Wood Mackenzie says Delaware Wolfcamp still leads the pack—for now

HOUSTON -- The Delaware Wolfcamp has been the focus of much of the increase in Lower 48 drilling activity in the past 18 months. While breakevens continue to trend down and the play has attracted a number of new entrants, there are clear signs that growth is plateauing. Is tight oil's crown jewel losing some of its shine?

Stacking up in its favor – the play's competitive economics

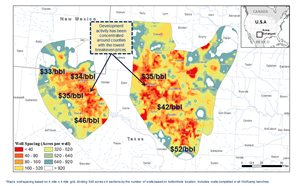

- There's still over eight years of drilling inventory economic under $45/bbl. This accounts for 90% of locations in the play - substantially more than the 65% of locations that breakeven under $45/bbl in the Midland Wolfcamp.

- Three out of four sub-plays we have analyzed still break even on average under $35/bbl.

On the negative side, we see signs of slowing growth:

- Productivity has hit a ceiling. Average six-month cumulative production has reached a plateau in 2017, trending down from the annual 11% increase between 2013 and 2016. As activity ramps up, it's possible that the best wells have already been drilled. As a result, operators have had to adapt to a fresh set of challenges.

- Economics is king. It's no surprise that activity to date has concentrated on counties with the lowest breakeven prices. However, if operators continue to drill up these areas, they will eventually need to switch to less developed areas with less favorable economics.

- Rig growth has peaked. Rig count quadrupled in the Wolfcamp from mid-2016, after major M&A deals drove investment in the basin. Growth flattened out in the second half of 2017, and we expect this to stay flat, with less than 10 net rig additions planned in 2018.

- Extended laterals on the rise. Lateral length has increased by an average of 10% since last year to 6,500 ft. As long as the revenue associated with marginal production more than offsets the cost of additional drilling, operators will continue to test lateral length.

Our verdict? Still an attractive play

With the two Delaware basin tight oil plays set to contribute nearly half of Permian crude production by 2025, the Delaware Wolfcamp is still an attractive play, where breakevens reign supreme.

To adapt to slowing growth, we expect operators to shift their focus to maximizing value across an entire asset rather than a single well.