U.S. drilling: More of the same expected

During second-half 2023, an unprecedented number of mergers and acquisitions took place, with a variety of multi-billion-dollar deals involving large operators announced. These were highlighted by ExxonMobil's takeover of Pioneer Natural Resources and Chevron's acquisition of Hess Corp. There were $388 billion in M&A transactions in the U.S., valued at $100 million and above, announced by U.S. energy companies. This activity drove 34% of fourth-quarter 2023’s total U.S. deal value.

These strategic acquisitions were driven by robust oil prices, which substantially bolstered cash flow and profitability. The energy industry saw contracts for large transactions of over $100 million surge 83%, compared to 2022, with a major push at the end of the year. The number of deals in fourth-quarter 2023 was up 228%, compared to fourth-quarter 2022, according to Bruce On, Principal in Ernst & Young’s Strategy and Transactions practice.

As we start 2024, more major consolidations are expected. Record profitability has helped fund these mergers, which are driven by a surge in post-pandemic demand, geopolitical tensions affecting supplies, and improved structural performance in the businesses. The wave of consolidations is being driven by companies focusing on securing additional current and future production, while ensuring increased profitability through synergies achieved by eliminating redundant costs and optimizing operations. We foresee many deals contemplating significant margin gains through optimization in supply chain and procurement, field development, drilling and ESG.

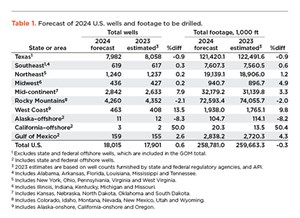

Accordingly, we expect U.S. drilling to remain flat with last year’s level, but read on further for additional factors, Fig. 1.

GEOPOLITICAL ISSUES

Oil prices should remain high and broadly stable, year-on-year, due to OPEC’s 2.5-MMbopd reduction and continued geopolitical unrest in the Middle East and Ukraine. Despite these disruptions, global oil demand grew by 2.3 MMbopd in 2023 and should cross the 100-MMbopd consumption mark for the first time in history (IEA). However, spare OPEC capacity should be sufficient to absorb potential shocks.

These circumstances, combined with supply issues exacerbated by the war in Ukraine, have created a unique set of economic, geopolitical and trade policies that have triggered significant disruption in the broader energy market. Traditionally, energy trade flows have been driven by market forces, specifically the interplay of supply and demand and the availability of storage and transportation infrastructure. But since the onset of the Russia-Ukraine war, disrupted trade flows have affected price differentials and regional industrial competitiveness. The situation evolving in the Middle East and the Red Sea is emerging as a significant geopolitical risk to oil markets that may have major implications for trade, if the situation escalates further.

ESG FOCUS FADING

Although some companies continue to invest in clean energy alternatives, their direct spending on low-carbon technologies, excluding investments to reduce emissions from operated assets, constitutes only 4% of their upstream capex (IEA). The global upstream industry is expected to generate $2.5 trillion to $4.6 trillion in free cash flows from its hydrocarbons business between 2023 and 2030—so, lack of capital is not an issue. Instead, the challenge is introducing innovation while maintaining profitability and shareholder value (Rystad).

However, the frequency of ESG conversations about ROI and shareholder alignment in E&P company boardrooms has remained consistent (Evercore ISI). About 62% of survey participants noted a slight increase in conversations during 2023. Although conversations have yet to slow or decline, approximately 38% noted the frequency of conversations is unchanged, suggesting growing interest in ESG may soon peak. In any case, analysts expect operators to continue exhibiting capital discipline with ESG.

U.S. companies committed to hydrocarbon production. While some global supermajors and state-owned companies are positioning themselves as renewable and energy companies, U.S.-based operators remain committed to oil and gas. A record 93% are not likely to expand their resource base to include renewables, while 7% are somewhat likely. No survey respondents indicated they are more likely to seek additional ESG revenue streams in the near-to-medium term.

SPENDING UPTURN

Global E&P spending is projected to increase 5% in 2024, compared to 11% in 2023. While growth is decelerating in both North America and internationally, spending trends remain positive, with the globally coordinated upturn entering its third year. North American growth will slow 2% in 2024 from 19% in 2023. However, North American E&Ps achieved record 44% growth in 2022, driven primarily by improved balance sheets and robust cash flows. However, slower-than-expected demand growth in China, combined with concerns about an economic downturn and egress constraints, has prompted several companies to reduce capex.

