Regional Report: Russia

Russian E&P has proven unexpectedly resilient in response to the recent oil price decline, all the while struggling through its longest recession in two decades. In March 2016, output went as far as to hit a post-Soviet record. According to the Russian Ministry of Economic Development, Russia produced 10.91 MMbopd in March, up from the 10.36 MMbopd produced a year prior, or 5.3% higher. Natural gas production, however, underwent a 1.35% decrease, to 58.1 Bcfgd.

Despite the low commodity prices and many predictions of a rapid decline in production, Russian operators registered a 13% raise in drilling last year, to 7,869 wells. Additionally, Russia’s largest producer, Rosneft (responsible for 35.4% of liquid hydrocarbons pumped in Russia), achieved a 30% boost in total wells drilled.

Early this year, Rosneft surpassed natural gas exporter Gazprom, in terms of market value, for the first time since its shares began trading in 2006. Gazprom still outweighs Rosneft in terms of output, however. Its oil and natural gas output are equivalent to about 8 MMbpd, while Rosneft pumps roughly 5 MMbpd.

Statoil and other producers—such as Exxon Mobil Corp. and Royal Dutch Shell—have continued to strengthen their involvement in Russia’s energy sector, even amid the restrictive sanctions imposed by Europe and the U.S. This is because Russia remains among the top five regions that producers expect will drive growth in international production over the next decade.

COMPETITION AND CONTENTION

Holding the world’s largest natural gas reserves (1,736.5 Tcf) and the eighth-largest oil reserves (86.15 Bbbl), and dominating as the world’s leading natural gas exporter, Russia has established itself as a global energy giant. In recent years, however, competition has been growing in Russia’s biggest oil markets.

The world’s largest oil exporter, Iran, has begun shipping crude to European countries, including Poland and Sweden, which traditionally have been Russian markets. Europe receives almost 70% of Russia’s oil exports, making it one of the country’s top customer markets. Consequently, a surge in Iranian exports, after the lifting of sanctions, could have lasting effects on the value of Russian shipments to the region. This is significant, considering that oil and gas sales account for about half of governmental revenues, amplified by the price collapse, as well as international sanctions over Ukraine.

In November 2015, Russia halted all natural gas shipments to Ukraine, after the latter declined to purchase greater amounts amid ample supply. Gazprom produces 66.1% of Russia’s gas, and has had a fairly contentious relationship with Ukraine during the course of the recent price slump. According to analysts, Ukraine has made an effort to reduce its dependence on Russian gas, while Gazprom also has decreased its reliance on transit through its neighbor.

Last year, Ukraine relied on Russia for more than 20% of its gas needs, but had stopped imports in July 2015, due to a price dispute. Shipments resumed in October, however, after the European Commission brokered an interim deal between the former Soviet republics. An international arbitration panel is reportedly being arranged to rule on the gas supply contract, sometime during 2016.

Russia has the capacity to replicate Saudi Arabia’s oil strategy, but with its gas supply. According to economists, Russia could remain a top competitor by boosting gas exports and production, and cutting prices. Reportedly, Russia already expects sales to Europe to reach a record this year. Norway, which is Europe’s second-biggest gas supplier, is catching up as a competitor, as well. Norway expects a level of European sales similar to last year’s record.

According to Russia’s Energy Ministry, the country plans to stabilize output through development of Soviet-era discoveries in the next two decades, as drilling of new finds has been delayed by sanctions and falling prices. The country’s long-term energy strategy is to target offshore oil production with an increase of 240 MMbbl to 365 MMbbl. “We’ve got a safety cushion until 2035,” said Deputy Energy Minister Kirill Molodtsov during an interview late last year. “The potential for output growth at oil fields already in operation is higher than in unexplored territories.”

Moreover, for the last several years, Molodtsov’s ministry has been urging the government to establish a new profit-based tax system, which is expected to help spur crude output. However, the Finance Ministry reportedly has suggested that Russia wait until at least 2017, given the economic recession.

EFFECTS OF SANCTIONS

As a result of the conflict between Russia and Ukraine, the European Union (EU) and the U.S. initiated sanctions against the Russian oil sector. The sanctions—which include an equipment export ban and a financial instruments restriction—are having an onerous impact on Russian oil companies, as well as on their investors.

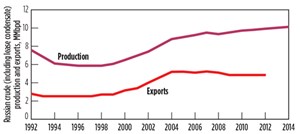

Since Washington imposed the sectoral sanctions, which began in March 2014, the market capitalization of Russia’s highest-ranking oil and gas companies has deteriorated steadily. Despite the immense pressure that these sanctions put on its energy sector, Russia continues to pump massive amounts of crude oil, Fig. 1. The country produced an average 10.685 MMbopd in 2015.

