|

| One of Chesapeake’s eight-operated rigs drilling a Haynesville well in Shreveport, La . Courtesy of Chesapeake Energy Corp. |

|

Cheniere Energy may well be the most prominent player in the Haynesville/Bossier shale these days, which, in itself, speaks volumes on the near-term prognosis for a once-lionized gas play that continues to be snagged in a holding pattern.

The Houston company’s steadily advancing plans to complete a Louisiana facility, capable of initially exporting 4.5 Mtpa of LNG—perhaps as early as late 2015—gives operators a morsel of encouragement that perhaps the death of the Haynesville/Bossier shale has, indeed, been greatly exaggerated. With Cheniere having nailed down firm long-term contracts with gas-hungry international buyers, Haynesville producers are busy making their sales pitches, in hopes of cutting into some of the glut that continues to keep prices in the cellar.

“I think, if I were a purchaser of LNG, I’d want to go to the company that had the best assets in the country and that’s Chesapeake,” CEO Doug Lawler told analysts in August. “For long-term deliverability, and capturing the greatest price opportunity for our gas, we will continue to look at opportunities to secure LNG contracts at pricing that we would consider to be favorable. We’ve not signed anything yet, but we have had a number of discussions.”

In the meantime, despite a modest and brief uptick immediately following the brutal winter just passed, gas prices have since fallen back to the $4/Mcf range, according to the U.S. Energy Information Administration (EIA), which expects record injection build-up through October. Consequently, active rigs have become a threatened species within the dry gas-dominant Upper Jurassic Haynesville shale, which stretches some 9,000 mi² across northern Louisiana and East Texas. As if soft commodity prices were not enough, Haynesville wells are also deeper and much more technically daunting than their counterparts elsewhere in the U.S. Consequently, accessing the nearly 75 Tcf of technically recoverable gas reserves that the EIA estimates is locked within the Haynesville is enormously expensive, putting it even farther behind the proverbial eight ball.

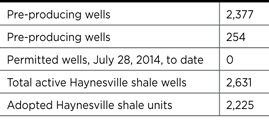

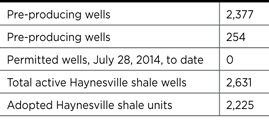

Nevertheless, as of Aug. 17, Baker Hughes data showed 45 rigs drilling in the Haynesville, up one from the like period last year. Activity is split nearly even between the Louisiana core (Table 1) and the East Texas sector (Table 2) with 23 and 22 active units, respectively. Over the first six months, the rigs still finding work drilled 207 new wells, according to Baker Hughes, matching the wells drilled in the first two quarters of 2013, which saw a year-end total of 404 new wells. If nothing else, Haynesville rigs appear to be more efficient, as reflected in the most recent EIA drilling efficiency report that tracks production delivered by individual rigs. EIA showed 5.32 MMcfgd produced per rig in July, with each Haynesville rig expected to have produced 5.402 MMcfgd in August.

| Table 1. Haynesville shale gas play well activity, august 2013 to July 2014 (Louisiana). |

|

|

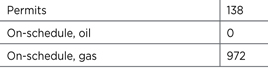

| Table 2. Wells permitted and completed in the Bossier/Haynesville shale, July 7, 2014 (Texas). |

|

|

Meanwhile, once-active Haynesville players, like Encana, are mobilizing rigs a few miles south to target the emerging Tuscaloosa Marine shale that covers a wide swath across southern Louisiana and into Mississippi. In the Carthage area of the Haynesville’s East Texas sector, operators also have the option of hedging their production by vertically targeting the overlaying, and more liquids-laden, Cotton Valley formation. Surprisingly, on the other end of the spectrum, a couple of acquisitions totaling nearly $1.5 billion would suggest that there are some who believe the Haynesville, and its overlaying Bossier shale, may yet have some better days held in reserve.

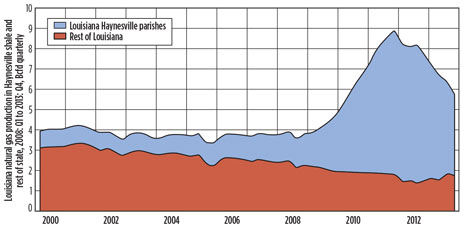

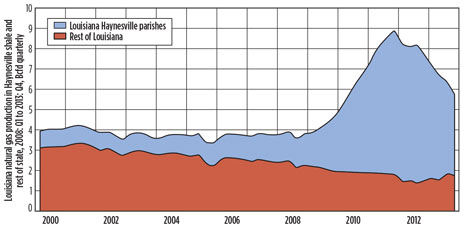

What is not surprising, however, is that year-over-year, less gas is being sent through the sales line. In an April statement, the Louisiana Department of Natural Resources (DNR) noted the obvious in announcing that, at year-end 2013, the Haynesville saw a 30% production decline compared to the previous year, dropping to a cumulative average of around 3.97 Bcfd, Fig. 1. “Some industry observers say the Haynesville play remains at a disadvantage, since it produces mostly natural gas and has one of the highest costs of drilling among shale plays in the U.S.,” according to the DNR statement.

