Industry at a Glance

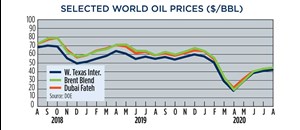

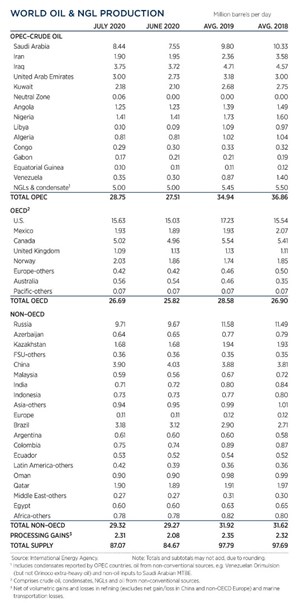

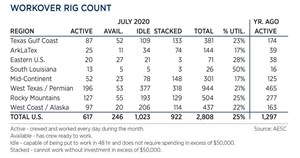

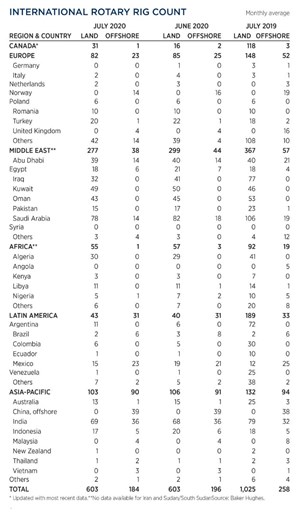

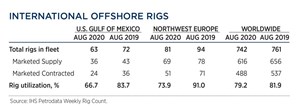

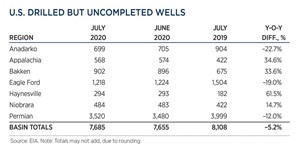

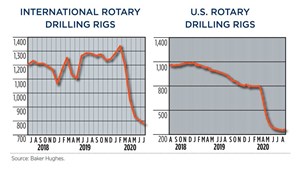

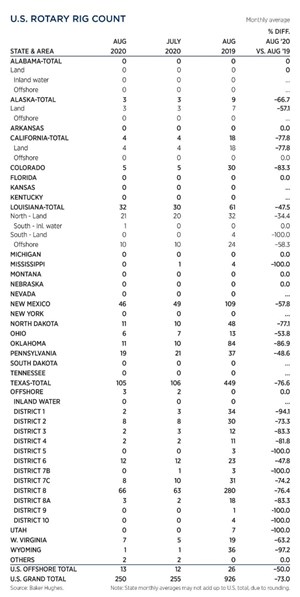

Continued economic recovery/demand rebound in China helped push oil prices higher in August, with WTI ($42.10/bbl) and Brent ($44.50/bbl) posting gains of 3.5% and 3%, respectively. Despite uncertainty over post-Covid-19 demand, U.S. crude futures posted their fourth straight monthly gain, as prices recovered from the negative price event in April. With the OPEC+ agreement winding down, Saudi Arabia increased output 9% in July, to 8.5 MMbopd, but Russia held constant at 9.3 MMbopd. Output in the U.S. declined for the fifth straight month, to 10.3 MMbopd in July (API). U.S. drilling activity fell to another all-time low of 244 rigs the week of Aug. 14, but rebounded to 254 over the next two weeks, indicating a bottom may have been established. Total international activity averaged 775 rigs in July, just 24 fewer than reported in June.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)