Global activity looks solid and is increasing

The short-to-near-term outlook for global upstream activity looks promising, given that as of this writing (late September), oil prices are noticeably above $90/bb for both Brent and WTI; supply remains relatively tight; and demand for oil continues to increase. The U.S. and its lack of E&P growth is something of an anomaly at this juncture, which can be traced to several factors. These include some operators (mostly publicly held) continuing to practice fiscal discipline; prices for oilfield equipment and services rising as much as 20% over the last year; great uncertainty remaining on the governmental/regulatory front; and many industry firms having trouble hiring enough people to allow growth in their activity.

Nevertheless, a healthy majority of countries outside the U.S. should see an increase in the number of new wells drilled this year. There are even indications that exploration activity is on the upswing, prompted by countries and companies eager to diversify sources of oil and gas supply in the wake of Russia’s 2022 invasion of Ukraine.

Nasser’s tidy summation of the situation. Perhaps Saudi Aramco President & CEO Amin Nasser summed up the situation facing oil and gas companies worldwide best, as they wrestle with the challenge of the so-called Energy Transformation. In remarks to the World Petroleum Congress, held in Calgary during mid-September, Nasser said, “…there is the sheer scale of the challenge. We are talking about the complete transformation of a $100 trillion global economy today. One that is likely to roughly double in size by 2050, with close to an additional 2 billion energy consumers. In short, the re-invention of our entire energy-based way of life in less than 30 years.”

“Let us be inspired by that,” continued Nasser, “but understand it means making history. And so far, the reality on the ground is that despite concerted efforts to move to alternatives, global coal consumption is at record levels, exceeding 8 billion tons, with demand still robust. In oil, one widely-publicized scenario calls for global demand to fall by more than 25 million barrels per day by 2030. Yet oil consumption is projected to approach 103 million barrels per day in the second half of this year, which would be a record.

“Meanwhile gas has become an increasingly important bridge fuel, with access to adequate and affordable supplies a geopolitical hotspot. By contrast, despite record renewables growth, wind and solar combined still only account for about 5% of global primary energy consumption today.”

In short, what Nasser described is a situation where oil and gas remain crucial to the functioning of the global economy and will continue to do so for many years to come. Accordingly, we present World Oil’s international E&P outlook.

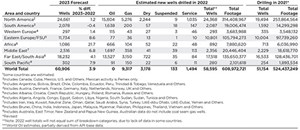

Global highlights. Drilling outside the U.S. during 2022 was noticeably higher than the 2021 level, gaining 10.1%. Building on that progress, World Oil projects the number of wells drilled outside the U.S. in 2023 will increase 6.6%, as the global upstream industry continues to surge higher. Every region, save for South America (which barely has a decline), will experience higher drilling levels this year.

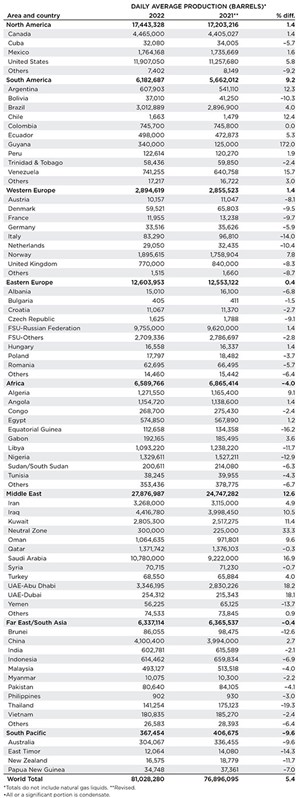

On the production front, with the world coming out of the Covid-19 pandemic last year, worldwide output of crude and condensate experienced robust growth during 2022. Global production gained 5.4% last year, averaging 81.028 MMbopd. Improvement was noted in five of the eight regions that World Oil tracks.

