North American Forecast: Canada’s fundamentals have improved, but politics could still interfere

There is much to be positive about in the Canadian oil patch, as 2022 winds down. The horror of the Russian invasion of Ukraine has united much of the West in expected and unexpected ways. Shifting reliance on Russian oil and gas to reliable and ethical sources like Canada has become a necessity for many European nations.

With oil and gas prices stabilized at levels not seen for many years, producers have increased spending, buoyed by outstanding financial results. Key indicators, such as drilling, licenses issued, and land sale bonuses, are all up substantially over 2021. Challenges include access to materials, supply chain constraints, and the availability of trained labor. According to the Canadian Association of Petroleum Producers (CAPP), total oil production (crude, bitumen and condensate) averaged 4.412 MMbpd, up 6.8% from 2021’s average of $4.155 MMbpd, including 257,593 bpd offshore, Fig. 1.

Governmental factors. But despite the growing global realization that demand for hydrocarbons will continue to grow for the foreseeable future, and the increasing importance of securing supplies from a stable, ethical, and environmentally conscious country like Canada, the federal government continues to ram through its net-zero agenda, rather than promote Canadian supplies.

For example, the federal Canadian Greenhouse Gas Offset Credit System Regulations and the Clean Fuel Regulations—policies that underpin Canada’s emission reductions plan—came into effect, in July. Currently, the carbon tax is set at $50/tonne, and it will increase to $170/tonne by 2030. The prohibitive costs of this program could lead to production shut-ins, which, in turn, will further exacerbate prices and add to inflation.

It is puzzling to see Prime Minister Justin Trudeau discuss the possibility of Liquified Natural Gas (LNG) facilities on Canada’s East Coast without any talk of how the needed gas would actually be shipped there. The reality is that without changing existing federal policy, it is virtually impossible to build anything associated with hydrocarbons that falls under federal jurisdiction. Many industry observers believe that the critical pipeline infrastructure will never be built under the current administration. In fact, some producers are now looking at LNG terminals in the Gulf of Mexico, rather than deal with the political constraints in the Canadian market.

Without any meaningful support from its government, the industry has shifted gears. The Canadian oil patch is recognized worldwide for its innovation and technical expertise. That skillset is now directed at finding ways to meet the federal requirements without shuttering oil and gas production, which is widely regarded to be the true objective of the federal policy.

Carbon Capture, Utilization and Storage (CCUS) opportunities abound in western Canada, and the oil patch is working diligently to take advantage of the opportunity to reduce its carbon footprint. The Alberta government recently announced it was investing C$40 million in 11 CCUS projects across the province. The province is well-positioned to invest; with the exception of the federal government, Alberta has benefited more than any other jurisdiction from high oil prices. Revenues in 2022 are expected to produce a surplus of more than C$13 billion.

Hydrogen is also emerging as a future clean energy source, with Alberta and Saskatchewan the most likely sources, according to Natural Resources Canada. Canada and Germany recently ‘signed’ a non-binding (i.e. yet another photo-op for Trudeau) agreement to sell Canadian hydrogen to the energy-starved nation, although there is no infrastructure in place, nor any significant production. Experts believe it will be many years before hydrogen is commercially developed within Canada, and the capability to ship it overseas even further off.

Pipeline sector. Access to markets, regardless of the product, continues to plague producers, as they face political obstacles at home and abroad. Canadians watched with astonishment as U.S. President Joe Biden, fresh off killing the Keystone XL pipeline project, but facing massive energy prices, went on a junket to Saudi Arabia this summer to beg for more oil, rather than explore ways to increase access to oil markets for his neighbor to the north.

Meanwhile, Enbridge has been battling to keep its Line 5 open, despite challenges from an indigenous band in the Lake Superior area, and Michigan Governor Gretchen Whitmer, over claims the pipeline presents an unacceptable risk. The Canadian government has twice invoked the 1977 Transit Pipelines Treaty to counter these challenges. Ironically, shutting down the line would result in further energy price increases in the U.S. Enbridge has stated that Line 5 provides half the oil and propane used in Ontario and the U.S. Midwest. In the meantime, Canadian crude-by-rail shipments continue to grow, to meet demand across North America.

Oil sands producers are profiting from a rare congruence of high commodity prices, just as many projects are paying down their capital costs. This has also played a significant role in the massive surplus that Alberta will enjoy in 2022. Producers also continue to work with provincial and federal regulators to standardize requirements for releasing treated water. Currently, water storage facilities, like tailings ponds, are an obstacle to reclamation efforts. Releasing treated water would allow producers to properly restore the landscape.

Mergers and acquisitions activity has slowed somewhat in 2022, as investors would prefer to reap the benefits of high commodity prices. Yet, there were still several notable deals. In late June, Whitecap Resources Inc. announced it had acquired XTO Energy Canada in an all-cash deal valued at C$1.9 billion, significantly expanding the company’s stake in the Duvernay and Montney plays of northwestern Alberta.

And in September, Tamarack Valley Energy Ltd. acquired Deltastream Energy Corporation in a cash and equity deal worth C$1.43 billion. All of Deltastream’s assets are located in Alberta’s Clearwater play.

Spending plans have increased over the course of 2022, on the continued strength of oil prices. Tourmaline leads the way, with a capital budget of C$6.6 billion, an increase of 28% over its previous target of C$5.1 billion. Suncor Energy has planned expenditures of C$4.9-5.2 billion this year. Canadian Natural Resources Limited is just behind, with spending now ticketed at C$4.9 billion, an increase of almost C$600 million from its original capital plan this year. Cenovus Energy Inc. has increased its capital budget by C$400 million, to a range of C$3.3-3.7 billion.

As spending increases, producers will look to add to their portfolios through crown land sales, which have been in full swing across western Canada, with the exception of British Columbia, where officials are still working out the details of the 2021 Supreme Court ruling on the Blueberry River First Nation’s challenge to BC’s resource development policies.

Land sales. In Alberta, first-half land sale purchases totaled C$133.3 million ($682.66/hectare) compared to C$50.9 million ($220/ha) last year. Saskatchewan brought in C$26.5 million ($684.61/ha), versus just C$2.7 million ($205.51/ha) in 2021. And in Manitoba, producers spent just C$204,000 ($266.17/ha).

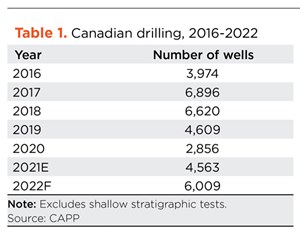

Drilling. As expected, drilling (Fig. 2) also has recovered somewhat through the first half of 2022, with 2,400 wells drilled, an increase of 31.5% over last year’s six-month total of 1,825, according to Daily Oil Bulletin records.

According to World Oil’s survey results, most provinces predict that drilling will increase this year. CAPP is forecasting a big increase, to 6,009 wells drilled across Canada (Table 1), up almost 32% from last year’s total of 4,563, including some offshore activity, with up to nine wells drilled off Canada’s East Coast. Footage drilled last year totaled 48.2 MMft of hole.

Meanwhile, the Canadian Association of Energy Contractors has revised its original 2022 forecast upward to 6,902—an increase of 2,254 (up 48.5%) from 2021 levels.

And the Petroleum Services Association of Canada stuck with its forecast from last November, predicting that 5,400 wells will be drilled this year, an increase of just over 16% from last year.

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Canada's upstream soldiers on despite governmental interference (September 2023)