish their treasuries and drill at reasonable levels. Activity rebounded so strongly that existing E&P infrastructures in many countries are now strained. According to early data supplied by governments and operators, drilling outside the U.S. jumped 24.0% last year, tallying 40,946 wells. Drilling increased in six of eight regions, and the gains were mostly in double digits. Improvement was particularly good in South America (up 70%), and Eastern Europe and the FSU (up 59%). This year, high oil and gas prices should continue to work their magic on drilling numbers. World Oil predicts that drilling outside the U.S. will total 43,649 wells, for a 6.6% increase. Every region should post a gain except for South America, which will be flat because of Venezuela.

North America Last year, North American drilling returned to the heavy activity levels experienced in 1996 and 1997. Regional wells outside the U.S. totaled 16,787, up a resounding 32% over the 1999 figure. However, offshore wells fell 35%, to only 33. As was true last year, finding and developing new natural gas reserves is a major factor in Canada’s record drilling pace, as well as in Mexican activity. High crude prices are adding discretionary drilling for oil. This year, North American drilling outside the U.S. should rise 3.1%, to 17,306 wells (47 wells offshore). If enough extra rigs can be found, the total may go even higher. Canada. It is hard to imagine that the outlook for Canada’s upstream market could be any more bullish than at present. Preliminary data compiled by the Canadian Association of Petroleum Producers (CAPP) show that the country last year broke the drilling record set in 1997. There were 16,529 wells drilled in 2000, a whopping 32% increase over 1999’s figure. Rig utilization averaged 64% of the total fleet last year, although in the traditionally busiest months of January and February, rig usage hit 90% and 94%, respectively. A year later, in the third week of January 2001, the rate hit a record 96.7%, said the Canadian Association of Oilwell Servicing Contractors (CAOSC). As opposed to the previous record year of 1997, when oil completions hit an all-time high (8,558), it was the number of gas wells drilled that set a record last year at 9,030. High crude prices also boosted oil drilling. Last year’s 5,500 oil wells were the most drilled since the 1997 record. World Oil’s survey of Canadian operators shows that they plan to boost their drilling efforts by a collective 44.5%. In addition, they will target 47.5% of their wells toward gas, versus 48.0% last year. Whether enough rigs and crews can be found to sustain even half of such an expansion is highly debatable. Our forecast will mimic CAPP’s outlook, which calls for a 2.9% rise to 17,015 wells, including 15 offshore. An expanded look at Canada’s E&P industry will appear in a feature article in World Oil’s March 2001 issue. Mexico. Drilling levels have remained remarkably consistent within Mexico over the last several years. There were 235 wells drilled in 2000, a figure virtually identical to 1999’s total. However, there was greater emphasis on drilling wells onshore, as offshore wells dropped to 13 from 32. Exploratory drilling accounted for 33 wells, or 14% of total activity. Once again, natural gas was the dominant feature of exploration and development projects nationwide. According to estimates from state firm Pemex, there were 192 gas completions and only 12 oil wells drilled. Both figures reflect onshore and offshore activity. Pemex said last year that it would spend $400 million on exploring and developing non-associated gas. This is in addition to $800 million that was budgeted for the Burgos basin near Texas. In addition to Burgos, several gas development projects include the Grijalva Delta basin in southeastern Mexico; Macuspana field in southern Tabasco state; and the harnessing of associated and non-associated gas in the Bay of Campeche. Pemex also has expressed a desire to drill five or more deepwater wildcats in the Gulf of Mexico during the next seven to 10 years. The wells would be drilled in water depths from about 2,000 to 4,600 ft. With that in mind, the U.S. and Mexico last summer signed a treaty that defined each country’s jurisdiction in an area of the Gulf known as the "Doughnut Hole." Last month, the countries exchanged their instruments of ratification, putting the treaty into effect. About 60% of the area goes to Mexico, and the U.S. takes 40%. The outlook this year calls for Pemex to drill 250 wells, or 6.4% higher than 2000’s level. Offshore wells are expected to double to 30. Cuba. As was true in 1998 and 1999, wells drilled last year totaled 19, all onshore. Six of these wells were exploratory, resulting in four oil completions. This year, the Ministry of Basic Industry expects operators to take advantage of high oil prices and boost drilling 58%, to 30 wells. One of these wells is an offshore test slated by Petrobrás. Seven additional exploratory wells are scheduled onshore. Roughly 3,730 mi of 2-D seismic are planned offshore. South America Buoyed by high oil prices, this region posted one of the largest percentage gains in drilling worldwide. Wells drilled rose 70%, to 3,174. With the exception of Chile, all the major countries of South America experienced higher drilling