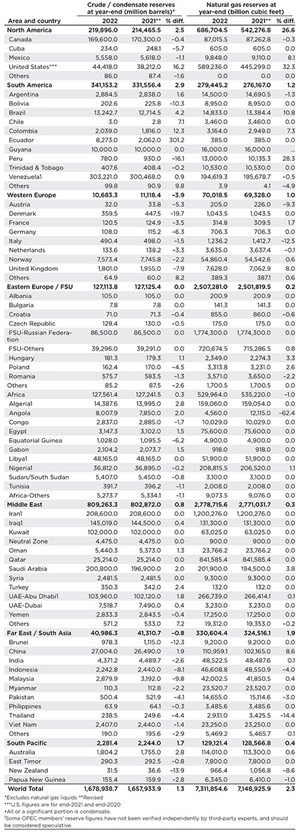

Hand-in-hand with the strong gain in drilling levels during 2022, both oil and gas reserves showed gains. Worldwide crude and condensate reserves increased 1.3% to 1.679 trillion bbl, with five of eight regions showing improvement. Meanwhile, natural gas reserves performed even better, gaining 2.3% to 7,311.9 Tcf. Please read forward for discussions of activity in the eight global regions.

NORTH AMERICA

Outside of the U.S., upstream activity will be affected by the regulatory front in Canada, as well as increased operations offshore Mexico. Last year, new wells drilled in the region outside the U.S. totaled 5,839, up 23.4%. Activity this year will be supported by fresh, deepwater discoveries offshore Mexico and renewed governmental support in Canada. Again, outside the U.S., World Oil forecasts a strong drilling increase of 10.5% in the region. Meanwhile, oil output, including the U.S., was up 4.2%, at 18.176 MMbpd. Oil and gas reserves were up 2.5% and 26.6%, respectively. The latter figure was due in large part to a 32.3% gain/revision in U.S. gas reserves.

Canada. Upstream activity in Canada was heavily impacted during late spring and summer by wildfires that threatened production in Alberta. Thousands of barrels were left shut-in for days, as onsite crews evacuated worksites. In addition, crude output fell to a seven-year low, due to oil sands mine maintenance.

However, industry continues to move forward with increased spending plans, and it has continued its decarbonization efforts and pursuit of new opportunities in carbon storage, hydrogen and LNG, all while continuing to increase production. Canadian producers are planning to boost output to fill the Trans-Mountain pipeline, which is undergoing expansion to accommodate 890,000 bopd of production, almost doubling its existing capacity. With all this in mind, World Oil expects drilling in Canada to increase 10.2%, Fig. 1. Nationwide oil production averaged 4.465 MMbpd, up 1.4%. Oil and gas reserves held nearly stead at 169.6 Bbbl and 87.0 Tcf, respectively. For more details, please see the Canadian forecast article authored by Robert Curran in this issue.

Mexico has seen a boost in upstream activity that should grow further in 2023. Large discoveries from Wintershall Dea and Eni will move this trend forward. Preliminary estimates from the Wintershall-operated Block 30 offshore Mexico indicated discoverable resources between 200 MMboe and 300 MMboe. In addition, the Eni-operated Block 7 offshore contains an estimated 200 MMboe.

Discoveries aside, activity increases from Perenco and Talos Energy are adding to the positive growth in the region. Perenco deployed artificial lift technologies to boost production after a drilling campaign at Santuario Noreste onshore Mexico. Additionally, a consortium led by Talos Energy has made great strides in developing the highly-anticipated Zama offshore field.

Given this activity and other projects, World Oil expects drilling to increase 18.4% in Mexico, Fig. 2. Countrywide oil production averaged 1.764 MMbpd in 2022, up 1.6%. Oil reserves were down 1.1%, but gas reserves gained 8.1%.

SOUTH AMERICA

Much of South America’s growth will come from Venezuela, as leaders around the world reconsider global sanctions. Activity in the lucrative Stabroek block offshore Guyana continues at a steady pace. However, standstills in Brazil, Colombia and Trinidad and Tobago may negatively impact drilling activity, as failed discoveries and exploration bans stunt growth. In all, World Oil forecasts regional drilling to slip 0.4%. Oil production was up 9.2%, to 6.183 MMbpd. Oil and gas reserves were up 2.9% and 1.2%, respectively.

Brazil. Activity in Brazil has thrived, with multiple offshore wells going onstream this year by Karoon and Petrobras. Karoon achieved first production from its PAT-2 well at Patola field. The well went onstream in March at a rate of 12,000 to 14,000 bpd. Petrobras also announced the arrival of the FPSO Sepetiba from a Chinese shipyard. It will begin production in fourth-quarter 2023 at Mero field.

