DEA submits PDO for Dvalin field in the Norwegian Sea

HAMBURG, Germany -- DEA has submitted the Plan for Development and Operation (PDO) for Dvalin field—previously Zidane—to Norway’s Ministry of Petroleum and Energy. Dvalin will be the company’s first operated field development project in Norway.

The Dvalin license plans to produce a total volume of approximately 18.2 Bcm of natural gas from two reservoirs. The development cost is estimated to be 1.1 billion Euros (10 billion Norwegian Kroner), with production slated to start in 2020.

“It’s is a major step for DEA to hand-in the PDO and to transfer this project into the next phase,” said Thomas Rappuhn, CEO of DEA Deutsche Erdoel. “The Dvalin development will contribute significantly to DEA’s ambition to further grow our business in Norway.”

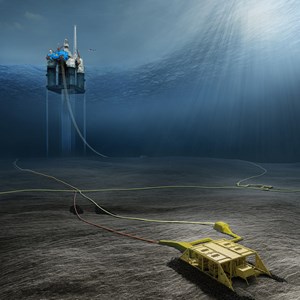

Dvalin will be developed with a four-well subsea template, which is connected to the Heidrun platform. At Heidrun, the gas will be partly processed in a new module, before it is transported in a new export pipeline to Polarled, going to the Nyhamna onshore gas terminal. At Nyhamna, the gas will be processed and transported to the European market.

“Dvalin is DEA’s first development as field operator in Norway, and we are looking forward to the upcoming tasks,” said Hans-Hermann Andreae, managing director of DEA Norge. “Together with our partners, we have come up with a development solution with sustainable long-term economics in an environment of low market prices.”

Creative work in the project team and market developments in the supplier industry have made it possible for the partnership to make the project economical sound. “Over the last few years, we have managed to reduce cost by more than 20%. As a consequence, DEA has got the opportunity to open a new area in the Norwegian Sea for gas production and export,” Andreae said.

Dvalin field lies in PL435 in the Norwegian Sea, approximately 15 km northwest of Heidrun and 290 km from Nyhamna.

DEA Norge is the operator of PL435 with a 40% share. Its partners are Edison (20%), Maersk (20%) and OMV (20%).