JERRY GREENBERG, Contributing Editor

|

| In 2010, Approach Resources Inc. launched a pilot program (left) to test the potential of the Wolfcamp oil shale play in Crockett County, Texas. Using horizontal drilling and advanced completion techniques, the effort proved successful, opening up a major new supply of domestic oil (Photo courtesy of Approach Resources); Apache Corporation (center) is running an accelerated drilling program in both the Permian and Anadarko basins to increase liquids production. The company is running 36 rigs in the Permian, up from 24 in 2011, and 24 rigs in the Anadarko, up from seven in 2011; A combination of sophisticated horizontal-drilling techniques and fracture-stimulation technology (right) has enabled Linn Energy to boost production of oil and gas in the Granite Wash area of the Anadarko basin (Photo courtesy of Linn Energy). |

|

The Permian basin of Texas and southeastern New Mexico has experienced dramatic growth in drilling activity and increased production during the past couple of years. To the north, in the Texas Panhandle and western Oklahoma region of the Anadarko basin, operators have been moving toward more liquids-rich and oily plays with horizontal wells, some of which have laterals approaching 10,000 ft in length. One Anadarko basin field that has seen renewed activity is Hogshooter, a long-time play that has garnered renewed attention, due to its high production rates.

The regions are expected to continue posting gains in drilling and production figures, as long as the price of oil remains high. Meantime, even with high commodity prices, operators are doing what they can to reduce costs, including contracting more efficient drilling rigs. However, a few operators noted in recent quarterly reports that they would be reducing the number of rigs drilling the plays during the second half of this year. There could be a couple reasons for fewer rigs, including better-performing, more efficient drilling rigs, or possibly that some operators are meeting their planned production levels as a result of more prolific wells, or both.

Operators also are using tools to determine optimal fracturing and stimulation jobs and, in one case, buying sand resources for proppant supplies to cover expected future fracing activity.

Drilling and completing horizontal wells has infused a new impetus into the region, although many operators continue to drill vertical wells and comingle production from different reservoirs. As a result, the Permian basin rig count continues to climb, as does the number of drilling permits issued by the Texas Railroad Commission (RRC). In fact, on an annualized basis, the industry could see its highest number of drilling permits issued, significantly surpassing the 9,000-plus drilling permits issued during 2011.

Citing Texas Workforce Commission (TWC) figures, the RRC said there are about 47,000 oil-and-gas-related employees associated with activities in the Permian basin. The TWC estimates that there were about 49,000 employees in oil-and-gas-related activities during fourth-quarter 2011. These include workers in oil and gas extraction (more than 12,000), oil and gas well drilling, support activities for oil and gas operations (the largest category, with more than 26,700 employees), natural gas distribution, and pipeline transportation of crude oil and natural gas. Total wages paid during the fourth quarter were over $1 billion.

One reason, unrelated to the price of oil, why the Permian basin will continue its growth in drilling and production activity, is a ruling by the U.S. Fish and Wildlife Service (FWS) that a certain lizard is not endangered. If the FWS had ruled in favor of the critter, drilling activity could have been significantly hampered. To save the reptile, operators and land owners have joined to make sure its habitat is preserved.

PERMIAN BASIN REGION

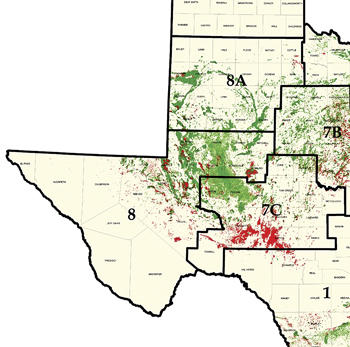

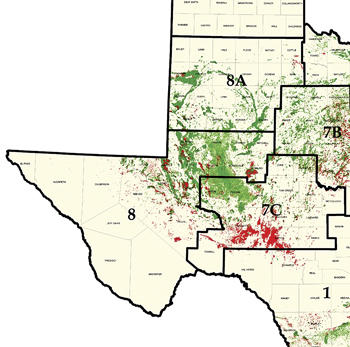

The Permian basin region covers much of West Texas, Fig. 1, and is best represented by RRC districts 7C, 8 and 8A, which include 59 counties, although a majority of production is attributed to certain fields within the region. In southeastern New Mexico, the Permian basin includes four counties: Chaves, Eddy, Lea and Otero. Several operators are active in fields, in these counties, in addition to operating in West Texas.

