Oil majors reluctant to place bets on aging North Sea, as output descends

Since the 1960s, the North Sea has remained a highly sought-after region for oil and gas E&P. Nevertheless, the aging North Sea basin is seeing a steady decline in output, as some majors give ground to the area’s high production costs, in search of higher returns elsewhere.

In June, when ExxonMobil announced its plan to divest its Norwegian upstream portfolio, a principal analyst at Wood Mackenzie told Bloomberg that “Norway is no longer core to the overall business.”

Likewise, in October 2018, it was reported that Chevron had plans to sell its last remaining oil exploration license in Norway. The company transferred its 20% stake in PL 859 to DNO ASA. According to a Sept. 28 letter from the Norwegian energy ministry, the deal “[implied] that Chevron Norge AS shut down its operations in Norway, [leaving] the Norwegian shelf permanently.”

Just one month after Chevron announced its exit from Norway, it was reported that ConocoPhillips also was considering sale of its remaining North Sea assets in November 2018. It was believed that the prospective sale could cause some competition among buyers, ready and willing to invest in the projects cast off by the oil majors.

Exxon, Chevron and ConocoPhillips are not the only majors ready to take a step back from the oil and gas sector offshore Norway and the UK. Through various mergers and asset sales, Shell, BP and Total also have withdrawn from the North Sea in some capacity.

Despite these oil majors’ withdrawal, a new accumulation of North Sea independents is set to take over, as the region still holds its ranking as one of the top M&A markets in the world. In fact, the Norwegian Petroleum Directorate (NPD)—Norway’s governmental specialist directorate and administrative body that reports to the Ministry of Petroleum and Energy—reported in January that 33 companies had been offered ownership interests in 83 production licenses on the Norwegian Shelf in the Awards in Predefined Areas (APA) 2018—the largest number ever awarded in a single licensing round.

NORWAY

As the world’s fifth-largest oil exporter and its third-largest gas exporter, Norway’s energy sector is booming. The country’s oil and gas industry is focused primarily offshore, particularly on the Norwegian Continental Shelf (NCS), where it exercises sovereign rights. The area of the NCS is approximately four times that of Norway’s mainland, which translates to an immeasurable amount of E&P potential.

The NPD reported an average daily production rate of 1,599,000 bbl of oil, NGLs and condensate in May. Although this is down from the 1,657,000 bpd reported in May of last year, some are left wondering if recent progress at several projects in the region could turn the tide.

Aasta Hansteen field. One of the largest regional accomplishments, of late, is Equinor’s Aasta Hansteen gas field starting production in December. “Aasta Hansteen is a pioneer! Located in 4,265 ft of water, this is the deepest field development on the Norwegian Continental Shelf, the largest spar platform in the world, and a first on the NCS,” Anders Opedal, Equinor’s executive V.P. of technology, projects and drilling, said in a release.

The field—situated 186 mi west of Sandnessjøen in the Vøring area, an isolated part of the Norwegian Sea, where weather conditions are harsh—produces from seven wells in three subsea templates. It has the deepest installation of subsea equipment on the NCS and, according to Equinor, its floating platform is taller than the Eiffel tower.

Originally comprised of three separate discoveries—Luva (1997), Haklang and Snefrid South (1998)—Aasta Hansteen is increasing exploration activity in the area. Both Aasta Hansteen and the 299.5-mi pipeline from the field to Nyhamna have the capacity to accommodate new discoveries. According to Equinor, the first one (Snefrid North) is already under development and will come onstream toward the end of this year. The field’s recoverable resources, including that of Snefrid North, are estimated to be around 55.6 Bscmg and 353 MMboe.

Duva and Gjøa P1 projects. In February, Neptune Energy submitted development plans for the Duva (PL 636) and Gjøa P1 (PL 153) projects, in the Norwegian sector of the North Sea. The fields reportedly will be developed as subsea tie-backs, connecting to the nearby Gjøa platform. First production from the projects is anticipated for late 2020 or early 2021.

Duva field, formerly known as Cara, holds recoverable resources of approximately 88 MMboe. Developed with a four-slot subsea template, Duva reportedly will be tied back to the Gjøa platform and is expected to yield about 30,000 boed at maximum production. It will have three production wells, two oil producers and one gas, with the possibility for a fourth oil well. Likewise, Gjøa P1 is a further development and extension of Gjøa field, with a focus on increased exploitation. The project’s recoverable resources are estimated to be around 32 MMboe, yielding 24,000 boed at maximum production.

