DAVID WOOD, DWA Energy Limited, Lincoln, UK.

|

| The Arctic Princess leaves Melkøya port near Hammerfest, northern Norway, with an LNG cargo from Snøhvit field for markets in Spain, the U.S. and Japan. Photo courtesy of Statoil. |

|

Since 2011, the LNG sector has continued to demonstrate its global appeal, and its ability to reconfigure and expand gas markets. Furthermore, it has demonstrated a capability to respond to dramatically changing market conditions and redirect cargoes to various destinations, something that cannot be done easily through gas pipeline systems. Consequently LNG’s influence is expanding in all gas-trading continents, albeit in ways not envisaged a few years ago.

In North America, LNG provides potential opportunities for gas supplies trapped in an oversupplied market to enter profitable markets through exports. In Asia, it has helped to plug energy shortfalls following the March 2011 Fukushima nuclear accident in Japan and the large-scale outages of nuclear capacity. LNG has also competed effectively in Asia against oil products during sustained periods of high oil prices, providing LNG suppliers with high returns from oil-indexed cargoes. In Northwest Europe, expanded LNG volumes delivered to gas hubs have shaken up gas markets dominated for decades by long-term take-or-pay contracts, indexed mainly to petroleum products by the somewhat complacent pipeline gas suppliers (i.e., Norway and Russia).

The sustained differential between long-term pipeline gas in Europe, and cheaper short-term gas traded at hubs, has persisted from 2009 to 2012. This is due partly to lower gas demand caused by an economic recession, and caused partly by more abundant LNG supplies from diverse sources. This has led to several European power utilities posting large losses in recent periods, caused by the take-or-pay elements of their long-term pipeline gas contracts; being forced to buy gas at a high price and sell at a lower price is never going to be a profitable model. Gazprom, which had resisted calls by its customers to discount the prices of its oil-indexed contracts since 2009, finally announced that it had agreed to as much as a 10% reduction in gas prices with E.ON, the German power utility, in July 2011.

The rapid deployment of floating storage and regasification units (FSRUs) at strategic locations around the globe to bring in competitive energy supplies continues to open up and expand emerging LNG markets, particularly in South America and the Middle East, but also in parts of Europe and Asia. The increasing number of countries that intend to deploy FSRU vessels is testament to the appeal of limited infrastructure requirements to smaller or seasonal gas importers, and to those wishing to benefit from LNG imports quickly.

Following decades of being proposed as a viable technology, floating liquefaction projects have finally been sanctioned in Australia and Malaysia. If these pioneering projects prove to be efficient and cost-effective, several more are likely to follow over the next decade. All these positive developments progressively make the LNG industry more diversified and better positioned to provide secure, sustainable supply around the globe. This does not mean, however, that LNG is poised to displace pipeline gas as the main, most-efficient means of transporting large gas volumes from a gas-resource-rich region to a major market. However, in many cases, geopolitical issues and long distances, including the crossing of transit countries, imposes higher transit tariffs and risks for major export gas pipelines than LNG options.

The presence of LNG storage and regasification terminals, and import gas pipelines, both feeding into a major gas market, tends to lead to a dimension of competitiveness and flexibility. This improves security and diversity of gas supply, and acts to moderate gas prices in that market. This applies, even when most of the flexibility comes from 15% to 20% of the LNG trades being conducted on a short-term basis, rather than long-term contracts that are required to underpin most of the existing pipeline gas supply chains.

Having extolled LNG’s virtues, it is important to not get too carried away with these positive developments. The imbalances and disparities between the North American, European and Asian gas markets result in a number of negative outcomes for gas players along the supply chain, e.g., Asian gas buyers locked in to oil-indexed prices, and some producers captured by long-term supply contracts into North America (e.g., Egypt, Nigeria, Qatar, Trinidad & Tobago and Yemen). This situation means that LNG traders, aggregators and portfolio LNG players, as they are often referred to, continue to have plenty of opportunities to arbitrage short-term cargoes destined for North America and/or Europe, and divert them to high-paying Asian customers. This trade is very lucrative, and when cargoes are diverted from their contract destinations to higher-paying alternatives, the ultimate LNG supplier/producer often shares the benefits with its long-term customer.

However, what happens in some cases now is that cargoes land in North America, and then are re-loaded and exported to Asia or other higher-priced destinations. In such cases, the ultimate producer of gas can be disadvantaged, if it does not share in the benefits of sale of the re-loaded cargo. The U.S. Energy Information Administration (EIA) statistics for LNG imported and re-exported from the U.S. suggest that several such re-exported cargoes have been traded over the past year or so. Such treatment of gas producers by some LNG aggregators and traders, even if contractually possible, is unlikely to foster long-term sustainable relationships between gas buyers and suppliers, and seems likely to fuel disputes between them in the future.