In addition, Petrobras and CNOOC have been producing from the Buzios offshore field, at a rate as high as 616,000 bopd, from four FPSOs. The plan is to add eight additional FPSOs to the field complex by 2030. Four of those FPSOs have been under construction already.

However, drilling in Brazil’s Equatorial Margin has stalled, as a Petrobras-operated drilling rig sat idly waiting for approval from authorities. ExxonMobil completed a drilling campaign after failing to find oil. Still, the Brazilian government surprised the industry by lifting key hurdles in the Foz de Amazonas basin, which will allow Petrobras to embark on a drilling campaign in the area. Countrywide, World Oil anticipates drilling to jump 28% higher. Oil production was 4% higher, at 3.012 MMbpd, Fig. 3. Oil and gas reserves were up 4.2% and 10.8%, respectively.

Argentina. At the beginning of 2023, World Oil stated that Argentina’s combined oil and gas production was at an all-time high. This statement still holds true, as activity picks up in the region’s lucrative Vaca Muerta shale play, with pipeline expansions expected to solve bottlenecking problems in the area.

Although supermajor ExxonMobil has put all of its shale assets in the country on hold, oil production from other shale operators is expected to create a surplus in energy trade, according to Energy Undersecretary Flavia Royon.

Upcoming elections in the country have put the state of producing regions like Vaca Muerta into question. However, state companies have assured operators that Argentina’s shale industry is safe from political influence. That having been said, World Oil expects drilling in the country to increase 8.3%. Oil production jumped 12.3% higher, to 607,903 bpd. Oil reserves were up 1.6%, but gas reserves fell 1.3%.

Guyana and Suriname. Industry attention is focused on Guyana and Suriname, as ExxonMobil continues to develop the area’s offshore assets. The delivery of the FPSO Prosperity will bring roughly 220,000 bopd online from the Stabroek block this year. The vessel joins the Liza Destiny and Liza Unity FPSOs, which currently produce over 380,000 bpd.

Other oil and gas companies are following ExxonMobil’s success in the region. TotalEnergies launched development studies for Block 58, drilling several wells in August 2023 to confirm resource reserves of roughly 700 MMbbl. World Oil expects drilling offshore Guyana to increase 7.1%. With the introduction of additional productive capacity, Guyana’s oil production rate jumped 172%, to 340,000 bopd.

Offshore Suriname, APA Corp. continued its work in Block 58 (Fig. 4) and edged closer to constructing the country’s first commercial deepwater project. The most recent appraisal well in August 2023 confirmed the extension of oil resources 14 km from the discovery well. In February, APA had estimated combined oil resources at the Sapakara and Krabdagu discoveries to be more than 800 MMbbl. Drilling offshore Suriname totaled six wells in 2022, with another three wells planned for 2023. Overall, including onshore work, Suriname’s drilling is up 26% this year. Oil production last year from traditional onshore wells averaged 16,833 bpd, up 3.2%.

Colombia. The government made good on its promise to focus on renewable energy at the expense of oil and gas development. Ecopetrol’s CEO called on the country’s governing forces to drop the ban on new oil exploration licenses to tap into the region’s undiscovered resources. In fact, dwindling reserves have prompted Colombia’s fossil-fuel averted President, Gustavo Petro, to study the impact of the ban.

Parex Resources abandoned its exploration campaign in Colombia after tests showed an absence of hydrocarbons. However, Canacol Energy found positive results after drilling additional exploration wells around its Lulo 1 gas discovery site. Meanwhile, Ecopetrol and other producers have boosted production through technological advances. World Oil expects drilling to decrease 23.5%. Oil production was essentially even at 745,700 bpd. Oil and gas reserves improved 12.3% and 7.3%, respectively.

Venezuela’s upstream sector has been impacted historically by global sanctions. However, that hasn’t stopped the country, of late, from increasing its production and drilling activity. As Chevron has returned to the country and resumed output from the region, there’s been speculation that the Biden administration will temporarily lift U.S. sanctions, boosting production rebound odds. Chevron has been producing 100,000 bopd during 2023.

If the reversal does happen, other major players may achieve results similar to Chevron’s. Some international companies, such as Eni and Repsol, have already begun pressing Venezuelan President Nicolás Maduro for more control of their operated oil fields, so that they can increase output.

With this uptick in activity, World Oil anticipates drilling this year will increase 29.6%. Oil output was up 15.7%, to 741,255 bpd. Oil reserves increased 0.9%, but gas reserves were off 0.5%.