Troll field extension. The productive life of Troll field, in the northern part of the North Sea, near Bergen, is to be extended beyond 2050. The PDO for the Troll Phase 3 development was approved by the Ministry of Petroleum and Energy in December. The field includes the main Troll Øst and Troll Vest structures, in Blocks 31/2, 31/3, 31/5 and 31/6, Fig. 1. Already the biggest gas producer on the NCS, Troll is expected to deliver another 2.2 Bboe through Phase 3. Containing about 40% of total gas reserves on the NCS, it reportedly meets 7% to 8% of Europe’s daily gas consumption.

Torger Rød, Equinor’s senior V.P. for project management, said, “With a break-even of less than $10/bbl, Troll Phase 3 is one of the most profitable and resilient projects ever in our company.” According to the company, the $918.5-million expansion is anticipated for start-up in the first half of 2021.

Gullfaks output boost. Equinor also announced plans to invest $269 million to increase production at Gullfaks field. Situated in the northern part of the Norwegian North Sea, on Block 34/10, Gullfaks was developed with three large production platforms—Gullfaks A, B and C. Its satellite fields—Gullfaks South, Rimfaks, Skinfaks and Gullveig—have been developed with subsea wells that are remotely controlled from the Gullfaks A and C platforms. In January, Equinor said that, alongside its partners, it will drill seven new wells at Gullfaks to improve oil recovery by 17 MMbbl. Because of the carbonate reservoir, drilling at Gullfaks is said to be challenging. Nonetheless, the partners are planning to improve recovery through the use of water injection and new production wells in the Shetland/Lista Phase 2 development.

Oda start-up. In January, Spirit Energy was given approval for the start-up of production at Oda field, a subsea development where the wellstream is sent to the Ula platform (about 8 mi away) for processing and transport. Spirit reported that the field came onstream in March, under budget and nearly five months ahead of schedule. Oda’s reserves are estimated to be 32.7 MMboe, of which 31.5 MMbbl are oil. Peak daily production reportedly is expected to reach nearly 35,000 bbl.

Tor field redevelopment. As the operator of Tor field, in the Ekofisk area of the Norwegian North Sea (Blocks 2/4 and 2/5), ConocoPhillips submitted a redevelopment plan for the field in July. The field, which was in production from 1978 to 2015, is a unitized chalk field about 8 mi northeast of Ekofisk. When the field’s installation reached the end of its lifetime and was shut down, only about 20% of its resources-in-place reportedly had been produced.

ConocoPhillips’ Tor 2 plan includes a two-by-four slot Subsea Production System (SPS), with eight production wells. The system will be connected to Ekofisk by multi-phase production and lift gas pipelines to existing risers. According to the company, controls and utilities will be afforded through a service umbilical from the same existing platform. The new greenfield facilities will be less than a mile west of the original Tor platform, with no connection to the shut-in facilities.

The plan also includes seven production wells to be drilled in the Tor formation. A pilot well also is planned to test long-term productivity in the Ekofisk formation. According to ConocoPhillips, the redevelopment project has a resource potential of approximately 60-70 MMboe, and first production is anticipated for year-end 2020.

Barents Sea. A marginal sea of the Arctic Ocean, the Barents Sea is a shallow shelf sea with an average depth of about 750 ft. Since the beginning of hydrocarbon exploration in the area in 1969, several important discoveries have been reported on the Norwegian side of the sea’s Norway-Russia divide, including that of Snøhvit field.

Snøhvit, approximately 87 mi northwest of Hammerfest, produces LNG, LPG and condensate. It was the first major development on the NCS with no surface installations, according to Equinor. The field’s subsea production facilities are positioned on the seabed, where 20 wells are due to produce gas from not only Snøhvit, but from Askeladd and Albatross fields, as well. Askeladd, however, is not expected to come onstream until after 2020.

According to NPD estimates, the Barents Sea holds the greatest amount of exploration potential. Because the region is still largely under-explored, more than half of Norway’s undiscovered oil and gas is believed to be in the Barents Sea.

In addition to Snøhvit, Goliat is the only other producing field in the area. In January, Vȧr Energi AS and Equinor reported successful results at the 7122/7-7 S Goliat West appraisal well, increasing the field’s resource estimates. The appraisal well, situated about 1.2 mi south of the Goliat FPSO and nearly 50 mi northwest of Hammerfest, was drilled by the West Hercules semisubmersible rig, in a water depth of approximately 1,243 ft. The Tubȧen reservoir was encountered, and its hydrocarbon column was estimated to contain between 59 ft and 196.8 ft. The companies reported that the lower reservoir had been found oil-bearing and composed of several sandstone layers, with good reservoir properties and a minimum hydrocarbon column of 114.8 ft. The well was permanently plugged and abandoned.