The remainder of this article highlights some of the key developments in the LNG sector since 2011 on a country-by-country basis. Part 1 of this review addresses the demand side. The supply side is covered in Part 2, which is scheduled to run in the October issue. Several countries now appear in both sections. The import and export statistics quoted in the article are reported by the BP Statistical Review of World Energy (June 2012 and earlier editions).

ASIAN DEMAND

China. The current capacity of the country’s five existing LNG receiving terminals is about 18 million tons per annum(mtpa). The capacity is expected to grow to 30 mtpa by 2015, as five more plants under construction are added along the country’s coastline. The Dapeng terminal in Guangdong is in the process of being expanded from 6.7 mtpa to 13.5 mtpa, forming part of the ongoing expansion to 2015. CNOOC and Shenzen Energy were granted permission in July 2012 to build a second LNG receiving terminal at Shenzen, Guangdong, with an initial capacity of 4 mtpa. In addition to the five terminals under construction (Zhejiang, Zhuhai, Hainan, Tangshan and Qingdao), each with an initial capacity in the range 2 to 3 mtpa with plans for subsequent expansion, several others are in planning at Yacheng, Jieyang and Guangxi.

Whereas China was able to secure LNG supply for its first two LNG terminals at favorable prices (i.e., minimal oil indexation) nearly a decade ago, it is more of a challenge now. China’s state-owned companies have entered into a series of long-term oil-indexed contracts with LNG projects under construction in Australia and Papua New Guinea, and some short-term and medium-term diversion cargoes for ongoing LNG supply expansion. China estimates, in its latest five-year plan, that it will need up to 60 new LNG tankers by 2020 to service its LNG requirements and is planning to build most of them in China. Currently, it builds LNG carriers at the Hudong shipyard, but intends to develop up to three other shipyards to achieve this goal. China’s imports of LNG increased by some 29% to 6.7mt in the first half of 2012, relative to the same period in 2011, at an average cost of about $11.30 / MMBtu, according to the Beijing-based General Administration of Customs data.

India has emerged as a major Asian LNG import market over recent years and is set to continue its growth with the building of new receiving terminals. In 2011, India imported 12.7 mt, making it the third largest LNG importer in Asia, behind Japan and Korea. Most of the LNG arrived from Qatar (76%), with additional cargoes coming from Algeria, Australia, Egypt, Malaysia, Nigeria, Norway, Oman, Trinidad, U.A.E., the U.S. and Yemen.

Petronet LNG set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat, in 2004, and is in the process of building another terminal at Kochi, Kerala. While the Dahej terminal has a nominal capacity of 10 mtpa, the Kochi terminal will have a capacity of 5 mtpa. While Dahej is importing LNG from Qatar, Kochi plans to import LNG from Australia’s Gorgon field.

Construction of state-owned Gas Authority of India’s (GAIL) 5-mtpa receiving terminal in Dabol, Maharashtra, is nearing completion and should be fully commissioned in 2012. GAIL began commissioning the long-delayed facility in second-quarter 2012. There are plans to expand pipeline capacity within India, which currently acts as a bottleneck limiting access of many customers to LNG. The government reduced GAIL’s pipeline tariffs in July 2012 in attempts to further promote gas from third parties reaching customers.

Several projects are in the planning phase to build new LNG receiving terminals on India’s eastern coast that, to date, lacks an LNG import facility. A 5-mt FLNG facility by Shell and Reliance at Kakinada in Andhra Pradesh is awaiting a final investment decision for a possible 2014 start-up. Other projects under consideration along India’s east coast by several companies include a 5-mt LNG receiving terminal at Haldia in West Bengal.

Indonesia. The world’s largest LNG exporter not so long ago (a position now held by Qatar), Indonesia commissioned its first FSRU in April 2012. The Nusantara FSRU is stationed in Jakarta Bay, West Java, and is being supplied by Total with LNG from Indonesia’s LNG export terminal at Bontang, East Kalimantan, which is contracted to supply some 11.75 mt of LNG to the FSRU from 2011 to 2012. In addition to conventional gas, the Bontang export facility has also received coalbed methane production from the adjacent Sanga-Sanga field held by Vico Indonesia, a joint venture between BP and Eni.

Pertamina is mulling conversion of the aging Arun LNG export terminal in North Sumatra into an LNG receiving terminal to take gas from the Tangguh LNG export facility, operated by BP, in Indonesia’s Papua province. In June 2012, BP signed a gas supply agreement with Indonesia to supply LNG from the Tangguh export facility for use in domestic Indonesian power supply. This is part of plans to add an additional liquefaction train to that export facility. Shell’s entry into the remote offshore Masela Bock to join Inpex brings a little closer the development of the Abadi natural gas field in Indonesia’s Arafura Sea using FLNG technology. The Indonesian government announced in June 2012 that it was expecting $20 billion to be invested in that project from 2013, leading toward a 2018/2019 start-up date.

