U.S. upstream muddles along, with an eye toward 2024

A convergence of economic, geopolitical, trade and policy factors have exacerbated the issue of years of underinvestment in upstream hydrocarbon production and has triggered a change in energy markets. The hard push to transition to renewables and clean energy alternatives created an unprecedented reduction of investment in hydrocarbon-based energy, in favor of developing green resources. In 2021, global oil and gas discoveries hit their lowest level in 75 years. Total global discovered volumes were calculated at 4.7 Bboe, the lowest tally since 1946.

Despite the record-low resource replenishment, U.S shale players followed investor mandates for measured investment and financial discipline (Fig. 1), but this approach reduced capital expenditures and contributed to a tight market, which caused WTI to hit a 14-year high of $115/bbl in June 2022. The continued shift away from traditional energy investment has altered the three major components of a balanced energy equation: 1) energy security; 2) supply diversification; and 3) lower-carbon production/technologies. Additionally, the uncertainty surrounding energy policy and carbon costs has increased pressure on all three components, causing concerns and ongoing issues.

ESG impact fading. The drive to abandon drilling for hydrocarbons lessened during first-half 2023, as environmental extremism and the ESG initiative lost momentum. Many U.S. oil companies are getting back to the business of drilling and completing oil and gas assets. Investments by several major players are surging, as companies shake off the notion that an energy transition can be achieved by quickly switching to green alternatives.

At the World Petroleum Congress, held in Calgary during the week of Sept. 18, Saudi Aramco CEO Amin Nasser said, “the IEA’s prediction that oil consumption will peak this decade and grow at a slower rate in the near term, as the energy transition gathers pace, has been proven to be unrealistic,” Fig. 2. “This notion is also wilting under scrutiny, because it’s mostly being driven by policies rather than the proven combination of markets, competitive economics and technology. There is no quick fix for the energy transition,” Nasser concluded.

Another indication that the majors are moving back into fossil fuels is the consensus that to lower carbon emissions will require much more natural gas than previously stated. The U.S. is forging ahead with new projects that will make it one of the world’s top LNG exporters. This momentum marks a turning point for gas, which the environmentalists thought would serve as a short-term bridge while developing “cleaner” alternatives and would be phased out in the near-future. But with the promise of renewables failing to materialize, the idea that natural gas demand will peak anytime soon has vanished.

“LNG sellers look around this market and feel pretty confident that gas demand will be with us for decades to come,” said Ben Cahill, senior fellow with the Center for Strategic and International Studies. Russia’s invasion of Ukraine, he said, and the subsequent energy crisis and record-breaking price surge, has changed the long-term prospects for natural gas.

OPEC cuts supply. Major consuming nations have criticized the Saudis and their allies for constricting supplies during a period of record demand, warning that a renewed inflationary spike would squeeze consumers and endanger the global recovery. Nonetheless, Riyadh said it could deepen current cutbacks if deemed necessary. OPEC output plunged in September to a two-year low, as the Saudis implemented a unilateral reduction of 1 MMbopd, while Russia also reduced exports. As a result, global crude markets are forecast to have a supply shortfall of 1.2 MMbopd by year-end, as the cuts are causing serious concern about commodity availability.

The impact of the above factors is higher energy prices and improved cash flows for producers. The balance that companies strike between increasing investment and continuing capital discipline is a major factor. However, the U.S. industry’s investment trajectory for the remainder of 2023 will likely be more focused on traditional hydrocarbon-based development, as renewables have proven to be a poor investment. Producers that had ventured into the lower-margin renewable power business are now rethinking those investments, due to lackluster returns.

MACRO U.S. PICTURE

The Baker Hughes rotary rig count stood at 772 units during the week ending Jan. 6, 2023. U.S. drilling activity remained steady averaging 758 rigs during the first four months of the year. During late April, the U.S. rig count started dropping, despite a relatively stable WTI price of approximately $72/bbl. The rig count steadily declined for the next four months, dropping to 631 during the week ending Sept. 1. The September tally is the lowest since Feb. 4. 2022, when the count stood at 613, Fig. 3.

