Special Focus: 2020 Forecast - U.S. Drilling

Despite flagging drilling activity in 2019, the U.S. became the world’s largest crude producer, with output hitting a record-high in December at 12.87 MMbopd, a 10.4% y-o-y gain. However, the flood of crude and “every-man-for-himself” mentality of U.S. shale producers put downward pressure on global crude benchmarks during 2019.

To avoid a crash in oil prices, OPEC elected to yield, with Saudi Arabia gradually reducing its output during the year by 1.11 MMbopd, from a high of 10.24 MMbopd in January to just 9.13 MMbopd in September. The masterfully staged cutbacks were enough to balance markets and keep benchmark prices relatively steady throughout the year. Geopolitical factors also caused occasional price spikes. Tensions in the Middle East escalated, when an Iranian-sponsored attack on a large Saudi Arabian production facility curtailed output in September. In addition, a U.S. drone strike killed an Iranian military leader in January. However, after the immediate risk to supply waned, crude prices returned to trading in line with market fundamentals.

Even with surging U.S. crude output, it is becoming apparent that shale is not a panacea for production growth. Drilling in U.S. shale fields continued to wane, with y-o-y (Dec. 2018 to Dec. 2019) declines of 64% in Oklahoma, 47% in Pennsylvania, 35% in Colorado and a 20% reduction in Wyoming, Ohio and Texas RR District 8 (Baker Hughes). Also, the depletion of premium drilling locations and capex cuts of 7% are projected to reduce oil and liquids growth in 2020 to around 500,000 bpd and 200,000 bpd, respectively. According to Halliburton and Schlumberger, U.S. shale fracing has peaked and is in a period of sustained contraction. Both companies predict that spending in North America will continue to decline this year, and both are downsizing their business in the region to match lower demand. The OFS industry, in general, has cut thousands of jobs, as shale companies slash spending to generate cash flow.

The aforementioned factors, along with World Oil’s surveys of operators and state agencies, have all shaped this cycle’s U.S. forecasting process. Accordingly, World Oil’s editorial staff presents its 2020 U.S. forecast, as follows:

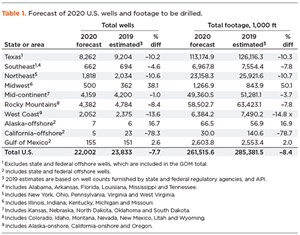

- U.S. drilling will decrease 7.7%, to 22,002 wells, Table 1.

- U.S. footage will decline 8.4%, to 261.5 MMft of hole

- The U.S. Gulf of Mexico should improve 2.6%, to 155 wells.

U.S. MARKET FACTORS

During the past year, U.S. E&P continued to lose momentum, and 2020 will be driven by lower-for-longer spending and reduced activity levels. M&A among U.S. shale companies will have an impact on activity, as the consolidated entity typically spends less than the separate stand-alone companies. The pullback in drilling and completions started early in 2019, and the decline in the rig count was steeper than most companies had expected (see p. XX). The ability and willingness of OPEC+ to orchestrate production cuts, to stabilize crude markets, was significant in helping U.S. oil producers remain profitable.

Excess service capacity. The declining activity in U.S shale plays was so severe that the OFS sector was forced to scrap entire fleets of fracing equipment. With half of the available hydraulic horsepower sitting idle, shale completion specialists retired truck-mounted pumping units and other redundant equipment. Approximately 2.2 million hydraulic horsepower, or 10% of industry capacity, have been earmarked for scrap. In previous market slumps, unused equipment was mothballed for use when demand increased. This time, gear is being stripped down for parts or sold for scrap. The scrapping of frac equipment is a clear indication that a significant change in mindset has occurred. And the problem is also spreading to sand mines and the truckers who haul it.

