Regional report: Northwest Africa

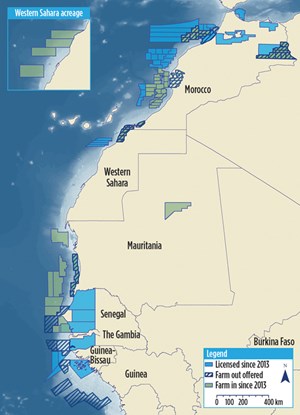

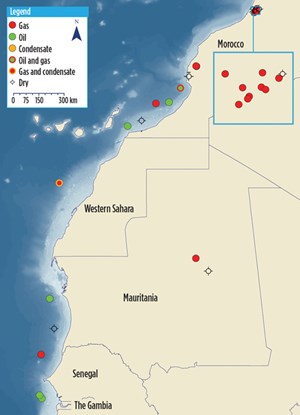

Historically, exploration in the frontier coastal countries of northwestern Africa (Guinea to Morocco) has been limited. However, in recent years, the region has seen an increase in licensing and drilling activity, resulting in some key discoveries. This article presents a round-up of the history, key players, recent exploration and future plans in the countries of Guinea, Guinea Bissau, Senegal, Mauritania and Morocco, and provides an outlook for the industry in the region as a whole, Figs. 1 and 2.

MOROCCO

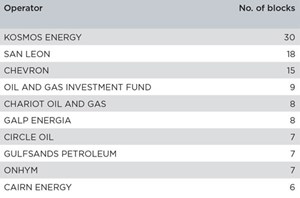

Among our focus countries, Morocco has experienced the most exploration activity in its history, with 36 exploration wells drilled offshore and 273 onshore. Recently, we have seen companies in Morocco acquiring additional seismic data, to be able to better identify new exploration concepts. Since the beginning of 2013, 20 exploration wells have been drilled, illustrating a continued focus on exploration, Table 1.

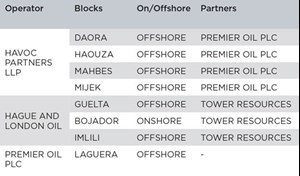

Morocco is involved in a border dispute over Western Sahara. The Authorities of The Sahrawi Arab Democratic Republic (SADR) offer 18 blocks, eight of which are licensed, Table 2.

In 2014, Office National des Hydrocarbures et des Mines (ONHYM) awarded six permits covering 14 blocks, including both onshore and offshore acreage. This follows the award of seven permits covering 29 blocks during 2013. The 2014 awards saw two new operators, New Age Ltd. and Maxim Resources, entering the country. Repsol, Chariot Oil and Gas, Woodside Petroleum and Gulfsands Petroleum also expanded their Moroccan portfolios, each signing one permit during the year. Woodside initially entered Morocco in July 2014, farming into the Rabat Deep offshore permit, in a deal for a 25% working interest from Chariot.

In the latter stages of 2014 and into 2015, low oil prices started to have an impact on licensing in Morocco. The industry saw Fastnet Oil and Gas electing not to farm into the onshore Tendrara license prior to the Dec. 31, 2014, cutoff date, concluding that market conditions at the time were not suited to its strategy.

On May 11, 2015, Sound Oil announced that the company had been granted a 30-day exclusivity period in relation to a potential farm-in to the Tendrara permit. This deal would see Sound Oil take operatorship and a 55% working interest in its first license in the country. Mubadala Petroleum also made its debut into Morocco during March 2015, when it signed a one-year reconnaissance license for the Mediterranee Quest Block.

Morocco experienced a surge in exploration activity during 2014, with 12 exploration wells drilled. This has been followed by a further three wells spudded, to date, in 2015.

Offshore, five exploration wells were drilled in 2014, compared to just one, Foum Draa-1 (FD-1), in 2013. Cairn Energy followed FD-1 with Juby Maritime-1 (JM-1) in January 2014, resulting in non-commercial heavy oil shows. Kosmos Energy, Galp Energia and Genel Energy drilled the Foum Assaka-1 (FA-1), Tarfaya Offshore-1 (TAO-1) and Sidi Moussa-1 (SM-1) wells respectively; FA-1 discovered non-commercial oil and gas shows; TAO-1 was plugged and abandoned after failing to encounter hydrocarbons at the Trident and Assaka prospects, and SM-1 encountered oil shows. However, it was plugged and abandoned, due to reservoir damage restricting testing. The latest offshore well, Al Khayr-1 (CB-1), drilled by Kosmos Energy in the Cap Boujdour permit, was completed in March 2015 and plugged and abandoned with non-commercial hydrocarbon shows.