The 141-rig loss represents a 22% decrease in activity, which occurred mainly in gas-dominated shale fields, as operators stacked rigs in these regions, due to depressed natural gas prices. Those low prices occurred despite prolonged record heat in a large portion of North America over the last several months. The market showed no signs of recovery with the commodity at the Henry Hub (HH) trading at $2.58/MMBtu in August, compared to $2.55/MMbtu in July. Despite short-term price stability, the 12-month running average at HH plummeted 12% in August, down to $3.68/MMBtu. This documents the protracted price decline since August 2022 when operators were receiving $8.81/MMBtu.

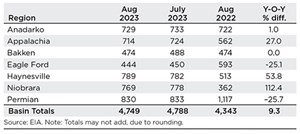

Drilled-but-uncompleted. Despite depressed U.S. natural gas prices, operators continue to drill in gas-dominated regions, but with less intensity. DUCs in the major oil plays continue to drop, but not as rapidly as in previous months, Table 1. In August 2023, there were 4,749 DUCs in the U.S., 406 more than the 4,343 tallied in August 2022 (+9%). In recent months, the build in the DUC inventory has moderated, but only two of the seven regions mapped by EIA show y-o-y declines. In the Niobrara region, DUCs are up to 769 (+112%), the Haynesville region has 789 (+54%), Appalachia has 714 (+27%), with 474 DUCs reported in the Bakken inventory, the same as one year ago. On a positive note, the Permian and Eagle Ford experienced y-o-y declines of -26% and -25% in their DUC inventories, respectively.

OVERALL U.S. FORECAST

In third-quarter 2023, OPEC+ reduced oil supply during a period of record demand, which was sparked by an increase in Chinese consumption and an uptick in petrochemical feedstock requirements. The combination of factors caused a supply shortfall of 1.2 MMbopd, as Saudi Arabia extended its production cuts, causing concern about commodity availability. Additionally, a substantial drawdown in inventory caused benchmark crude prices to surge to a 10-month high the week of Sept. 15, with Brent up to $93.87/bbl and WTI jumping to $89.14/bbl.

Despite the combination of restricted Saudi supply, increased demand and surging oil prices, World Oil forecasts a slight downturn in drilling activity for the remainder of the year, projecting 18,210 total wells for 2023—a 1.7% decrease from the 2022 count of 18,529, Table 2. However, total footage is projected to increase from 252.9 MMft in 2022 to 258.3 MMft in 2023—a jump of 2.1%. During 2023, 9,204 wells are estimated to have been drilled during the first six months, while 9,006 are predicted to spud in the second half of the year, for a half-to-half drop of 2.2%. A 3.9% reduction in footage is expected in the last six months of the year.

Caveat. We have confidence in this forecast, but if crude prices persist at $90/bbl or higher, activity may increase more than forecast. However, if the price drops sufficiently below $90/bbl, then we may see a greater decline in the second half of this year. We are predicting a mild increase in the fourth quarter, which is why some numbers are not forecast lower.

MERGERS AND ACQUISITIONS

Exxon Mobil has agreed to acquire Denbury Inc., a CCS developer and EOR company, in an all-stock transaction valued at $4.9 billion. The combined assets and capabilities further accelerate ExxonMobil’s Low Carbon Solutions business and create a compelling customer decarbonization proposition. Denbury’s leading CCS network underpins ExxonMobil’s commitment to low-carbon value chains, including CCS, hydrogen, ammonia, biofuels and direct air capture. Transaction synergies are expected to enable more than 100 MTA of emission reductions over time, driving strong growth and returns. The acquisition includes Gulf Coast and Rocky Mountain oil and natural gas operations that consist of proved reserves totaling 200 MMboe, with 47,000 boed of current production.

Permian Resources will acquire Earthstone Energy in an all-stock transaction valued at $4.5 billion, inclusive of Earthstone’s net debt. The transaction strengthens Permian Resources’ position as a leading Delaware basin independent with 400,000 Permian net acres, with total production of 300,000 boed, Fig. 4. Permian Resources and Earthstone are operating an 11-rig drilling program, focused primarily on the Delaware basin. The combined company plans to allocate at least one of Earthstone’s two rigs in the Midland basin to the Delaware basin. During 2024, the combined company expects to allocate 90% of capital to high rate-of-return projects in the Delaware, focused predominantly on Lea, Eddy, Reeves and Ward counties. The transaction increases Permian Resources’ position in the Permian by 223,000 net acres to over 400,000 net acres.