Trinidad and Tobago. Activity in Trinidad and Tobago has declined dramatically. The Caribbean country is even inviting neighboring countries to process their oil and natural gas in Trinidad and Tobago, due to a lack of resource output. As the country’s economy relies on its energy sector, processing hydrocarbons is essential to keeping things afloat during this decline in upstream activity. As such, World Oil predicts a 34.8% decrease in drilling. Oil production fell 2.4%, to 58,436 bpd. Oil reserves declined slightly, while gas reserves remained unchanged.

WESTERN EUROPE

Still reeling from an energy crisis brought on by Russia’s invasion of Ukraine, Western Europe has placed energy security at the forefront of its priorities. While new Norwegian discoveries still have a long way to go before first production, operators in the North Sea are finding new ways to optimize and extend mature field life. A total of 297 new wells is estimated to be drilled this year, for a 1.4% increase. Regional oil production averaged 2.895 MMbpd in 2022, up 1.4%. Oil reserves slipped 3.9% lower, but gas reserves were up 1.0%.

Norway. Norwegian companies, principally Equinor and DNO, continue to make progress through multiple, significant offshore discoveries and major field developments, Fig. 5. In addition, Equinor’s Field Life Development unit has brought the mature Statfjord Øst field on the Norwegian Continental Shelf back to life, with production increase expectations sitting at roughly 26 MMboe.

Wintershall achieved first production from Dvalin natural gas field, providing enough resources to heat over 2 million homes. Considering that most of Western Europe has been battling an energy crisis since Russia’s invasion of Ukraine, this is a significant plus for Norway and the rest of the region.

In addition, the Norwegian Ministry of Petroleum and Energy approved Aker BP’s development plan for Tyrving field in the North Sea, which has recoverable resources of around 25 MMboe. Other significant players expected to increase production in the area include Neptune Energy, Spirit Energy and Var Energy, among others.

Taking the various players into account, World Oil expects drilling to actually decrease 7.7%. Oil production shot up 7.8% last year to 1.896 MMbpd. Oil reserves slipped 2.2%, but gas reserves gained 0.6%.

United Kingdom. Operators in the UK continue to work in the North Sea despite windfall taxes that make investing in the region’s oil and gas sector unattractive. However, it seems officials are working to close the supply gap created by Russian sanctions with home-grown energy.

In July, Prime Minister Rishi Sunak confirmed plans to award hundreds of offshore licenses to increase North Sea production and has hinted at continuing the trend with future licensing rounds. While many experts are anticipating a decline in North Sea production, the government has conceded that fossil fuels are essential to support the region’s energy security.

The main goal for operators in the region, it seems, is to invest in developing currently producing assets and attracting activity back to an area that otherwise pushed operators away with unappealing regulations, Fig. 6. For example, through a reconfiguration campaign, Perenco extended the field life of its UK North Sea assets by a decade.

Taking all of this into account, World Oil expects drilling in the UK to increase 11.9% this year. Oil production declined 8.3% to 770,000 bpd. Oil reserves fell 7.9%, but gas reserves gained 8.0%.

Others. Elsewhere in Western Europe, activity is expected mostly to increase. France’s drilling is forecast to grow 33.3%, while Germany and Italy will increase by 63.6% and 50%, respectively. The Netherlands appears to be the outlier, as we expect drilling there to decrease 35.3%.

EASTERN EUROPE/FSU

A combination of OPEC+ production cuts and global sanctions are some main factors in activity for Eastern Europe and the greater FSU. However, an uptick in activity from Azerbaijan, Albania and Romania may offset decreases brought on through Russia’s geopolitical position. Total wells drilled in the region are forecast to rise 8.6%, to 11,734. Regional oil production inched up 0.4%, to 12.604 MMbpd. Oil and gas reserves in the region remained essentially flat last year.

Russia. While global sanctions have been imposed on Russia for more than a year-and-a-half after its invasion of Ukraine, they don’t seem to have impacted the country’s upstream operations significantly. In fact, Russia’s oil firms are setting a record pace in their drilling this year, even as the country has agreed with OPEC+ to make longer production cuts. According to data seen by Bloomberg, Russian rigs drilled 14.7 MMm (48.2 MMft) of production wells from January through June, 6.6% more than planned and 8.6% more than the same period in 2022, Fig. 7. Last year, Russian operators set a post-Soviet production drilling record, and it appears that a new record high will be established this year.

