Prices and governmental policies combine to stymie Canadian upstream growth

The oil and gas industry is known for its cyclical nature, wild market swings, and unpredictability. Companies do what they can to establish stability, because the apex of the cycle can be so lucrative. But what strategy can companies employ when they are besieged by their own elected officials?

As Canada’s Liberal government, propped up by the left-wing New Democratic Party, has watched its popular support plummet, it has introduced increasingly punitive measures targeting fossil fuels and the companies that extract and develop them, Fig. 1.

Most recently, it unveiled its latest salvo, a cap-and-trade system that would apply not only to greenhouse gas emissions, but also to upstream oil and gas facilities. This despite the fact the Canadian government has already lost a ruling from the Supreme Court of Canada that determined the federal impact assessment act (Bill C-69) was largely unconstitutional, due to its overreach into provincial jurisdiction.

The original court challenge was filed by Alberta, with the support of Saskatchewan and Ontario, three First Nations, and the Indian Resource Council, founded in 1987 by chiefs representing oil-and-gas-producing First Nations. The feds challenged the original Alberta Court decision that originally ruled the act was unconstitutional in 2019.

In response to this and other issues, such as lack of market access (largely due to the federal government’s unwillingness to approve any new international or national pipelines), Canadian producers are spending their dollars elsewhere. Reinvestment in the Alberta oil patch reached an all-time low in 2022, after first dropping below a 1:1 ratio in 2017. The negative impacts to the Alberta economy and long-term stability of the industry in the province have been enormous.

Despite all the uncertainty, there are some bright spots. Spending appears to be trending upward. The governments of Alberta and Saskatchewan have said they would battle Ottawa’s attacks on the industry, and they have. The new administration in British Columbia is proving to be more reasonable and willing to look at creative ways to boost both provinces’ fortunes without compromising environmental protection, like finding ways to foster the development of the infrastructure necessary to bolster Canada’s burgeoning LNG export industry. And U.S. President Biden’s recent decision to pause approvals of new licenses to export LNG has opened another door for Canada to step up and meet global demand.

BLENDING O&G WITH OTHER ENERGIES

Global hydrocarbon demand projections vary, but all credible sources point to continued growth for decades to come. As global attitudes have shifted back to accepting this reality, the Canadian industry is well-positioned to take a big step forward on the international stage, provided they get support at home.

Interest is also ramping up in green energy options that augment oil and gas operations while reducing their environmental impacts. Alberta’s current expertise in hydrogen, renewable fuels like diesel, and carbon dioxide sequestration, provides a competitive advantage that Canada would be wise to exploit.

In addition, the possible use of nuclear power has resurfaced, particularly Small Modular Reactors (SMRs) that could potentially be used to offset the use of other power sources (usually natural gas) as a feedstock for large oil projects, like those in the oil sands.

In 2022, Alberta, Saskatchewan, Ontario and New Brunswick released a strategic plan regarding eventual SMR development. Alberta’s Cenovus Energy Inc. plans to conduct a comprehensive study, supported by the province. Cenovus will assess SMR technologies, plus site and economic viability, as part of its commitment to achieving net-zero operations by2050. But overcoming public resistance to nuclear power in Western Canada—where no nuclear plants have ever been constructed—will be difficult, and critical to any future development.

On a broader basis, the Pathways Alliance—a consortium of Canadian oil sands producers with a target of net zero emissions by 2050—continues work to develop a carbon capture storage hub and a 400-km (249-mi) trunkline to transport CO2 from the oil sands area in northwest Alberta to a hub in Cold Lake. The consortium consists of six companies: Imperial Oil Limited, Canadian Natural Resources Limited, Suncor Energy Inc, Meg Energy Corp., ConocoPhillips, and Cenovus.

As market access continues to exert downward pressure on oil and gas prices in Western Canada, crude-by-rail exports remain very high, exceeding 167,000 bpd in November 2023.

CAPITAL SPENDING

In the meantime, spending projections are mixed for the year ahead. Some industry analysts are very bullish: Enserva, formerly called the Petroleum Services Association of Canada, is projecting a 10.5% increase in Canadian capital expenditures. Global spending projections are trending upward as well, but others caution that a potential recession could negatively impact demand and commodity prices, leading to reductions in budgets overall.