Ovintiv Inc acquired the Midland basin assets of Black Swan O&G, PetroLegacy Energy and Piedra Resources for $4.275 billion. The acquisition added 1,050 net, 10,000-ft well locations in addition to 65,000 net acres of largely undeveloped land adjacent to Ovintiv's existing Permian operations. Ovintiv also closed an all-cash sale of its Bakken assets in North Dakota to Grayson Mill Bakken for $825 million. In 2024, Ovintiv expects to deliver oil and condensate production of 200,000 bpd with a capital investment of $2.1 billion to $2.5 billion.

Civitas Resources will acquire oil producing assets in the Midland and Delaware basins of West Texas and New Mexico from Hibernia Energy and Tap Rock Resources for a total of $4.7 billion.

Midland basin entry. Civitas also has agreed to purchase Hibernia’s Midland basin assets for $2.25 billion in cash. The assets include 38,000 net acres in Upton and Reagan counties, Texas. First-quarter 2023 average production was 41,000 boed, of which 56% was oil. After the acquisition, the company will have an inventory of 450 locations in the Midland basin.

Delaware basin entry. Civitas will purchase Delaware assets from Tap Rock for $2.45 billion, which includes $1.5 billion in cash and 13.5 million shares of Civitas stock valued at $950 million. The assets include 30,000 net acres, in Eddy and Lea counties, New Mexico. First-quarter 2023 average production was approximately 59,000 boed, of which 52% was oil. After the acquisition, the company will have an inventory of 350 locations in the Delaware basin.

Patterson-UTI Energy and NexTier Oilfield Solutions merged in an equal all-stock transaction. The combined company, to be known as Patterson-UTI Energy, Inc., has an enterprise value of approximately $5.4 billion. It will provide comprehensive drilling and completion services, with operations in major U.S. basins. The combined company will have a comprehensive operational and technology portfolio, along with data analytics to maximize well performance. The merger creates a leading U.S. contract drilling business, with 172 super-spec drilling rigs. It also creates a well completions business with deployed capacity of 45 active spreads and 3.3 million hydraulic fracturing horsepower, with nearly two-thirds of deployed fleets being dual fuel-capable.

OILFIELD SERVICE SECTOR

Oilfield service costs have increased over the past year, with operators reporting pricing increases of about 20%. Company representatives said they are experiencing a shift in inflation across different product lines after two consecutive years of price increases in drilling consumables (bits, fluids and tubulars) and drilling rigs. Operators said pressure pumping equipment, pressure pumping consumables, and completion and downhole tools saw the greatest price increases.

OFS diversification. Evercore ISI says the large oilfield service providers, including SLB, Baker Hughes and Halliburton, are well-positioned to harvest cash flow from the global upturn and selectively investing in the energy transition. The service industry is still in the early stages of this up-cycle, and visibility will improve for the next several years of revenue, EBITDA and FCF growth. The focus will remain on delivering returns above the cost of capital, moving margins and free cash flow higher, while leveraging new technologies.

Evercore also believes that the large OFS companies will continue to play a leading role in decarbonizing oil and gas operations and accelerating the energy transition for the industry. The role of natural gas and LNG as transition and destination fuels is also coming to the forefront. This should translate into additional LNG opportunities, especially in stable, lower-cost markets. Digitalization is also accelerating.

GOM O&G AUCTION

A federal judge ordered the Biden administration to expand its sale of Gulf of Mexico oil leases set for auction on Sept. 27, Fig. 5. The Louisiana-based judge concluded that the Interior Department was wrong to remove 6 million acres off the auction block. At issue is the department’s decision last month to reduce territory offered and impose traffic limits on vessels, in a bid to safeguard the habitat of one of the world’s most endangered whales. U.S. District Judge James Cain said, “the process followed here looks more like a weaponization of the Endangered Species Act than the collaborative, reasoned approach prescribed by the applicable laws and regulations.” An appeal by environmental groups on Sept. 26 was denied, leaving in place an order forcing the Biden administration to expand an upcoming sale of GOM offshore drilling rights.

GOM offshore wind lease. The U.S. Department of the Interior held the first-ever offshore wind energy auction for the Gulf of Mexico region on Aug. 29. The auction resulted in one lease area receiving a high bid of $5.6 million. RWE Offshore US Gulf was the winner of the Lake Charles Lease Area, which Interior says has the potential to generate approximately 1.24 GW of offshore wind energy capacity and power nearly 435,400 homes.