This is all the more remarkable, considering that Russian oil firms accelerated their drilling, even as the Kremlin told them to reduce output by 500,000 bopd. At first, this was for just a few months in retaliation for Western sanctions over Ukraine. However, the reduction was extended until the end of 2024 in coordination with other members of OPEC+.

Not surprisingly, we predict the record-breaking drilling pace will result in an 8.1% gain in Russian wells drilled this year. Oil production rose 1.4%, to 9.755 MMbpd. Oil and gas reserves remained unchanged.

FSU others. Most activity in the FSU outside Russia is concentrated in Kazakhstan and Azerbaijan. In Kazakhstan, oil exports increased 8%, y-o-y, during first-half 2023. After slipping 1.5% to 1.773 MMbpd in 2022, Kazakhstan’s oil production rose 6% during first-half 2023. In Azerbaijan, partners TotalEnergies, ADNOC and SOCAR have made great strides in developing the Absheron offshore asset. The second phase of development is expected to increase output by 5.5 Bcm (194.2 Bcf) of gas per year. World Oil predicts drilling by this group of countries will be up 12.9%. The group’s oil production was down 2.8% at 2.709 MMbpd. Oil reserves remained unchanged, while gas reserves rose 0.8%.

Eastern Europe Others. Among the smaller countries of Eastern Europe, we see mostly small increases in drilling for the remainder of 2023. Most notably, Albania is forecast to boost drilling 43.5%. World Oil forecasts that Poland and Hungary’s drilling activity will increase by 10.0 % and 5.3%, respectively. OMV Petrom has made multiple significant discoveries in Romania. In June 2023, OMV Petrom and Romgaz approved a development plan for the Domino and Pelican South offshore fields, in the Neptun Deep Block, Fig. 8. This will be Romania’s first commercial deepwater project. First gas is expected in 2027. For Romania in 2023, World Oil expects drilling to increase 3.4%.

AFRICA

Downward-trending output is set to continue, although discoveries in the Orange Basin (offshore Namibia) and growing production in the Hibiscus/Ruche field (Gabon) could prove promising. Nigeria, Mozambique and South Africa are taking the fore in pursuit of gas, while Egypt’s Zohr field faces an unexpected slump. World Oil expects the region’s new wells to increase 21.7% to 1,086. Regional oil production declined 4.0% to 6.590 MMbpd. Oil reserves crept up 0.3%, while gas reserves slipped 1.0% lower.

Angola faced a 4.5% drop in oil production, from 1.16 MMbopd in May 2022, to 1.11 MMbopd in January 2023. During all of 2022, Angolan production averaged 1.155 MMbopd, up 1.4%. Furthermore, Angola still managed to pass by Nigeria to become Africa’s leading oil producer in April. Meanwhile, the country is courting up to $15 million in exploration investments from Exxon, with a MOU promising improved fiscal terms. And IOCs are conducting multiple E&P projects, including Kaombo North, the Eastern and Western hubs at Block 15/06 operated by Eni Angola, plus CLOV Phase 2 and Dalia Phase 3 on Block 17, operated by TotalEnergies.

World Oil anticipates a 38.3% increase in drilling. Oil reserves gained 2.0%, but gas reserves were revised sharply downward.

Egypt. Zohr field—which supplies 40% of gas exports—slumped in production over the last year, down 11% down from 2021’s level. A $7.7 billion, Eni-BP investment bid to bolster production was confirmed in Q3 and could counter this loss. Meanwhile, the GNN field added another discovery in August. The GNN-11 well produced more than 2,500 bopd. The field’s early production facility was brought onstream in March 2023 at 4,200 bopd, with more wells due to come online. In addition, production and first gas were achieved by United Oil & Gas at the ASH-8 well and North El Amriya and North Idku project, respectively.

World Oil anticipates drilling to increase 4.6%. Oil production rose 1.2%, to 574,850 bpd, Fig. 9. Oil reserves were up 1.5%, while gas reserves remained steady.