Like its neighbor, Malaysia, Indonesia is now embarking on a more complex LNG strategy that involves continued exports of large quantities of LNG under its long-term supply contracts to East Asian buyers alongside movements of LNG, including imports, to supply a network of LNG receiving terminals. Indonesia’s LNG export plan is discussed in Part 2 of this article.

Japan continues, by far, to be the world’s largest LNG importer. The energy shortfall resulting from the shutdown of Japan’s nuclear power capacity from March 2011 through to mid-2012 further increased its demand for LNG (together with petroleum products and coal) for power generation. In 2011, Japan imported 79.2 mt of LNG, which was up from 69.2 mt in 2010, an increase of 14.5% on the year. In January 2012, Japan set a record for the most LNG that it had ever imported in a single month, i.e., 8.2 mt. Malaysia, Australia, Qatar, Indonesia, Russia and the U.A.E. were Japan’s major gas suppliers in 2011, in that order.

The outlook for LNG imports to Japan is uncertain in mid-2012, as a significant part of its nuclear power capacity comes back on-line. Japan’s economy has struggled for more than a decade, and the impact of the March 2011 tsunami has further dented its economy. Hence, at a time when many LNG suppliers are looking to place short-term cargoes into Asian markets, due to economic weakness and over-supply of gas in Europe and North America in 2012, growth in LNG demand is unlikely to come from Japan in the medium term. Nevertheless, Japan’s commitment to LNG is robust, and the fact that it is building new combined cycle gas turbines, shows that its LNG demand growth should return over the long term.

Malaysia has made key advances on LNG imports and exports in 2012. In June, it commissioned an LNG receiving terminal 3 km offshore Sungai Udang, Melaka, which consists of an island jetty re-gasification unit (JRU), two floating storage units (FSUs—converted LNG carriers) with a 3.8-mtpa throughput capacity and a 3-km subsea pipeline connecting to a new 30-km onshore pipeline that links into the existing Peninsular Gas Utilisation (PGU) pipeline network. In June 2012, Petronas signed a flexible LNG supply contract with Statoil for the delivery of about 1 Bcm of gas over three-and-half years. In February, a new LNG receiving terminal project was announced for Lahad Datu in Sabah to feed a 300-MW power plant to be commissioned in 2015. A feasibility study for another regasification terminal at Johur is also underway.

Pakistan suffers an energy crisis, which includes a significant shortfall in the ability of its domestic gas production to meet demand. Estimated gas supply in Pakistan is some 4.2 Bcfd with demand at 5.4 Bcfd, and the shortfall set to rise to 3.0 Bcfd by 2016. Negotiations have been underway for several years with Iran for an import pipeline, and with Turkmenistan for the construction of the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline. Both pipeline projects are expensive, and fraught with political and commercial risk. Pakistan has awarded LNG import licences to three companies planning to sanction three separate FSRU facilities at Port Qasim, each with 0.5-Bcma capacity. In July 2012, Global Energy Infrastructure Pakistan stated that it would complete establishment of the first FLNG by October 2012; Energy Corporation EVTL expected to complete the second by December 2012; and Pakistan Gas-Port expected to complete the third vessel by 2014. During early 2012, Pakistan began negotiations for 0.5 Bcfd of LNG supply with Qatar and Algeria, but as of July 2012 had failed to agree on a price with Qatar, as that country is seeking a full oil-price indexation pricing mechanism. LNG is likely to play an important role in Pakistan’s long-term security of gas supply, even if it eventually goes ahead with one or other of the controversial gas pipeline import projects.

Singapore. The country’s LNG receiving terminal is now 80% complete and on track for completion before the end of 2013. Singapore makes little secret of its desire to become a major LNG trading hub, once this terminal is operational. The proposed Trans-ASEAN (Association of South East Asian Nations) Gas Pipeline (TAGP), backed by Singapore, is an ambitious project aimed at linking gas supplies among Indonesia, Malaysia, Singapore, Vietnam, Myanmar, the Philippines, Brunei and Thailand, with a target of being operational by 2020. A vital component of that scheme is the development of the massive CO2-rich East Natuna gas field offshore Indonesia, for which an Indonesia-Thailand gas pipeline is to link supply from that field to the Thailand-Malaysia Joint Development Area (JDA), and on to Thailand’s existing pipeline network at Erawan. LNG delivered at Singapore could ultimately be fed into TAGP and delivered onward by pipeline (or LNG) across Southeast Asia. At that point, Asia may have the competition of gas supply necessary to break away from oil-indexed pricing that makes its gas supplies currently so expensive.