Oilfield service pricing. The OFS industry has struggled to capture much of the value that it provided to E&P companies during, and after, the downturn (Evercore investment firm). This is evidenced by the sector’s decline in returns on capital, which pales in contrast to production efficiency gains. This, coupled with a shift toward more commoditized shale activity, led to a collapse of the industry’s return on capital employed. A major problem is industry fragmentation, which has driven irrational pricing schemes and product line instability. When market share changes are volatile, economic profitability tends to suffer. Given the impact of unfavorable supply/demand trends, Evercore predicts that pricing will decline in 2020 for North American drilling, completion and production services.

Crude output. Surprisingly, U.S. oil production continued to grow steadily in 2019 (see page XX). The year started with operators pumping an average 11.94 MMbopd in January. Total production increased to an all-time high of 12.87 MMbopd in December, a 9% y-o-y increase. EIA forecasts that U.S. oil output will average 13.3 MMbopd in 2020 and 13.7 MMbopd during 2021. Most of the growth is forecast to occur in the Permian region of Texas and New Mexico.

Capex. The oil and gas industry is at a crossroads, says James West, chief analyst at Evercore (see page XX). Investor demands for returns have turned off the capital spigot for U.S. shale, the main driver of global oil growth during this past decade. Equally disturbing, the oil price crash of 2014 cut non-shale E&P spending by 40%, and the industry is barely off the budget bottom.

Spending discipline to slow shale output. U.S. oil production growth is heading for a major slowdown, as capital discipline and weak prices play out, said IHS Markit V.P. Raoul LeBlanc. A new outlook for oil market fundamentals for 2019-2021 predicts total U.S. production growth to be 440,000 bopd in 2020 before flattening out in 2021. Modest growth is expected to resume in 2022, but those volumes will be in stark contrast to the boom levels of recent years.

The key challenge for producers now is to meet investors’ new focus on return on capital. This comes at a time when companies face prolonged, lower prices and when access to financing from capital markets is more difficult.

Drilled-but-uncompleted. The number of U.S. DUCs is finally dropping. As of December, the DUC total stood at 7,573, or 11.9% less than reported by EIA a year earlier. DUCs in the Permian also are declining, with 3,612 tallied in December, 10.8% less than the year-ago figure of 4,048. Although some consulting firms have suggested that there is no DUC backlog beyond a normal drilling and completion cycle, why does EIA keep reporting this large backlog of wells?

Commodity prices. WTI and Brent oil prices started 2019 at $51.38 and $59.41/bbl, respectively, before WTI topped out at $63.86/bbl in April, and Brent peaked in May at $71.32/bbl. Prices remained relatively stable throughout the remainder of the year despite escalating geopolitical tensions in the Middle East and the ongoing trade dispute between China and the U.S. And with Saudi Arabia quietly returning to the role of swing producer, both crude benchmarks were higher at the end of the year, with Brent trading at $67.31 and WTI priced at $59.88, an increase of 13% and 17%, respectively. The EIA forecasts that Brent spot prices will average $65/bbl in 2020 and $68/bbl in 2021, compared with an average $64/bbl during 2019. EIA predicts that WTI will average $5.50/bbl lower than Brent through 2020 and 2021.

Henry Hub (HH) spot natural gas prices averaged $2.57/MMBtu in 2019, down 19% from 2018. HH prices hit their high point of $3.11/MMBtu in January 2019, but they quickly retreated during the year, as abundant supply from U.S. shale fields overwhelmed demand and the fledgling LNG industry’s capacity to export product. And on Jan. 22, 2020, HH posted the lowest January price in more than 20 years, dropping to $1.89/MMBtu, the lowest January price since 1999. However, Evercore expects a slight rebound, and predicts that natural gas will average $2.37/MMBtu in 2020. EIA forecasts that HH spot prices will average $2.33/MMBtu in 2020, and then increase in 2021 to an average $2.54/MMBtu.