Libya is angling to re-achieve the 2010 production level of 1.54 MMbopd. With current production at 1.2 MMbopd, this ambitious target may be within reach. Also, there is the possibility next year of Libya’s first oil and gas licensing round since 2007, Despite some production outages in July, the country is forging ahead with a contract for a 30,000-bpd refinery. We anticipate wells drilled to increase 75.9%, as the country’s drilling efforts continue to recover. Oil production was down 11.7% in 2022, to 1.093 MMbpd. Oil and gas reserves remained steady, with no official updates provided.

Nigeria. Despite Nigeria’s push to reach a 2.6-MMbpd crude production target by 2027, supermajor investments are uncertain. Exxon still seeks to finish selling its shallow-water assets, which stalled in August 2022. However, the 2019 Kolmani field discovery—1.0 Bbbl of oil and 500 Bcfg—could shift Nigeria to a more gas-centered producer in the future. Meanwhile, drilling is set to be very active, with an estimated 140 exploration wells year-on-year until 2030 expected. World Oil predicts a 51.4% increase in drilling. Oil production was down 12.9%, to just 1.330 MMbpd, with further slippage occurring during first-half 2023, allowing Angola to become the continent’s top producer, Fig. 10. Oil reserves slipped 0.2%, but gas reserves rose 1.1%.

South Africa. The 3B/4B Block in offshore Orange Basin looks to be a hotbed of activity, with two discoveries this year, Jonker and Venus, totaling 4 Bbbl and 5Bboe respectively—adding to existing Brulpadda and Luiperd gas discoveries. The country’s fifth licensing round closed in early Q3, but lagging economic policy incentives may dampen enthusiasm for investment.

MIDDLE EAST

Yearly crude oil output remains below pre-Covid levels. Still, various licensing and bidding rounds promise future growth, and gas is a major focus, with Iran, Iraq, Israel and Qatar leading the way. Meanwhile, Iraqi Kurdistan-Turkish conflict over a major pipeline has persisted since March, and civil war in Sudan is already causing export woes. However, some conflicts may be easing: Saudi Arabia is pursuing agreements with Houthi rebels in Yemen to allow reopening the oil sector. World Oil anticipates a 6.8 % change in regional drilling, with 2,516 new wells. Regional production grew 12.6% in 2022, averaging 27.877 MMbopd. Oil reserves were up 0.8%, and gas reserves eased 0.3% higher.

Saudi Arabia. Saudi Aramco made $161.1 billion of net income in 2022, with yet further ambitions to boost output by 1.5 MMbpd through various projects in the coming years, despite voluntary 1-MMbpd cuts extended through end-2023. Renewables are increasing also, and 4.5 GW of total solar capacity are planned by 1H 2026, with 1.5 GW of projects announced in September 2023, plus 1.8 GW of wind planned but still to be announced. Two deals increased Saudi supply to Chinese refineries by 690,000 bpd.

World Oil anticipates a 14.9% boost in the Kingdom’s drilling. Oil production was up 16.9% in 2022, averaging 10.780 MMbpd. Oil reserves increased 2.0%, and gas reserves jumped 3.8% higher.

UAE-Abu Dhabi. For UAE, the agenda appears sustainability-focused in 2023; ADNOC achieved FID for the Habshan facility, raising future carbon capture capacity to 2.3 mtpa by 2026. Meanwhile, the Tabreed project marks the Emirates’ first foray into geothermal energy, as a part of plans to achieve 14GW by 2030. Wells drilled, overall, are projected to rise 17.4%, as ADNOC increased its onshore drilling capacity with 10 new hybrid rigs, which promise 10-15% lower emissions intensity, Fig. 11. Oil production was up 18.2% last year, at 3.346 bpd. Oil reserves rose 1.8%, while gas reserves inched up 0.1%.

Iran. Despite the lingering effects of Western sanctions and IS group security concerns, Iran’s gas-related activity looks to increase. And $1.5 billion in exploration comes on the heels of a claimed 200-Tcfg discovery in the Sea of Oman. Meanwhile, oil exports reached a record 2.98 MMbpd in August this year, and increased focus on the West Karun cluster. Akkas (5.6 Tcfg), Mansuriya (4.5 Tcfg) and South Pars fields could spur greater gas numbers, as well. Iran also conducted diplomatic rapprochement with Saudi Arabia this year. Oil production was up nearly 5%, at 3.268 MMbpd. Oil and gas reserves remained unchanged.