South Korea is the world’s second largest LNG importer, with Kogas being the single largest LNG buyer. It has posted significant growth in its demand over the past few years, importing 36.5 mt of LNG in 2011, experiencing 43% growth over five years, which is impressive, taking into account that this period includes the global recession of 2008-9. Qatar, Indonesia, Malaysia, Oman, Russia and Yemen were South Korea’s major gas suppliers in 2011, in that order. South Korea is slightly less diversified than Japan in the context of the number of countries from which it imports LNG; it also has greater seasonal swing in its LNG demand, requiring significantly more LNG during its cold winter months. Mild winters can, therefore, significantly reduce South Korea’s LNG seasonal demand.

Taiwan continues to receive LNG at its two receiving terminals (Taichung and Yung-An), with about 75% delivered under long-term cargoes. In 2011, it received about 12 mt of LNG, including short-term deliveries from suppliers throughout the world.

Thailand commissioned its first LNG receiving terminal in 2011. PTT, the state-owned entity in Thailand, commissioned the $900 million 5-mtpa terminal, located at Map Ta Phut in Rayong province. Construction relating to a second 5-mtpa unit at the same location is expected to start soon. Thailand has imported LNG cargoes from a number of suppliers over the past year. Several of these cargoes were originally destined for North America, but subsequently diverted to secure high prices.

EUROPEAN DEMAND

The evolution and medium-term trend for the European natural gas market is one of a widening supply gap, as indigenous gas production continues to decline quite rapidly. In 2003, the European Union imported 52% of its natural gas demand, whereas by 2010, this had risen to 65% (Wood, 2012). In 2011, the European Union produced 155 Bcm of gas, but consumed 448 Bcm, suggesting imports (ignoring changes to storage inventories) of about 65%. The European market, however, contracted by some 9.9% from 2010 to 2011, and signs during 2012 suggest that it has contracted by an even greater percentage (approaching 20%, according to some analysts) as the European economy continues to contract at an alarming rate. This trend has led to an oversupply of gas coming into Europe and several cargoes from Qatar and Nigeria, for example, being diverted to Asia to take advantage of that arbitrage opportunity in the first half of 2012. In July 2012, that arbitrage window was closing, as oversupply of gas into Asia led to LNG prices softening to a level (i.e., less than $13.5/MMBtu) vs. NBP prices equivalent to about $9/MMBtu, and the LNG shipping costs (of some $150,000/day), Suez Canal fees and boil-off losses for the journey from Europe to Asia that removed profitability from moving cargoes from Europe to Asia. European LNG supply chains are under increasing pressure in mid-2012 to find profitable destinations for the surplus cargoes in their long-term contracts.

The United Kingdom. As North Sea gas production has declined, the UK has rapidly increased its LNG imports in recent years. In 2007, the UK imported just 1.1 mt of LNG; by 2010 LNG imports had increased to 13.8 mt. In 2011, the U.K. imported 18.7 mt, making it the largest LNG importer in Europe during that period, with some 87% of it originating from Qatar, with other cargoes arriving from Algeria, Egypt, Nigeria, Norway, Trinidad and Yemen. This large new supply of gas into Europe had a negative impact on hub gas prices, widening the gap between NBP and continental pipeline gas prices. In 2012, import volumes have fallen, due to economic recession, but it is now clear that LNG supplies will continue to offer significant security and diversity of supply for the U.K. and act as competition to pipeline gas supplies from Norway and continental Europe. The NBP price has become the major benchmark against which LNG into northwest Europe is now traded.

Spain has, for many years, been Europe’s leading LNG importer, but lost this position to the UK in 2011. LNG enables Spain to manage substantial swings in gas demand for power generation and to back-up its renewable power generation sector. Spain currently operates six LNG receiving terminals spread around its coastline. Construction of a new terminal at Musel on the north coast is nearing completion, but because of declining gas demand in Spain, it will be mothballed when completed at the end of 2012. Two new LNG receiving terminals are at an advanced stage of planning for the Canary Islands, to eventually be located in Gran Canaria and Tenerife. Spain imported about 18.2 mt of LNG in 2011 (down from 20.4 mt in 2010) with further declines anticipated for 2012, due to the economic recession. Spain maintains diversified sources of LNG supply, with significant volumes arriving from Nigeria, Algeria, Qatar, Egypt, Trinidad, Peru and Norway, with minor supplies coming from the U.S. and Belgium (i.e., re-exports), Oman and Libya during 2011.

