Industry at a glance

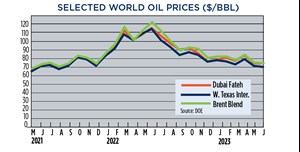

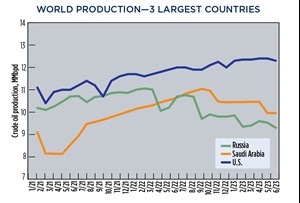

Benchmark crude prices traded in a narrow range in June as persistent global economic concerns overshadowed deepening supply cuts from OPEC+ countries. Oil demand growth continues to slow, while China’s widely anticipated reopening has failed to extend beyond travel and services, with its economic recovery losing steam after a surge earlier in the year. Brent hovered around $75/bbl in June, slightly below the $75.5/bbl averaged in May, but a staggering $48/bbl less than the year ago price of $112/bbl. WTI traded around $70/bbl in June, slightly less than in May but 39% less than the average price of $115/bbl in June 2022. Prices are expected to face more downward pressure in the coming months due to the expected return of a major Libyan oil field.

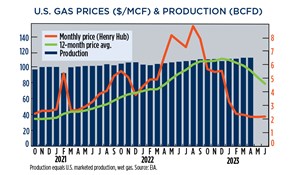

U.S. natural gas outlook. With above-average natural gas inventories and lackluster demand in Europe, it appears the U.S. natural gas market will remain depressed in the coming months. In June, the commodity at Henry Hub was trading at $2.18/MMBtu, with the 12-month running average down to $4.59/MMbtu, the lowest since April 2022 when the 12-month running average was just $4.51/MMbtu.

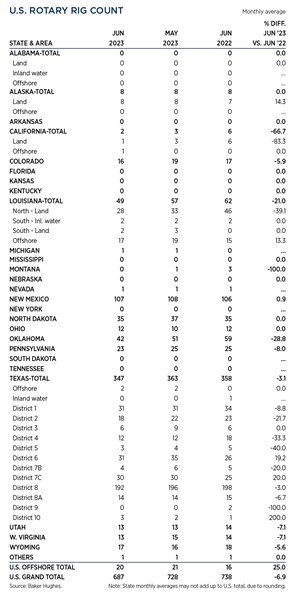

U.S. rig count. Depressed crude prices continued to negatively impact U.S. drilling, with the rig count dropping another 16 rigs in June, after a 24-rig loss in May. In June 2023, the overall U.S. rig count averaged just 687, the lowest monthly average since March 2022 (662). The overall Texas count was down 16 rigs to 347, with four-rig losses reported in RRC District 2 (18), District 6 (31) and the Permian District 8 down to 192. Oklahoma suffered a nine-rig decrease, down to 42, a drop of 17.6%. Total activity in Louisiana was down 14%, dropping eight rigs to an average of 49 in June. The largest decline occurred onshore Louisiana, with a loss of five-rig loss, down to 28.

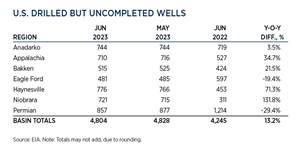

Drilled but uncompleted. Despite depressed U.S. natural gas prices, operators continue to drill in gas dominated regions. However, most gas regions show a slight m-o-m reduction, with the exception of the Niobrara region. In June 2023, there were 4,804 DUCs in the U.S., 559 more than the 4,245 tallied in June 2022. In recent months, the build in the DUC inventory has slowed, but there are large y-o-y gains still being reported in multiple shale basins. In the Niobrara region, DUCs are up to 721 (+132%), Haynesville has 776 (+71%), Appalachia has 710 (+35%), with 515 DUCs in the Bakken inventory (+23%). These four regions account for 43% of the total U.S. DUC count. On a positive note, the Permian and Eagle Ford experienced y-o-y declines of -29% and -19% in their DUC inventories, respectively.

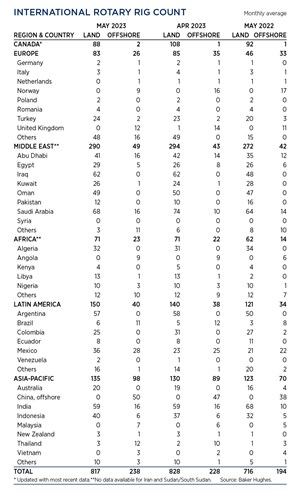

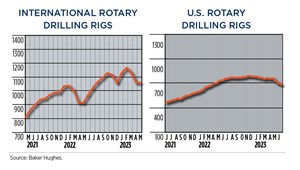

International rig count. Drilling activity outside the U.S. remained relatively steady with the exception of Canada. In May, the international rig count averaged 1,055, just one less than the 1,056 working in April. The largest decrease was reported in Canada, which suffered a 19-rig decline due to spring thaw. The decrease in Canada was offset by a 14-rig surge in the Asia-Pacific region (233) and a 10-rig gain in onshore activity in Latin America (190).

- Dallas Fed: Outlook improves, even as activity little changed; break-even prices increase (April 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)