While capex growth in North America should continue, data suggest further moderation in 2024, with a forecasted increase of 2.2% in the U.S. (Fig. 2) and 2.3% in Canada. This implies a third consecutive year of spending upturns. In the U.S., spending levels have recovered from the depths of the 2009 financial crisis and have also surpassed more than half of the historical peak in 2014, while Canada is currently running at one-third of its historical peak.

Cash flow remains the key determinant for E&P spending. For the eighth consecutive year and the ninth time in ten years, cash flow is the key factor for 2024 E&P spending. Oil price continues to rank second, while the natural gas price moved up to fourth from fifth last year. Service costs remained third, while service availability slipped from fourth to seventh place. However, service availability was the most cited potential bottleneck for E&Ps to miss their production targets in 2023, which appears to be a lesser problem in 2024.

Carbon-reducing technologies. Companies have expressed a commitment to reducing carbon emissions and are willing to pay a premium of up to 10%, a slight decrease from the 2023 figures, when 55% were willing to pay a premium. Notably, no respondents were willing to pay more than 10%–20% extra for carbon-reducing technology in 2024, but there was a record 22% willing to pay within the 10%-20% range in 2023. Similarly, no participants were willing to pay 20%-30% more in 2024, aligning with the 2023 findings.

Digital transformation. The industry has been developing digital technologies to increase efficiency, reduce costs, and advance safety and sustainability measures. Most recently, artificial intelligence (AI) has emerged as a potential transformative technology, with applications across the value chain. AI-driven predictive maintenance is instrumental in achieving multiple objectives, including cost reduction, heightened productivity and the assurance of operational reliability. The value created by generative AI (GAI) for the industry can be categorized into four dimensions: 1) cost reduction; 2) enhanced process efficiency; 3) creation of new revenue streams; and 4) ultimately culminating in the acceleration of innovation-led change within the company (Deloitte):

- Cost reduction. GAI-driven solutions could aid companies in cutting operational costs, especially in addressing challenges related to unplanned downtime.

- Process efficiency. GAI could enhance efficiency by integrating and analyzing diverse data sources.

- Revenue expansion. GAI can help pave the way for increased revenue generation. It has the potential to optimize the exploration of high-yield reserves and enhance recovery from the existing ones. The collaboration between Shell and SparkCognition employs deep learning for subsurface imaging to unlock new areas and drastically shortens exploration timelines from nine months to less than nine days.

- Accelerating innovation. GAI can expedite the development of new solutions by enabling rapid testing of innovative ideas and concepts.

The abovementioned factors, along with World Oil’s surveys of operators and state agencies, have all shaped this cycle’s U.S. forecasting process. Accordingly, World Oil’s editorial staff presents its 2024 E&P forecast, as follows:

- U.S. drilling will increase 0.6%, to 18,015 wells.

- U.S. footage will decrease 0.3%, to 258.8 MMft of hole.

- U.S. Gulf of Mexico activity should improve 2.6%, to 159 wells.

U.S. MARKET FACTORS

Capex. Expanding on the robust growth seen in 2023, North American (NAM) spending is expected to increase 2.2% in 2024, surpassing pre-Covid levels, says James West, senior managing director at the Evercore ISI investment firm (see Capital Spending article). Within NAM, the U.S. is poised to lead once again, with a projected spending increase of 2.2%, while Canada should experience an uptick of 2.3%. In NAM, independents and private operators play a significant role, contributing to 70% of the region's capex. Following the Covid-19 pandemic, private operators were quicker to boost their spending, whereas publicly traded independents focused on strengthening their financial positions and prioritizing shareholder returns. Analysts foresee a potential shift in this trend as private operators begin adopting a more fiscally cautious approach with the rise in service cost inflation.

Although private operators constitute 18% of estimated U.S. capex, they make up 53% of the rig count. This suggests that overall U.S. spending might exceed estimations. Based on analysis, private companies’ capex increased 14.4% during 2023 in the U.S., a substantial drop from the 67% increase of 2022. This growth is expected to slow further to a 6.8% increase in 2024, compared to 2.7% for independents. Majors in the U.S. are expected to show more restrained growth of 0.8%, while Canada is anticipated to experience accelerated growth of 25.6%. At the current 2.2% growth rate, it would take over a decade for NAM's capex to reclaim its historical peak, hit in 2014.

U.S. oil production continued to rise in 2023 despite the year-long reduction in drilling activity, reaching an all-time high of 13.1 MMbopd in October, surpassing its previous record set in September by 53,000 bopd (EIA). Output surpassed the previous high set in November 2019 of 13.0 MMbopd. U.S. crude has played an increasingly vital role in global oil markets, due to OPEC+ leaders Saudi Arabia and Russia extending production cuts. The U.S. has routinely shipped about 4.0 MMbopd overseas to fill the gap caused by the tight market.

