What's new in exploration

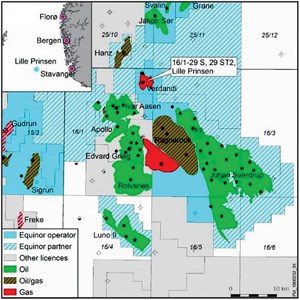

Norway announced a wildcat discovery in the North Sea (NS), in an area that they say was “not previously known to contain oil or natural gas.” Really? The new Prinsen well is only a few km northwest of Ragnarock oil and gas field, and a few less northeast of Ivar Assen oil field, Fig. 1. The entire NS contains oil and gas. This well demonstrates that exploration is possible, even in the middle of one of the most exploited areas on the planet. No need for a “real” Ragnarock yet for Norway.

Reducing risk. ConocoPhillips (CP), no stranger to the NS, limited risk when I worked there by not having more than 35% in any deal. Ken Tubman, V.P., Subsurface, at CP, recently offered insight on the company’s E&P strategy for the future at a presentation for the Geophysical Society of Houston.

Ken says future geophysicists need to be open to new technologies, and willing to learn and apply “new” approaches inside their existing tool set, but leveled by expertise that I call experience with success and failure. He thinks we may see a pick-up in offshore development, relying heavily on imaging technology, but acknowledging that much of the industry’s capital will continue to be invested onshore.

Furthermore, “math and analytical skills” will be key in new development areas by reducing risk with augmented characterization and modeling, where data analytics and machine learning are at the core of each new CP approach. Why? A.I. will enable CP to find ways to gain efficiency and look at more data. One such approach that newer software and larger computing machines allow is seismic data acquisition that changes “regularization” theory. CP is betting big on compressive seismic imaging (CSI), under the tested belief that it gives better data at lower cost. (https://www.gshtx.org/publications/GSH_Journal/2018_June.aspxn p30)

CSI has been around in some form or another since the beginning of seismic. Simply put, it uses sources and receivers in close proximity and shoots over a line or area. The early shot hole crews used this method to fast shoot a land line and still have old, bold shooters. When vibration trucks showed up, independent sweeps were employed. Often, these Vib trucks were way off line, and there was no GPS to track. However, the assumption on all shots or sweeps was a regularized geometry of uniform shot-to-receiver spacing, and all data were aligned to that hypothesis, regardless of where on the earth the shot occurred. That was always the constraint because of: 1) theory; and 2) the computer has to see regular, predictable intervals, n ∗ x, x = 1 + limit.

What if you could perform dense patches around surface obstacles, or create circular shot lines and use the actual geometry? We tried them all, but forced gathers into CMP x,y boxes, based on some range of offset. New efforts became possible by mega-compute cycles. Now, we could play in a manner that data programs could be simulated first (cheap) and tried in the field, small-scale. (“Simultaneous sources: The inaugural full-field, marine seismic case history,” Beasly, SEG 2012, Las Vegas).

Compressive sensing. “Technology, based on non-uniform sampling, sparsity and optimization can increase sampling efficiency by a factor of two or more in each sampling direction... When combined with simultaneous shooting, the gains can be even larger—changing the way that we acquire seismic data is a daunting challenge. Any data we acquire must be suitable for the geophysical analysis required for exploration and development—but also comparable or better results from applications such as imaging, inversion and 4D analysis.

ConocoPhillips has recently completed a full year of production application of CSI to land, marine and ocean-bottom node surveys. In all cases, we have achieved significant improvements in both acquisition efficiency and in data quality. Acquisition efficiency improvements achieved in production range from a factor of four to as high as 10. Charles Mosher, Sept., 2017. (https://library.seg.org/doi/10.1190/segam2017-17679803.1).

Not everyone is embracing this approach with good reason, mainly their current cap investment in existing kit. “Modifying seismic acquisition, based on the performance of new processing tools, adds risk and should be done cautiously for this expensive process.” (Christoff, ION 2014. https://www.iongeo.com).

Exploration is all about cost. Since management attitudes remain, I offer a scenario like this: propose a conventional seismic program, say budget a $4-million, turnkey bid. Actually, at 1/4th x better than the “older” design, the bid was $1 million. I would inform Servco to double aerial coverage or double the shot density, and award an open, $2-million contract. At the end of the survey, costs went over 50%. We pay $3 million, get twice the initial coverage; Servco wins, Oilco wins—more coverage at higher resolution. We come in 25% under budget and on time, the best words that management can hear! I learned those lessons from my exploration manager in Ponca City, Okla., and from drilling engineers in Jakarta. ![]()