Far East: Viet Nam

August 2000 Vol. 221 No. 8 International Outlook FAR EAST Viet Nam Viet Nam’s per-capita commercial energy consumption is still among the l

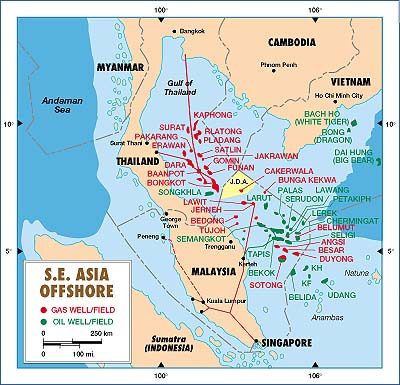

FAR EASTViet NamViet Nam’s per-capita commercial energy consumption is still among the lowest in Asia. While such consumption will remain low compared to neighboring countries, growth in energy usage, particularly natural gas, is likely to grow. Most-active foreign firm in Viet Nam’s upstream sector remains Russia’s Zarubezneft. The company runs a joint venture with state firm Petrovietnam, called Vietsovpetro, which dominates drilling and production statistics. Licensing. Three new licenses were awarded during 1999. In July, offshore Blocks 07 and 08 were gained by Vietnam American Exploration (Vamex), a subsidiary of Texas-based Sterling Project Co. Covering 2,654 sq mi, the two blocks are south of BP Amoco’s Lan Tay and Lan Do gas fields, in waters disputed with Indonesia.

Last October, Unocal (operator) and Japan’s MOECO signed for Gulf of Thailand Block 52/97, adjacent to Block B in the Malay basin. Petrovietnam retains an option to take a 30% stake in 52/97, if a discovery is made. The final award, Block 16-1, was made to Soco International and three partners last November. The Cuu Long basin tract is next to Vietsovpetro’s Bach Ho oil field. Soco will acquire seismic data and drill two wells. Meanwhile, Petrovietnam invoked its option to take a 15% share of offshore Block 6-1, which contains Lan Tay and Lan Do gas fields. On adjacent Block 05-3, AEDC and Teikoku Oil relinquished their interests, leaving BP Amoco and Statoil with 50% shares in the tract. Last February, Conoco farmed into a 30% interest in offshore Block 15-2 of the Cuu Long basin. The block contains Japan-Vietnam Petroleum’s (JVPC’s) Rang Dong field. In April 2000, a consortium of Conoco (40%, operator), Korea National Oil Co. and Petrovietnam signed a PSC for offshore Block 16-2. The 1,075-sq-mi tract is near Bach Ho oil field. Conoco expected to begin a 3-D seismic survey by mid-2000. Exploration. Petrovietnam last November let a seismic contract for the Mekong Delta. The survey includes 1,554 mi of 2-D data onshore and 4,847 mi of 2-D data offshore. The low exploratory drilling level experienced in 1998 continued in 1999, with only four wells (one wildcat and three appraisals) drilled. Anzoil’s D24-1 wildcat in the Hanoi basin was drilled to 11,942 ft and flowed gas at uncommercial rates under 50,000 cfd. Anzoil’s two appraisals were no better. The D14-4X was drilled to 10,500 ft and tested negligible amounts of gas, while D14-5 was a duster. Meanwhile, JVPC drilled the 15-2-VD-2 appraisal and classified the well as a "tight hole." Drilling/development. Estimated wells drilled were up slightly last year. Another small gain is forecast this year. In June 2000, Statoil said it would contribute $231 million to help operator BP Amoco and other partners develop the Nam Con Son gas project. The development will involve Lan Tay and Lan Do gas fields in offshore Block 6-1. The group still hopes to deliver first gas by sometime in 2002. Production. Vietnamese oil output rose 19% last year, to nearly 290,000 bpd. Natural gas production is estimated to have averaged 135 MMcfd. Dominant producer Vietsovpetro’s combined output from Bach Ho (White Tiger), Rong (Dragon) and Dai Hung (Big Bear) oil fields was about 234,775 bpd last year, up 10%. An additional 55,000 bopd came from Rang Dong and Ruby (operated by Petronas) fields. Vietsovpetro is undertaking a major rehabilitation of ailing Dai Hung oil field, which was producing only 7,000 bpd in early 2000. The firm said it would upgrade production facilities and drill several more wells. JVPC is drilling four new production wells at Rang Dong field this year. The

goal is to restore output to a 40,000-bopd level.

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)