In contrast to exploration efforts offshore, success was seen onshore, where nine wells were drilled in 2014, including a number of discoveries in northern Morocco. Gulfsands and Irish firm Circle Oil were the most active, drilling seven exploration wells between them. Circle, currently undertaking a 12-well drilling program, drilled four exploration wells in the Sebou permit during 2014; SAH-W1, Caid Guedari-12 (CGD-12) and Ksiri-12 (KSR-12) all resulted in gas discoveries; however, its Kab-1bis well failed to encounter the target Guebbas sands. On May 12, 2015, Circle spudded its first well in the Lalla Mimouna permit, Lalla Mimouna-1 (LAM-1), targeting Miocene gas-bearing sands.

Gulfsands Petroleum completed two successful exploration wells during 2014, Lalla Yetou Updip-1 (LTU-1) and Dardara Southeast-1 (DRC-1). Gulfsands’ success continued into 2015 with its Douar Ouled Balkhair-1 (DOB-1) well in January. All three wells made gas discoveries and have been suspended as future producers. Gulfsands has been working with ONHYM to start production from these discoveries as soon as possible. An appraisal well is set to be drilled on the Dardara Southeast discovery in second-half 2015, with first gas anticipated in late 2015.

PetroMaroc was also successful with Kamar-1, which intersected two distinct gas-bearing intervals. In November 2014, the Tamanar-1 exploration well was spudded by Petroleum Exploration in the Haha permit. The well was plugged and abandoned with undisclosed results.

Looking to the future, following limited success offshore, plans have turned to focus on evaluating well results, and seismic acquisition and interpretation. Chevron has announced that it needs two-and-half years to gather seismic data over its three underexplored permits. Woodside is also planning to shoot 2D seismic in its Rabat Ultra Deep permit, in second-quarter 2015. Following CB-1, Kosmos also plans to carry out analysis of the source and reservoir potential in the Cap Boujdour permit, prior to drilling a second exploration well in 2016.

Also offshore, Pura Vida Energy spudded the Mazagan-1 well, targeting Cretaceous and Jurassic plays during May 2015. Pura Vida will use the results to determine a location for a second well in the Mazagan permit, anticipated in fourth-quarter 2015. Subject to finding a partner, Chariot plans to drill the JP-1 prospect in the Rabat Deep permit, with estimated gross prospective resources of 618 MMbbl in second-half 2016.

Onshore, Gulfsands is expected to resume drilling in the Rharb permits in second-half 2015, where a further three gas wells need to be drilled to meet the minimum work obligation. Seismic work is also ongoing in its Fes and Moulay Bouchta permits. Following success with the Kamar-1 and Koba-1 exploration wells, PetroMaroc has outlined plans to appraise the potential of Sidi Moktar. This is dependent on obtaining financing and will initially involve testing and completing of Kamar-1 and Koba-1.

MAURITANIA

In Mauritania, sporadic exploration has been seen since the 1960s, with more than 60 wells drilled to date. Most exploration has focused on the offshore Senegal–Bove basin, with a handful of wells on the onshore Taoudenni basin. Exploration was largely unsuccessful until the beginning of the 21st century, when Woodside Petroleum discovered Mauritania’s first and only producing field, Chinguetti.

Chinguetti oil field was discovered in 2001 with the Chinguetti 4-1 exploration well. Appraisal put P50 recoverable reserves estimates at 123 MMbbl of 27° API oil. The field went into production at a rate of 66,000 bopd in March 2006, however it quickly encountered problems, due to geological complexities and went into decline, producing just 11,500 bopd by Spring 2008. In December 2007, Petronas Australia obtained all of Woodside’s 47% interest and operatorship of the field. In 2014, production at Chinguetti averaged 5,500 bopd. There have been several offshore oil and gas discoveries including Banda (2002, gas), Tiof (2003, oil), Tevet (2004, oil) and Labeidna (2005, oil), which are all in Tullow’s C-10 Block. Dana Petroleum also had success in Block C-7 with the 2003 Pelican gas discovery.

