Economic impacts of the 2020 oil market crash

The job losses and wider economic impacts of the 2020 oil downturn are overshadowed by the broader COVID-19 economic collapse. Still, those impacts are significant for both local and the U.S. economies. The upstream oil and natural gas (O&G) industry risks losing more than 200,000 jobs over the next 6–12 months—comparable to the 2015–16 oil market downturn. It also risks: (1) being one of the slower sectors of the economy to recover, and (2) shrinking in terms of spending and employment over the longer term. Both states and local communities face risk not just through the downturn, but longer term from the lower employment/economic multiplier effect and, potentially, reduced royalty payments.

In many studies of the impacts of the changing energy landscape, such as in the coal sector, the focus tends to be on job losses. While those are critical, the wider revenue decreases can be even more damaging to state and local economies. We consider these broader potential impacts of both the current oil market crash and the longer term landscape, informed by the 2015–2106 market downturn in O&G.

Economic Impacts

Upstream Oil & Gas (O&G) provides considerable economic contribution to several states in the U.S. The U.S. Bureau of Labor Statistics (BLS) indicates that U.S. O&G and Oilfield Services and Drilling (OFS) companies employed 464,600 as of October 2019, Fig. 1. In select states, this comprises ~5% of the workforce, including North Dakota and Wyoming. The relative revenue contribution varies from state to state and includes taxes and royalties associated with the value of production, sales taxes on hydrocarbons, use taxes on related equipment and personal income taxes from industry employees. Texas leads states in absolute revenues, with $16.3 Billion in Fiscal Year 2019 (7% of state revenue). Leaders in terms of proportion of state revenues derived from O&G are: Alaska (70%/$1.1B of FY2019 state revenues), Wyoming (52%/$2.2B in FY2017, although this includes coal and other minerals), and North Dakota (45%/$1.6B in FY2017). In terms of economic impact, several studies over the last decade have pointed to a 2x or greater “multiplier effect” of the upstream industry on the economy.

The 2015–16 downturn had a significant labor and economic cost. Per the BLS, direct employment in the sector troughed at 406,800 in the third quarter of 2016, down 235,900 jobs from the pre-downturn peak of 642,700 at the end of 2014. From a state revenue perspective, to offer just two examples, Texas receipts were $9.4B in FY2016, down 40% from $15.7B in FY2014, and New Mexico receipts were $1.6B in FY2016, down 20% from $2.0B in FY2014. In terms of the multiplier effect on the economy, the Oklahoma Chamber Research Foundation offers one data point that suggests a somewhat more modest impact than the aforementioned broader U.S. studies. It cites a $8.9B (55%) annualized decline in household income directly from the total O&G sector (peak 2014 quarter to trough 2016 quarter) and a $13.5B (10.5%) statewide household earnings decline over the same period, or a 1.5x multiplier. This multiplier appears to be largely a function of layoffs—the same report cites 21,500 job cuts in Oklahoma O&G over that period (a 34% decline) vs. 30,800 job losses in the state overall (a 1.9% decline).

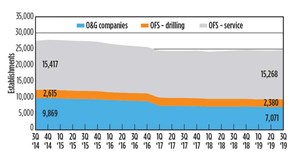

Recovery from 2016 was marked by higher production with lower employment. From aforementioned troughs, employment recovered to 487,200 by January 2019, i.e., 20% above the 2016 trough but still 24% below the 2014 peak. There has been some winnowing of O&G companies participating in the sector as well—the BLS reports a 28% drop in O&G company establishments to 7,071 as of the end of the third quarter of 2019 from the 2014 peak. Notably, U.S. production in 2019 averaged 12.2 MMbopd and 111.5 MMcfd of natural gas, versus 8.8 MMbopd and 86.0 MMcfd in 2014, as the industry deployed a host of measures that raised production per well.

Conclusions

It seems reasonable to expect that job cuts can exceed those of 2015–16 given: (1) the apparent trajectory of rig and hydraulic fracturing crew counts, which threaten to fall below 2016 decades-low trough levels; (2) the likely challenges accessing capital (there are likely to be many bankruptcies in O&G during the downturn); and (3) distancing efforts related to COVID-19. States’ revenues also appear to be at greater risk as a lower absolute oil price decline may be more than offset by production cuts, particularly by FY2021. Job cuts in this early stage of the downturn are certainly more aggressive than in 2015–16. For example, 1.3 million Texans filed for unemployment in the month ending mid-April, including in some heavily O&G-exposed communities, although this was largely driven by the response to the COVID-19 pandemic and only an unknown portion was related to O&G layoffs.

Post-downturn, employment appears unlikely to fully recover for several reasons, including: uncertainty with respect to oil price recovery, continued financing constraints, and further concentration of activity into fewer, larger O&G (and OFS) companies. The industry also likely embraces further efficiency measures that reduce industry staffing requirements—particularly powerful among these will be continued implementation of digital technologies and data science, which can streamline all facets of upstream development. It is also worth noting that OFS companies are seeing increased customer interest in cloud technology, which, among other benefits, facilitates remote operations.

As the O&G industry shrinks, and states face revenue risk over the near and longer term, political and policy responses may include being less industry “friendly”. States face some revenue decline risk longer term, in part from lower employment but also potentially from lower sustained oil prices that can impair royalties. This points to the need for states to plan for ensuring their economies are resilient and well diversified.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)