Annual U.S. crude production growth likely peaked at 1.6 MMbopd in 2018, which capped off record production growth of nearly 3.0 MMbopd over two years from strong spending in the Permian basin. (Evercore). U.S. spending growth slowed to 19% in 2023 from the mid-year prediction of 21%. Despite this, projections suggest a 1.0 MMbopd increase in U.S. crude oil production for 2023. Notably, U.S. offshore production remained steady throughout the year but experienced a 6% y-o-y increase, reaching a year-to-date average of 1.8 MMbopd. Assuming no unforeseen disruptions affect production, the offshore sector is poised to contribute to EIA’s forecast of 250,000-bopd growth in U.S. crude output in 2024.

Oil price expectations have increased since mid-year 2023, with companies expecting West Texas Intermediate to average $77/bbl, up $3/bbl in 2024. After hitting a 10-year high of $122/bbl in June 2022, due primarily to a combination of the war in Ukraine and the economic recovery from the pandemic, crude oil price rapidly declined to the mid-$60s, due to a weaker economic outlook in China and recessionary concerns. Fears of an economic slowdown, combined with the surprise OPEC+ supply cuts and the war in Israel, increased oil price volatility in 2023. Operators expect oil prices in 2024 to trend at current spot levels, as ongoing OPEC+ production cuts will offset production growth from non-OPEC countries, driving a healthier supply-and-demand balance.

EIA forecasts that crude prices in 2024 and 2025 will remain near their 2023 average, because global supply and demand for petroleum liquids will be relatively balanced over the next two years. The agency expects Brent to average $82/bbl in 2024, with WTI slightly lower but generally following the same price path. Evercore ISI forecasts WTI oil prices to average $76 in 2024, supported by a steady upcycle driven by constructive fundamentals on both the demand and supply sides of the equation. However, if WTI drops to $75/bbl, operators indicate they will consider adjustments to their 2024 capex plans.

Natural gas supply and demand. EIA forecasts supply of natural gas, including production and imports, to increase 1 Bcfd in 2024. Natural gas demand, including domestic consumption and exports, will rise 2.0 Bcfd, with demand growth mostly the result of increased pipeline transportation and LNG exports. The modest natural gas supply growth in EIA’s 2024 forecast is driven by a 1.5-Bcfd increase in production, offset slightly by a 0.4-Bcfd decrease in imports. The U.S. will start 2024 with 14% more natural gas in storage than the previous five-year average, and inventories will remain high enough to limit significant upward pressure on prices.

Natural gas price. EIA forecasts natural gas to average under $3/MMbtu at Henry Hub in 2024. Record gas production, and storage inventories that remain above the 2019–2023 average, mean that gas prices in our forecast are less than half the relatively high annual average price in 2022. The HH spot price is forecast to average between $2.60/MMBtu and $2.70/MMBtu in 2024, an increase of about $0.10/MMBtu from 2023.

LNG outlook. The U.S. has become the world’s biggest exporter of liquefied natural gas (LNG) for the first time, with 2023 shipments overtaking leading suppliers Australia and Qatar. The U.S. exported 91.2 million metric tons of LNG in 2023, a record for the country, according to data through Dec. 31. The expanded output was due to last year’s restart of Freeport LNG in Texas, which had been shuttered for months following a June 2022 fire and explosion. In 2024, two new LNG projects in the U.S. are due to start production: Venture Global LNG’s Plaquemines facility in Louisiana and Golden Pass in Texas, a joint venture between ExxonMobil and QatarEnergy. At full capacity, the two projects would add another 38 million tons per year of U.S. export capability.

In 2023, U.S. LNG exports averaged 12.0 Bcfd. In 2024, with the two new LNG export projects coming on-line, EIA expects LNG exports to increase to 13.3 Bcfd. U.S. LNG exporters used 98% of their nominal capacity in 2022, mainly because of the outage at the Freeport LNG facility in Texas and the ramp-up period of the new Calcasieu Pass LNG export facility in Louisiana. EIA expects U.S. LNG exporters to use 105% of nominal capacity in 2023 and 108% in 2024. These utilization levels are equivalent to 88% and 90% of peak capacity in those years. The start-up timelines for the two new U.S. LNG export projects are a significant source of uncertainty in the EIA forecast. It remains to be seen whether President Biden’s sudden pause in LNG export licensing during January will stick and whether it will damage U.S. LNG efforts.

