Regional report: UK-Norway

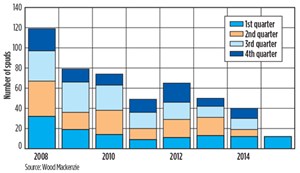

Across the UK, levels of upstream exploration and appraisal (E&A) and deal activity have decreased since the peak seen in 2008. During first-quarter 2015, E&A activity in the UK was particularly low, with only 12 E&A wells drilled. In Norway, there was a peak of E&A activity in 2009, followed by a drop in activity in 2010 to 2012; however, 2013 and 2014 saw slightly higher levels. The first quarter of 2015 saw relatively high figures, with 14 E&A wells drilled.

The UK continues to face challenges, including high costs, basin maturity, and poor weather conditions, which have all hindered activity. Onshore UK has seen its own challenges around public objection and environmental concerns, particularly with regards to unconventional drilling. In addition to these challenges, the oil price drop since the second half of 2014 has put further pressure on the industry.

These pressures and challenges have created the need for the UK government to step in and encourage further activity. The UK has seen a decline in production since 1999 and E&A drilling activity since 2008, which led to the Wood Review, the introduction of the Oil and Gas Authority, and subsequent tax changes in the March Budget 2015. In Norway, the outlook is slightly more positive, which may be due to the exploration tax rebate introduced in 2005, and the ongoing participation of the Norway government in the upstream industry.

UK CONTINENTAL SHELF

On the UK Continental Shelf (UKCS), E&A drilling and deal activity remains subdued, with 12 wells drilled in the first quarter of 2015, compared to 32 in the first quarter of 2008, Fig. 1. As few as four wells are currently planned for the remainder of 2015. The year 2008 represents the highest peak in E&A drilling since 1997. On average, 12.5 wells were spudded per quarter during 2014, compared to 29.75 per quarter in 2008.

Deal activity during the first quarter of 2015 has fallen by 93%, compared to 2008 with only one farm-in taking place, compared with six asset acquisitions, two divestitures and six farm-ins during the first quarter of 2008. There has been a decrease of 90% in the number of deals in comparison to first-quarter 2014 when 10 deals were announced. Field developments and startups have also been muted, with no fields approved for development in first-quarter 2015.

In 2014, a total of 519 MMboe was produced on the UKCS, compared to approximately 985 MMboe in 2008. Although production on the UKCS has steadily declined over this period, 2013 to 2014 saw a stabilization, with only a small drop (1.1%) in production. Oil and Gas UK predicts that this decline in production is likely to be reversed in 2015. The predicted rise in production can be attributed to an increase in production from new field startups, a factor which can be attributed to action taken by the UK government to stimulate activity in previous years. The loss in production on the UKCS throughout 2014 from assets producing prior to 2014 may be offset by around 67 MMboe from these new fields that commenced production in 2014 and are expected to start production in 2015.

The challenges on the UKCS have been magnified by the recent significant drop in the oil price. The challenges include a maturing basin, cost-control pressures and poor weather conditions. Harsh weather caused delays/cancellations in rig mobilization and pushed back drilling dates and a general reluctance to commit to future projects. According to the Oil and Gas UK Activity Survey 2015, 2014 saw the lowest level of production revenue delivered since 1998 (£24.4 billion), while potentially commercial reserves discovered during 2014 were only one-fifth (50 MMboe) of the average rate (over 250 MMboe per year) discovered over the last ten years. Now more than ever, significant investment, as well as cost cutting, is required and it will be interesting to see how the oil price collapse affects the level of drilling activity in 2015.

Four new fiscal measures were announced in the UK Budget in March 2015, aimed to boost investment and support the regeneration of the UKCS, which have been implemented in the Finance Bill 2015. Specifically, a 10% decrease in Supplementary Charge Tax (SCT) to 20%, a 15% decrease in Petroleum Revenue Tax (PRT) to 35%, £20 million funding for surveys of under-explored areas in the next two years and the introduction of a broad Investment Allowance, allowing an exemption of 62.5% of investment expenditure from SCT. These fiscal measures form part of a roadmap for the future fiscal regime of the UK’s oil and gas industry, which acknowledges the maturity of the North Sea and the need for an approach to reduce the overall tax burden, simplifying the oil tax regime and introducing tax support for exploration. The addition of a new field allowance for ultra-high temperature, high pressure (HTHP) field clusters, included in the Finance Bill 2014, was described by OGUK as having “the potential to attract £6 billion of investment in the near term if it is pitched at the appropriate rate.”

The Wood Review, which focused on how to maximize economic recovery from the North Sea for the benefit of the UK, includes recommendations that have the potential to turn things around and encourage a shift towards a more holistic approach, with strong collaboration between industry and Government. The implementation of a Government-enforced shared strategy for “maximizing economic recovery (of oil and gas) for the UK,” coupled with a new arm’s length regulatory body to oversee this program and a greater commitment by industry to the sharing of infrastructure and reduction of operational delays, may provide the needed boost for the UKCS.