LNG exports. EIA expects U.S. net natural gas exports to double by 2021. The federal agency forecasts that U.S. natural gas exports will exceed natural gas imports by an average 7.3 Bcfd in 2020, 2 Bcfd higher than in 2019, and 8.9 Bcfd in 2021. Growth in U.S. net exports will be led primarily by increases in LNG exports and pipeline exports to Mexico. Net natural gas exports doubled in 2019, compared to 2018, and EIA expects that they will double again by 2021.

U.S. FORECAST

The substantial ramp-up in U.S. shale drilling activity, which started in January 2018, is staring to wane, despite production cuts by Saudi Arabia and Russia that have supported crude prices during the last 12 months. Years of costly drilling and highly questionable buying sprees have gutted shareholder returns of large- and mid-sized shale producers. To stave off further deterioration of stock prices and dwindling investor returns, operators will reduce drilling expenditures in 2020, in line with cuts implemented during second-half 2019. As expected, the Permian will remain a major target for companies seeking to add oil reserves, but at a slower pace. However, operators working in several premier shale plays in Oklahoma, Pennsylvanian, Ohio and Colorado are indicating that these areas are reaching maturity or are no longer profitable. World Oil forecasts that the trend will continue in 2020.

Gulf of Mexico. With the limitations of the unconventional plays becoming more apparent, operators plan to increase drilling in the Gulf of Mexico. World Oil predicts a 2.6% increase in wells drilled and a 2% jump in total footage during 2020. In the GOM, average time from discovery to first production has been cut in half over the last four to five years, and final investment decision to first production has declined 33% (Wood Mackenzie).

U.S. REGIONAL ACTIVITY

World Oil projects that nationwide drilling was down 7.1% in 2019. With the shale field development continuing to slack off, a 7.7% decrease is forecast in 2020, Table 1. With the lack of new drilling locations and dwindling ROIs in the heavily drilled shale fields becoming more apparent, a swing back toward conventional plays should start to gain momentum in 2020.

Texas. Shale drilling will continue to dominate the Lone Star State, but at lower activity levels. Still, the relentless pace of activity during the boom era pushed Texas oil production to 5.62 MMbopd in December, a 12% y-o-y increase. However, the higher crude output produces a significant amount of casinghead gas, and in the Permian, operators are flaring enough gas to meet the residential demand across the whole of Texas. Local gas prices will remain under stress until more pipelines come online.

With overproduction/flaring reaching a critical point, Permian basin operators working in RRC District 8 (Fig. 1) plan to slow drilling 13%, with a reduction in footage of 12.7% in 2020. In District 7C, World Oil forecasts a 6.7% reduction in wells and a 6.6% decline in footage. In the heart of the Eagle Ford in District 1, operators plan to reduce drilling 10.3%, with an accompanying 10% drop in footage.

The natural gas oversupply has led to bust scenarios in Districts 4 and 10, which we predict will suffer 22.6% and 12% drilling declines, respectively. Districts 8A, 5 and 9 also will decline, with losses of 20%, 13.7%, and 3.4% respectively. In East Texas’ mature Panola gas area of District 6, drilling and footage may plummet 25%. World Oil forecasts total combined activity in Texas will decrease 10.2% during 2020, with footage down 10.3%.

Southeast. In northern Louisiana, the flood of natural gas will force operators to decrease Haynesville shale activity to curtail production. Activity by smaller companies also will slow in the state’s mature shallow oil fields. Drilling activity in the northern half will be down 9.2%, with footage decreasing 10.1%. In southern Louisiana, footage is forecast to slump 10%, with well spuds down 10.2%. Combined, Louisiana will suffer a 9.4% decline in wells and a 10.1% reduction in footage during 2020.

Northeastern states. A warm winter and excess Marcellus production forced spot gas prices to drop to a 20-year low in January. Despite increased pipeline capacity in the Appalachia basin and a ramp-up of the Cove Point LNG facility in Maryland, activity in the Marcellus-Utica shale play continues to slow. Drilling in Pennsylvania is forecast to decline 14.9%, with footage dropping 13.7%. In West Virginia, World Oil forecasts total wells and footage to decline 5%. After suffering a 17% reduction in activity during 2019, we forecast Ohio’s wells and footage to decline another 9.8% in 2020. Excessive horizontal well lengths and low gas prices are partially to blame for the collapse.