Woodside’s Banda discovery was appraised successfully by Petronas in 2008 and has estimated recoverable reserves of around 1.2 Tcfg. Tullow planned to develop Banda, but in 2014 announced that it was pulling the funding for the project as part of a wider initiative to cut spending in the low oil price environment.

Mauritania’s National Oil Company, Société Mauritanienne des Hydrocarbures et de Patrimoine Minier (SMHPM), typically holds a 10% carried interest in the exploration phase of each PSC. Despite interest from majors, approximately 86% of the onshore acreage remains unlicensed, Table 3.

Recently, a number of players have entered the country via farm-in deals. In August 2013, Cairn Energy farmed into Chariot’s Block C-19, obtaining a 35% interest in return for approximately $26 million in back-costs. In February 2015, Chevron farmed into Kosmos’ C-8, C-12 and C-13 Blocks, obtaining a 30% interest. Chevron agreed to pay a disproportionate share of costs for one exploration well and a second contingent well, as well as a share of past exploration costs. Sterling Energy also farmed into Tullow’s C-3 Block in February 2015, obtaining a 40.5% interest.

Tullow launched a three-well campaign in 2013 with the drilling of Frégate-1, operated by Dana Petroleum, followed by Tapendar-1 in 2014. Fregate-1 discovered gas-condensate and oil in shallow intervals; however, the deeper primary target contained only a non-commercial hydrocarbon column. Tapendar-1 targeted Miocene and Upper Cretaceous intervals, and was plugged and abandoned dry. Tullow subsequently cancelled the third well.

In April 2015, Kosmos announced a significant play-opening gas discovery at its Tortue-1 well in Block C-8. Preliminary analysis showed that the well intersected volumes exceeding pre-drill estimates of 2.1 Bboe in Cenomanian reservoirs.

The outlook for Mauritania is mixed following recent exploration results. Petronas stated that it is considering divesting its Mauritanian assets, including Chinguetti. In addition to pulling out of Banda’s development, Tullow has cancelled its planned exploration drilling in the country.

Progress in the onshore Taoudenni basin is slow, with Saharan conditions and a lack of infrastructure making exploration difficult and expensive. However, Total has recently secured a one-year extension to the first phase of its exploration license, which could indicate drilling in 2015.

In contrast, Kosmos is planning an appraisal program to further delineate the Tortue discovery, as well as one exploration well, Marsouin-1, in Block C-8 during third-quarter 2015. A program is also being planned to test other prospects in the Greater Tortue Complex, which extends southward into Kosmos’ Senegalese acreage. Chariot also has shot 3D seismic and matured four prospects in its C-19 Block to drill-ready status. The Cretaceous and Tertiary KT-1 prospect is likely to be the primary drilling target; anticipated in first-half 2016.

SENEGAL

Exploration in Senegal began in the 1950s, focusing almost exclusively onshore until the late 1960s. Over 140 exploration and appraisal wells have been drilled to date, including wells in the area now governed by the Senegal/Guinea-Bissau Management and Cooperation Agency (AGC); however, commercial success has been limited.

The first commercial discovery was made onshore in 1959 by Societe Africaine Des Petroles (SAP) with the Diam Niadio-4 well near Dakar. Diam Niadio field produced oil, gas and condensate from 1986 to 2000. Diam Niadio East was discovered in the 1990s by Tullow, and was brought onstream in 1993. Diam Niadio produced over 7 Bcfg and 60,000 bbl of oil before being abandoned in 2000.

In 1996, Fortesa International hit the Gadiaga oil discovery. The field began producing in October 2002, and it produces approximately 7 MMcfgd. Total discovered Dome Flore and Dome Gea fields in 1967 and 1970, in the southern offshore region now governed by the AGC. Together, the fields have estimated P50 reserves of around 300 MMbbl of heavy oil in shallow Oligocene carbonates, and have never been exploited. Shell Senrex drilled Baobab-1 in 1996 on the Dome Gea flank. No subsequent wells were drilled offshore until 2014.