Meanwhile, Interior has approved the nation's first four commercial-scale offshore wind projects, held four offshore wind lease auctions—including a record-breaking sale offshore New York—staged the first-ever sales offshore the Pacific and Gulf Coasts, initiated environmental reviews of 10 offshore wind projects and advanced the process to explore additional wind energy areas in Oregon, the Gulf of Maine and Central Atlantic. BOEM’s lease sale offered two areas offshore Galveston, Texas, one comprising 102,480 acres and the other 96,786 acres, and a third area, 102,480 acres, offshore Lake Charles, Louisiana. The two Galveston lease areas offered did not receive bids.

OFS EMPLOYMENT

Employment in the U.S. oil field services and equipment sector increased by 1,949 jobs to its highest level since March 2020, to reach 666,965 in August 2023, according to preliminary data from the Bureau of Labor Statistics (BLS) after adjustments to July numbers and analysis by the Energy Workforce & Technology Council. The gains in August were made in four of the seven categories tracked by Energy Workforce. The August increase continues to bring the sector closer to a pre-pandemic number of 706,528 reported in February 2020. “Employment across the oil and gas industry continues to grow, indicating our continued demand for a skilled workforce. As demand for employees across the energy services and technology sector increases, the industry must continue to concentrate on growing our dynamic and sustainable workforce,” said Council President Molly Determan.

CAPEX FORECAST

North American spending is projected to increase 21% during 2023, which represents a significant acceleration of 292 basis points (bps) compared to the 18% growth projected in a December survey, says James West, senior managing director at Evercore ISI. However, this growth is significantly lower than the 43% increase experienced in 2022. Growth rates for privates, independents and majors in 2023 are expected to be 25%, 23% and 21%, respectively, but significantly lower than the 73%, 58% and 23% observed in 2022. NOCs are expected to experience more moderate growth rates of 11%, down from 16%, y-o-y. While the spending for NOCs is expected to slow compared to the December survey, it represents less than 1% of total U.S. spending, while independent operators, including private companies, account for 69% of all spending, and majors account for 31%. U.S. capex is projected to recover to pre-pandemic levels (within 3%) in 2023, surpassing levels last seen in 2010, heading into the shale revolution.

Shale investment booms. U.S. independent shale oil producers invested in output growth during the second quarter at the fastest rate in three years, a departure from the fiscal discipline that’s been the industry’s focus (Rystad Energy). Reinvestment rate surged 72% in the second quarter, a high not seen since 2020, according to the study focusing on 18 companies that collectively account for 40% of U.S. shale output. The cash injection comes as the steep drop in output from U.S. shale wells is more significant than expected. The rapid declines have forced producers to optimize operations to keep production from slipping further (Enverus).

EIA U.S. OIL/GAS FORECAST

The U.S. Eneargy Information Administration expects new milestones for U.S. crude production amid increased global petroleum demand and rising crude prices. EIA has forecast U.S. oil production to surpass 12.9 MMbopd for the first time in late 2023 and to exceed 13 MMbopd in early 2024. In its August Short-Term Energy Outlook, EIA forecasts U.S. production to average 12.8 MMbopd in 2023, which is 200,000 bopd more than in its July forecast. EIA expects sustained global demand for petroleum products, and Saudi Arabia’s extended voluntary production cuts will contribute to oil prices rising through the remainder of the year.

Oil price forecast. OPEC+ continued to reduce oil supply during a period of record demand, which was sparked by an increase in Chinese consumption and an uptick in petrochemical feedstock requirements. Global crude markets are forecast to have a supply shortfall of 1.2 MMbopd by year-end, as Saudi Arabia extended its production cuts, causing concern about commodity availability. The increased demand and reduced output caused EIA to predict Brent crude to average $93/bbl during fourth-quarter 2023, up from $86/bbl in August. EIA says a decline in global oil inventories in the coming months supports their Brent price. EIA expects Brent price to decrease to an average $87/bbl by second-half 2024, due to an increase in global crude inventories.

