As Guyana awaited the results of a first-ever offshore lease sale, the small South American nation was poised to finally reap the economic rewards befitting a major player in the global petroleum arena.

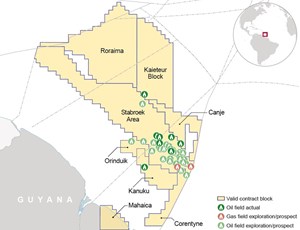

Concurrent with the July 15 offering of 14 ultra-deepwater and shallow-water blocks (Fig. 1) is a newly enacted production sharing agreement (PSA) model that gives the government a bigger slice of a rapidly growing pie. Among other provisions, the new PSA calls for a 10% government royalty—some eight percentage points higher than the contentious terms that an Exxon-Mobil-led consortium nailed down when it ushered Guyana onto the world petroleum stage seven years ago. The three-company joint venture remains the country's sole producer.

The revamped PSA structure, however, is not expected to dissuade operators from trying to get a stake in what is inarguably the world's hottest offshore play. Testament to Guyana's rising profile, OPEC put out feelers in June as to whether it may wish to join Venzeula as the only South American countries in the cartel, according to a June 27 article in The Wall Street Journal. Guyana officials reportedly said no thanks, for now.

"It seems that the operators have accepted that the government will demand more favorable terms, and it has had little effect on the interest of IOCs (international oil companies) to continue investing, and thus would have low impact on future activity," Magda Rodriguez, S&P Global senior analyst, Americas, said in an interview.

Bearing that out, Ministry of Natural Resources (MNR) Minister Vickram Baharrat said in late February that more than 20 companies had filed intentions to bid, pending their evaluations of the final PSA to be released this month. Prospective bidders included newcomers Shell, Petrobras, Chevron and QatarEnergy; government officials also reached out to India's Oil and Natural Gas Corp. (ONGC) to gauge its interest in bidding.

Though Guyana and Suriname share a border on South America's northern Atlantic Coast, their oil production has moved along vastly different tracks. With a third floating production storage and offloading (FPSO) vessel set to begin lifting light, sweet crude from the giant Stabroek Block by the fourth quarter, Guyana is expected to average production of around 353,000 bpd this year, up from 276,000 bpd in 2022, and is on track to exceed 1.2 MMbpd by 2030 at the latest, according to S&P and government data. ExxonMobil, as operator, holds a 45% interest in the 6.6-million-acre block with minority partners Hess Corp. (30%) and China's CNOOC (25%). Promising discoveries notwithstanding, Suriname is at least four years away from initiating offshore production, Rodriguez says.

Though shallow-water activity has picked up, the Guyana-Suriname basin is widely regarded as a deepwater play, with discoveries in up to 9,000 ft of water and drilling conditions strikingly similar to those in the outer Gulf of Mexico. As of July, eight floaters were drilling ahead in the basin, all but one in Guyana (Fig.2), according to S&P Global.

Like Guyana, Suriname opened up competitive bidding this year, mainly for shallow water acreage in the largely unexplored Demerara area, to the northeast and directly across the nautical border on the southwest side of Stabroek. The closing of the sale on May 31 saw qualified bids received on three of the six blocks on offer. The winning companies have not been disclosed as of this writing, pending signing of the PSA, which are said to closely mirror those of its neighbor.

"To make the licensing process more transparent, Suriname, like neighboring Guyana, has decided to abandon its open-door policy for the allocation of exploration areas, in favor of competitive bidding processes," says Rodriguez. "Heightened investor interest, stemming from Suriname’s exploration success, is expected to reduce pressure on the country’s authorities to offer major concessions on fiscal terms for future contracts."

As for the delayed Guyana lease sale, the 11 shallow-water and three ultra-deepwater blocks on offer range in size from 386 to 1,157 sq. mi—miniscule compared to Stabroek, which is recognized as equivalent in size to 1,150 Gulf of Mexico blocks. The sale was postponed from April to enable more time to iron out the intricacies of the new PSA.

Despite wide speculation that ExxonMobil would be prohibited from participating in the offering, given its oversized footprint, the MNR identified the super-major as a prospective bidder. Reuters also reported on March 6 that ExxonMobil was among those paying $20,000 for pre-sale geologic data.

SPREADING THE WEALTH

The government has been quick to point out that the newly structured PSA will not affect the 2% royalty that the ExxonMobil consortium negotiated in 2016 for Stabroek, which essentially served as the new store on the block, offering cut-rate deals to attract customers. "We are not renegotiating Stabroek. We don't want to lose momentum," Guyana V.P. Bharrat Jagdeo was quoted as saying during the March CERAWeek energy conference in Houston.