levels. This year, every country – except Venezuela – expects increased drilling. Activity should be particularly strong in Brazil and Peru. Excluding Venezuela, South America would be up 8.9% – otherwise, the region will be flat. Venezuela. After a surprisingly good rookie year running Venezuela’s petroleum sector in 1999, the regime of President Hugo Chavez seemed well on its way to further improvement. Indeed, drilling last year was up a resounding 81%, at 1,470 wells. Unfortunately, Chavez soon proved that the only petroleum-related expertise he has gained relates to convincing fellow OPEC members to stick together on production quota moves. He could not resist meddling directly in the affairs of state firm PDVSA. Chavez replaced the company’s president with a career military man, who has no hydrocarbon experience. Chavez also reordered upstream priorities, further confusing foreign participants. As a result, PDVSA now predicts 1,300 wells for 2001, a decline of 11.6%. Thus, Venezuela is likely to suffer the embarrassment of being the region’s only major driller to suffer a decline in 2001. Argentina. The region’s second-largest driller nearly doubled its activity last year, tallying 1,070 wells for a 91% increase. According to IAPG, roughly 8%, or 90 wells, were exploratory, resulting in 60 oil completions, 14 gas wells and 16 dry holes. In Neuquen province, the government will be opening bidding processes for the operation of 18 oil and gas fields this year, said provincial Energy Undersecretary Ricardo Rodriguez Alvarez. The province expects initial investment of $100 million to further develop the deposits. One field, Las Tacanas, already had received bids at press time, with award of the tender imminent. This year, Argentine drilling should rise slightly, to 1,100 wells. Brazil. Like its fellow South American countries, Brazil rode higher oil prices to a drilling gain last year. There were 281 wells drilled, up 17% from 1999’s figure. Offshore wells totaled 90. Drilling included 45 exploratory tests and appraisals (18 onshore, 27 offshore), and 236 development wells (173 onshore, 63 offshore). The exploratory wells included four new oil wells and two new gas fields. Among these successes were two onshore gas finds by Petrobrás in Bahia (Block BCAM-40) and an offshore oil discovery struck by TotalFinaElf (Block BC-2). Next June, regulatory agency ANP intends to host a third bidding round for 53 oil exploration areas. Most of the blocks will be offshore in the south and central sectors. ANP predicts that 341 wells will be drilled this year, for 21% gain. Of these, 140 will be offshore (up 56%). Exploration wells will jump 80%, higher, to 81. Colombia. The government’s decision to reduce its take from smaller E&P projects – to encourage greater upstream investment – appears to be paying off. Drilling rose 26.5% last year, to 105 wells. Rig activity improved to 14 working units per month from 11.5 average rigs active in 1999. Despite threats from environmentalists and the local U’wa indigenous tribe, Occidental Petroleum last November began drilling its Gibraltar 1 well in the Samore Block. Nationwide, drilling is expected to rise 9.5% this year, to 115 wells. Western Europe As expected, Western European drilling began a recovery last year, gaining 12.4%, to 672 wells. Six of eight countries with significant drilling activity registered gains. This year, an 11.8% increase to 751 wells is forecast, with improvement spread evenly through most of the region. United Kingdom. Early data from the UK Department of Trade and Industry (DTI) show that British drilling improved 6.8% last year, to 299 wells. Within the total, offshore activity tallied 269 wells. Exploratory drilling accounted for 23%, or 69 wells, including 56 offshore. It was the first increase in exploratory drilling since 1996. However, only six new discoveries were struck. Nearly one-third (18) of all offshore wildcats and appraisals were drilled by Kerr-McGee. This year, DTI predicts a 12% gain, to 334 wells. Roughly 300 of these will be offshore. Analysts expect 74 exploratory wells (60 offshore, 14 onshore) and 260 development wells (240 offshore). Norway. Development work still accounts for 90% of all Norwegian drilling. Last year, 200 wells were drilled, 18% greater than 1999’s level. Within the total, the Norwegian Petroleum Directorate said that 24 exploration wells were drilled, up from 22 in 1999. Arthur Andersen said that this was the highest level of exploration drilling in three years. The leading exploratory drillers were Statoil and Norsk Hydro, with nine wells, each. This year, another gain to 205 wells is forecast, of which 25 to 30 will be exploratory. Eastern Europe/FSU Thanks to sustained, high crude prices, this region blew past our original forecast a year ago for a small drilling increase. Wells drilled jumped 59% higher, as operators reinvested portions of unexpectedly high production revenues back into drilling. Given the current price outlook, a further 21% gain, to 7,656 wells, is expected. Russia. A rebirth of sorts is underway in the Russian upstream sector. After years of depressed activity, last year’s unusually high oil prices put cash windfalls into Russian firms’ hands. They responded by boosting drilling 87%, to 5,577 wells. Sibneft last year