OFS pricing. The majority (68%) of operators entered 2023 expecting service prices to increase. A fundamentally strong global economy was driving higher pricing expectations for labor, tubulars and transportation. Oilfield service companies had only begun to implement pricing increases for select products and services in 2021, carving back substantial savings passed on to operators during the pandemic. Higher pricing peaked in 2022, with 39% of operators experiencing broad service pricing increases.

In 2024, 50% of operators expect a price increase in 2024, a decline from 68% in 2023 and a significant decrease from 85% in 2022. The remaining 50% of operators expect pricing to remain stable, increasing from 32% of them y-o-y. For the third consecutive year, labor is a leading concern, with 75% foreseeing pricing increases in 2024, compared to 77% in 2023. In 2022, a robust global economy drove high expectations, with 89% anticipating price hikes for labor, followed by tubulars at 84% and transportation at 78%. However, geopolitical events, including the war in Ukraine, renewed Covid-related lockdowns and increased interest rates, have introduced economic risks, tilting the landscape toward a potential global recession. Consequently, 8% and 23% of operators in 2023 anticipated pricing declines for transportation and tubulars, respectively. With rising concerns about a global recession in 2024, respondents have become more cautious.

Drilled-but-uncompleted. Lower U.S. drilling activity is starting to cause a reduction in the overall DUC count on a y-o-y basis. In December 2023, there were 4,374 DUCs in the U.S., 203 less than reported in December 2022 (4,577). Over the last several months, the build in specific DUC inventories has moderated, with four of the seven regions showing y-o-y declines. The Bakken, Eagle Ford, Permian and Anadarko regions experienced y-o-y changes of -39%, -31%, -22% and -2% in their DUC inventories, respectively. However, large year-over-year gains were reported in gas-dominated regions. In Appalachia, DUCs are up to 768 (+24%); the Haynesville reported 735 (+21%), and the Niobrara count reached 667 (+27%). These three regions account for 50% of the total U.S. DUC inventory.

U.S. RIG COUNT

Since hitting an all-time low of 244 rigs in August 2020 during the Covid event, the Baker Hughes U.S. rig count steadily improved, topping out at 784 the week of Nov. 23, 2022. At the start of 2023, the U.S. count stood at 772, and climbed three rigs the following week to 775, the high mark for the year. The count steadily deteriorated throughout the year before bottoming at 616 the week of Nov. 10, 2023. The 159-rig loss represents a 21% reduction in total U.S. drilling activity over the 10-month period. After bottoming, the rig count climbed slightly during the remainder of the year, hitting 626 the week of Dec. 8. As of Feb. 2, 2024, the rig count stood at 619, suggesting that U.S. drilling activity will remain below 700 during the remainder of 2024 at current commodity prices.

U.S. WELLS FORECAST/TRENDS

Given the aforementioned indicators, along with our surveys of operators and state agencies, World Oil predicts that U.S. drilling will increase 0.6%, to 18,015 wells in 2024. However, we expect footage drilled to decline slightly, with 258.8 million feet of hole expected, a decrease of approximately 0.3%, Table 1.

U.S. GULF OF MEXICO

With the hard push to convert to renewables fading, operators working the U.S. Gulf of Mexico (GOM) are once again focusing on the high ROI that these monumental offshore prospects offer. There is an onslaught of good news and positive indicators that suggest operators are poised to increase offshore development in 2024 and beyond. Accordingly, we expect a 2.6% increase in wells drilled (159) and a 4.3% increase total footage during 2024, Fig. 3. Although these are relatively small gains, two major operators are setting the stage for decades-long involvement in the prolific offshore venue.

Talos Energy successfully started oil and natural gas production at its Lime Rock and Venice discoveries, located near its 100% owned and operated Ram Powell platform in the U.S. Gulf of Mexico. The Lime Rock and Venice wells were brought online in December 2023 and have achieved an initial combined gross production rate of 18,500 boed, averaging 45% oil and 55% liquids. The estimated, combined, gross, ultimate recoverable resources of these two discoveries are approximately 20 MMboe to 30 MMboe.

Talos President and CEO Tim Duncan said, "the start-up of Lime Rock and Venice in less than 12 months is an extraordinary achievement by our operations team, which included new subsea installation and facility upgrade work. These prospects exemplify our strategy of utilizing purchased infrastructure and seismic imaging expertise to identify new investment opportunities, to grow reserves and production.

Talos also entered into an agreement to acquire the deepwater U.S. GOM assets of QuarterNorth Energy for $1.29 billion. The transaction will add 30,000 boed of production, averaging 75% oil from roughly 95% operated assets. The deal also adds proved reserves of approximately 69 MMboe. QuarterNorth operates and holds a 50% working interest in the Katmai discovery in the Green Canyon region, producing an estimated, combined 27,000 boed gross from two early-life wells.