That said, the Guyanese government has been widely slammed for the low-ball Stabroek terms. "The push for Guyana to have a bigger hand in its oil wealth is nothing new," says Rodriguez. "Guyana was criticized for the deal it made with ExxonMobil, following its initial discovery, on the grounds that Guyana gave up too much."

Unlike Suriname, Guyana has no national oil company, which only serves to strengthen ExxonMobil's influence. However, that may be about to change. "Guyana has been inundated with oil company interest since ExxonMobil made its initial discovery in 2015 and will now look for a strategic partner to run a state-run oil company, potentially from the Middle East," says S&P's Rodriguez.

Meanwhile, along with higher government royalties, the terms of the PSA, as drafted, call for minimum signing bonuses of $20 million for deepwater parcels and $10 million for shallow-water tracks, a 10% corporate tax and a reduction in the cost recovery ceiling from 76% to 65%. Contracts for deepwater blocks will comprise a 10-year exploration period and a 20-year production period, while the shallow-water blocks carry maximum five- and 20-year exploration and production periods, respectively.

"No limits have been placed on the number of blocks a company can bid on, but they will limit the number of blocks awarded per company to three," Rodriguez says. "If a company is interested in bidding for multiple blocks, they must be submitted in order of preference."

Though Guyana makes no secret of wanting to lessen ExxonMobil's clout, for now Stabroek remains the driving force of the nation's booming offshore sector.

“UPSIDE, UPSIDE”

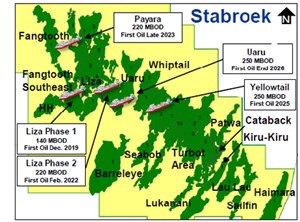

With the April arrival of the Prosperity FPSO, ExxonMobil and company are gearing up for first production from a third, sanctioned oil development on Stabroek, with more on the way.

"We currently have line-of-sight to six FPSOs in 2027, with a gross production capacity of more than 1.2 million barrels of oil per day," says Hess CEO John Hess. "We have the potential for up to 10 FPSOs, to develop the discovered resources on the block."

The latest FPSO is on track to begin production of up to 220,000 bopd, early in the fourth quarter, from Payara field, located due north of the Liza Phase 1 (Fig. 3) and Liza Phase 2 developments, which produced a cumulative 375,000 bpd in the first quarter.

On April 27, Guyana gave the green light for development of Uaru field, which followed the Yellowtail approval some three weeks earlier as the fourth and fifth sanctioned oil developments on Stabroek, Fig. 4. With a capacity of 250,000 bopd, the Errea Wittu FPSO—the first Guyana project for Japan's MODEC International—is targeted to begin production from the $12-billion Uaru development in 2026. ExxonMobil said the development will include 10 drilling slots and 44 production and injection wells. The SBM Offshore One Guyana FPSO is expected to go online at Yellowtail in 2025, at a gross capacity of roughly 250,000 bpd.

The consortium also plans to seek regulatory approval for the three-field Whiptail development later this year, which would mark the sixth sanctioned project to go into the production phase. With first oil slated for 2027 or early 2028, the Whiptail development plan combines the Whiptail 1 discovery well, with the Tilapia-1 and Pinktail-1 discoveries serving as satellites. The project is designed to include 40 to 65 development wells, with production capacity of 220,00 to 275,000 bpd.

Hess COO and President of Exploration and Production Gregory Hill told analysts on April 26 that initial production expectations, thus far, have proved to be conservative.

"We continue to see further upside in the subsurface, as we kind of produce the wells," he said. "Liza Phase 1 was debottlenecked at 140,000 barrels, and it's actually producing between 140,000 and 150,000 barrels. And then if you look at (Liza) Phase 2, it has a nameplate of 220,000 barrels. It's on track to be debottlenecked towards 250,000 barrels by the end of the year. So, upside, upside."

Including the Fangtooth Southeast-1 and Lancetfish-1 wells drilled early this year, the joint venture has drilled more than 30 discoveries on Stabroek since 2015, underpinning recoverable resources that Hess estimates at more than 11 Bboe. The now-sanctioned developments have a Brent break-even price of around $25-$35/bbl, according to the minority partner. Rodriquez says Guyana, as a whole, averages break-even costs of $40.72, which is "the lowest of any market outside of the Middle East."

