U.S. producing gas wells increase despite low prices

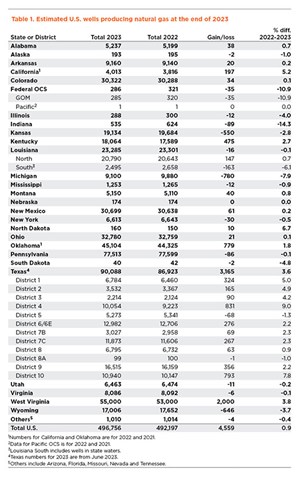

Active natural gas wells saw a slight increase in the U.S. during 2023 of 0.9%, to 496,756 total wells, compared with 492,197 in 2022, Table 1. Accordingly, total marketed gas production in the U.S. also saw an increase. The numbers are good, considering that gas prices have been low over the last year. However, some of the increased output from the increased number of active gas wells has gone toward LNG exports.

The top five states for active gas producers are Texas, Pennsylvania, West Virginia, Oklahoma and Ohio. Together, these states account for 60.5% of active U.S. gas wells, totaling 300,485.

Texas had one of the better percentage gains in number of active gas wells last year, and in terms of actual numbers, the state had the biggest gain in the country. Texas producing gas wells increased 3.6% to 90,088. According to Railroad Commission figures, 10 out of 12 districts achieved increases. And even in the two districts where there were declines—5 and 8A—the reductions were only 1.3% and 1.0%, respectively.

The five areas with the greatest numbers of active gas wells continue to be Districts 9 (northern Texas, 16,515 wells); 6/6E (East Texas portion of Haynesville shale); 7C (eastern portion of the Permian basin, 11,873 wells); 10 (Texas Panhandle, 10,940 wells); and 4 (deep South Texas and part of Eagle Ford shale, 10,054 wells). District 4 had the largest numerical gain, with 831 wells added. District 4 also had the largest percentage gain at 9.0%. District 10 was second in both categories, with 793 wells added and a 7.8% gain.

Southeast. In Louisiana, the number of producing gas wells remains largely the same, albeit a slight decline of about 0.1%. Total well count for 2023 was 23,285, with a loss of about 16 wells from the previous year. Northern Louisiana, which includes a majority of the Haynesville shale, posted a slight increase of nearly 1%, tallying 20,790 wells. Meanwhile, southern Louisiana’s active well count suffered a 6.1% decline, down to 2,495. In other parts of the region, there was very little change. Arkansas was up 0.2%, with 9,160 gas wells. Alabama also improved, gaining 0.7% to 5,237 wells. Mississippi experienced a small loss, falling 0.9% to 1,253 wells.

Northeast. As the leader of the region and second-ranked state in the U.S. for active gas wells, Pennsylvania experienced a very tiny loss of 0.1%, equal to 86 wells and a total of 77,513. The fact that the well count did not grow can be traced partially to a 24% drop in the Keystone State’s drilling during 2023, as operators cut back activity in reaction to low gas prices. In neighboring West Virginia, gas producers increased 3.8%, to 55,000, despite drilling declining 13%. Some of the gain may be due to operators completing DUCs, as well as inactive wells being put back online. Ohio inched up 0.1%, to 32,780 wells, while Virginia slipped 0.1%, to 8,086 wells, as CBM drilling remained fairly low. New York state saw its active gas wells dip a half-percentage point to 6,613.

Midwest. The regional leader in active gas well population is Kentucky. It also posted the only gain among the four significant states in the region, tallying 18,064 wells for a 2.7% increase. Meanwhile, Michigan had a rather severe 7.9% loss of 780 wells for a new total of 9,100. Last year’s low gas prices are believed to have exacerbated the situation. Down in Indiana, gas producers in the southwestern portion of the state’s share of the Illinois basin declined 14.3%, to 535 wells. Speaking of Illinois, that state’s share of its namesake basin experienced a 4.0% reduction in active gas wells to 288.

Mid-continent. Oklahoma and Kansas are the major contributors to gas production in the region. In Oklahoma, active gas wells increased 1.8%, to 45,104, much of it in the Arkoma basin. Meanwhile, in Kansas, much of the gas production remains in the Hugoton field area in the southwestern part of the state. Gas producers there fell 2.8%, to 19,134 active wells. And North Dakota remains a small source of activity, the state nevertheless still posted a respectable 6.7% gain during 2023, totaling 160 gas producers. Nebraska remained exactly even with 2022’s gas producer count at 174 active wells.

Rocky Mountains. Leading the region in gas producers, New Mexico also has the sixth-largest active gas well population in the U.S. Last year, New Mexico’s gas producers edged up 0.2%, to 30,699, adding wells in both the northwestern (San Juan basin) and southeastern (Permian basin) parts of the state. To the north , Colorado saw its gas producer count increase 0.1%, to 30,322, thanks primarily to activity in the DJ and Piceance basins. In Wyoming, where drilling last year was even to slightly lower, active gas wells fell 3.7%, to 17,006. This production is primarily in Sublette, Sweetwater and Converse counties. Utah’s gas producers slipped 0.2%, to total 6,463 wells.

Federal waters. In the Gulf of Mexico, active gas wells decreased nearly 11% in 2023, to 285, as several years of below-par drilling took their toll. This year, operators hope to stem the tide, stop the loss of gas wells and begin to add back to the gas well population. Meanwhile, on the Pacific OCS, production from gas wells is minimal, with one active well reported.

Related Articles

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)