launched a $1-billion oilfield development program, which saw the firm increase its drilling 118%, to more than 350 wells. Similarly, LUKoil pushed its drilling 66% higher, to about 950 wells, and Tatneft’s drilling gained 83%, to roughly 550 wells. Meanwhile, Tyumen Oil struck a new oil deposit in the Samotlor field complex of Western Siberia, the firm’s sixth find since it began operating there in 1997. This year, Sibneft plans to expand drilling another 35% in an effort to boost its crude output by 11%. Overall, Russia is likely to post a 21% drilling increase in 2001, to 6,733 wells. Other FSU countries. The outlook for the remainder of the FSU is very similar to Russia’s trend. Wells drilled in the other 14 republics were up a collective 15.6%, at about 370 wells. This year, further growth of 20% is predicted, to 445 wells. Kazakhstan will see a significant drilling increase, led by development work at the giant Tengiz and Karachaganak fields. Other significant drillers (50 or more wells) will include Azerbaijan, Ukraine, Uzbekistan and Turkmenistan. Countries outside the FSU. Many of these Eastern European nations saw their drilling activity bottom out last year, and they are poised for some sizeable rebounds in 2001. In Romania, state firm Petrom was distracted by an impending privatization, as well as the arrest of its president, Ion Popa, on charges of misuse of authority. Nevertheless, Petrom reports that it is ready to boost drilling back to 295 wells or greater, compared to last year’s 217-well tally. Exploratory work should account for nearly 15% of all drilling. In Poland, domestic operators drilled 62 onshore and two offshore wells. Foreign oil companies drilled another five wells. This year, domestic firms plan 70 wells (68 onshore); foreign operators will drill 10 wells onshore. Africa The continent continues to enjoy a healthy E&P sector, where drilling rose 19% last year, to 764 wells. African drilling continues to benefit from exploratory successes offshore the western coast. Egypt again will be very strong. Overall, Africa should improve 13%, to 863 wells. Egypt. Wells drilled zoomed 17.8% higher, to 199, of which 65 were offshore. There were 85 exploratory wells, including 25 offshore. Of these wells, 29 were oil successes (23 onshore and six offshore), and 13 found natural gas (five onshore and eight offshore). Given the government’s stated intention to become a major gas exporter, upstream work is expected to focus increasingly on gas field developments. This year, state firm EGPC expects 2,872 mi (2,300 onshore and 572 mi offshore) of 2-D seismic lines and 1,318 sq mi (664 sq mi onshore and 654 sq mi offshore) of 3-D seismic. The drilling forecast calls for a 21% boost, to 241 wells (106 offshore). Exploratory wells should total 114 (45 offshore). Algeria. Drilling totaled an estimated 145 wells last year, virtually unchanged from a year earlier. Rig activity rose to an average 14.5 units per month from 13.0 units in 1999. State firm Sonatrach struck an oil find last fall in southern Algeria, 93 mi south of Hassi Messaoud. Meanwhile, Agip, BHP and Sonatrach continue to develop Rourde Oulad Djemma and four neighboring oil fields. BP and Sonatrach are developing In Salah gas field complex. BP also is slated to begin drilling wells at the In Amenas gas project. The forecast this year is for 150 wells. Nigeria. Activity rose marginally, to 85 wells, of which about 70% were offshore. Working rigs remained nearly identical to 1999’s level, at 7.8, including 6.4 offshore. The future is looking brighter in Nigeria, now that the reformist regime has decided to increase the meager funding that its joint upstream ventures with foreign operators have received in past years. The seven joint ventures will see their combined budgets increased nearly $1 billion, to $6.1 billion. Of that amount, the government will kick in $3.53 billion, up from last year’s $2.3 billion. Accordingly, 12.9% hike in drilling to 96 wells is expected. Middle East In tandem with OPEC members’ crude output cutbacks, Middle Eastern drilling slipped about 3% in 2000, to 1,169 wells. This year, however, the region should gain 7.6%, to 1,258 wells. The increase is due in part to new oilfield work in Kuwait and Saudi Arabia’s natural gas program. Oman. The sultanate again led the region, totaling 295 wells, or about 4% above 1999’s level. More than 90% of all wells were oil completions. Exploratory drilling comprised 13% of activity. Dominant operator PDO broke its own horizontal drilling record last September. The Lekhwair 329H1 well totaled 5,396 m, more than 500 m longer than the previous record. A 6.8% gain to 315 wells is forecast this year. Saudi Arabia. Wells drilled rose 5.8%, to 237. Average number of working rigs also jumped to 25, from 20. There were several good natural gas discoveries struck in central and eastern Saudi Arabia during the last 12 months. Two recent finds were Ghazal (40 MMcfgd, 62 mi west of Haradh) and Mazalij 24 (17 mi north of Ghazal). Natural gas figures prominently in future Saudi drilling plans, now that the Natural Gas Initiative is set to open that portion of upstream activity to foreign oil companies. Eight firms are short-listed for three core projects (Haradh, Kidan / Shaybah and Red Sea-area developments). Officials will