Nearly all production, thus far, has been pulled from the Upper Cretaceous New Amsterdam formation, but in a rarity for Stabroek, the joint venture landed a dry hole in April, with a step-out carbonate well drilled 37 mi from the Liza-1 development. "That (Kokwari-1 exploration well) was a higher-risk carbonate play, and it didn't encounter commercial hydrocarbons, but it did provide a lot of valuable data that further improves our understanding of the subsurface," Hill said. Meanwhile, in efforts to prove up commercial reserves outside of Stabroek, a Canadian joint venture is evaluating the commercial feasibility of an exploration well on the Corentyne block—its second in as many years. Partners CGX Energy Inc. of Toronto and Frontera Energy Corp., Calgary, said "multiple oil-bearing intervals" were encountered in the Wei-1 BP1 bypass exploration and appraisal well that reached a TD of 20,450 ft in June. The original Wei-1 wellbore was drilled to 19,142 ft, while the bypass well was drilled from 18,757 ft to TD, where it primarily penetrated Santonian targets. The Noble Discoverer semisubmersible began drilling the well in January and has since been released.

As programmed, the well targeted stacked Santonian, Maastrichtian and Campanian-aged sands within channel and fan complexes in the northern section of the block. Prior to the open-hole sidetrack, which was necessitated by failure to recover a stuck wireline fluid sampling tool, CGX said the Wei-1 had encountered some 71 ft of net pay in the secondary Maastrichtian and Campanian targets. No additional appraisal wells have yet been announced.

"Following the bypass, data collected from LWD and cuttings indicate multiple hydrocarbon shows in the primary target reservoirs in the Santonian interval. Results from the well are encouraging, and data acquisition is ongoing via wireline logging, MDTs (modular formation dynamics tester) and sidewall core sampling," CGX said in a statement.

The well was drilled some 9 mi northwest of last year's Kawa-1 light oil and condensate discovery, on the southern edge of Stabroek. The "rank wildcat" was drilled to 12,578 ft, in approximately 1,912 ft of water, in January 2022, and it was subsequently plugged and abandoned, after encountering roughly 177 ft of hydrocarbon pay from the same three sands as the Wei-1.

Operator CGX holds a 32% interest in the Corentyne Block, while Frontera, its majority corporate shareholder, controls the remaining 68% stake.

Elsewhere, further plans remain up in the air, after the August 2022 abandonment of an exploration well on the Repsol-operated shallow-water Kanuku Block. The Beebei-Potaro prospect was plugged and abandoned after encountering water-bearing reservoirs.

Repsol and Tullow Oil plc, U.K., each have a 37.5% interest in the approximately 748-m2 Kanuku license, with TOQAP Guyana BV holding the remaining 25% stake. Neither Repsol nor Tullow responded to requests for comment on near-term plans for the asset.

The Noble Regina Allen jack-up drilled the well to just under 14,190 ft, in around 233 ft of water.

SURINAME AWAITS FIRST OIL

Abutting Stabroek, directly across the maritime border, appraisal drilling is continuing on the TotalEnergies-operated Krabdagu-3 well, on Block 58, Fig. 5. With 50-50 partner APA Corp. of Houston, TotalEnergies is eyeing an oil hub development that would combine the adjoining Krabdagu and Sapakara discoveries, though no formal plans have yet been announced. APA estimates the two assets collectively hold more than 800 MMbbl of oil in place, helping position Block 58 as Suriname's version of Stabroek.

"It is still unclear when the final investment decision will be made for Block 58, which pushes offshore oil production out to 2027 or later," says S&P's Rodriguez. "Crude production is still expected to have a significant increase toward 460,000 bpd by the late 2030s."

Any offshore production would represent an increase, as Suriname is averaging a modest 15,000 bopd, all from legacy onshore wells. The TotalEnergies joint venture is expected to drive offshore production in Suriname, with Rodriquez particularly singling out the Maka Central 1 and Kwaskwasi 1 discoveries on Block 58, as well as the APA-operated Baja 1 discovery well on adjacent Block 53. The three projects could have estimated peak oil production of 116,000 bpd, 114,000 bpd and 121,000 bpd, respectively, she said.

"We continue to progress toward an oil hub development project, with activity in the first half of 2023 focused on appraising Krabdagu," APA President and CEO John Christmann told analysts in a May 4 call. "We have completed the flow test on the first appraisal well (Krabdagu 2) and are currently in the pressure buildup phase. Results of this well, thus far, are in line with expectations."

TotalEnergies CEO Patrick Pouyanné said any decision on moving forward with a potential Krabdagu-Sapakara development hinges partly on addressing high gas-oil ratios (GOR).