|

| Fig. 1. The Texas Permian basin lies generally in Railroad Districts 7C, 8 and 8A. |

|

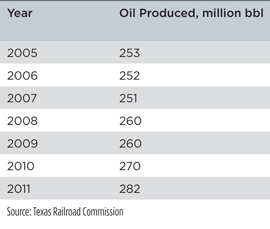

Oil in the Permian basin region of Texas was first produced in 1921. Through June 2012, about 29 billion bbl of oil have been produced, and it doesn’t appear that there will be a slowdown. The RRC said that crude output from the Texas Permian basin during 2011, 282 million bbl, accounted for 71% of the state’s entire oil production of about 400 million bbl. It also accounted for about 14% of the total U.S. oil production of roughly 2 billion bbl, according to the RRC, citing the U.S. Energy Information Administration (EIA).

The region consists of conventional sandstone and unconventional reservoirs. Operators recently have been targeting the unconventional formations, including shales and tight sands. Among the more popular of these formations are the Spraberry and Wolfcamp (or Wolfberry when targeting both intervals), Bone Spring, Cline and Avalon, among others.

Spraberry field is the most productive of late, well outpacing the others, many of which are experiencing declining production. In 2006, Spraberry field was producing about 14 million bbl annually, according to RRC figures. Production shot up to about 20 million bbl produced during 2008, and about 24 million bbl in 2009. During 2011, Spraberry field was producing above 40 million bbl per annum.

Other top 10 Permian basin fields, based on annual production, can’t compare with Spraberry. Rounding out the top five fields, Wassan produced about 18 million bbl during 2011, although that is a drop from its most recent high of about 21 million bbl in 2005. The other top five fields, Slaughter, Levelland and Yates, also showed declining annual production.

ANADARKO BASIN OVERVIEW

In January 2011, the U.S. Geological Survey (USGS) issued its Assessment of Undiscovered Oil and Gas Resources of the Anadarko Basin Province of Oklahoma, Kansas, Texas and Colorado, 2010. The USGS noted that the province is at a mature stage of exploration and development for conventional resources. The USGS estimated in 2010 that the mean technically-recoverable undiscovered continuous (unconventional) and conventional resources totaled 495 million bbl of oil, 27.5 Tcf of natural gas, and 410 million bbl of NGLs in the Anadarko basin province. The estimate included the Las Animas arch area of southeastern Colorado. Mean, undiscovered continuous resources were estimated at 79% of oil, 90% of natural gas and 81% of NGLs in the province, according to the USGS at the time.

The USGS said that much of the remaining conventional resources are from field growth in the mature province. Continuous (unconventional) resources, according to the USGS, are focused in the deep part of the Anadarko basin in Oklahoma and Texas, noting the Woodford shale oil and shale gas fields.

Operators have been drilling and completing vertical wells in Granite Wash and other fields for decades. However, as with many other plays, horizontal drilling and multi-stage completions have resulted in Granite Wash and other Anadarko basin plays gaining new interest. One of the more active, recently, is Hogshooter field, an older play that is attracting significant attention, due to higher oil prices, horizontal drilling methods and multi-stage completion techniques.

ACQUISITION ACTIVITY

During first-half 2012, operators have been buying and selling properties in both regions, several of which have resulted in transactions worth billions of dollars. Last January, Apache Corp. acquired Cordillera Energy Partners III LLC, a privately held company, for $2.85 billion. The transaction gave Apache about 224,000 net acres in the Granite Wash, Tonkawa, Cleveland and Marmaton plays in western Oklahoma and the Texas Panhandle areas of the Anadarko Basin. Cordillera had estimated proved reserves of 71.5 million boe, with production last January of 18,000 boed. Additionally, the company identified 14,000 potential drilling locations in liquids-rich Anadarko basin plays.

In another purchase, Unit Corp.’s Unit Petroleum Co. bought assets from Noble Energy, including about 84,000 net acres, mainly in the Granite Wash, Cleveland and Marmaton plays in the Anadarko basin for $617 million in cash. The acquisition adds about 25,000 net acres to Unit’s Granite Wash holdings, including 617 potential horizontal drilling locations. Unit said it would accelerate its drilling activity in the acquired properties during the second half of 2012 and into 2013, using seven rigs from its contract drilling business unit.