Iraq. In spite of lowered oil output this year, due to OPEC+ cuts, Iraq seeks to focus on gas self-sufficiency. A possible gas-centered licensing round stands at odds with the country’s trend of losing supermajors—Petronas and ExxonMobil being the latest of these exits. The Iraqi Kurdistan pipeline export conflict and subsequent pipe closure looks to stretch on into the coming months. Still, a $27 billion multi-project deal with TotalEnergies promises an estimated $10 billion capex. Accordingly, World Oil expects a 19.5% increase in drilling for 2023. Oil production last year averaged 4.417 bpd, up 10.5%. Oil and gas reserves were up and flat, resprectively.

Oman. For Oman, 2020 economic pain still lingers. However, a successful $2.5 billion loan negotiation by EDO, and the two-part onshore and offshore bidding round in 1H 2023 may change Oman’s prospects. State firm OQ agreed to sell 40% stakes in blocks 48 and 60, respectively, and World Oil anticipates drilling to improve 2.6% in 2023. Meanwhile, Oman’s PDO aims to produce 30% of its power from renewables by 2060. Oil production rose 9.6% to 1.065 MMbpd last year. Oil reserves rose 1.3%, while gas reserves were unchanged

Lebanon. Despite continued political turmoil and poor economic conditions, Lebanon is pushing its offshore drilling during 2023. TotalEnergies was looking to begin exploration drilling offshore in Block 9 in Q3, with results by end-2023. Meanwhile, the country is looking to secure increased fuel supply agreements with Iraq in exchange for Lebanese healthcare and other services, given Lebanon’s historically poor power supply.

Israel. Gas output hit a record 2.36 Bcfd during Q1 2023—most of it coming from Leviathan field, which has supply and production capacity expansions planned for 2025. With considerable interest from majors for Israel’s 4.5 Tcfg Aphrodite field and Q2 licensing round, as well as exploration license 434 for Megiddo Valleys, this level of activity is likely to increase. Meanwhile, BP and ADNOC have partnered to purchase 50% of NewMed Energy. Zion Oil and Gas is looking to re-enter the MJ-1 well, due to promising geological structures, and anticipates a new exploration license.

FAR EAST/SOUTH ASIA

We expect regional drilling to increase 4.1%, with 18,232 new wells spudded. While China remains responsible for the bulk of these, Thailand boasts a 32.7% drilling increase of its own. Multiple majors have decreased their Southeast Asian presence, with $5 billion-plus of assets slated to change hands in the coming years. Regional oil production was 0.4% lower, with a number of smaller countries slightly less. However, China made up for most of it with a 2.7% gain of its own. Oil reserves decreased 0.8%, while gas reserves jumped 1.9% higher.

China’s demand for oil is riding high, with IEA estimates of the increase rising from 100,000 bpd to 2 MMbpd, and 800,000 bpd more in consumption demand, year-on-year, for Q2 2023. Despite an estimated 100-MM-ton Bohai Sea discovery in March, imports from Russia and Saudi Arabia increased year-over-year for 1H 2023, 28% and 7.3% respectively. The Bohai Bay and Bohai Sea remain an important contributor to Chinese attempts to grow domestic oil production, Fig. 12. Indeed, offshore wells drilled are now topping out over 400 per year. We expect offshore drilling to increase 3.7% this year.

Coal remains a key energy source, comprising 56.2% of electricity generation for 2022, with 106 GW of planned capacity approved last year despite ambitions for carbon-neutrality by 2060. The country’s carbon peak is currently expected in 2030. World Oil anticipates Chinese drilling to increase 3.0%. Oil production managed another gain, rising 2.7% to 4.100 MMbpd. Oil reserves were up 1.9%, and gas reserves picked up 8.6%.

India reached record crude refinery output in January 2023 at 5.39 MMbbl, with a concurrent 4% rise in natural gas output and 1% dip in crude oil production. Drilling may be down 1.8% this year, but it will be targeting around 150 million tonnes of oil equivalent in yet-to-find resources, with hopes to probe these by 2025. The Dhamra LNG terminal received its first cargo in April, and a month earlier, the Block KG-D2 MJ field commenced natural gas production, with predicted total block output of around 30 MMcmd in 2024. Oil production was off 2.1% at 602,781 bpd. Oil reserves were down 2.6%, while gas reserves were essentially unchanged.