Based on 2024 spending plans from some of Canada’s largest companies, it appears the optimism may be justified. Suncor has announced a budget of C$6.3-6.5 billion, up more than 12% from last year’s estimated C$5.4-5.8 billion; CNRL, at $5.4 billion, up just under 4% from its estimated $5.2 billion in 2023; Cenovus, with a projected spend of $4.0 - $4.5 billion, which is almost identical to its spending last year, and Imperial Oil has announced it will spend $1.7 billion this year, which is identical to its estimated expenditures in 2023.

M&A ACTIVITY

Strong oil prices, mixed with political instability, also created a favorable environment for deals in 2023. The total value of M&A activity in the Canadian oil patch was approximately $16.4 billion, up 6.5% from $15.4 billion in 2022, according to Calgary-based Sayer Energy Advisors.

There were five deals in 2023 worth more than $1 billion, totaling $11.7 billion. The largest of the five transactions was ConocoPhillips’ acquisition of TotalEnergies EP Canada Ltd.’s stake in the Surmont oil sands project and associated assets for $4.4 billion in April; Crescent Point Energy Corp. acquired Hammerhead Energy Inc. for approximately $2.7 billion in November; Crescent Point also purchased the Montney assets of Spartan Delta Corp. for $1.7 billion in March; TotalEnergies EP Canada divested the remainder of its Fort Hills oil sands stake to Suncor Energy Inc. for just under $1.5 billion in October, and Tourmaline Oil Corp. acquired Bonavista Energy Corporation for approximately $1.5 billion, also in October. In January 2024, Tourmaline announced its intent to divest the Duvernay assets it picked up in that deal.

PRODUCTION

Producers continue to benefit from the low Canadian dollar, which continues to hang around the US 75-cent mark this year versus the U.S. dollar. A low Canadian dollar provides a buffer for the export-driven oil and gas industry, which ships substantial volumes of oil and gas south to U.S. customers.

The Canadian Association of Petroleum Producers (CAPP) released figures that indicate the country’s oil production may have hit a new record-high at 5.04 MMbpd during 2023, Fig. 2. Active producing oil wells totaled 73,048, including 108 offshore. Natural gas output averaged 18.3 Bcfd.

DRILLING

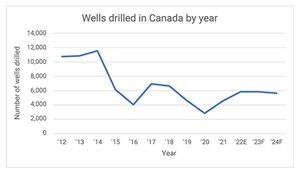

After a very strong start to 2023, drilling dropped off as the year progressed. Overall, according to the Daily Oil Bulletin (DOB), there were 5,776 wells drilled last year, down 3.2% from the total of 5,969 in 2022. Approximately 80% of the wells targeted oil.

In Alberta, said DOB, there were 3,384 wells drilled, down just over 5% from 3,577 in 2022. In Saskatchewan, drilling was down just over 11% to 1,338 wells versus 1,510 the previous year. British Columbia saw activity jump by almost 38% to 513 wells drilled, compared to 373 wells in 2022. And Manitoba had 153 wells, a decrease of almost 33% from 227.

For 2024, the Canadian Association of Energy Drilling Contractors is predicting that drilling will increase over 8%, to 6,229 wells, with a similar increase in employment levels.

World Oil survey results are less optimistic. The Canadian Association of Petroleum Producers is projecting drilling to decrease about 8% to 5,380. British Columbia is forecasting drilling will remain flat this year, while the Alberta, Saskatchewan and Manitoba provincial governments did not respond to the opportunity to submit a survey. World Oil, itself, is somewhere between the various estimates, calling for a 3.1% decline to 5,650 wells, Fig. 3.

LAND SALES

Land sale totals were relatively flat in 2023, although activity heated up toward the end of last year. British Columbia land sales have not resumed since the 2021 Supreme Court ruling on the Blueberry River First Nation’s challenge to BC’s resource development policies. Any resumption there should provide a boost, although when that will occur is unknown.

In Alberta, spending dropped slightly last year, with $434.4 million collected ($498.68/hectare), a drop of 5.4% from last year’s total of $459.37 million ($474.26/hectare). Saskatchewan saw a surge of almost 43% in 2023, to $74.66 million ($322.23/hectare), compared to $52.25 million ($689.93/hectare) in 2022.

And Manitoba garnered $544,319 last year ($181.28/hectare), down more than 17% from $656,523 ($254.86/hectare) in 2022. Land sale levels will provide a good measuring stick for future activity as 2024 unfolds.

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)