"The good news is that we are trying to develop an oil pool. The difficulty in Suriname is that the gas-oil ratio is quite high, so what we wanted to identify is a pool with a lower GOR, in order to be able to have an efficient (oil) development," he said on April 27. "The first two appraisal wells of these two discoveries have been positive. Today, it's a pool of around 500-plus million barrels of oil. We are waiting for the last oil well, in order to reach 600 to 650 million barrels, and then it will be time to go to development."

The Krabdagu 3 appraisal well, however, has not progressed as smoothly as its predecessor, says APA. Located some 6.4 mi from the Krabdagu 1 discovery, the well is being drilled with the recently arrived Transocean Development Driller III semisubmersible, which is on contract until October, at a day rate of $345,000, according to Transocean's latest rig fleet status report.

"The Krabdagu 2 well moved on pretty much as expected, but I will say the Krabdagu 3 well is running a little behind, but that also was a brand-new rig that was brought in the basin. So, there's been some fits and starts on the drilling of the third well. It's just taking a little longer than anticipated."

APA also is "assessing the next steps" for the Block 53 Baja asset, after a discovery well in the third quarter of 2022 found 112 ft of net oil pay in the Cretaceous Campanian horizon—shallower than the Santonian formation of previous Suriname discoveries. The drillship Noble Gerry de Souza drilled the well to 17,356 ft, in 3,740 ft of water. As operator, APA holds a 45% interest in the block, with minority partners Petronas (30%) and Spain's CEPSA Suriname, S.L (25%).

Elsewhere, another TotalEnergies-led joint venture signed two production sharing contracts (PSC) with state-owned Staatsolie on May 15, for shallow-water Blocks 6 and 8, to the immediate south of Block 58. TotalEnergies (40% interest) will operate the adjacent southern blocks, which lie in an average 131 ft of water, with partners QatarEnergy (20%) and Staatsolie subsidiary Paradise Oil Co (40%).

The PSCs call for a six-year exploration period, with the first well required to be drilled in the third or fourth year.

Hess also ventured across the border, teaming up with Chevron and Shell on Block 42, north of Block 58. The three are equal partners in the Shell-operated block, where Hess says another exploration well will be drilled this year, following disappointing results from a well drilled late last year. In November, the Zanderij-1 well was deemed non-commercial, but Hess said the results "provided helpful information that showed a working petroleum system." No timeline for the proposed second well has been released.

Cross-border gas pact eyed

Guyana has been all about oil, but an initiative aimed at producing more gas has it looking to its neighbor for help.

A gas strategy expected to be completed by the end of 2023 will explore joint development opportunities with Suriname. Guyana V.P. Bharrt Jagdeo particularly singled out the Pluma discovery, in the southeastern portion of the oil-rich Stabroek Block, where it and other discoveries have yielded 17 Tcf of associated gas.

"In some areas like Pluma, there is more gas, less oil, and right across the border in Suriname, they’ve discovered some gas fields. So, we're looking at the possibility of joint development, and all of that is part of the study,” he said on May 25. "We are trying to maximize, from the utilization of these resources, its value to the country."

However, sorting out joint developments can be tricky, when the reservoirs being unitized are controlled by different jurisdictions. Guyana has added a unitization clause in its newly drafted production sharing agreement (PSA) model, and while not applicable to the locked-in terms the ExxonMobil-operated consortium negotiated for the Stabroek license, the unitization clause "could provide a useful framework for a joint gas development," said Magda Rodriguez, S&P Global senior analyst, Americas.

Lead photo: Left: The drillship Don Taylor is one of four that Noble is currently running in Guyana. Image: Noble Corp. Middle: The Prosperity floating production storage and offloading (FPSO) vessel arrived in Guyana in April, to prepare for first oil before year-end. Image: SBM Offshore. Right: More jackups like the Seadrill West Castor, shown here during an earlier six-well drilling campaign in Suriname, may be needed as shallow water activity is poised to increase. Image: Staatsolie Maatschappij Suriname N.V.

- Regional Report: Brazil (February 2023)

- International Forecast: Some noticeable recovery is finally underway (September 2022)

- Guyana-Suriname Regional Report: The overly generous PSA may be history (July 2022)

- Characterizing seismic facies in a carbonate reservoir, using machine learning offshore Brazil (June 2022)

- 2022 Forecast: Activity outside North America will lead global recovery (February 2022)

- Regional report: Brazil – weathering the pandemic (February 2022)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)