In its Maramaton play, Unit completed the first extended horizontal well, which is producing from about 9,500 ft of lateral. First production occurred on April 14, 2012, and the well produced 50,000 boe in the first 69 days, averaging 725 bopd.

Another Permian basin transaction was Sumitomo’s $1.4-billion investment in exchange for 30% of Devon Energy’s interest in 650,000 net acres in the Cline shale and Midland-Wolfcamp shale. Sumitomo will invest $340 million in cash and $1.025 billion in the form of a drilling carry, which will fund 70% of Devon’s capital requirements, resulting in Sumitomo paying 79% of overall drilling and completion costs during the carry period. Based on the company’s work plan, Devon expects the entire $1.025-billion carry to be realized by mid-2014.

ANADARKO BASIN DRILLING

During 2011, Forest tested six prospective intervals in the Texas Panhandle, establishing a total of eleven intervals as commercial for horizontal development. Forest identified an additional five intervals as prospective for horizontal development. During first-quarter 2012, the company completed five horizontal Granite Wash wells that had an average, 24-hour, initial production rate of 14 MMcfd, including approximately 1,200 bpd of liquids, 52% of total equivalent production. Three of the wells, completed in the Granite Wash “A” zone, had average, 24-hour, initial production rates of 16.8 MMcfgd, with a liquids content of about 50%.

Forest additionally completed two Missourian Wash wells that had an average, 24-hour, initial production rate of 2,721 bopd, 546 bpd of NGLs, and 3 MMcfgd, for a total equivalent rate of 3,765 boed. The company also said a new oil zone located outside of Wheeler and Hemphill Counties yielded a 24-hour initial production rate of 821 bopd, 492 bpd of NGLs, and 4.3 MMcfgd, for a total equivalent rate of 12.2 MMcfed.

Forest completed a Missourian Wash Hogshooter well with a 24-hour maximum production rate of 1,500 bopd, 570 bpd of NGLs, and 4.4 MMcfgd, for a total equivalent rate of 2,800 boed. To date, the company has completed five Hogshooter wells that have had an average 24-hr maximum production rate of 3,050 Boed.

The company said it would fund its Eagle Ford development program and reduce overall capital spending rates by cutting capital from lower-return liquids projects in East Texas and the Panhandle area. By the fourth quarter of 2012, Forest said in a news release, it will have two rigs running in the Eagle Ford, two rigs running in the Panhandle (down from five at mid-year) targeting the Hogshooter and other oil intervals, and one rig running in East Texas targeting liquids intervals, down from two at mid-year.

As noted above, Apache (also active in the Permian basin) acquired Cordillera’s significant holdings in the Anadarko basin. One result is a significant increase in drilling activity, Fig. 2. Apache said in early August that it was operating 24 rigs in the Anadarko basin, up from seven rigs at the end of 2011.The company estimated that it will drill 240 wells in the Anadarko during 2012. Its future inventory includes 32,546 known drilling locations, the vast majority of which are in the Granite Wash, with more than 22,800 identified drilling sites. Tonkawa field comes in a distant second with 2,795 identified drilling locations, followed by Cleveland field with 2,302 locations, Maramaton with 1,593 drilling locations identified, and then Canyon Wash with 1,016 sites. These locations have an estimated net resource of 5.4 billion boe.

|

| Fig. 2. Apache Corp. has been drilling wells in the Granite Wash portion of the Anadarko basin for 50 years, and the firm expects to double its activity in the play during this year. |

|

Linn Energy holds more than 450,000 net acres in central and northern Oklahoma and southern Kansas. The operator holds about 70,000 net acres in the Texas Panhandle Granite Wash area and about 25,000 net acres in the Oklahoma Granite Wash. The company acquired acreage in late 2011 that added significantly to its Granite wash drilling locations, identifying more than 600 horizontal drilling locations in its Texas Panhandle acreage and multiple, vertical infill drilling locations. The company said it drilled 30 operated Granite Wash horizontal wells in 2011 and planned to drill about 60 horizontal operated wells in 2012.