|

| Fig. 1. Haynesville shale historical gas production from first-quarter 2008 to fourth-quarter 2013. Sources: Louisiana Department of Natural Resources and U.S. Energy Information Administration |

|

LNG LOOMS LARGE

In the meantime, having cleared all pertinent federal regulatory hurdles, the Cheniere Energy Sabine Pass LNG terminal (Fig. 2) is considerably closer to actually exporting LNG than the seven similar facilities in widely varying stages of development along the Louisiana and Texas coasts. By July, the first two of six planned processing trains at the 1,000-acre Cameron Parish site were roughly 69% complete, Cheniere says, with construction well underway on the third and fourth trains. Cheniere has put the price tag of the first four trains at around $7.74 billion, but says the fixed fee portion of the contracts already in hand amounts to approximately $2 billion annually.

|

| Fig. 2. The sprawling Cheniere Energy Sabine Pass LNG terminal under construction on a 1,000-acre waterfront site Cameron Parish. Courtesy of Cheniere Energy, Inc. |

|

Cheniere says the initial two trains have aggregate liquefaction capacity of 1 Bcfd, with the first expected to begin LNG production by the end of 2015, and the second to follow closely thereafter. The third and fourth trains are expected to begin shipping liquefied gas as early as 2016, while the final two are still in the very preliminary engineering stage. With each train in the Sabine Pass facility having engineered capacity of 4.5 Mtpa, the Cheniere terminal conceivably could have a cumulative export capacity of 27 Mtpa, providing all six trains are completed and put into service.

To the west, Cheniere also is awaiting final approval from the U.S. Federal Energy Regulatory Commission (FERC) for its planned LNG export terminal at Corpus Christi, Texas. FERC is awaiting results of an environmental assessment of the project before granting its authorization.

In a related development, a Sempra Energy-led consortium also moved closer to begin exporting LNG out of Louisiana. After receiving LNG export approval from the U.S. Department of Energy (DOE), the Cameron LNG consortium in August approved a final investment decision, clearing the way for the beginning of construction on its estimated $1-billion terminal in Hackberry, La., Fig. 3.

|

| Fig. 3. A computer-generated image of the Cameron LNG export terminal under construction in Hackberry, La., adjacent to the existing terminal. Courtesy of Sempra Energy. |

|

The DOE approval gives Cameron LNG final authorization to export up to 12 Mtpa of domestically produced LNG to all current and future Free Trade Agreement countries. That authorization was followed in February with conditional DOE approval to export to non-Free Trade Agreement countries. Cameron LNG earlier received the FERC go-ahead to site, construct and operate the facility, a spokesperson said.

The liquefaction project will use many of Cameron LNG’s existing import facilities, and will comprise three liquefaction trains capable of handling approximately 1.7 Bcfd. Construction is expected to start later this year, with full commercial operation in 2019.

Farther to the east, Louisiana LNG Energy, LLC, on Feb. 5, filed an application with the DOE for export authorization covering an LNG terminal to be located on the East Bank of the Mississippi River near New Orleans. In May, the principals said they had secured an undisclosed amount of funding from an affiliate of ArcLight Capital Partners for the project, which has targeted a start-up of third-quarter 2017.

The mid-scale LNG export terminal would comprise four trains, each capable of processing up to 74.38 MMcfgd for a total planned export capacity of 2 Mtpa.

Operators clearly will have no shortage of suppliers ready to provide ample feedstock. Chesapeake, for one, points to the close proximity of the 387,000 net acres it controls in the heart of the Haynesville infrastructure to the planned LNG terminals along the Gulf Coast, Fig. 4. Lawler said the priority now is to make its holdings cost-competitive, which begins at the well construction and field development stage.

|

| Fig. 4. Chesapeake holdings in relation to their proximity to the planned Gulf Coast LNG export terminals. Source: Chesapeake Energy Corp. |

|

“We believe the competitiveness of the asset would be a fantastic source for LNG purchasers, if we could be more competitive. So we’re recognizing that and seeing outstanding results in the Haynesville. Our team is doing a fantastic job, and we’re in great position to move forward, provided we capture the value from an LNG contract or any other sales contract that we might pursue,” he told analysts.