determine final consortiums for the projects late this month and sign memorandums of understanding in April. Irrespective of additional gas activity, the forecast is for a 5.5% increase to 250 wells in 2001. Iran. The overwhelming portion of drilling activity continues to be development work, accounting for 96% of the total. There were 135 wells drilled last year, up slightly from 1999’s figure. Iran’s parliamentary energy committee has approved plans to allow $2.8 billion in buy-back deals with foreign operators to develop giant Azadegan oil field, discovered in September 1999. Japanese oil firms have been given permission to submit offers by June 2001 for developing parts of the field. For 2001, Iranian drilling should tally 142 wells. Far East Activity within this region was essentially flat last year, totaling 11,861 wells. The picture is distorted by China’s dominant share of activity and the fact that Chinese drilling is operating at full capacity, with little or no room for growth. Given that limitation, Far Eastern drilling will grow 4.6% in 2001, to 12,401 wells. However, ongoing field projects and new exploration programs in Indonesia, Thailand and elsewhere will boost activity outside China by 24%. China. By all indications, the country continues to operate at its full drilling capacity, as domestic firms PetroChina, Sinopec and CNOOC attempt to keep crude output level or slightly ahead of the previous year. An estimated 10,055 wells were drilled in 2000, up 0.6% from 1999’s level. Offshore wells were up marginally, at 55. Despite the primary goal of adding to crude reserves, China seems to be more successful lately in finding new gas fields. For instance, Sinopec’s gas reserves increased 4% last year. The 2001 outlook calls for 10,210 Chinese wells (up 1.5%), including 55 offshore. Indonesia. Uncertain petroleum policies and separatist violence in some provinces limited drilling to 1,045 wells, or 4% more than in 1999. Within that total, 18.3% were offshore. Foreign operators are not sure what state firm Pertamina’s relationship with them will be, following the company’s announcement that it will lay off 40% of its workers and reshuffle its directors. Operators are also nervous about violence caused by separatists clamoring for the independence of Aceh province on the tip of Sumatra. They resent the "siphoning" of Aceh’s oil and gas wealth by Jakarta, and allege human rights abuses. Nevertheless, Pertamina is due to tender 21 concessions early this year, and the firm predicts a 27% drilling increase to 1,323 wells, including 231 offshore. Others. Drilling slowed momentarily in Thailand last year, but the kingdom expects to have a resurgence in 2001. Wells drilled totaled 180 last year, of which 86% were offshore. This year, 210 wells are forecast, with gains predicted both offshore and onshore. India’s activity was nearly level at 323 wells, including 55 offshore. A 35% increase in exploratory drilling will push Indian activity to 345 wells this year. Officials in Myanmar said that 31 wells were drilled there in 2000, including two offshore. They predict a 61% increase to 50 wells in 2001, all onshore. Exploratory drilling is set to increase 56%, to 14 wells. South Pacific Despite minor improvements in New Zealand and Papua New Guinea, South Pacific drilling fell 6% in 2000, to 211 wells. For the third year in a row, Australian activity declined. This year, however, strong economics and exploratory successes will propel regional drilling to its highest level since 1998. A 22% improvement to 257 wells is expected. Australia. After two years of drilling declines in 1998 and 1999, activity improved 8%, to 190 wells. Offshore activity comprised 45% of the total. Several significant discoveries were made offshore last year, including INPEX’s gas find at Brewster in permit WA-285-P and Shell’s Iago 1 strike in permit WA-25-P. This year, exploratory drilling should remain strong offshore, as will development work, led by Woodside Petroleum’s project at the Legendre oil fields offshore Western Australia. A 24% gain in offshore wells is forecast. Onshore, drilling gained about 5%, to 105 wells last year, thanks to increased work by dominant operator Santos. In 2001, Santos is expected to maintain a higher level of activity, and Queensland state expects its drilling to jump 127% higher. There also will be greater onshore participation by a number of smaller firms. The outlook is for a 19% gain in onshore wells. In total, Australian activity should see a 21% increase to 230 wells. Others. Recent

exploration results have been encouraging in New Zealand. Swift Energy found more oil in its Rimu

permit onshore southeast Taranaki, and Westech Energy is drilling eight onshore and offshore wells around its

Kauhauroa and Tuhara gas finds. New Zealand Oil & Gas is also drilling several exploratory wells during

its 2000 – 2001 fiscal year. In all, $160 million was spent on New Zealand drilling last year, and the

outlook for 2001 is similar, with at least 15 wells forecast. In Papua New Guinea, the exploratory

emphasis is shifting back onshore, after two dry holes were drilled offshore last year. Three wildcats are

slated onshore for 2001. Overall, PNG activity should rise 71%, to 12 wells.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||