During first-quarter 2012, Linn drilled three successful Hogshooter wells, with average initial production of about 2,500 bopd, 500 bpd of NGLs and 3 MMcfgd. Linn identified about 50 additional Hogshooter drilling locations. The company commented in its first-quarter 2012 results that it plans to shift a portion of its capital from the traditional Granite Wash drilling program to focus on Hogshooter field and anticipated drilling 12 Hogshooter wells during second-half 2012. Updating the Hogshooter program in its second-quarter comments, Linn said that due to low prices for natural gas and NGLs, it shifted all eight of its operated rigs in the Texas Panhandle portion of the Granite Wash to its Hogshooter acreage, and increased the planned number of wells to 20 during the second half. Additionally, the company said it is mapping Hogshooter potential in the western portion of Oklahoma and could begin testing Hogshooter wells in the Mayfield area by the end of 2012.

DRILLING ACTIVITY

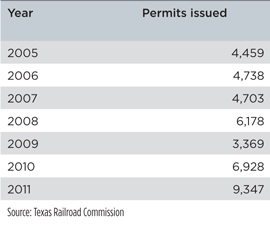

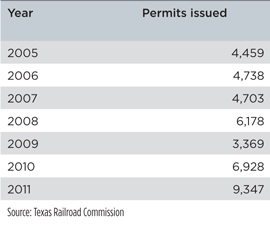

As noted earlier, the number of new drilling permits issued by the RRC increased significantly during the past two years and is on track to post its highest number of permits during 2012. Table 1 shows the number of new drilling permits issued for Permian basin wells (excluding amendments and recompletions) since 2005. Of course, 2009 was a dismal year for the global oil and gas industry, and the Permian was not unscathed, as illustrated by the number of drilling permits, yearly average rig count and flat oil production.

| TABLE 1. NEW DRILLING PERMITS ISSUED FOR PERMIAN BASIN WELLS |

|

|

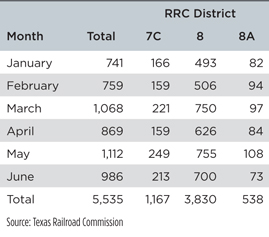

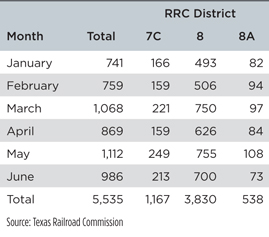

Activity really took off in 2010 and continued to increase during 2011 and 2012. The number of new drilling permits issued in 2011 is a 110% increase over 2010 and a 177% increase when compared with 2009, Table 1. This year, the industry is on track to receive more than 11,000 new drilling permits, based on the number of drilling permits issued during first-half 2012, Table 2.

| TABLE 2. PERMIAN BASIN NEW DRILLING PERMITS, BY DISTRICT, 2012 |

|

|

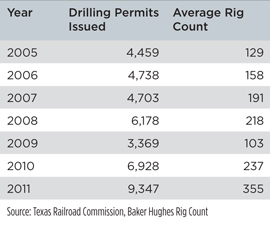

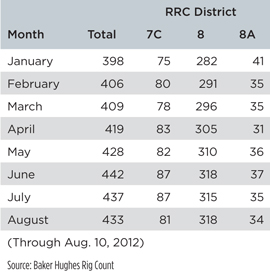

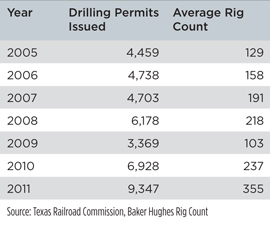

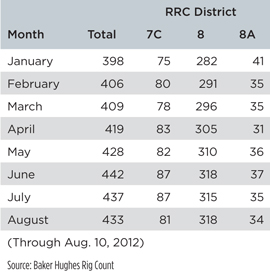

The number of drilling permits issued by the RRC is a good indicator of future activity, as long as oil prices remain high. The number of rigs running correlates, more or less, to the number of drilling permits historically, as illustrated by the Permian basin rig count, Table 3. This year, based on the first-half figures, the industry could see an even-higher average rig count. Through the first half of August 2012, the average rig count is 421, an 18.5% increase over the 2011 figure, and a whopping 308% increase over the average of 103 during 2009, Table 4.