COSTS IN CROSSHAIRS

Like Lawler, the first order of business in the corner offices of operators still holding a presence in the Haynesville/Bossier shale is reducing costs. In the bygone days, when gas prices were hovering in the double-digits, a bevy of operators were more than willing to pay as much as $10 million to drill a deep Haynesville prospect, considering their exceptionally high initial production rates (IP) and attractive estimated ultimate recoveries (EUR), which at one time made it the nation’s most prolific dry gas theater.

The times, they have most definitely changed. With today’s commodity prices, operators are struggling to justify the drilling of wells that can reach as deep as 14,000 ft, total vertical depth (TVD). Ranging in thickness from 150 ft to 300 ft, the Haynesville shale also brings with it bottomhole temperatures that can reach as high as 350°F, and ultra-high pressure gradients of 0.85 psi/ft to 0.93 psi/ft that can send wellhead treating pressures during stimulation past 10,000 psi.

Chesapeake says much of its cost-containment focus is on reducing rig spud-to-release time. Average per-well drilling time in 2012 was 248 days, and the operator’s target this year is 70 days, on average. In addition, Chesapeake is re-examining its completion and frac stimulation programs, with the dual aim of reducing costs and increasing the EUR of its Haynesville wells.

The cost-cutting measures appear to be paying off. By the first quarter, Chesapeake reported that it had sequentially reduced average well costs from $8.9 million last year to $7.5 million, with its best Haynesville well, to date, coming in at $6.9 million. Those expenditures are a far cry from the high of $10 million that Chesapeake had to shell out in 2012 to drill some Haynesville wells.

EXCO Resources, for another, also is focusing mainly on reducing costs of the average 16,500-ft, MD, wells with 4,200-ft laterals and 14 frac stages that it drills and completes in the core Holly area of DeSoto Parish. Though it has reduced Haynesville per-well drilling and completion costs, year-on-year, from $9.5 million in 2011 to $7.2 million at the end of last year, the independent said the 2014 design features six wells/section on 107-acre spacing, which affords the addition of three frac stages, with per-well costs averaging $7.5 million.

In addition, EXCO says it continues to decrease spud-to-rig release time to an average low of 33 days, and also has adopted water management initiatives that are helping to further reduce costs, including the elimination of water trucking. EXCO said the cost-cutting competencies that it developed in the Haynesville are being transferred to its Eagle Ford holdings.

Canada’s Encana, on the other hand, has suspended Haynesville-targeted drilling this year, instead turning its attention to coaxing more production out of its existing wells with a sweeping re-frac program. “This process utilizes new diverting technology that allows us to continually pump, in order to re-stimulate pre-existing perforations,” says an Encana spokesman. “This program had excellent results on the first two wells completed, and the plan is for us to re-frac five more wells in the Haynesville, in the third quarter. Our teams are evaluating hundreds of wells for re-frac potential in other areas of the company’s portfolio as well, such as the Eagle Ford, the DJ basin in Colorado, and the Montney in Western Canada.”

LAND GRABS

While established players have either put a hold on drilling or else tried to increase their existing production, others are moving to get their feet in the door. Apparently backing up its belief that the play is temporarily down for the count and not yet ready for permanent retirement, year-old Vine & Gas in August shelled out $1.2 billion to acquire Shell’s 107,000 acres and producing wells in the North Louisiana Haynesville corridor. The Haynesville sell-off further reinforced Shell’s aggressive intent to shed its U.S. shale gas holdings.

With the deal, the Dallas-based independent, which was created earlier this year by the Blackstone Group private-equity firm, acquires all of Shell’s Haynesville assets, including 418 producing wells, of which 193 were operated by Shell.

Blackstone also reportedly holds an estimated $2.1-billion stake in Cheniere Energy Partners and its Sabine Pass LNG export facility, which it announced in early 2012.

Also in early August, Vanguard Natural Resources, LLC, said it had entered into a definitive agreement to acquire roughly 23,000 net acres held by Hunt Oil Co. in North Louisiana and East Texas for $278 million. The legacy acreage is prospective for both vertical Cotton Valley and horizontal Haynesville wells, Vanguard said. The deal includes working interests in more than 290 producing wells, generating approximately 17.5 MMcfed, broken out to some 67% gas and 33% liquids.