Malaysia. Six oil and gas discoveries occurred during the domestic exploration drilling campaign begun last year, and Petronas anticipates 2-MMbopd peak domestic production in 2024. Shell’s Timi platform achieved first gas production, and Petronas’s 2020 105,000 km2 offshore seismic program has reached its third phase. We predict an 11.3% increase in drilling. Oil production averaged 493,127 bpd, down 4.0%. Oil reserves were down 9.8% in the short run, while gas reserves gained 0.4%.

Indonesia. The country has ambitions to reach 1 MMbopd and 12 Bcfgd of output by 2030, with Petronas and Eni acquiring additional interests. The latter is looking to fast-track development of the Gendal and Gadang project’s estimated 2 Tcf of gas reserves. We predict drilling to increase 8%, including 18 wells planned by 2026 to maximize existing Kruh Block production. Oil production was down 6.9%, averaging 614,462 bpd. Oil and gas reserves were down 8.1% and 4.0%, respectively.

SOUTH PACIFIC

The region’s gas trend continues, even with Australian policy pushing a renewable-heavy energy mix. There is gradual progress on the PNG LNG project. Various projects and surveys are planned to increase production. World Oil anticipates regional drilling to increase 7.9%, totaling 302 wells. Oil production across the region averaged 367,454 bpd, down 9.6%. Oil reserves were up 1.7%, while regional gas reserves squeezed out a 0.4% gain.

Australia. Gas remains of key interest as a supporting fuel, with the country looking to achieve an 82% renewable energy mix by 2030. Strikes at Chevron’s Wheatstone and Gorgon LNG facilities—resolved in September—caused LNG prices to jump as much as 35% in August, though a collective 5% of global LNG production wasn’t affected. Elsewhere, Walyerling field production was also delayed until third-quarter 2023. During late 2022, bp sold its share in the Woodside-operated North West Shelf Oil Project to Jadestone Energy. The North West Shelf Oil Project comprises four fields that produce through the FPSO Ohka, which was installed as a replacement production vessel in 2011, Fig. 13.

The state of South Australia saw drilling jump last year from 52 to 119 wells. The higher level is expected to be maintained this year. In Queensland, conventional oil wells dropped from 43 in 2021 to 15 last year. However, coal seam gas wells rose from 567 to 646. Look for that state’s oil drilling to rebound a bit this year. The CSG wells should remain steady.

Across the entire country, not counting the CSG wells, we anticipate drilling to be up 4.2%. Oil output dropped 9.6% in 2022, averaging 304,067 bpd. Oil and gas reserves were up 2.8% and 0.6%, respectively.

New Zealand. The country has an election coming up on Oct. 14, and part of the political debate is on energy policy. The ruling Labour Party had imposed a ban on new offshore oil and gas exploration in 2018. But the challenging National Party has said that it would repeal that ban. And ACT Party Leader David Seymour has said that the Labour Party has an “insistence on headlines rather than practical policies.” It is likely that the two parties would have to join together to form a new government after the election.

Interestingly, in spite of the exploration ban, the offshore share of New Zealand’s total drilling has increased, as operators develop the assets they already possess. In 2021, offshore drilling comprised six of 16 total wells in the country. Last year, that share jumped to nine of 16 wells. And there seems to be an urgency to drill more, to boost the country’s gas production capability. We predict that the country’s drilling will jump 43.8% this year. Oil production during 2022 fell 11.7%, to 16,575 bpd. Not surprisingly, oil and gas reserves slid 13.9% and 8.6% lower, respectively.

Papua New Guinea. Two FEED contracts—for four LNG “e-trains” with 4 MMtpa total capacity and phase one upstream production studies, respectively—were awarded this year to JGC and TotalEnergies. Kumul Petroleum, meanwhile, has proposed a fifth “e-train” and has purchased a 2.6% additional stake in the PNG LNG project from Santos as well, all the while debating a $3 billion price tag for developing a collective 2.5 Tcfg from four gas fields, offshore and onshore. A multi-client 3D survey offshore commenced in June. World Oil predicts a 66.7% change in drilling, although this is a well count change in the single digits. Oil production was down 7.0% at 34,748 bpd. Oil and gas reserves were 2.8% and 1.0% lower, respectively.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)