| TABLE 3. PERMIAN BASIN RIG COUNT |

|

|

| TABLE 4. PERMIAN BASIN MONTHLY AVERAGE RIG COUNT, 2012 |

|

|

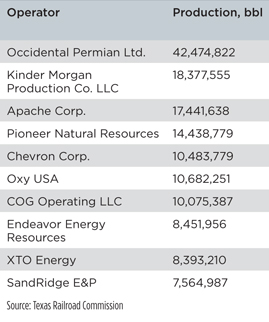

TOP PERMIAN BASIN OPERATORS

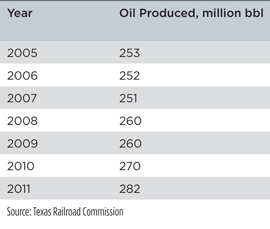

Permian basin crude oil production has increased steadily since 2007, except during 2009, when production was flat, Table 5. Since 2009, production has been rising again, and in 2011, the industry saw production grow by 22 million bbl.

| TABLE 5. PERMIAN BASIN CRUDE OIL PRODUCTION |

|

|

| TABLE 6. TOP 10 PERMIAN BASIN OPERATORS, 2011 |

|

|

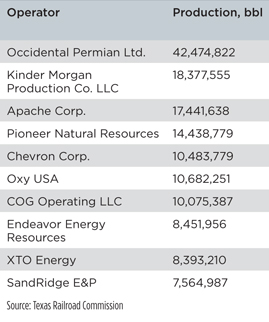

The top 10 Texas Permian basin operators, in terms of 2011 production totals, show that Occidental Petroleum is by far the largest, with production last year of more than 42 million bbl. The next largest operator, a very distant second, is Kinder Morgan Production Co. LLC, with 2011 output of just over 18 million bbl.

Occidental. Oxy says that its Permian basin crude production accounts for about 15% of all oil produced in the state. The operator has an inventory of more than 2,000 drilling locations on nearly 3 million net acres. About two-thirds of the operator’s Permian oil production is from fields in which it employs CO2 flooding. This EOR method can increase ultimate oil recovery by 15% to 25% in the fields where it is used, according to the company, with CO2 flooding expected to recover 1–3 billion bbl of additional oil from Permian basin fields operated by the company. The firm operates more active CO2 floods than any other operator in the Permian, with resulting production nearly equivalent to that of all other Permian operators combined. Oxy noted that it injects more than 550 Bcf of CO2 into Permian reservoirs annually.

Kinder Morgan Production Co. Kinder Morgan is the largest marketer and transporter of CO2 and is the second largest oil producer in Texas, with nearly 100% of its output associated with its CO2 oil operations. The company is a major source of CO2 supply to the oil industry and to its own EOR operations in the Permian basin. The company operates the largest CO2 pipeline in the industry, and the largest natural source of CO2 in the Americas, the McElmo Dome. The company is expanding its CO2 capacity in the region at a cost of about $250 million.

Apache Corp. The company’s Permian basin region controls more than 3 million gross acres, which increased substantially following the acquisition of BP’s Permian acreage and the merger with Mariner Energy in 2010. The company operates more than 12,000 wells in 152 fields, including 45 waterfloods and six CO2 floods. Apache’s Permian production was up 38% as a result of these acquisitions, coupled with an active drilling program that averaged 25 rigs during 2011, including the drilling of, or participation in, 507 wells with only two dry holes. The company’s 2011 estimated proved reserves in the Permian were 751 million boe, representing 25% of its total proved reserves.

The Deadwood area is one of its most active in the Permian, running an average 11 rigs and drilling 195 wells in 2011. Gross oil production was more than 8,000 bpd, along with 17 MMcfgd at the end of 2011, compared with 2,000 bopd and 6 MMcfgd at the beginning of 2011. Apache said that it expects to drill more than 300 wells in Deadwood during 2012, and has an inventory of about 1,000 additional vertical locations across multiple formations and stacked pay zones.

Apache also noted that it will continue drilling in the Bone Springs, Wolfcamp and Cline shales, and off-structure Grayburg formations during 2012. It estimates that it will drill, in total, 760 wells with an average 32 rigs in the Permian basin during 2012.

Pioneer Natural Resources. The operator said that early drilling results from its horizontal Wolfcamp shale “are exceeding expectations,” and it estimates that the southern 200,000 acres of its Spraberry position have more than 4,000 horizontal drilling locations, with a gross resource of more than 2 billion boe. The company is seeking a JV partner to accelerate development of the resource during the second half of this year.

The operator also said it plans to begin delineating horizontal Wolfcamp shale potential in the northern acreage during the fourth quarter of this year. Based on its success there, the company said it is increasing its net resource potential from 5 billion boe to 7 billion boe. Future horizontal wells in the Wolfcamp shale are expected to have longer lateral lengths with significantly higher estimated ultimate recoveries.