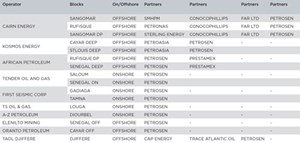

The state participates in exploration through the state oil company, Societe des Petroles du Senegal (Petrosen), typically holding a 10% carried interest in exploration licenses, Table 4. Players have recently gained acreage through farm-in deals, as seen in Mauritania and Morocco. March 2013 saw Cairn farm into First Australian Resources’ (FAR Ltd) Rufisque, Sangomar, and Sangomar Deep blocks, acquiring a 65% interest and operatorship in return for the funding of one exploration well and paying back-costs. ConocoPhillips entered the same three blocks in August 2013, acquiring a 35% interest. Kosmos also farmed into the Cayar Offshore Deep and St. Louis Deep Blocks in August 2014, acquiring a 60% interest and operatorship from PetroAsia in return for the costs of a 3D seismic program and one exploration well in each block.

In April 2014, Cairn spudded the first well offshore Senegal in nearly two decades, in the Sangomar Deep Block, the FAN-1 exploration well. The well made a significant oil discovery in Cretaceous sandstones with a P50 STOIIP estimate of 950 MMbbl. This was followed by SNE-1 on the same block, which encountered excellent-quality Cretaceous sands with best estimate P50 resources of 330 MMbbl.

Senegal has good existing infrastructure in comparison to its West African neighbors. There is a major deepwater port in Dakar, as well as an established refinery and the Cap Des Biches power plant connected to its onshore producing gas fields.

Looking to the future, Kosmos is planning further seismic and drilling on its Greater Tortue Complex, which extends into the St Louis Deep license in Senegal. Kosmos’ Tortue discovery in Mauritania, coupled with the SNE and FAN discoveries in Senegal, provide strong encouragement for exploration in the country, de-risking much of the underexplored offshore.

Cairn has proposed a $150-million, three-year exploration and appraisal program, beginning later this year. The program will start by appraising the SNE-1 oil discovery with two wells, and will also test additional exploration prospects in the same play. The Sirius and Soleil prospects are potential targets with best estimate prospective resources of 204 MMbbl and 101 MMbbl, respectively. There will also be further technical evaluation of FAN-1. Cairn estimates that there needs to be at least 200 MMbbl of proven oil reserves to make SNE-1 a viable development, anticipated to be a stand-alone project with

an FPSO.

Adjacent to Cairn’s SNE and FAN discoveries, African Petroleum is also looking for a partner to help fund further exploration on its Rufisque Deep Block. The operator has expressed a desire to drill at least one well in the block since 2014.

GAMBIA, AGC, GUINEA, GUINEA BISSAU

Gambia, Guinea Bissau, Guinea, and the region governed by the AGC (the Senegal/Guinea Bissau Joint Economic Zone), all offer acreage in the Senegal-Bove basin, with similar geology to Senegal and Mauritania. However, there has been very little investment in these regions. There have been a few discoveries, which remain undeveloped, and the region has little infrastructure. With the exception of Guinea Bissau, licensing in each country is limited to a handful of blocks.

In The Gambia, just three wells have been drilled. BP drilled Brikama-1 and Sarakunda-1 onshore in the 1960s; both were dry. In 1979, Chevron drilled Jammah-1, which encountered gas shows in shelf-edge Cretaceous carbonates.

The AGC area offshore Senegal/Guinea Bissau now contains Dome Flore and Dome Gea fields, originally discovered when the region was governed by Senegal. Ophir drilled Kora-1 in the AGC Profond Block in 1993, which was plugged and abandoned after failing to find the anticipated target.

Guinea Bissau has had a little more activity, with around 20 wells drilled. Esso Guinea drilled 10 wells between 1960 and 1973, encountering oil shows on and offshore. A handful of wells also were drilled offshore by Pecten Guinea Bissau (now Shell) between 1980-1990, encountering oil and gas shows. In 2002, Premier Oil began a drilling campaign that led to the Sinapa oil discovery in 2004. Sinapa is estimated to contain unrisked, 2C resources of 13.4 MMbbl, but questions remain over the reservoir quality.

Two wells have been drilled in Guinea. The first, GU2-B1, drilled by Buttes Resources in 1977, was dry, encountering sands and volcanics. Most recently, Hyperdynamics and Dana Petoleum drilled the deepwater Sabu-1 well in 2011, encountering residual oil shows.