During 2014, in response to Russia’s sullied relations with the EU and the U.S., President Putin moved in another direction, as he reached his first $400-billion deal to supply gas to China from East Siberia. State-run Gazprom made plans to deliver as much as 1.1 Tcf/year to China from West Siberia—which adds to the 1.3 Tcf from the first contract—ousting Europe as its top customer.

Additionally, a new tax regime took effect Jan. 1, 2015. The new taxation stipulates the reduction of current rates of export duty on crude oil and petroleum products, while increasing the base rate of mineral extraction tax on commercial oil. Overall, the tax has proved exceptionally arduous to the Russian oil industry, compared to that of other countries.

OUTPUT FREEZE

Although the U.S. has taken over the title of world’s largest oil and natural gas producer (combined), Russia continues to pump at record levels. While locked in an intense struggle for market share, Russian officials have cooperated on plans to join OPEC in stabilizing global oil markets. Despite that, preliminary data from the Energy Ministry show that Russia has ramped up production, adding to the global glut.

In February, Russia, along with Saudi Arabia, agreed to freeze output after talks in Qatar. The freeze was reportedly conditional on other nations’ willingness to participate. In March, doubts surrounding the proposed production freeze were rampant, as Russian output climbed to 10.912 MMbopd. Additionally, according to the Energy Ministry, Russian oil exports also rose 5.1% from the same month a year earlier, to 5.59 MMbopd.

PROJECT DEVELOPMENT

Western Siberia. In October 2015, Gazprom Neft acquired additional licenses for geological prospecting, exploration and development on the Yuilsky-3, Lyaminskiy-6 and Severo-Ityakhskiy-1 Blocks, all of which are situated in the Khanty-Mansiysk Autonomous Okrug. The areas were selected strategically on the basis of localized assessments of the long-term development of the Bazhenov formation. The formation is in the West Siberian basin, and was formed from sediment deposited in a Tithonian-age deepwater sea.

In January 2015, Gazpromneft-Khantos, a subsidiary of Gazprom Neft, found shale oil at Yuzhno-Priobskoye field, in Western Siberia. It was discovered while testing a deviated well that had been drilled for exploration of the Bazhenov deposits.

The Bazhenov formation runs to depths of 6,560 ft to 9,845 ft, and while the stratum covers an area of approximately 386,100 mi2, it is reasonably thin. Thickness ranges from just 33 ft to 130 ft. Gazprom Neft has estimated more than 508 MMbbl of potentially recoverable reserves from the formation.

Gazprom Neft has made considerable progress in its exploration of reserves in the Bazhenov formation at Vyngayakhinskoye field, situated in Russia’s Yamalo-Nenets Autonomous Okrug. This was the company’s first attempt at exploring unconventional reserves, and it has focused primarily on identifying the most viable technologies to develop the Bazhenov deposit. In late 2015, the firm undertook hydraulic fracturing of the Bazhenov strata of Vyngayakhinskoye field, via two directional wells that had been used previously for oil production from traditional reservoirs. Gazprom Neft expects to frac one well in the coming months, after obtaining a 295-ft core sample.

Vadim Yakovlev, first deputy CEO and head of Gazprom Neft’s upstream division, said, “Starting this new project at Vyngayakhinskoye field will give us a better understanding of how unconventional reserves can be better incorporated into commercial production. Opening up this formation—which, thus far, remains practically undeveloped—will, in the future, make a considerable contribution to oil production and extend the life of our fields.”

Owned and operated by TNK-BP, a Rosneft company, Samotlor field is being developed further, in an effort to maintain production. There reportedly are plans to drill 227 new wells this year, double the number drilled back in 2014. Samotlor produced 152.6 MMbbl of oil last year, and is expected to maintain that rate of output going forward, in an effort keep production going for the next 50 years.

In May, Total began gas and condensate production from the Termokarstovoye onshore field, which is operated by Terneftegas, a JV between Novatek (51%) and Total (49%), in Russia’s Yamalo-Nenets Autonomous District, Fig. 2. The field is made up of very thin reservoirs, which lie deep underground. Despite the challenging permafrost and the extremely remote location, the field produces 65,000 boed.

Further north, situated on the Gydan Peninsula, the first production well at Vostochno-Messoyakhskoye field was completed by Gazprom Neft and Rosneft in July 2015. The field is part of the Messoyakha group, which also includes Vostochno (eastern) and Zapadno (western) Messoyakha acreages. These acreages constitute the northernmost onshore oil fields of Russia.