Wolfcamp will continue to be the company’s focus, with about 90 horizontal wells drilled in the play by the end of 2013 to hold expiring acreage. Between 30 and 35 horizontal wells will be drilled during 2012. Pioneer was operating four rigs at the end of the second quarter this year and anticipates increasing its fleet to seven rigs during the fourth quarter.

To assure an adequate supply of proppant sand for its Permian exploration programs, Pioneer recently purchased Carmeuse Industrial Sands (CIS) for about $297 million. CIS is the top producer of Hickory frac sand (Brady Brown), according to Pioneer. “By securing supply at below market prices,” said Pioneer Chairman and CEO Scott Sheffield in a news release, “we expect to reduce annual capital spending by $65 million to $70 million, based on our estimated sand requirements and current market prices.”

Chevron Corp. Chevron is one of the largest acreage holders in the Delaware basin of Texas and New Mexico. The company planned to begin drilling four operated oil wells in mid-2012, following a 3D seismic survey, with more seismic planned.

In the Midland basin, the Wolfcamp tight oil area continues to be developed, using vertical drilling and multi-stage fracture stimulation. At the end of 2011, Chevron had an average non-operated working interest of about 70% in more than 900 wells, with average net oil-equivalent production of more than 15,000 bopd. The remaining acreage, which is operated and approximately 97% owned, continued to ramp up during the year. Six rigs were operating at the end of 2011.

COG Operating (Concho Resources). In May 2012, Concho Resources purchased Three Rivers Operating Co. for $1 billion in cash. Three Rivers held about 310,000 gross acres in the Permian. In December 2011, Concho bought Petroleum Development Corp.’s remaining Permian basin assets for about $175 million, giving Concho roughly 10,800 gross acres and adding more than 170 identified Wolfberry drilling locations

The company’s $1.5-billion 2012 capital budget includes $1.4 billion for drilling and completion activities. At the end of the first half of this year, the company was operating 37 drilling rigs, including seven in New Mexico’s Yeso field, 19 in the Texas Permian basin, 10 in the Delaware basin and one in the Lower Abo formation of New Mexico. The company is running 15 horizontal drilling rigs within that 37 operated-rig total, including 10 in the Delaware basin, one in the Texas Permian and four on the New Mexico shelf.

However, the company said that for the remainder of 2012, it expects to operate an average 33 rigs, including 13 horizontal drilling rigs. Of the total 33 rigs, seven will drill Yeso wells, 17 will drill in the Texas Permian, and nine will drill in the Delaware basin. The Company expects this activity level to be sufficient to invest the remainder of its $1.5-billion annual capital budget, and produce 28.7 to 29.8 MMBoe this year.

As of June 30, 2012, the company had identified 2,470 drilling locations on its New Mexico Shelf assets, with proved, undeveloped reserves attributable to 680 of the locations. Of the total drilling locations, 1,559 target the Yeso formation vertically, 369 target the Yeso formation horizontally, 111 target the Lower Abo formation, and the remaining drilling locations target other objectives. COG expects to drill 310 wells this year in the New Mexico Shelf.

In the Texas Permian, the company identified 5,772 drilling locations, with proved undeveloped reserves attributable to 1,786 of those sites. Of these, 2,064 target the Wolfberry play through 40-acre spacing, 2,629 target the Wolfberry play on 20-acre spacing, 927 target the Wolfcamp vertically in Irion and Schleicher Counties, and the remaining drilling locations target other objectives. The company expects to drill about 350 wells during 2012 in the Texas Permian, in the Wolfberry play.

In its Delaware basin assets, COG identified 2,375 drilling locations, with proved undeveloped reserves attributable to 195 of the locations. Substantially, all of the, 2,375 drilling locations target horizontal objectives in the northern Delaware basin. The company tested a horizontal Wolfcamp shale well in the southern Delaware basin earlier this year and had completed three horizontal Wolfcamp shale wells on its acreage in Reeves County. The company expects to drill another seven horizontal wells on its acreage in Reeves and Pecos Counties during 2012.

SandRidge Energy. The company is increasing its 2012 capital spending to $2.1 billion from $1.85 billion, with $480 million earmarked for the Permian basin. The company drilled 182 wells in the Permian during the first quarter, and 206 wells during the second quarter. The company plans to operate an average 12 rigs throughout the year, drilling about 750 wells in the Central Basin Platform, primarily Grayburg/San Andres vertical wells, at depths ranging from 4,500 ft to 7,500 ft.