France continues to develop its LNG receiving capacity, although strikes continue to impact its reliability. EdF and partners (Fluxys and Total) sanctioned and started construction of a new 9.6-mt LNG facility at Dunkirk in June 2012. This new facility will increase France’s LNG import capacity by 20% and is expected to be operational by the end of 2015. The terminal will reinforce LNG entry points into Northwest Europe’s gas hubs, competing with nearby LNG facilities in Belgium, the Netherlands and the UK. France imported 10.8 mt of LNG in 2011 (compared with 10.3 mt in 2010). Most of that supply came from Algeria, Nigeria and Qatar, with additional cargoes received from Egypt, Norway, Trinidad and Yemen.

Belgium has been importing and re-exporting LNG for many years. In 2011, it imported 4.9 mt of LNG, mainly from Qatar, with small quantities from Algeria, Nigeria, Trinidad and Yemen. It re-exported 10% of the LNG imported as cargoes to Spain, Japan and Korea. These LNG movements highlight Zeebrugge’s role as a gas trading hub.

The Netherlands commissioned its first LNG receiving terminal at Rotterdam in September 2011. The Gate (i.e. Gas Access to Europe) terminal’s 9-mtpa capacity is held by Dong, RWE, EconGas OMV, Eneco and EON Ruhrgas. The plant has begun operations at a time of falling gas demand in Europe, and indications are that it will operate initially at less than full capacity with some capacity holders (e.g., Dong) already considering re-exporting cargoes to the more lucrative Asian market.

Italy relies on LNG to provide security of gas supply. This strategy was tested in February 2012, when Gazprom, during a severe cold spell in Europe, curtailed gas exports to Western Europe and supplies to Eni destined for Italy dropped below its contractual minimum. LNG supplies brought in through the Panigaglia terminal were able to alleviate the gas shortage, while bad weather prevented vessels from unloading LNG into the Adriatic offshore LNG receiving terminal during that period. This incident highlights the value of LNG in its security of supply role in Europe, but also indicates that the availability of regasification terminals in different locations within a country further improves the supply security situation.

Italy has had several LNG receiving terminals under consideration for many years. Local objections and convoluted planning regulations continue to delay most of these progressing through to construction. The economic downturn has not improved their chances of being constructed in the medium term. BG Group announced in 2012 that it had frozen plans to progress with the planned Brindisi LNG project, which it had struggled with since 2001 and had already spent about $250 million toward site construction.

Italy imported 6.5 mt of LNG in 2011 (down from 6.7 mt in 2010), with most of the supply coming from Qatar and Algeria supported by additional cargoes received from Egypt, Norway, Spain and Trinidad.

Portugal imports small quantities of LNG. Economic recession is likely to limit expansions of import capacity or quantities landed there in the medium term.

Greece imports small quantities of LNG. Economic recession is likely to limit the expansion of import capacity or quantities landed there in the medium term.

Cyprus is in the early stages of planning an LNG export project following the discovery of a large gas field in deep water by Noble Energy and partners in January 2012. The field, named Aphrodite, is located in Block 12, which lies about 40 km north of Noble-operated Leviathan field offshore Israel (discovered in 2010), itself estimated to hold some 20 Tcf of gas. The Cypriot energy authorities announced in June that they are planning to construct a submarine pipeline from the field to a liquefaction plant, probably to be located in the Vasiliko region of the island.

There is a possibility that Cyprus and Israel will cooperate in the development of these two fields to supply a single liquefaction plant. Ethnic and political disputes between Cyprus and Turkey over the sovereignty of Cyprus, and geopolitical disputes surrounding Israel, are likely to complicate and delay financing of this project. Nevertheless, the European Union is likely to see merits in a liquefaction facility within its borders that can help to provide security of gas supply in the event that planned pipeline supplies through Turkey, Bulgaria and Romania are interrupted.

Turkey imported 4.6 mt of LNG in 2011 (down from 5.9 mt in 2010), with supply coming mainly from Algeria and Nigeria, with additional cargoes received from Egypt and Qatar. Turkey’s likely role as a major gas transit route for pipeline gas from the Caspian Sea and Middle East is likely to limit any expansions in LNG capacity in the medium term.

Poland is constructing its first LNG receiving terminal at Świnoujście, consisting of two standard-sized tanks with a capacity of 160,000 m3. Total project costs are estimated at Є693 million. Construction began in March 2011 and is expected to be completed by July 2014. In the first stage of operation, the terminal will be able to re-gasify 2.5 Bcm of natural gas annually. During subsequent stages, depending on the increase of demand for gas, it will be possible to increase the dispatch capacity on that site up to 7.5 Bcm. Poland, which is heavily dependent on Russian gas, sees LNG and potential shale gas developments as a way of diversifying away from Russian gas and improving its security of supply.