This location proved particularly challenging, as the production well crosses strata subject to unusually high pressure and longstanding permafrost. The well runs to a length of about 7,545 ft, and extends to a comparatively short total depth of approximately 2,755 ft, with a horizontal section of around 3,280 ft. The Vostochno-Messoyakhskoye fields are scheduled to go into full-scale commercial production this year, and well stock is expected to reach 63 units.

Additionally, Yarudeyskoye field, developed by Yargeo, a JV between Novatek (51%) and Nefte Petroleum Limited (49%), achieved full capacity of 70,520 bopd, in January 2016. The field, which is also in the Yamal region of Siberia, is now producing about 25.4 MMbbl of crude oil per year from the 24 production wells in operation.

Caspian Sea. In February 2015, Lukoil-Nizhnevolzhskneft, a Lukoil subsidiary, established a world record for horizontal drilling, with a significant bottom displacement. Drilled from an offshore, ice-resistant, stationary platform at Yuri Korchagin field in the Caspian Sea, Well No. 108 was drilled to 16,102 ft in the 9.5-in. section, in a single run, without tripping. The well, which was drilled to a TVD of 5,135 ft, has a total length of 26,263 ft. This is the largest footage drilled in a well within the Korchagin field development project. Lukoil held the previous record, as well, which also had been in the Caspian Sea.

Arctic Shelf. In March 2016, Gazprom Neft announced that the 10-millionth barrel of oil had been produced at Prirazlomnoye field, 37 mi offshore in the Pechora Sea. The field is the first, and only, oil-producing field on the Russian Arctic Shelf. The field produced Arctic oil for the first time in April 2014, with a total of 2.2 MMbbl of oil being produced that year. The company said that it plans to more than double output in the coming year. “The 10-millionth barrel of oil is a major landmark, proving that oil production on the Arctic Shelf can be both safe and viable,” said Gennady Lubin, executive director, Gazprom Neft Shelf.

Development of the field required construction of the ice-resistant Prirazlomnaya rig and platform, which is anchored to the seabed and designed specifically for operation under the most extreme climatic conditions. This was necessary, due to the severe Arctic conditions in the Pechora Sea, as wind and sub-zero temperatures persist for approximately five months of the year, Fig. 3. The platform walls are about 9.8 ft thick, ensuring complete isolation from the surrounding environment while drilling.

Eastern Siberia. Vankorneft, a Rosneft subsidiary, has advanced in the development of fields in the northern part of Eastern Siberia, particularly in the Turukhansky District of the Krasnoyarsk Territory. Specifically, the company has worked hard to develop Vankor field, which is the largest field to be discovered and brought into production in Russia in the last 25 years. Hydrocarbon reserves were estimated initially at 909 MMbbl, while peak production has been projected at 87.2 MMbbl annually. The field yielded its 100-millionth ton (727 MMbbl) of oil in April 2015.

Executed in 1996, Sakhalin-1 is the first large-scale shelf development project to be carried out in the Russian Federation and implemented under a production sharing agreement (PSA)—Rosneft (20%); Exxon Mobil (30%, Operator); Sodeco (30%); and ONGC (20%). The consortium anticipated the development of Chayvo, Odoptu and Arkutun-Dagi fields on the northeastern Sakhalin shelf, in the Okhotsk Sea, Fig. 4.

Accordingly, in January 2015, the participant companies of the consortium announced the start of commercial oil production at Arkutun-Dagi field, about 15 mi from the northeastern shore of Sakhalin Island. Oil output is gathered at the Berkut platform. The field is expected to bring total daily production at Sakhalin-1 to more than 196,000 bopd. The other two fields—Chayvo and Odoptu—already began production in 2005 and 2010, respectively. Rosneft produced its one millionth ton (over 700 MMbbl) of crude oil at the northern tip of Chayvo field in May 2015.

As opposed to Lukoil’s Well No. 108 in the Caspian Sea, which set a one-run horizontal drilling record, Exxon Mobil and its partners successfully completed drilling of the world’s longest horizontal well in April 2015. The well, which was drilled at Chayvo field, set the record at 44,291 ft, MD, and a horizontal reach of 39,478 ft, MD. This is not the first world record that Sakhalin-1 has set in extended reach drilling. Since the beginning of the drilling program in 2003, the Sakhalin-1 consortium has set records for nine of the ten world’s longest wells.

Rosneft finalized an agreement with BP, for the sale of an estimated $750 million of a 20% share of Taas-Yuryakh Neftegazodobycha (Taas), creating a new JV in Eastern Siberia. The JV has plans to concentrate on some of the largest fields in East Siberia, including Srednebotuobinskoye oil and gas condensate field, which is now producing approximately 20,000 bpd. ![]()