Talos was named as the apparent high bidder on 13 deepwater blocks comprising 48,000 net acres in the U.S. Gulf of Mexico Outer Continental Shelf Federal Lease Sale 261 held by the Bureau of Ocean Energy Management on Dec. 20, 2023.

Shell Offshore made a final investment decision (FID) for Sparta, a deepwater development in the U.S. Gulf of Mexico. The project is owned by Shell (51% and operator) and Equinor (49%). Sparta should reach a peak production of 90,000 boed and has an estimated, discovered recoverable resource of 244 MMboe. Sparta will be Shell’s 15th deepwater host in the Gulf of Mexico and is scheduled to begin production in 2028. The Sparta development will be the first of Shell’s replicable projects to feature all-electric topside compression equipment, significantly reducing greenhouse gas intensity and emissions.

Shell also announced the FID for a phased campaign to deliver three wells in the Great White unit to increase oil production at the Shell-operated Perdido spar in the U.S. Gulf of Mexico. After completion of this campaign in April 2025, these wells collectively are expected to produce up to 22,000 boed at peak rates. Perdido’s productive capacity is 125,000 boed at peak rates. The wells will be owned by Shell (operator and 33.34% WI), Chevron (33.33% WI) and bp (33.33% WI).

TEXAS

In Texas, 7 of the 12 Railroad Commission Districts will be down this year, with gas-dominated regions forecast to experience the largest reductions. Shale oil districts will experience mixed results, with the well count in the Permian’s District 8 expected to drop 3.3%. There will be downward pressure on crude markets despite expanding tensions in the Middle East, fresh instability in the Red Sea, and the war in Ukraine. Due to instability in crude markets, we predict that statewide, wells drilled and total footage will both be down about 1%, Fig. 4. The Permian (Districts 7C, 8 and 8A) will account for 63% of all drilling in the Lone Star State during 2024.

The Texas shale industry experienced a historic wave of consolidation in 2023, giving rise to modern supermajors. The ExxonMobil ($65 billion) and Chevron ($60 billion) deals come after a decade of lowered investment in exploration. With the major U.S. shale plays largely defined, M&A has become the preferred tool to replace declining reserves and secure longevity in these companies. For the best-quality resources, there also are more buyers now than sellers, driving prices upward. The full-year 2023 M&A value is approximately $190 billion, a new record high. Below are the major deals and results of these consolidations.

ExxonMobil and Pioneer Natural Resources announced a definitive agreement for ExxonMobil to acquire Pioneer in a $60 billion all-stock transaction. The merger combines Pioneer’s 850,000 net acres in the Midland basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland basins, creating the industry’s leading unconventional inventory position. Together, the companies will have an estimated 16-Bboe resource in the Permian. ExxonMobil’s Permian production will double to 1.3 MMboed, based on 2023 volumes and is expected to increase to 2 MMboed in 2027.

Transaction benefits: Combining Pioneer’s differentiated Permian inventory and basin knowledge with ExxonMobil’s proprietary technologies, financial resources and industry-leading project development is expected to generate double-digit returns by efficiently recovering more resource with a lower environmental impact. The complementary fit of Pioneer’s contiguous acreage will allow ExxonMobil to drill laterals up to four miles long, which will result in fewer wells and a smaller surface footprint. The company also expects to enhance field digitalization and automation that will optimize production throughput and cost.

Occidental Petroleum agreed to acquire CrownRock L.P. in a cash-and-stock deal valued at $12 billion, including the assumption of $1.2 billion in debt. Occidental has lined up $10 billion of committed bridge financing through Bank of America, which should be replaced with more permanent financing, including term loans and bonds. Oxy also plans to issue $1.7 billion in new shares to help fund the deal. CrownRock has Permian operations that complement assets that Oxy acquired through its 2019 takeover of Anadarko Petroleum. To secure that deal, CEO Vicki Hollub secured a $10 billion investment from Warren Buffett’s Berkshire Hathaway, which is now Oxy’s biggest shareholder. Although the deal offers a clear boost to Oxy’s holdings in the Permian, Bloomberg analysts said, “the $12 billion price is on the higher end of our analysis the region’s large acreage blocks offer scarcity value.”