Natural gas production. EIA forecasts U.S. dry natural gas production to remain relatively stable for the remainder of 2023 and 2024. Dry natural gas output averaged more than 102 Bcfd during first-half 2023, which is a 6-Bcfd increase compared with the same period in 2022, Fig. 6. The agency predicts dry natural gas production will average 104 Bcfd through the end of 2024. Production has remained at relatively high levels throughout 2023, despite a decline in U.S. natural gas prices. The U.S. benchmark HH spot price averaged $2.41/MMBtu during first-half 2023, compared with an annual average of $6.42/MMBtu in 2022.

The Permian basin has driven the majority of U.S. natural gas production growth in 2023. EIA expects increased oil drilling activity to continue to drive greater natural gas production in the Permian, although these increases will be offset by some small production declines in other large producing regions. EIA forecasts an increase in gas production during fourth-quarter 2024, as new pipeline capacity comes online and demand for LNG feed gas increases, as developers expect two new facilities to come online at the end of 2024.

Natural gas prices. HH spot price is forecast to rise 19%/MMBtu for the remainder of the year. U.S. natural gas production has been relatively flat in recent months, a trend that is expected to continue for the rest of this year. This, combined with year-over-year growth in natural gas consumption, means U.S. natural gas inventories are expected to decline, putting upward pressure on prices.

The HH spot price has averaged below $2.50/MMBtu every month since February of this year. Last year, nominal prices averaged $6.42/MMBtu for the year. Lower gas prices in the first half of this year were a result of increases in gas production, lower-than-average consumption due to mild winter weather, and the resulting higher-than-average storage inventories. In June, the HH spot price averaged $2.18/MMBtu, the third month in a row it averaged below $2.20/MMBtu.

WORLD OIL U.S. FORECAST

Despite reduced Saudi and Russian supplies, demand recovery and a resulting increase in crude prices, operators working the various U.S. oil shale plays plan to moderately decrease drilling activity for the remainder of 2023. Overall, activity in the Texas shale plays will experience decreased activity in the second half of the year. Drilling in District 8 (Permian) is projected to decline 6%, while Districts 1 and 2 (Eagle Ford) are forecast to drop approximately 6% and 11%, respectively. Despite depressed natural gas prices, drilling on the Texas side of the Haynesville play will surge 25% on a y-o-y basis.

Gulf of Mexico. The offshore rig market is experiencing a long-awaited recovery, driven by increased demand and uncertainty caused by the Russia-Ukraine War. Contractors have more pricing power, as utilization rates approach the 90% range. The incremental demand increase is driving day rates higher across the global fleet at different depths, reaching $450,000/day for ultra-deepwater units and the latest-generation drillships. Rig attrition and corporate restructuring have significantly reduced sector costs, resulting in rising day rates, improved utilization and opportunities for increased shareholder return and debt reduction for rig companies.

In the Gulf of Mexico, it appears that offshore operators are poised to ramp-up activity in 2023 after last year’s modest decline, Fig. 7. Although World Oil’s survey results, and federal officials, predict well counts will decrease slightly during second-half 2023, y-o-y activity is more positive. World Oil forecasts that GOM activity totaled 77 wells in the first half of the year, with another 75 scheduled to be drilled during second-half 2023. However, the projected 152-well total will be 18% higher than 2022’s figure of 129. Total footage drilled should be up 18%, to 2.667 MMft on a y-o-y basis.

STATE-BY-STATE OUTLOOK

Texas. Every shale play in the Lone Star State will experience a decrease in activity during second-half 2023. On a half-over-half basis, World Oil predicts Texas activity will decline 9.6% during the second half of the year. However, on a y-o-y basis, Texas activity is forecast to increase 8% in 2023, compared to 2022’s total. Footage is projected to increase 9.5%.

In the Permian basin (Fig. 8), District 8 will be down 6% in second-half 2023, but its total will be 9% higher than the figure drilled in 2022. In Eagle Ford’s District 1 and District 2, h-o-h well and footage totals are projected to decline, but total wells drilled on a y-o-y basis tell a different story. In District 1, operators will drill 15% more wells in 2023, compared to the number spudded in 2022. District 2 will remain unchanged on a y-o-y basis. District 4 in the Eagle Ford will experience a 39% decrease between the two halves, and suffer a 9% y-o-y loss in well count during 2023. Depressed natural gas prices are the primary reason that gassy District 4 is in decline. Districts 7C and 8A will suffer h-o-h declines of 18% and 21% respectively, but y-o-y activity in District 7C will improve 12.6% in 2023 (653). Activity in District 8A will drop just 2.5% on a y-o-y basis.