Croatia's plans to build an LNG facility are somewhat more speculative than other Eastern European projects. The country had announced plans to construct the 7.5-mtpa Adria LNG terminal on the island of Krk by 2016 to link into the proposed Trans Adriatic Pipeline (TAP). However, project sponsors (E.On Ruhrgas, OMV, Total and Geoplin) have delayed a decision until 2013. Croatian state-owned pipeline operator Plinacro has confirmed that it is undertaking a feasibility study for a separate LNG facility on Krk, with possible participation from Hungary to take gas to as far afield as Poland and Romania. The fate of such a project is likely to be linked to final routes selected for the South Stream and Nabucco pipeline projects, planned to export gas in large quantities from Russia and the Caspian via Bulgaria.

Lithuania is at an advanced stage of planning to contract an FSRU vessel, with a supply target of at least 25% of the country’s gas supply. It is that level of supply that is deemed necessary to ease its dependence on Russian gas. The other Baltic States have been planning their own LNG receiving terminals for similar reasons. In May 2012, Lithuania agreed in principle that the floating storage regasification unit, to be built at Klaipeda by Hoegh LNG, could move seasonally between Klaipeda and the Latvian port of Riga. The FSRU vessel is due to be completed by December 2014, and could be located in Riga in summer and supply Latvia's underground storage facility, and then relocate to Klaipeda in winter. Also in May 2012, the Estonia electricity utility Elering named Dutch company Vopak LNG as its strategic partner for a feasibility study on a planned LNG terminal at Muuga harbor near Tallinn. The European Commission has expressed its wish for all three Baltic States to share a single LNG receiving terminal to optimize the benefits and better enable them all to diversify from Russian supply. Finland may also join this partnership to build a large-scale LNG facility.

Ukraine completed a feasibility study in April 2012 for the construction of a 7.5-mtpa LNG receiving terminal, to be located adjacent to the oil terminal at the port of Yuzhny. The study estimated the base case cost of building such a terminal to be some Є735 million. The government has expressed the desire to hold a 50% share in the facility and a construction tender is planned for late 2012. In May 2012, Ukraine announced that it was negotiating possible future LNG supply from Qatar. One key obstacle to an LNG receiving terminal in the Black Sea is constraints on the timing and number of vessels that can transit the Bosporus. Any significant gas supply into Ukraine from such a proposed terminal could utilize Ukraine’s extensive underground storage capacity to balance winter demand and trade gas onward into the European Union from such storage facilities.

NORTH AMERICAN DEMAND

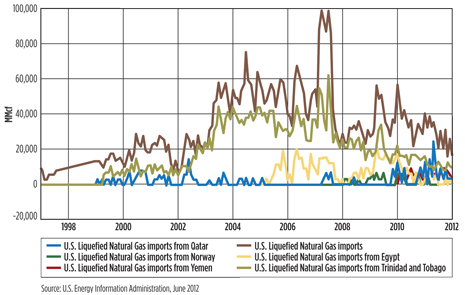

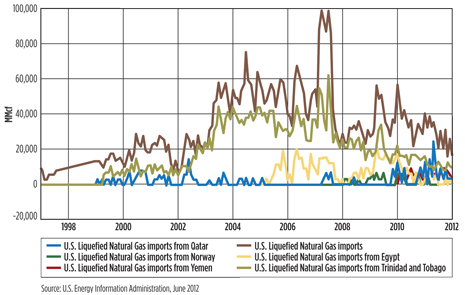

United States. LNG imports have collapsed in recent years, due to the impact of shale gas causing a gas supply glut and becoming a victim of its own success in collapsing prices to a level at which, in the short-term, few projects remain commercially viable. Clearly, prices below $3/MMBtu are unlikely to be sustained in the medium term, as considerable shale gas production is shut-in and new drilling is curtailed. The impact of shale on LNG imports in the U.S. has been dramatic, Table 1 and Fig. 1.

|

| Fig. 1. India’s first LNG receiving terminal is located at Dahej, on the west coast. |

|

| Table 1. United States LNG imports, as reported by EIA for U.S. Department of Energy (click to enlarge) |

|

|

In 2007, 16.1 mt of LNG were imported to the U.S., representing a peak in that trade. Since 2010, despite low prices in the U.S., LNG has been landed from the seven countries. Three countries are landing cargoes in the U.S. on a regular basis (Qatar, Trinidad and Yemen) suggesting that they are obliged to do so under long-term contracts. It is unlikely, on a netback basis, that the LNG coming from the Middle East is profitable for the LNG suppliers at the landed prices achieved since 2011, as cargoes from those countries could have, in the first half of 2012, earned more than five times those prices in some Asian markets. LNG deliveries at such prices seem unsustainable in the medium term.