UK ONSHORE

Public opinion and political approach towards oil and gas exploration onshore UK has always been split. However, the balance of environmental consequences against economic benefit has become even more topical amidst the current oil price in post-recession Britain. Furthermore, public objection to the rise of unconventional techniques has been well documented since Cuadrilla admitted to causing a 2.3 Richter earthquake in Blackpool in 2011, among other seismic events abroad. However, the unparalleled success of the U.S. shale industry, coupled with the potential of conventional oil and gas onshore UK, demonstrated by the recent Horse Hill and Wressle discoveries, is making the potential economic upside of onshore oil and gas hard to ignore.

In 2014 and early 2015, three major onshore conventional exploration campaigns were undertaken: Egdon’s Wressle and Europa’s Kiln Lane, both in the East Midlands petroleum province, as well as UKOG Horse Hill in the Weald basin. In 2013, there were two wells, both by Rathlin Energy: West Newton 1 and Crawberry Hill 1. West Newton 1 was tested, and Rathlin was ‘encouraged’ by the results, and at Crawberry Hill 1, Rathlin is working to satisfy the pre-operational conditions required for a well test.

Exploration well Kiln Lane 1 targeted two intervals, and after drilling to a TD of 2,291 m, the sandstones encountered were determined as water-wet, although there were significant oil shows. Notwithstanding the poor result of the well itself, Europa remains positive about the remainder of the license area in the East Midlands petroleum province, which covers 540 km2. Operator Europa (50%) shares the license with Celtique (25%) and Egdon (25%).

The other significant East Midlands exploration campaign is Wressle, which has undergone well testing on four separate hydrocarbon-bearing intervals, with both gas and oil encountered. A flowrate of 700 boed was announced in Egdon’s second-half report for 2014, highlighting the intention to bring the discovery into development. Egdon operates PEDL180 (25%), with partners Europa Oil & Gas (33.3%), Celtique (33.3%) and Union Jack Oil (8.3%).

Finally, the discovery at Horse Hill hit the headlines in April this year, after UKOG announced that the Horse Hill 1 well has an oil in place (OIP) of 158 MMbbl/mi2 in the Weald basin. This figure could be conceived as reasonably contentious and debatable; however, the prospectivity of the area is difficult to deny. Horse Hill Developments Ltd operates the license, with a 65% equity and consists of a consortium of oil and gas companies (including UKOG), which have collaborated for exploration in the area. The remaining equity is held by Magellan Petroleum (35%).

Wytch Farm is the only field onshore UK to produce hydrocarbons in comparable volumes to its offshore counterparts. Other fields that have been put into development have not reached such prolific levels; however, the volumes required to achieve commerciality onshore are significantly smaller due to lower capital and operational expenditure.

The only shale gas drilling activity in 2014 was an exploration well that was spudded by IGas. No hydraulic fracturing was undertaken—it was an exploration well to validate the geological model in license PEDL184, near Liverpool. Regardless of the perceived lack of actual drilling, a £30 million deal was secured in March, whereby INEOS acquired interest in multiple IGas licenses, spanning northwest England, East Midlands and Scotland. INEOS has also agreed to fund a £138 million work program as part of the agreement.

In terms of the future of unconventionals in the UK, Prime Minister David Cameron announced his party’s desire for the nation to “go all out for shale”, a standpoint, which was not held with such aplomb as the other major parties. This will come as good news to major players in the UK unconventional scene, as will the appointment of Amber Rudd as energy minister, a public shale advocate.

The outlook in Scotland is different, with a moratorium on all planning consents for unconventional oil and gas extraction being announced in January 2015 by the Scottish Government. This will not rule out the use of the technique in Scotland; however, it shows that the Government is taking environmental concerns seriously and may be difficult for companies to receive drilling permits.

NORWAY

During the first quarter of 2015, 14 E&A wells were spudded on the Norwegian Continental Shelf (NCS). This is the same number of wells drilled during the same period in 2008, when a peak in drilling activity was seen. Of the 14 wells drilled in first-quarter 2015, 11 were exploration wells and three appraised known discoveries. Of the seven exploration wells completed during first-quarter 2015, three encountered hydrocarbons. Statoil-operated Romeo well 2/4-22 S discovered oil in both primary and secondary targets. The Snefrid North exploration well 6706/12-2 operated by Statoil is located in license PL218. The well lies 6 km northwest of the Statoil-operated Aasta Hansteen field. The well proved a 105-m gas column, 75 m of which was in sandstone of very good quality. Statoil estimates the volumes in Snefrid North to be 9 Bcm. Well 26/10-1, on the Zulu prospect, also discovered gas.

Field development activity has been steadily decreasing since 2011, when six new fields were granted development approval. There were no field development approvals granted during the first three months of 2015; however, four startups took place. This compares to no field development approvals and one startup in first-quarter 2014. Despite the lack of development approvals during first-quarter 2015, a number of development projects are in the pipeline in the current upstream cycle. Currently, three out of eight projects with PDO approved status—Goliat, Martin Linge and Edvard Grieg—were approved for development in 2009, 2012 and 2013, respectively. These are expected to start production in late 2015/2016.