Permian Resources acquired Earthstone Energy for $4.5 billion in an all-stock transaction, inclusive of Earthstone’s net debt. The transaction strengthens Permian Resources’ position as a leading Delaware basin independent with 400,000 Permian net acres and pro forma production of 300,000 boed. The two companies are operating an 11-rig drilling program, focused primarily on the Delaware basin. The combined company plans to allocate at least one of Earthstone’s two rigs currently working in the Midland basin to the Delaware basin. During 2024, the combined company expects to allocate 90% of its capital to high rate-of-return projects in the Delaware basin, focused predominantly on Lea, Eddy, Reeves and Ward counties. Delaware basin activity will be weighted more towards New Mexico, as a result of the transaction.

APA Corporation acquired Callon Petroleum in an all-stock transaction valued at $4.5 billion, inclusive of Callon’s net debt. The transaction will add to APA’s inventory of high-quality, short-cycle opportunities. Callon’s assets provide additional scale to APA’s operations across the Permian, most notably in the Delaware basin, where Callon has 120,000 acres. On a pro forma basis, total company production exceeds 500,000 boed while enterprise value increases to $21 billion. Following the closing, the company’s worldwide production mix will be approximately 64% U.S./36% international.

Civitas Resources acquired the oil-producing assets of Vencer Energy in the Midland basin for $2.1 billion. The acquisition will increase Civitas’ holdings to 44,000 net acres in the Midland basin, with a current production of 62,000 boed. With the acquisition, Civitas' 2024 estimated Permian production is expected to reach about 170,000 boed (50% oil). Additionally, Civitas anticipates that its 2024 total company production will be in the range of 325,000 to 345,000 boed, with total capital expenditures of $1.95 billion and $2.25 billion. This strategic move will increase Civitas' portfolio with an estimated 400 gross development locations, primarily in the Spraberry and Wolfcamp formations. With the acquisition, Civitas now possesses 1,200 high-quality oil development locations in the greater Permian basin.

Chevron plans to increase 2024 spending, with big plans for its Permian assets. Global expenditures will reach a range between $18.5 billion and $19.5 billion in 2024, up from $17 billion in 2023, with the Permian budgeted at $5 billion.

BlackRock has invested $550 million of client capital in Occidental Petroleum’s Stratos direct air carbon capture project, which will be the world’s largest plant capturing CO2 directly from the atmosphere. Stratos is designed to extract 500,000 tons of CO2 each year—roughly equivalent to the emissions from 1 MMboe—and then bury the gas underground, generating carbon removal credits. The BlackRock investment represents 40% of the project’s total $1.3 billion cost, making it one of the largest investments in direct air capture to date. It also means Occidental’s share of the cost is reduced, freeing up capital for its Permian basin oil and gas operations. “This joint venture demonstrates that direct air capture is becoming an investable technology, and BlackRock’s commitment in Stratos underscores its importance and potential for the world,” said Oxy CEO Vicki Hollub.

TGS extended its Pontiac 3D survey in Midland basin to develop emerging oil and gas zones. The extension increases the size of the Pontiac 3D from 167 mi2 to a total of 267 mi2. The northern extension is positioned on the western edge of the Midland basin and encompasses historical production from Sprayberry and Wolfcamp intervals, along with significant accumulations in deep-seated structures in the Devonian and Ellenburger formations. The survey is designed to assist in the evaluation and horizontal development of multiple zones, including the emerging Barnett shale, Mississippi lime and Devonian horizons, which are highly prospective with analogous play concepts having been proven just north of Pontiac in Andrews County. The existing and new surveys are in Midland, Ector, Upton and Crane counties, Texas.

SOUTHEAST

The Southeastern region has an eclectic mix of oil and gas plays. This trend continues to produce a mixture of results. New drilling in the region is dominated by the Haynesville shale gas play in northern Louisiana. Drilling in that part of the state is forecast to be flat or slightly higher in 2024, despite depressed natural gas prices in the second half of 2023 and a lack of new pipeline infrastructure. The relatively high drilling activity rate and lack of new transportation venues has contributed to a 21% y-o-y increase in the area’s DUC inventory (735 wells).

Despite these factors and an abundant gas supply from other shale plays, we predict a modest 0.3% increase in Haynesville drilling activity during 2024. We predict footage totals to generally be the same as in 2023. In southern Louisiana, activity in shallow oil fields by smaller companies will be essentially unchanged, despite downward pressure on crude markets. The EPA has approved Louisiana’s bid to take the lead role in overseeing CO2 storage wells in the state. The move will accelerate permitting and construction of storage wells to capture emissions from oil refineries, ethanol plants and other industrial facilities.

Mississippi will experience a 4.2% improvement in total wells and a 5.2% increase in total footage. Alabama is one of only two states in the region forecast to suffer a decline in activity, with wells down 15.4% and footage off 9.3%.