Several Gulf of Mexico LNG import terminals are destined to be reconfigured to primarily export terminals over the coming years, but the ability to import, as well as export, depending upon market conditions and availability of supply, is likely to be retained by these terminals to increase their flexibility as emerging LNG trading hubs.

Canada began importing LNG through the Canaport receiving terminal (with capacity held 75% by Repsol and 25% by Irving Oil) in 2009. The terminal imported 2.4 mt of LNG in 2011 (operating at about one-third of its capacity), up from 1.5 mt in 2010, with most of the LNG coming from Qatar and Trinidad. Several other LNG import projects in eastern Canada were abandoned, as the reality of shale gas competition became apparent in 2009. Despite low gas prices, the LNG landed at Canaport is destined for the northeastern U.S. market and remains seasonally attractive when the northeastern U.S. gas hubs typically trade at price premiums to Henry Hub. A slowdown in development of shale gas in the Marcellus play, due to regulatory constraints on fracing activities, means that the northeastern U.S. LNG markets are likely to remain viable for another few years. In the medium term, the outlook for LNG imports to eastern Canada is negative, due to the overwhelming competition of likely rising gas production from the Marcellus shale.

Mexico commissioned its third regasification plant in March 2012. The 3.8-mtpa Manzanillo plant, built and owned by a consortium of Samsung (37.5%), Mitsui (37.5%), and Korea Gas (25%), is located on Mexico’s southwestern coast. The capacity holder is Mexico’s Federal Electricity Commission, supplied by Repsol, mainly from LNG from Peru. Mexico imported about 3.0 mt of LNG in 2011, compared with some 4.30 mt in 2010. On the other hand, pipeline gas imports from the U.S. were up in 2011 to 14.1 Bcm in 2011, compared to 9.3 Bcm in 2010, with Mexico taking advantage of low-priced shale gas.

It will be interesting to see how much LNG is actually landed in 2012 at the new Manzanillo terminal rather than diverted to higher-priced Asian destinations. In the medium term, as Mexico’s gas supply gap widens, it seems likely that LNG will continue to play an important role, but its market is under threat from competition from U.S. shale gas, and from within Mexico with development of the Burgos basin.

|

| Fig. 2. GATE receiving terminal in Rotterdam was commissioned in September 2011. |

|

MIDDLE EAST DEMAND

Israel. Gas supply from Egypt was one of the casualties of the “Arab Spring.” A gas pipeline built to supply Israel and Jordan from Egypt has been blown up some fifteen times since 2011, and Egypt froze supplies to Israel early in 2012, demanding a higher price for the gas it supplied. Several Mubarak-era Egyptian ministers and businessmen have been tried and imprisoned for selling the gas to Israel at what is claimed to be below-market rates. This situation has prompted Israel to increase the pace of its efforts to develop its recent large offshore gas finds and resort to LNG imports in the interim, using an FSRU being installed by Excelerate about 10 km off the coast at Hadera. The FRSU is expected to be operational by year-end 2012. BP is reported to be commencing delivery of two LNG cargoes per month to the Hadera FSRU from December 2012 for six months, to fill the gap until supplies of gas from Tamar field become available by pipeline to Israel. BP outbid Gazprom and Eni to win Israel Electric Corporation's liquefied LNG purchase tender in July 2012.

Israel is likely to become both an LNG importer and exporter over the next few years. The large reserves of the Tamar and Leviathan fields dwarf Israel’s energy needs. While 70% of the Tamar gas is designated for domestic supply to Israel, substantial gas reserves remain for export through liquefaction. Noble Energy, leading both the Tamar and Leviathan gas field development projects, signed an agreement in November 2011 with Daewoo to provide a floating liquefaction vessel to be operational by 2016. In March 2012, the Tamar partners signed a 15-year gas sales agreement with state-owned utility Israel Electric Corp for pipeline supplies and reported interest from Gazprom to sign a long-term LNG supply deal for up to 3 mtpa. The Gazprom deal would not please the European Union, busily trying to diversify away from increased dependency on Russian gas.

Jordan has announced plans to mitigate the pipeline gas supply interruption from Egypt by building its own FSRU facility in the port of Aqaba within the next two years.

Kuwait has been importing LNG since 2009 during the summer season through an FSRU operated by Excelerate. In 2011, Kuwait imported some 2.4 mt, mainly from Qatar, but with spot cargoes also arrived from Australia, Egypt, Malaysia, Nigeria, Spain and the UAE. To meet rising fuel demand, Kuwait announced in 2012 that it plans from 2013 to import LNG year-round, with plans for a permanent LNG import facility by 2017.