“The Goliat West appraisal well is a successful outcome of Vȧr Energi’s near-field exploration strategy, which will enable a fast-track development of incremental reserves through a subsea tieback to the Goliat FPSO, increasing the oil recovery in the area and extending the production horizon for the Goliat field,” Denis Palermo, Vȧr Energi’s V.P. of exploration, said in a release.

Johan Castberg, the world’s largest subsea development, is expected to be the region’s next big success story. The field’s PDO was approved in June 2018, with a planned start-up in late 2022. Its development concept includes an FPSO tied to subsea templates, with 18 horizontal production wells and 12 injection wells. Its resource base consists of three oil discoveries—Skrugard (2011), Havis (2012) and Drivis (2014)—with a collective proven volume between 400 MMbbl and 650 MMbbl.

UNITED KINGDOM

Similar to what is happening in Norway’s offshore sector, oil majors are taking a step back from business offshore the UK, as well. In July, Marathon Oil Corp. closed on the sale of its UK business to RockRose Energy, exiting the country entirely. The company held 21.4 MMboe of proved reserves in the UK and assets included the Brae area fields and Foinaven.

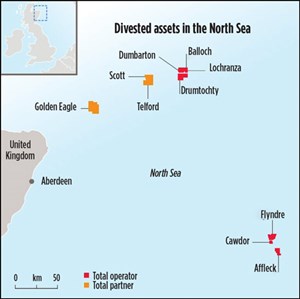

Likewise, Total recently divested several non-core UK assets to Petrogas NEO UK Ltd. The divested assets included Dumbarton, Balloch, Lochranza, Drumtochty, Flyndre, Affleck, Cawdor, GoldenEagle, Scott and Telford fields, which are situated in the eastern North Sea, Fig. 2. The company said that the divestiture was part of its portfolio management strategy, which aims to lower the company’s break-even point through the optimization of capital apportionments and the divestiture of “high technical costs assets.”

ConocoPhillips also announced sale of its UK business to Chrysaor Holdings Limited. The assets being sold reportedly include approximately 72,000 boed, as well as over 280 MMboe of proved and probable oil and gas reserves, with a further significant contingent resource base. Chrysaor CEO Phil Kirk said in a release, “This significant acquisition reflects our continuing belief that the UK North Sea has material future potential for oil and gas production.” Linda Cook, chairman of Chrysaor, added, “We are excited to play a role in the natural evolution of the North Sea and to enable the safe transfer of assets from major oil companies, such as ConocoPhillips, to new, well-funded, privately-owned operators.”

Projects. Despite the increased M&A activity in the region, major projects offshore the UK are moving forward. In June, Total reported progress at one of its largest UK assets. Culzean field, situated nearly 143 mi offshore Aberdeen on Block 22/25a, started production. The project, which reportedly was delivered ahead of schedule and more than 10% under budget, is in the Central Graben area and situated close to the company’s Elgin-Franklin fields. With a plateau production of 100,000 boed, Culzean is expected to account for approximately 5% of the UK’s gas consumption.

Hurricane Energy also announced an important start-up in the UK in June. First oil was achieved at the Early Production System (EPS) development of Lancaster field. This reportedly is the first basement reservoir development on the UK Continental Shelf. The EPS is the first phase of development for Lancaster field, and consists of two wells tied back to the Aoka Mizu FPSO, Fig. 3. Testing of both wells in early June revealed a combined flowrate of 20,000 bopd. The company said that it anticipates a gradual ramp-up over the first six months of production toward long-term operating efficiency of 85%.

Licensing. E&P activity on the UKCS could pick up following the 32nd UK Offshore Licensing Round, which was launched by the Oil and Gas Authority (OGA) in early July. The licensing round is offering 768 blocks or partial blocks throughout the UKCS. It will be open for 120 days, until the application closing date on Nov. 12, 2019. The OGA said that decisions are expected in the second quarter of 2020.

The latest licensing round follows the successful 31st Offshore Licensing Round, which saw the award of 37 license areas across 141 blocks or partial blocks to 30 companies in early June. “Exploration on the UK Continental Shelf continues to be revitalized, with the results indicating a continuation of the strong interest shown in the previous frontier round,” Dr. Nick Richardson, head of exploration and new ventures at the OGA, said in a release. “It has been very encouraging to see industry generating new prospects and play concepts, and seeking acreage in areas which have never before been licensed, such as parts of the East Shetland Platform, underlining the positive impact of ongoing Government-funded data initiatives.”

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)