NORTHEAST

The natural gas industry in the Northeastern region has plateaued, due to lack of pipeline infrastructure and the inability to build new ones, says EQT’s Toby Rice. The pipelines that supply the Northeast with natural gas have remained unchanged for over a decade, with no relief coming in the near future. Despite these factors, and a 24% y-o-y increase in Appalachia’s DUC count (768 wells), we predict that activity and footage in gas dominated Pennsylvania will increase 10% in 2024.

Chesapeake Energy and Southwestern Energy have merged, creating a $17 billion U.S. natural gas company, one of the largest gas producers in the U.S. Buying Southwestern solidified Chesapeake’s focus on natural gas and put the company in a position to capitalize on global demand for LNG shipments from the U.S. Gulf Coast. The acquisition makes Chesapeake’s gas production larger than its biggest rival, EQT Corporation, by expanding its holdings in the Marcellus (Appalachia) and the Haynesville.

In West Virginia, World Oil predicts operators will reduce drilling activity and footage totals by roughly 16%, as gas prices are forecast to remain below $3.0/MMbtu, Fig. 5. In Ohio, which produces more liquids than its neighbors, the number of new drilling permits issued to companies exploring the Utica/Point Pleasant shale formation in Columbiana County increased substantially in 2022-2023, compared to previous years. This trend is set to continue, with World Oil forecasting a 1% jump in wells, accompanied by a 2% increase in footage.

MIDWEST

This region has a long history of oil and gas production, but has virtually no shale plays. As such, conventional vertical drilling to typical sand, limestone and CBM reservoirs remains dominant. Despite gains in Michigan (+5.7%), Indiana (+22%) and Kentucky (+3%), the region will be limited by a decline in Illinois (-3.2%), which has the region’s highest volume of drilling. In Michigan, drilling activity and footage drilled will be up nearly 6%, as operators push deeper into the basin looking for new reserves at 74 locations. Indiana’s operators will increase activity significantly, with about 50 new wells targeting shallow, conventional oil. Footage will increase 26%. Kentucky officials expect a 3% jump in wells and a 1% increase in footage, with operators planning to boost oil development work.

MID-CONTINENT

This region will be the top performer in 2024, on both a well number and percentage basis, with the well total expected to reach 2,842. Noticeable gains are expected in conventionally oriented Kansas, where operators are pushing activity 18% higher by drilling relatively shallow wells at a ratio of 90% oil and 10% gas. Total footage drilled is forecast to increase 16%.

In North Dakota, Chevron purchased Hess Corp in an all-stock $53-billion deal to gain a share of ExxonMobil’s giant offshore Guyana discovery and build its position in the Bakken shale play. The Chevron deal will add years of oil and gas production to the company’s portfolio from U.S. shale. Chevron also increased its shale holdings by acquiring U.S.-based PDC Energy and Noble Energy. The combination of Hess, PDC and Noble will expand the company's shale output 40%, to 1.3 MMbopd.

Nabors successfully converted all four of its Hess Corporation drilling rigs working in the Bakken to cleaner highline power to increase reliability. Nabors installed its Canrig PowerTAP Highline Power Transformer Module to enable direct power from the utility grid. Backup onsite generators ensure power goes uninterrupted, should an outage occur. Over the next five years, Nabors expects this fully electric Bakken drilling fleet will reduce carbon emissions from its Bakken drilling operations by 50% and energy costs by 70%.

New shale work in North Dakota will compose approximately 30% of total activity in the Mid-Continent. However, oil and natural gas production in the Bakkan are still constrained, due to pipeline and oil transportation bottlenecks that will hamper activity in 2024. Still, more than half of the state’s annual income comes from tax revenue from oil. Despite transportation issues, we forecast drilling and footage to rise 5.6% and 5.2%, respectively, Fig. 6.

Activity in Oklahoma's SCOOP and STACK plays will suffer a slight decline, as operators continue to have difficulty extracting an acceptable ROI from irregular lithologies in the shale formations. However, some operators are completing high-flowing wells in the southern portion of the state. Kolibri Global Energy reported its Barnes 7-4H and 7-5H wells, both producing from the Caney formation, have delivered average production rates of 686 boed (78% oil) and 624 boed (77% oil), respectively. These wells are the second group of down-spaced wells in the Caney and were drilled at a 6-well per section spacing pattern. In spite of these promising results, drilling and total footage will be down 3% in the Sooner state and will be split 80% oil and 20% gas.