“This acquisition of mature, long-life natural gas and oil properties is an excellent addition to our current portfolio of assets,” Vanguard President and CEO Scott Smith said. “Along with an established base of producing assets, this acquisition features an inventory of behind-pipe and low-risk vertical drilling projects that we will begin to develop in 2015. In addition, based on our initial evaluation work, we believe there is the potential for meaningful horizontal drilling opportunities across some of the operated assets. With this transaction, we have established another core area, from which we can continue to build upon in the future.”

Meanwhile, Houston-based Linn Energy LLC raised eyebrows in late June with the reported $2.3-billion acquisition of Devon Energy Corp. gas assets spread across six states, including the Haynesville. According to Bloomberg, the acquisition includes a cumulative 896,000 acres and up to 275 MMcfd of gas production in the Haynesville, Rocky Mountains and Mid-Continent. According to Linn, the Devon acquisition gives it an aggregate 250,000 net acres in East Texas and North Louisiana.

NO MIDDLE GROUND

A sampling of a cross-section of some of the players still holding positions in the Haynesville/Bossier shale suggests no in-between where activity is concerned, with operators either maintaining modest drilling programs or suspending new well construction altogether.

Chesapeake Energy remains the most active operator in the Haynesville, running an average of eight rigs in the second quarter across its North Louisiana and East Texas leasehold. Chesapeake connected 13 gross wells to sales during the quarter, compared to seven new wells in the first quarter, when it operated an average seven rigs. First-quarter production averaged 495 MMcfed, with average peak production from the 13 new producers at roughly 12.6 MMcfd. Chesapeake says its Haynesville acreage holds some 10 Tcfe of recoverable resources, with gross estimated ultimate recovery (EUR) of 8.9 Bcfe/well.

EXCO Resources holds 70,000 net acres, prospective for the Haynesville/Bossier shale, 98% of which are held by production (HBP). The operator has drilled 13 gross wells thus far this year, with two completed. EXCO said it has identified 1,206 yet-to-be-drilled locations within its leasehold.

In the first quarter, the 441 EXCO-operated Haynesville wells averaged cumulative net production of 280 MMcfed. The operator says much of its effort this year is focusing on enhancing Haynesville base production, including the installation of artificial lift devices and reducing pipeline pressure.

Anadarko Petroleum Corp., which controls 360,000 gross acres, prospective for the Haynesville in both Texas and Louisiana, plans to run five rigs this year and drill up to 60 wells. Anadarko is concentrating activity primarily in its East Texas holdings, which it says has a 30% liquids component.

BHP Billiton holds 239,000 net acres in the core of what it describes as a swing play. BHP is running three Nabors’ Pace-X rigs, primarily, it says, to further its technical understanding of what it has labeled a “premier acreage position.” The current plan calls for the drilling of 39 Haynesville wells this year. Along with the drilling rigs, BHP also operates one “spudder” rig to pre-set surface casing and plans to add a second such unit in September, capable of pre-setting intermediate casing.

Penn Virginia says it has suspended East Texas Haynesville drilling until natural gas prices improve. The independent holds 33,400 net areas, mainly in Harrison and Panola counties, prospective for both the Haynesville and Cotton Valley.

Comstock Resources, likewise, says it has suspended Haynesville dry gas drilling after completing only two wells last year. The operator, which holds 72,000 net (85,000 gross) acres, prospective for the Haynesville and Bossier shale, said 2013 production declined 34%, year-on-year, to an average of 130 MMcfed.

Today, its onshore Louisiana activity is turning more toward the south, with a build-up this year in its prospective Tuscaloosa Marine shale (TMS) holdings, going from 52,200 net acres in the first quarter to 60,600 net acres as of July. Comstock is presently running one rig in the emerging southern Louisiana and Mississippi play.

Encana, like Comstock, has suspended Haynesville drilling this year and, instead, has re-focused on the TMS, where it has amassed approximately 200,000 net acres. The operator plans to drill between nine and 12 net wells in 2014, to further appraise its TMS holdings.

Meanwhile, along with its ongoing re-frac program, Encana brought 13 Haynesville carry-in wells (10 operated) on production in first-quarter 2014. “We saw a production increase from 331 MMcfd in the first quarter to 365 MMcfd in the second quarter of this year, attributable to strong carry-in well performance and higher base production,” the spokesman said.

EP Energy, which says only that it holds “significant natural gas assets in the Haynesville shale,” also took a drilling breather in 2013, and, if recent earnings reports are any indication, it will be more of the same this year.

|