Midwest. Activity levels should remain subdued in this region. In Michigan, the factors affecting drilling activity are mainly low commodity prices, and possibly rig availability. However, Illinois’ state regulatory agency, the Office of Oil and Gas Resource Management, is predicting an increase of 108% in drilling activity and a 110% jump in footage. Indiana’s operators cite price and political uncertainty as major factors limiting drilling. However, we forecast a 21.4% increase in spuds and footage during 2020.

Mid-continent. Disappointing results in the SCOOP and STACK plays of Oklahoma have forced operators to curtail drilling operations in the state despite the application of updated technologies and completion practices. During 2020, we predict that Oklahoma’s activity will decrease 7.7% overall, with a 10.6% reduction in footage. After declining to 420,000 bopd in 2015, the 2017-2019 drilling boom increased the state’s production 44% to 606,000 bopd, as of January 2020. Activity in the Sooner State continues to be dominated by Continental, Encana (formerly Newfield), Devon and Cimarex.

In the oil-rich Bakken shale of North Dakota, drilling remained relatively consistent during the 2017-2019 boom era,

. And 2020 should be no exception, as World Oil forecasts that drilling and footage will increase just 0.4%. We predict the trend to laterals approximately two miles long will continue through 2020, with some wells reaching an MTD of 21,000 ft. Oil transport from the remote location is still an issue, but the region’s entrenched operators will continue to support large drilling and completion investments. Oil production climbed to 1.49 MMbopd in December, a 7.5% y-o-y increase.

In conventionally oriented Kansas, operators continue to drill relatively shallow oil and gas wells to maintain production. And with the shale plays waning, investors are starting to shift attention back to traditional prospects that don’t require high-cost horizontal drilling and staged fracing. We predict a 3.4% increase in total wells and a 2.6% jump in footage in 2020.

Rocky Mountain states. The pro-green political climate taking hold in Colorado will put a dent in the state’s drilling (Fig. 3) during 2020. In April 2019, Senate Bill 118 was passed and it “fundamentally altered the oil and gas industry’s future in the state,” according to Governor Jared Polis. In 2020, we predict that operators will abandon drilling locations in the state in search of more favorable conditions in neighboring pro-drilling states. As such, we project 15% fewer wells and 13.5% less footage in 2020. However, Colorado’s crude production continues to climb, hitting 552,000 bopd in December, up 13.8%.

On the Wyoming side of the Niobrara shale, operators plan a 7% slowdown in drilling activity, making 7.3% less hole in 2020. The state still benefits from the 2017-2019 drilling boom, with production rising to 297,000 bopd in December, a 12.5% y-o-y increase. In northeastern Utah’s multi-horizon Uinta basin, drilling activity is forecast to increase 2.2%. Approximately 67% of the state’s mineral acreage is controlled by the U.S. BLM.

Although New Mexico was late to the Permian shale boom, that situation started changing in 2018-2019. However, we predict a slight slowdown in drilling during 2020, despite an increase in completion efficiencies in the Bone Springs formation. We forecast that the state will experience a 5.8% decline in well spuds and a 5.5% drop in footage.

West Coast. Drilling in California has been an up-and-down proposition over the past several years. In 2020, onshore operators should reduce drilling 15%, with total footage down 18.9%. As in previous years, most drilling is conducted by just four companies. Offshore California, we expect a 78% decrease in activity and total footage compared to last year. Despite erratic drilling activity, operators managed to pump 465,000 bopd in December, just 3.5% less than in 2018.

In Alaska, offshore work in the Cook Inlet will remain steady. Onshore activity on the North Slope is projected to increase 2.6%, with total footage up 2.7%.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)