There are many more operators, in addition to the top 10, that are very active in the Permian basin. Among these is Devon Energy, whose Permian production averaged 58,700 boed during second-quarter 2012, a 21% increase from second-quarter 2011. The company’s Permian oil production grew 24% over the same period, with light oil accounting for nearly 60% of its total Permian volumes. The company had six rigs running in the Bone Spring horizontal play in New Mexico, bringing 19 wells on-line during second-quarter 2012. Devon also brought eight Delaware basin wells online, including one with a 30-day initial production (IP) rate of 1,500 boed. Devon also has been active in the Wolfcamp shale during the first half of this year, with a couple of successful horizontal wells.

Sumitomo Corp. is investing $1.4 billion in exchange for 30% of Devon’s interest in 650,000 net acres in the Cline shale and Midland-Wolfcamp shale. The partnership is expected to drill 40 gross wells in 2012, including 28 in the second half. Devon has two rigs working in each of the Wolfcamp and Cline shales.

Lynden Energy said its plans call for drilling 37 gross wells across the Wolfberry play in 2012, an increase over its earlier announced 31 gross wells. Completions in the Wolfberry play are generally anticipated from a 2,500-to-3,000-ft gross interval, according to Lynden, and located between 7,000 and 10,500 ft, TD.

Laredo Petroleum has more than 600 vertical and horizontal wells on its Permian acreage, more than 2,200 ft of whole cores, more than 400 sidewall cores, and over 470 sq mi of 3D seismic in-house, with another 250 sq mi underway. About 80% of its $700-million 2012 capital budget, about $560 million, is directed at the vertical Wolfberry play, and the horizontal Wolfcamp and Cline shales. Laredo has been drilling and gathering data in the Cline shale since 2008 and has drilled and completed 26 horizontal wells in the Cline shale. The operator is contracting 16 rigs in the Permian.

Linn Energy entered the Permian basin in 2009 via acquisitions of various properties. Since then, it has made the region one of its core areas, with 88 million boe of proved reserves. Through the end of 2011 the company had closed on 10 Permian basin acquisitions totaling about $1.5 billion, resulting in more than 100,000 net acres while operating more than 1,300 producing wells. Full-year 2011 production increased 135% over 2010 production, according to the company, Fig. 3. Linn operated six rigs in Wolfberry during 2011, drilling 114 wells. The company identified about 400 future drilling locations. Most of the company’s Wolfberry wells include production from Spraberry, Wolfcamp and Strawn intervals. The operator is conducting a 20-acre infill pilot program in the Wolfberry that includes microseismic evaluation. Linn also operates secondary recovery water flooding in its Permian acreage.

|

| Fig. 3. Linn Energy increased its Permian basin oil production 135% during 2011 over its 2010 output figure. |

|

DUNES SAGEBRUSH LIZARD

The U.S. Fish and Wildlife Service proposed a rule to list the Dunes Sagebrush Lizard, Fig. 4, as an endangered species in December 2010. Adding the lizard—which makes its home in the shinnery oak dune habitat in New Mexico and Texas—to the endangered species list would have significantly impacted E&P activities in the Permian basin, where most of the species lives. The listing would have prohibited surface occupancy within 600 ft of designated lizard habitats. The result would impact seismic activity, drilling operations and pipeline construction.

|

| Fig. 4. A decision to keep the Dunes Sagebrush Lizard off the endangered species list means oil and gas operations in the Texas and New Mexico Permian Basin can continue increasing. Photo courtesy of U.S. Fish and Wildlife Service. Photographer: Mike Hill. |

|

In June 2012, as a result of unprecedented commitments to voluntary conservation agreements with New Mexico and Texas, the Fish and Wildlife Service determined that the species does not need to be listed under the Endangered Species Act. State-led voluntary conservation efforts to protect existing shinnery oak dune habitat now cover over 650,000 acres in the states, totaling 88% of the lizard’s habitat. These voluntary measures also minimize the anticipated impacts of other threats, such as off-road vehicle traffic, wind and solar development, and increased predation caused by development.

New Mexico is home to about 73% of the total lizard habitat, with Texas home to the remaining 27%.

|