Oklahoma. The SCOOP and STACK plays in southwestern Oklahoma continue to attract interest for hydrocarbon development. But the region’s inconsistent geology and less-than-ideal shale formations have produced unpredictable results. However, Kolibri Global Energy announced completion of two high-flowing Caney wells in its Tishomingo field in southern Oklahoma. The Barnes 8-1H and Barnes 8-2H initially flowed at 12-day average rates of 465 boed and 565 boed, respectively. These wells were the first down-spacing wells in the field, which were drilled at a six-well per section spacing pattern. Despite higher oil prices and high-flowing oil wells, World Oil forecasts that Oklahoma operators will drill 8.5% fewer wells in 2023, compared to last year, Fig. 9. Total footage is also forecast to drop with operators planning to make 7.6% fewer feet of hole, compared to last year.

Louisiana. In the state’s northern portion, we forecast operators developing Haynesville shale gas will drill 15% fewer wells in 2023 than they did in 2022, with total footage down approximately 30%. With natural gas prices hovering around $2.5/MMBtu, the decrease in activity could continue, similar to the Haynesville play in Texas RRC District 6. Despite depressed natural gas prices, operators continue to drill and archive DUCs in the Haynesville play. In August, the DUC count stood at 789, a 54% increase on a y-o-y basis. In the mature, shallow oil plays of southern Louisiana, we expect operators to drill 17% fewer wells, compared to last year. Well footage is expected to drop 16% on a y-o-y basis.

North Dakota. Transportation issues remain a challenge in this oil-rich shale play, but a greater concern is the sweet spot has reached maximum infill development. However, higher oil prices will help negate the cost of drilling the 21,100-ft wells. Considering these factors, along with data from state officials and World Oil operator surveys, we forecast that drilling will be up 4% in 2023, with total footage increasing 3%, on a y-o-y basis.

Northeast (Pa./W.V./Ohio). In the Northeast, depressed natural gas prices have slowed Marcellus activity. However, LNG exports from Dominion Energy’s massive Cove Point facility will enable two of the three major gas producing states in the Northeast to experience an increase in drilling activity, Fig. 10. Operators tapping the shale reservoir in Pennsylvania will decrease the number of wells drilled this year by 22%, compared to the figure in 2022. Total footage for 2023 is projected to slump 21%. But in Ohio, operators working in the Utica play plan to focus on condensate production, with this year’s total well count of 9% higher than last year’s level. Footage is forecast to increase as well, up 3.8%. In West Virginia, World Oil forecasts that operators will maintain the first-half drilling rate duing the second half, while spudding 17% more wells than in 2022. Footage also will be up 17% on a y-o-y basis. Due to depressed natural gas prices, operators working the shale fields of Appalachia were forced to increase their DUC inventory 27% on a y-o-y basis. In August, the DUC tally stood at 714, 152 more wells than reported in August 2022.

Midwest. There are approximately 32,100 oil and gas wells, 10,500 Class II injection wells and 1,750 gas storage wells producing from 650 fields in Illinois. These wells are controlled by 1,500 operators. There is oil production in 40 of the 102 counties, mainly in the southern part of the state. Operators working the mature fields plan to drill 9% more wells than what they spudded in 2022. Unfortunately, World Oil forecasts a 23% decline in total footage, as operators seek to reduce costs while maximizing oil production. In Kansas, much of the shallow drilling in the Hugoton basin appears to stay below the Baker Hughes rig count radar. According to the Kansas Corporation Commission, drilling in the Sunflower State is projected to decrease 15% in 2023, compared to the 2022 total. However, footage is forecast to increase 3%.

Rocky Mountains. The DJ basin of Colorado accounted for 7% of oil and 6.7% of natural gas production in the U.S. Lower 48 during 2020. Production peaked in November 2019 at 801,500 bopd and 5.8 Bcfgd. Since then, it has experienced a constant decline. The Covid-19 outbreak and subsequent restrictions on economic activities further affected production in the basin. The basin averaged 53 rigs in 2019 but decreased to an average 17 rigs in 2020, a drop of 68%. Overall production is still declining in the region, and with an unfavorable political climate and restrictions on leasing activities on Federal land, this trend is expected to continue. The DUC count in the Niobrara continues to lead the U.S. with a y-o-y increase of 112.

