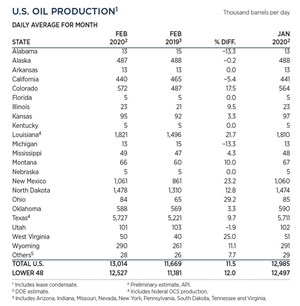

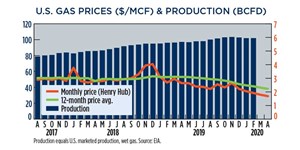

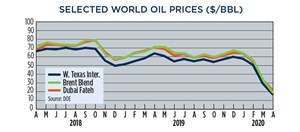

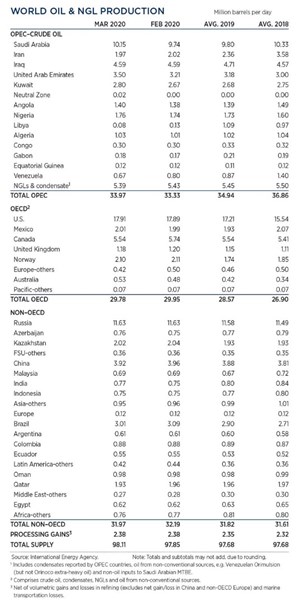

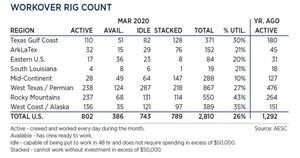

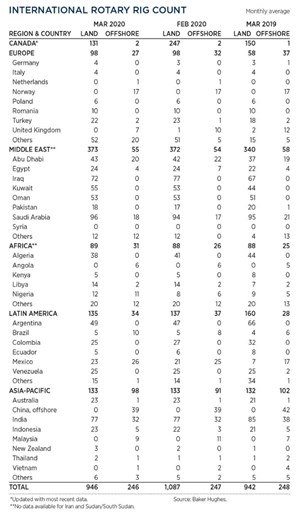

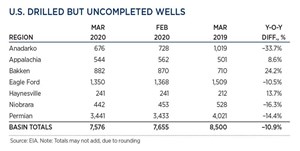

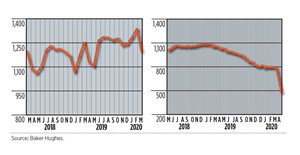

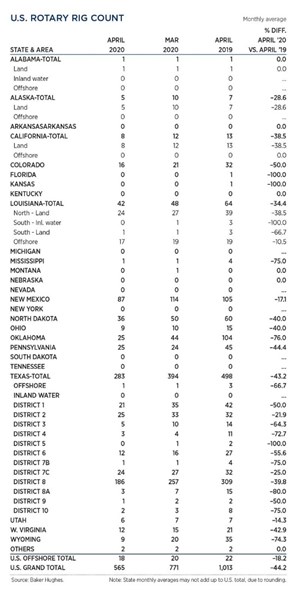

On April 20, panicked selling of oil futures, initiated by plummeting demand (Coronavirus) and fears over dwindling storage capacity, triggered a 300% drop in WTI futures to minus $37.63/bbl. Despite the price crash, WTI and Brent still averaged $17/bbl and $19/bbl in April. Unwilling to reduce output, the U.S. (12.9 MMbopd), Russia (11.3 MMbopd) and Saudi Arabia (9.7 MMbopd) continued to flood the market with crude, further hampering price recovery. U.S. drilling activity contracted sharply in April, dropping 206 rigs to 565, 27% less than reported in March. In the Permian basin, operators stacked 71 rigs in Texas District 8, while another 27 units were decommissioned in New Mexico, a reduction of 28% and 24%, respectively. International drilling activity decreased 142 rigs m-o-m, to average 1,192 in March.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)