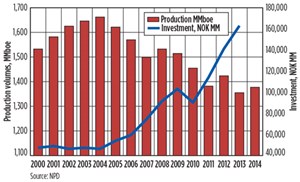

In first-quarter 2015, four fields came into production. This compares with five fields starting production throughout 2014. These four fields add 88,000 bopd to Norway’s production currently. Overall production in 2013 was 1.35 Bboe, which increased to 1.37 Bboe in 2014. Some of the projects on the NCS are among the most ambitious in scale and size of investment. Johan Sverdrup is one of the five biggest oil fields on the NCS and Statoil submitted the PDO in first-quarter 2015. Johan Sverdrup is one of the most important projects on the NCS, with expected total revenues to gross NOK1,350 billion. The development work for the field is expected to be undertaken in five phases and, once in production, it is estimated to account for 25% of Norway’s overall production. The total resources from the field are estimated at 1.7 Bboe to 3 Bboe, with an ambitious 70% recovery factor. The first-phase development is estimated at NOK117 billion, for four platforms and onshore power. Statoil has awarded a number of contracts in recent months, including one to a JV of Kvaerner and KBR. The contract, valued at NOK6.7 billion, includes the construction of topsides for the utility and living quarters on the platform.

Statoil has a large presence in Norway and is operating a number of large projects. Due to high costs across the North Sea, a number of developments have been delayed. More recently, the drop in the oil price has become a more important factor in making investment decisions. The oil price slump with the combination of rising costs in the upstream sectors have threatened to delay development projects in the pipeline. Statoil announced that it plans to cut its spending by 8% by 2016.

According to Statistics Norway (SSB), investment costs in the oil and gas sector went up by 1.1% during 2014 from 2013; however, the agency forecasts a 15.5% decrease in total investment in 2015 from the NOK214 billion accrued in 2014, Fig. 2. SSB reports the accrued investment costs for oil and gas extraction and pipeline transportation business whereas NPD reports investment incurred on fields on a yearly basis.

At the start of 2015, Statoil delayed the $4 billion upgrade of Snorre, which could yield a further 300 MMboe, because margins on the field were too low, particularly after the drop in the oil price. Statoil has also delayed its Arctic development of Johan Castberg in the Barents Sea for the second time as it reassesses the development scenario to minimize costs. The PDO was originally due to be submitted in mid-2014; however, the plan was revisited to reduce costs. In March 2015, Statoil postponed the concept selection and PDO submission for a second time to allow for further cost reduction studies. Concept selection is now expected in second-half 016, with expectations for an investment decision and PDO submission in 2017.

Despite high costs and the drop in oil price, the Norwegian Government introduced measures in 2005 that are supporting E&A activity in the current environment. The Norwegian Ministry introduced a tax rebate under which companies not in tax positions can claim back 78% in annual cash refunds from their direct or indirect exploration expenses. Norway has maintained buoyant levels of exploration drilling since 2006, which was preceded by a period of low activity.

Norwegian petroleum regulatory authorities require the operators to submit core samples from wildcat drilling so the industry can have a better understanding of the subsurface. Licensees also are required to invest in projects that can improve recovery. Drilling more wells, re-injection and facilities modifications are a few examples. Additionally, in April 2015, the Energy Minister highlighted that Statoil must move ahead with the Snorre upgrade as it is a time-critical investment, as the infrastructure is aging and any delay could negatively impact project economics.

The Norwegian Ministry is also keen to continue with initial seismic acquisition in the frontier south eastern Barents Sea region by encouraging the oil industry to jointly conduct resource-efficient 3D seismic acquisition. Statoil is the operator of the three-year Barents Sea Exploration Collaboration

(BaSEC) project in which 32 companies with assets in the Barents Sea are working collaboratively to find robust and cost-effective solutions for the region in both the short and medium term. During 2014, WesternGeco and PGS acquired an extensive 3D seismic survey over the eastern part of the Barents Sea. This area was previously off-limits for the oil and gas activity until recent resolution of a maritime dispute between Russia and Norway. Processing of the data from the campaign is expected to be complete in mid-2015 and will be available for 57 blocks offered under the 23rd Licensing Round.

RECOVERY DEPENDENT ON OIL PRICE

The drop in oil price at the end of 2014 has had a considerable impact on the upstream oil and gas industry in a region with already many challenges. The UK has been hit hardest, with Norway suffering less, however still forced to delay projects. A much-needed positive effect of the drop in the oil price is that costs have begun to fall. The slight upturn in oil price throughout May gave some optimism, and if upstream costs continue to fall significantly with the oil price at a stable level of $50-60, there could be a conducive environment for activity to pick up again through the current upstream cycle.

The UK Government is working to revive the industry throughout 2015. Oil and Gas UK is optimistic for an increase in production from the UKCS in the next 12 months and Prime Minister David Cameron is encouraging onshore unconventional exploration. The Norwegian Government is also heavily involved in ensuring project developments continue to take place and encouraging upstream activity to maintain production levels on the NCS. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)