United Arab Emirates (UAE) is planning to expand its LNG imports to meet domestic needs. An FSRU operated in Dubai by Shell since 2009 imported more than 1 mt in 2011, most of which came from a long-term contract with Qatar, but with spot cargoes also arriving from Australia, Malaysia, Nigeria and Trinidad. However, Abu Dhabi announced plans in March 2012 to build an FSRU in Fujairah (i.e., the Emirate with a coastline outside the Straits of Hormuz) to bring LNG into the UAE from 2014 without having to ship it through the Strait of Hormuz. This is strategically significant, as that waterway is under constant threat of closure to shipping from Iran, due to ongoing disputes regarding its nuclear ambitions and tightening sanctions.

|

| Fig. 3. U.S. LNG imports peaked in 2007 and has declined below 20 Tcf in 2012. Trinidad and Tabago is the leading LNG supplier to the U.S. |

|

SOUTH AMERICA DEMAND

Argentina imported more than 3 mt of LNG in 2011 through its Bahia Blanca FSRU facility, with supplies coming mainly from Trinidad, and additional cargoes arriving from Egypt, Nigeria, Qatar and Spain. The year 2012 has been a turbulent year for the LNG sector in Argentina. The nationalization of YPF led to Repsol cancelling its LNG supply contract in May 2012. This retaliation has required Argentina to compete with Asian buyers for spare cargoes at higher prices. Morgan Stanley is reported to have delivered some LNG cargoes to Argentina through a barter arrangement, trading the LNG for biodiesel derived from Argentina’s prolific soya crop. This arrangement followed unsuccessful attempts by Enarsa to reduce prices of cargoes supplied under oil-indexed contracts. High LNG prices led Argentina to sign a deal with Bolivia to supply additional pipeline gas from July 2012 to replace some of its LNG shortfall. The long-term outlook for LNG supply to Argentina has, therefore, become uncertain in 2012.

Brazil has two operational LNG regasification terminals. One is located in the northeast (Pecém, onstream 2008) and the other one in the southeast (Guanabara Bay, onstream 2009). In 2011, Brazil imported 0.75 mtpa of LNG from diverse sources (i.e., Nigeria, Qatar, Trinidad and the U.S.). Petrobras plans to bring a third terminal online in Bahia state in 2013, with a capacity of 500 MMcfgd. Although currently an LNG importer, Brazil is hoping to liquefy the large associated pre-salt gas reserves discovered offshore Brazil, using FLNG technology to satisfy its relatively small-scale LNG import requirements.

Chile has imported LNG since 2010 through two locations: Quintero and Mejillones. In 2011, supplies came from a diverse range of locations: Egypt, Equatorial Guinea, Indonesia, Qatar, Trinidad, the U.S. and Yemen. Chile's gas imports rose sharply in 2011 to meet a shortage of hydroelectric power supplies, due to drought. This shortage has prompted commitments in 2012 to expand the Quintero plant from a 2.5-mtpa capacity to 3.75 mtpa and northern Chile power producer GasAtacama to award Golar the contract to provide a long-term FSRU at Mejillones from 2015. The new-build FSRU will be moored approximately 1.6 km offshore and in a 50-m water depth. It will be capable of storing 170,000 m3 of LNG and delivering approximately 180 MMcfd, enough to provide power generation capacity of up to 1 gigawatt. There is an option to expand throughput to 360 MMcfgd as demand increases. Much of that power is destined to be consumed by the mining sector in northern Chile. GasAtacama is also reported to be negotiating with shale gas LNG export projects proposed for the U.S. to secure and link gas supplies to the Henry Hub benchmark gas price.

Jamaica. LNG is likely to become a more widely used energy source to supply some of the islands that are currently dependent upon burning expensive distillate fuels for power generation. As an example, Jamaica announced in July 2012 that Samsung had won a tender to build an FSRU to receive LNG imports for that nation. Article to continue in October 2012 issue.

REFERENCES

1. BP Statistical Review of World Energy, June 2012.

2. Natural Gas Monthly, U.S. Energy Information Administration, June 2012

3. Wood, D.A. , “2012.: A review and outlook for the global LNG trade,” Journal of Natural Gas Science & Engineering, Vol. 9, November 2012, pp 16 -27.

|

The author

DAVID A. WOOD is the principal consultant of DWA Energy Limited, UK, specializing in the integration of technical, economic, fiscal, risk and strategic information to aid portfolio evaluation and project management decisions. Dr. Wood has more than 30 years of international oil and gas experience spanning technical and commercial operations, contract evaluation and senior corporate management. / dw@dwasolutions.com. |

|