|

Vol. 232 No.2 |

|

|

| PRAMOD KULKARNI, EDITOR |

The mathematics and art of forecasting

One of the kindest divine acts is for humankind not to be able to see the future. If we knew we would have a car accident in 2013 or suffer a heart attack in 2016, we would not know how to go on living. Yet, we have an insatiable curiosity about the future. Ancient Greeks would consult the Delphic oracles about what the future held for them. Over the course of human history, crystal ball gazers as well as palm and tea leaf readers have made their own fortunes by predicting the fortunes of their gullible customers.

|

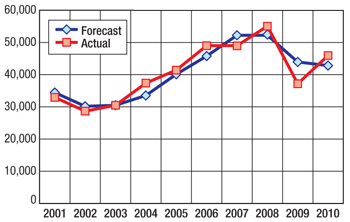

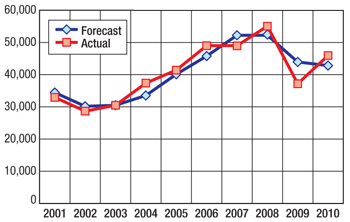

Historical comparison of World Oil’s annual US drilling forecast with the next year’s World Oil estimate of actual wells drilled. The two curves intertwine, so we’re neither overly optimistic nor pessimistic. The significant deviation in 2009 was due to a freefall in drilling due to the sudden drop in oil prices. Looking back, it seems like an irrational drop and a rapid recovery due, perhaps, to commodity speculation rather than logical supply/demand factors.

|

|

Determining the course of financial markets is one of the most difficult arenas of forecasting. Perhaps there are brilliant statisticians and mathematical modelers who have developed complex, proprietary algorithms to determine how the markets will fluctuate. What you typically find are financial pundits who say, “The Dow Jones will go past 12,000.” Or they might be pessimistic: “The Dow Jones will crash to 9,000.” They’re generally careful, however, in not specifying the timing. Certainly, there’s a good chance that sooner or later the DJI will exceed 12,000 or dive to 9,000, allowing them to take credit for a bygone prediction.

World Oil editors do go out on a limb with their annual forecast of the number of wells and footage drilled in the US and internationally. In addition to its appearance in this issue, we presented the forecast on Jan. 28 in Houston, followed by Rotterdam, Paris and Milan. Examined over the span of the last 10 years, we haven’t done such a bad job of crystal gazing (see figure).

You would think that World Oil’s forecast would just be a matter of compiling numbers directly from the operators or the state regulatory agencies. But there are a number of issues that make the task of forecasting less a mathematical exercise and more an art form composed of detailed analysis of diverse bits of information and informed judgment.

Survey sample. World Oil sends its forecast survey form to virtually all of the operators and oil and gas regulatory agencies in the US and around the world. But certain countries, such as Russia, Venezuela and Cuba, cannot be relied upon to return the survey and provide reliable numbers. Even in the US, certain states give our survey staff major headaches in providing well data. As such, we piece together data from other sources to provide reasonable results.

Compilation delays. Even for the US state agencies that provide detailed information, there is a natural delay in receiving data from the operators for wells that were drilled late in the year. As a result, we have to make a linear projection to adjust numbers that were received for nine or 10 months over the full 12-month period.

Rational exhuberance. Over the years, we’ve discovered that operators, especially the independents, are much more optimistic about the number of wells that they plan to drill over the upcoming year than are the state agencies, and usually that optimism turns out to be somewhat excessive when the year’s well count is finally tallied. As such, we have to dampen their enthusiasm to obtain more realistic figures.

Extraordinary events. We can accommodate steady transitions such as the operators extending the drilling envelope to deeper waters and the growing impact of shale gas exploration, but, obviously, we cannot foresee catastrophic events such as the sinking of the Deepwater Horizon and the consequent deepwater moratorium in the Gulf of Mexico. As a result, it was quite a challenge for us to forecast a reliable number for the Gulf. We cannot accurately say when the current “permitorium” will be lifted and drilling will begin in earnest in both deep and shallow waters. Another extraordinary event that has the potential for transformational change is the eruption of street protests in the Middle East. Several governments are expected to fall, and it remains to be seen whether the new regimes will be friendly to the West. These extraordinary changes may adversely affect the oil and gas economic scenario.

Despite these challenges, World Oil is able to make reasonable forecasts year after year. We are thankful that we have a unique combination of three generations of experienced consultants and young editors, who can collaborate and make informed forecasts that have withstood the test of time.

Pursuit of perfection. Lacking psychic powers, we’re unlikely to nail a forecast right on the head. To narrow the gap between the forecast and the actual, we’re planning to simplify the survey form a bit with the hope of increasing the sample size. As state reporting improves through better use of communication technologies, we hope that oil and gas drilling forecasting can become more of a mathematical exercise and less of an art form than it is today.

|