ROCKY MOUNTAINS

Drilling activity in Colorado (Fig. 7) has been consistent over the last 12 months, but state and federal policy will likely limit production growth in 2024. Despite a hostile and oppressive regulatory environment, Bayswater Exploration announced that the Colorado Energy and Carbon Management Commission unanimously approved a development that calls for 12 new horizontal wells in Weld County, northwest of the town of Eaton. The new project is the company's fourth application approved by the Commission since Colorado's new regulatory framework was implemented and the first approval in 2024. The company plans to drill 91 new horizontal wells in the Denver Julesberg basin in the next few years.

Prairie Operating acquired DJ basin assets of Nickel Road Operating for $94.5 million. The addition of NRO's assets adds 5,500 net leasehold acres and 62 permitted proven undeveloped drilling locations, mainly in rural Weld County, Colo. The 84% liquids weighted assets produce approximately 3,370 net boed, with proven reserves estimated at 22.2 MMboe. Despite the encouraging news, we expect well and footage totals to increase just 1.3% and 1.9% respectively.

In Wyoming, Canadian Overseas Petroleum confirmed its deep oil discovery in Converse and Natrona counties, Wyoming. A report by consultancy Ryder Scott indicates that the discovery contains 995 MMbbl of original oil in place. The company holds a significant acreage position in the region and plans to drill additional horizontal wells in 2024 to further delineate the discovery. Overall, the state’s drilling and footage totals will decline by approximately 5%.

In New Mexico, billions of dollars of new tax money is expected in the next fiscal year, driven by increased oil and gas production from the Permian basin in the southeastern corner of the state. The latest state report showed the potential for $3.6 billion in new revenue for 2024, a 43% increase from the 2023 budget. Despite the immense value that the oil and gas industry provides the state, in terms of tax revenue and employment, a major update of New Mexico’s Oil and Gas Act is being sponsored by Governor Michelle Lujan Grisham’s office. The seven areas of discussion include:

- Phase out freshwater use in oil and gas operations entirely.

- Lock the state’s 98% gas capture target into law.

- Increase new well setbacks from “sensitive locations” like homes, schools and hospitals.

- Increase bonding fees to reduce state liability for orphan wells.

- Increase fees and penalties.

- Direct penalties collected to a well reclamation fund instead of the state’s general fund.

- Tighten transfer rules for old wells that could end up being abandoned by new owners.

The Biden administration also proposes to block thousands of acres from future oil drilling or mining in northern New Mexico, in an effort to protect Native American lands. The proposal would ban new mining claims and oil and gas development across more than 4,200 acres in Sandoval County, New Mexico, north of Albuquerque. The actions appear to be having little effect on future activity, as drilling and total footage will be down just 3.4% and 3.3%, respectively.

WEST COAST

In California (Fig. 8), operators have a difficult path forward, given the regulatory and political hurdles being put in front of them. In fourth-quarter 2023, Chevron booked charges of $4 billion, citing policies that forced the company to impair U.S. production in California, because of continuing regulatory challenges. The reduction in upstream capital expenditure comes after the company said it was cutting refinery investments in the state because of policies aimed at phasing out fossil fuels.

Chevron has reduced spending in the Golden State by hundreds of millions of dollars since 2022, according to comments filed with the California Energy Commission. “California’s policies have made it a difficult place to invest, so Chevron has rejected capital projects in the state,” said Andy Walz, president of Chevron’s Americas Products business. “Such capital flight reflects the state’s inadequate returns and adversarial business climate.”

Nevertheless, development continues in the greater Kern Country heavy oil area, where drilling and total footage drilled will be up 20% and 25% respectively. Operators working offshore are expected to drill three new wells in 2024, 50% more than in 2023.

In Alaska, the Biden administration is pursuing changes that threaten drilling on new leases in the 23 million-acre National Petroleum Reserve-Alaska. The proposal for managing the Alaskan Reserve has alarmed oil industry advocates, who say it would thwart development in a crude-rich region the size of Indiana. Alaska’s congressional delegation said the Biden administration is “suddenly and dramatically reinterpreting the law, so that it can treat 13.1 million acres” of the reserve “as de facto federal wilderness.” A top ConocoPhillips executive says the changes stoke uncertainty about future oil projects and infrastructure across the region. World Oil projects drilling will be up 1.5% onshore, with total footage jumping 2% (Fig. 9). Meanwhile, activity will suffer a decline on Alaska’s North Slope, with drilling and footage down 8%.

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Canada's upstream soldiers on despite governmental interference (September 2023)

- Regional report: Newfoundland and Labrador: Despite some setbacks, NL’s offshore sector continues to ride its large potential to greater progress (September 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)