In The Gambia, licensing is governed by the Ministry of Petroleum. In January 2014, the government revoked licenses held offshore by African Petroleum and onshore by Oranto Petroleum, citing inactivity. African Petroleum has since had its license for A1 and A4 reinstated, negotiating an extension to the first exploration period to September 2016. The onshore block, Lower River, is now under application by Tender Oil and Gas.

The AGC governs all licensing in the Guinea Bissau/Senegal Joint Economic Zone and takes around 15% interest in exploration licenses. Proceeds from activity in the area are divided between Senegal and Guinea Bissau at a ratio of 85 to 15. Guinea has licensed three blocks, and the government of Guinea has proposed a licensing round for 25 blocks to be held in second-half 2015.

In Guinea Bissau, the government controls the licensing of new blocks via open tender. The national oil company, Petroguin, is entitled to 10% interest in deepwater licenses, and 20% to 30% interest in shallow water. Svenska Petroleum holds the license surrounding the Sinapa discovery.

Recent exploration has focused on gathering seismic data. In Guinea Bissau, Svenska and FAR are planning to drill the Sinapa West-1 well in 2016 and are also re-analyzing recent 3D seismic surveys to assess the potential of alternative plays, following the SNE-1 in Senegal.

In the Guinea Bissau/Senegal Joint Economic Zone, Oryx Petroleum is planning a well on the Dome Iris prospect in 2016, close to the Dome Flore discovery in the AGC Shallow Block.

Tullow had planned to drill the Fatala-1 exploration well offshore Guinea in 2015, however, it is unclear if this will go ahead following the fall in oil prices, which has impacted the company’s plans in West Africa.

Finally, in The Gambia, African Petroleum has completed 3D seismic and identified prospects analogous to FAN-1 and SNE-1 in Cairn’s neighboring block in Senegal. African Petroleum is looking for a partner in the license, and has committed to drill a well before September 2016.

REGIONAL OUTLOOK

The recent discoveries offshore Mauritania and Senegal, and onshore Morocco, have come at a crucial time for northwestern Africa. The low oil price threatens to impact exploration in such a frontier region, however, while some companies have reduced their exploration plans, the substantial discoveries made have succeeded in encouraging continued investment. The industry in the region has a long way to go before it can be comparable to the rest of the West African coast. There are, however, a few key players and projects in the wider region that are worth noting.

Tullow and Kosmos are two such key players. The pair discovered and developed Jubilee field in Ghana under Tullow’s operatorship, and bring valuable expertise up the coast to Mauritania and Senegal. Despite a cut in its exploration budget, Tullow is going ahead with development of the TEN fields offshore Ghana, where the overall cost of development is estimated to be $4.9 billion, excluding FPSO lease costs. The company is also focusing on its existing proven discoveries in onshore northern Kenya. Kosmos, also a partner in the TEN development, has been encouraged by its recent success in Mauritania and continues to invest in exploring the frontier.

Also in Ghana, the Offshore Cape Three Point project operated by Eni was sanctioned in January 2015, aiming for first oil in 2017, first gas in 2018 and peak production rates of 80,000 boed anticipated from the project in 2019. Eni is a key player in a number of major developments in the West African Atlantic margin. In January 2015, production began from its Nene Marine field in the Republic of Congo, just 16 months after discovery and eight months after the production permit was issued. Eni also is involved in a number of projects offshore in Angola’s Block 15. Production began from Sangos field as part of the deepwater West Hub development in November 2014, adding Cinguvu field in April 2015. Another three fields are anticipated to be bought online over the next two years as part of the project. Eni also plans to start production from the East Hub development in 2017, which will bring production from the license to over 200,000 bopd.

UP-AND-COMING PROVINCE

The northwestern African frontier has seen a boost in exploration efforts, rewarded by some key discoveries that define the region as an up-and-coming province. Despite difficult market conditions that the industry continues to face, which has seen players in the region prioritize their exploration efforts differently, the presence of experienced operators and majors in the region bodes well. Exploration and investments continue with new opportunities available and some potentially significant rewards on the horizon for those that choose to pursue them. ![]()

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)