In Colorado, state officials continue to attempt to severely limit drilling in the state. In 2019, Colorado passed Senate Bill 118, “which fundamentally altered the oil and gas industry’s future in the state,” according to Colorado Governor Jared Polis. Most recently, the state is pushing to repurpose oil and gas regulators to include a broader scope of work. Since its creation in 1951, the Colorado Oil and Gas Conservation Commission approved drilling permits and supervised completion practices. That role has put the governor-appointed panel at the center of countless conflicts related to climate change and the local impact of fossil fuel extraction. Now, a bill introduced by Democratic lawmakers in April would give a new title to the seven-member committee: the Energy and Carbon Management Commission.

However, it appears companies intend to push back against partisan politics and continue operations on existing leases, albeit at a reduced pace. World Oil expects operators in Colorado to drill 13.6% fewer wells than they did in 2022. Total footage is projected to decrease 12.3%.

In 2019, a federal judge ordered a halt to exploration on 300,000 acres in Wyoming, saying the government must account for its cumulative effect on climate change. The ruling came in a lawsuit filed by a pair of environmental groups, challenging the BLM’s decision to lease federal lands for energy development in the state. In September 2022, U.S. District Judge Scott Skavdahl affirmed the government's right to pause gas and oil lease sales to consider the environmental impacts of any subsequent drilling. The ruling was that a challenge launched by the state, alongside oil and gas industry groups, failed to show the U.S. Interior Department violated the Mineral Leasing Act (et al) when delaying leases in the state in 2021. It appears the legal action is slowing activity in the state, with operators planning to decrease drilling in Wyoming 3%. However, somewhat surprisingly, footage should increase 2%.

Drilling activity in Utah is forecast to remain relatively steady in 2023, with operators projected to spud 2% fewer wells than drilled in 2022, Fig. 12. However, companies will increase the footage total 1.6%, as operators drill deeper and push the length of horizontals to increase ROI.

A late-comer to the Permian boom, acreage in New Mexico has become as desirable as land on the Texas side of the Permian basin. Increased completion efficiencies in the Bone Springs formation will help support activity, as drilling in the Land of Enchantment is forecast to see an increase of 3.8% on a y-o-y basis for 2023. Total footage will increase 3.7%, y-o-y.

In California, it appears the remarkable Elk Hills field in western Kern County is starting to decline and can no longer support elevated development activity. The giant field was discovered in 1911 and has cumulative production of more than 1.3 Bbo. After 112 years of production, operators working around the Bakersfield area will spud 58% fewer wells in 2023. Total footage is also forecast to experience a 58% decline. With no new discoveries and an unfavorable political environment, operators working the Golden State will be forced to survive by maintaining less-attractive heavy oil fields and residual acreage from long-ago discoveries. Drilling offshore California (Fig. 13) will be unchanged on a y-o-y basis, with only three wells expected in 2023, the same as in 2022.

In Alaska, a federal judge declined to block progress on the Willow oil drilling project while lawsuits against the prospect proceed. The Biden administration approved ConocoPhillips’ extensive Willow project on Alaska’s North Slope in March. At completion, the project will provide 100,000 bopd, $10 billion in revenue for state, local and federal governments during its lifespan, 2,000 construction jobs and 300 permanent jobs. It appears the prospect of opening new onshore acreage is having the desired effect. Onshore activity on the North Slope is projected to increase 5%, up to 121 wells, with total footage up 7.5%. However, offshore work is forecast to decline 18% with nine wells forecast for 2023, two less than spud in 2022.

Others. We forecast activity in other producing states will be a mix of gainers and decliners. Drilling will increase on a y-o-y basis in Montana up six wells to 65, while Tennessee will be up one well to 78. Nebraska will jump four wells to 60, while Alabama will enjoy a three well increase up to 27. Activity declines are forecast in Mississippi, down two to 56, Kentucky will drop 17 to 99, New York will decline 15 wells to 38 and Arkansas will have 30 wells drilled in 2023, 13 fewer than in 2022.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)